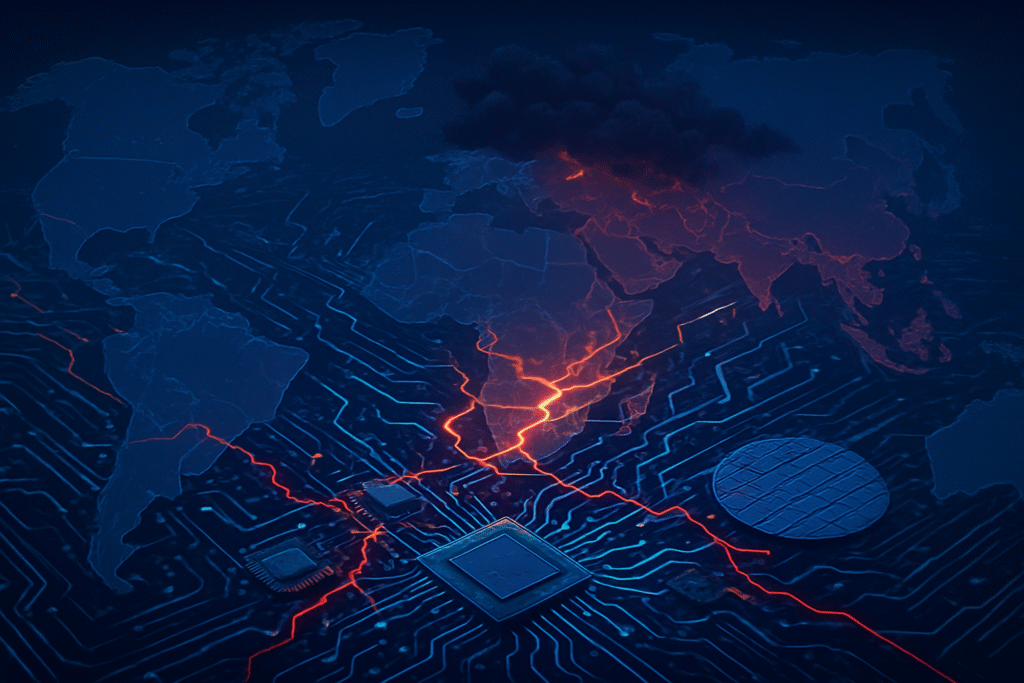

The global semiconductor market, still reeling from the aftershocks of the pandemic-induced supply chain disruptions, has been plunged into fresh turmoil by the escalating crisis surrounding Nexperia, a critical supplier of essential chips. This multi-faceted situation, marked by geopolitical tensions and unprecedented government interventions, has sent shockwaves through the tech industry, particularly impacting major automakers and exposing the profound vulnerabilities inherent in the intricately linked global supply chain. As of November 20, 2025, the crisis, which intensified in late September 2025, underscores a growing trend of national security concerns reshaping the landscape of global chip manufacturing and distribution, threatening both semiconductor availability and pricing stability.

Geopolitical Fault Lines Fracture the Chip Market

The Nexperia crisis, unfolding since late September 2025, has unveiled a unique and technically intricate disruption within the semiconductor ecosystem, diverging significantly from previous supply chain shocks. Unlike earlier shortages often sparked by natural disasters or sudden demand surges, this crisis is fundamentally rooted in a complex geopolitical standoff between the Netherlands and China, fracturing Nexperia's globally integrated production model. The primary impact is on mature, high-volume "legacy chips" – essential discrete semiconductors like diodes, transistors, and MOSFETs, as well as simple logic chips and switches. These components, while not cutting-edge, are the workhorses of numerous electronic systems, particularly within the automotive sector, where Nexperia specializes in delivering highly reliable, automotive-grade chips crucial for everything from adaptive headlights to electric vehicle battery management systems.

The technical disruption cascades through several critical manufacturing processes. Firstly, the crisis saw the Dutch government seizing operational control of Nexperia, leading to China's retaliatory imposition of export restrictions on finished components and sub-assemblies manufactured by Nexperia China and its subcontractors. Nexperia's Dongguan facility in China, a pivotal assembly and testing center, accounts for an estimated 70% of its end-product capacity, making this restriction particularly devastating. Secondly, Nexperia's European headquarters suspended direct shipments of wafers—the foundational material for integrated circuits—from its fabrication plants in the UK and Germany to its Chinese factory, citing non-payment and lack of transparency. This halt in wafer supply subsequently idled a significant portion of machinery at the Dongguan plant, directly impacting production output.

Furthermore, the internal conflict and "missing transparency and oversight" led Nexperia's head office to publicly declare its inability to guarantee the intellectual property, technology, authenticity, and quality standards for products delivered from its Chinese facility after October 13. This technical caveat introduces a profound risk for integrators. Compounding the challenge is the deep integration of Nexperia's chips; they are not easily swappable standalone components but are soldered into complex sub-assemblies from Tier 1 manufacturers like Bosch and Denso. Replacing these components necessitates lengthy and costly recertification (homologation) processes, making rapid transitions to alternative suppliers technically arduous and time-consuming, even if alternatives are found.

Initial reactions from the tech industry and experts were immediate and alarmed. Automakers and their Tier 1 suppliers received urgent notices from Nexperia regarding impending delivery shortfalls, with existing stocks projected to last only a few weeks. The European Automobile Manufacturers' Association (ACEA) and the Japanese Automobile Manufacturers Association (JAMA) expressed "deep concern," forecasting "significant disruption" across the industry. Major players like Honda (TM), Volkswagen (VWAGY), and Nissan (NSANY) quickly announced production adjustments, with Honda halting production at a Mexican plant and Nissan setting aside a substantial 25 billion yen ($163 million) provision to mitigate supply risks. Experts have branded this the "most acute geopolitical crisis since the pandemic" for the semiconductor sector, laying bare the deep "fragility underlying decades of globalised manufacturing" and highlighting critical "supply chain vulnerabilities" that demand urgent policy attention, as underscored by European tech commissioner Henna Virkkunen in the context of the EU Chips Act.

Ripple Effects: Automakers Bear the Brunt, Competitors Poised to Gain

The Nexperia crisis has unleashed a torrent of disruption across the global tech industry, with its epicenter felt most acutely within the automotive sector. Major automakers, including Germany's Bosch (BOSCHL.DE), which was forced to temporarily shut down three European factories, are grappling with severe chip shortages, leading to production halts and adjusted working hours for thousands of employees. Nissan Motor (NSANY) has reduced production at its Kyushu plant and provisioned 25 billion yen ($163 million) for supply risks. Honda Motor (TM) faces temporary plant shutdowns in North America and anticipates a reduction of 110,000 units, incurring a cost of approximately ¥150 billion ($969 million). Volkswagen (VWAGY) Group has warned of potential production stoppages for key models, with ripple effects expected across its brands like Audi, Porsche, Seat, and Skoda. Volvo Cars (VOLCAR B.ST), BMW (BMWYY), Mercedes-Benz (MBGYY), and Stellantis (STLA) have all either warned of impacts or established task forces to secure alternative supplies, highlighting the pervasive nature of Nexperia's role in their supply chains, even if indirect.

For Nexperia itself, the crisis has been a crucible of internal and external pressures. The company is navigating unprecedented internal governance tensions, with its Dutch headquarters and Chinese unit reportedly clashing over operational control and wafer shipments. The Dutch government's invocation of the Goods Availability Act sets a significant precedent regarding national security and corporate oversight in the technology sector. In response, Nexperia is actively pursuing short-term workarounds, accelerating the qualification of new wafer supply sources, and planning phased capacity expansions through 2026 to stabilize its fractured supply chain, aiming to regain trust and operational stability amidst the turmoil.

The competitive landscape is undergoing a significant re-evaluation. The crisis starkly underscores the inherent fragility of globalized semiconductor supply chains and the perilous risks associated with over-reliance on single-source suppliers or specific geopolitical regions. Automakers, in particular, are being compelled to fundamentally rethink their sourcing strategies, with some actively pushing for "China-free" component sourcing to mitigate future geopolitical vulnerabilities. This strategic pivot emphasizes a shift in industry priorities from pure cost efficiency to robust supply chain resilience, granting a distinct competitive edge to companies with diversified component sourcing or those capable of rapidly qualifying alternative suppliers.

Conversely, several of Nexperia's competitors and alternative suppliers stand to benefit significantly from this disruption. Companies such as Infineon (IFNNY), onsemi (ON), Renesas Electronics (RNECF), STMicroelectronics (STM), Vishay General Semiconductor LLC (VSH), Diodes Inc. (DIOD), and Rohm Co. (ROHCY) are identified as potential beneficiaries. As manufacturers scramble to diversify their component sourcing and reduce dependency on Nexperia, these alternative suppliers, particularly those offering similar general-purpose chips, are likely to experience increased demand and opportunities to gain market share. Furthermore, Taiwanese semiconductor companies are reportedly receiving a surge of transfer and rush orders, signaling a broader industry-wide effort to de-risk and reconfigure supply chains in response to the escalating geopolitical tensions.

A New Era of Tech Nationalism and Supply Chain Scrutiny

The Nexperia crisis, unfolding against a backdrop of escalating US-China tech tensions, serves as a stark and potent case study in the broader semiconductor landscape. It epitomizes the global trend towards "tech nationalism" and the urgent drive for supply chain de-risking, where corporate supply decisions are increasingly becoming instruments of state policy. Nexperia, a Dutch-headquartered chipmaker under the ownership of China's Wingtech Technology (600745.SS), found itself squarely in the crosshairs when expanded US export control restrictions effectively subjected it to sanctions. The subsequent invocation of the Cold War-era Goods Availability Act by the Dutch government to seize control of Nexperia's European assets, citing national security concerns, signaled a decisive shift in traditionally liberal trade policies towards alignment with broader Western efforts to secure critical technological infrastructure. Beijing's retaliatory export controls on Nexperia products from its Chinese facilities further solidified the crisis as a prime example of geopolitical fragmentation transforming global trade into a battleground for strategic influence.

This situation has profound implications for semiconductor availability and pricing. Nexperia is a critical supplier of essential, low-cost "legacy" chips – power and analog chips, transistors, diodes, and ESD protection circuits – vital for electric vehicles, telecommunications, and basic automotive functions. The company ships over 110 billion products annually, making its disruption deeply impactful. The export restrictions from China, coupled with Nexperia's internal corporate disputes and the halt of wafer shipments to its Chinese assembly facilities, have led to immediate and widespread production disruptions for major automakers globally. Reports indicated that inventories could run out by mid-December, threatening "devastating" outcomes for the industry. While explicit widespread pricing increases haven't been the primary focus of initial reports, such acute shortages and the arduous process of certifying alternative automotive-grade suppliers inevitably exert upward pressure on component costs, impacting the final price of everything from cars to consumer electronics.

Looking long-term, the Nexperia crisis raises several critical concerns for the tech industry and geopolitical stability. Firstly, it underscores the extreme vulnerability of tech-dependent industries, highlighting how control over manufacturing, intellectual property, and critical inputs can be weaponized in international relations. This will undoubtedly accelerate supply chain restructuring, pushing companies towards "multi-headquarters plus independent operations" models, nearshoring, and dual-sourcing to reduce reliance on single points of failure and politically sensitive regions. The EU, in particular, is expected to introduce follow-up measures to its Chips Act to prevent similar crises, reinforcing the push for greater regional autonomy in chip production.

Secondly, the crisis is likely to spur increased investment in localized research, development, and manufacturing capabilities, particularly for foundational chips, as nations strive for greater self-reliance. This could also lead to shifting capital flows, with Chinese capital diversifying manufacturing partnerships towards Southeast Asia and the Middle East to maintain export stability. Finally, and perhaps most critically, the Nexperia crisis has exacerbated tech trade tensions between China and Europe. The way this conflict is managed will set a significant precedent for how the EU handles foreign-controlled assets in sensitive sectors, further entrenching the strategic competition between major global powers and profoundly reshaping global commerce and international relations for years to come.

The Road Ahead: Resilience, Diversification, and Geopolitical Volatility

The Nexperia crisis, a direct consequence of intensifying geopolitical friction, is poised to catalyze significant near-term and long-term transformations across the semiconductor market and global supply chains. In the immediate future, the automotive industry will continue to grapple with severe production disruptions. Honda (TM), for instance, has already forecast a reduction of 110,000 units and a substantial financial loss due to chip shortages, primarily impacting its North American operations. Other major automakers like Volkswagen (VWAGY), Volvo Cars (VOLCAR B.ST), BMW (BMWYY), Mercedes-Benz (MBGYY), and Nissan (NSANY) are closely monitoring the situation, with some already tapping into reserve stockpiles. While Nexperia is implementing short-term workarounds and China has shown some flexibility in facilitating exports for civilian-use chips, these are temporary reliefs, not systemic solutions. The ongoing concern about Nexperia's inability to guarantee the intellectual property, technology, authenticity, and quality standards for products from its Chinese facilities after October 13, 2025, due to a lack of oversight, will continue to drive caution and urgent rerouting efforts.

Looking further ahead, the crisis serves as a profound "wake-up call," accelerating the existing trends of supply chain diversification and regionalization. Governments and corporations alike will intensify efforts to "de-risk" from China, increasing investments in domestic and regional semiconductor manufacturing capabilities, particularly in the US and Europe. This will involve substantial capital expenditure, as exemplified by Texas Instruments' (TXN) $60 billion build-out, and a strategic focus on securing the production of even "legacy" or "mature node" chips, whose critical importance has been starkly highlighted by this disruption. Nexperia itself plans phased capacity expansions at its non-China sites through 2026, indicative of this broader industry shift. The era of efficiency-driven supply chains is giving way to a resilience-driven model, emphasizing multi-sourcing, strategic inventories, and enhanced real-time visibility.

This environment will foster the accelerated adoption of advanced technologies for supply chain management. We can expect to see greater deployment of AI and data analytics for end-to-end supply chain visibility, predictive vulnerability identification, and proactive risk mitigation. Digital twins for supply chains, allowing for simulation of disruptions and testing of mitigation strategies, will become more prevalent. Blockchain technology may gain traction for secure and immutable tracking of semiconductor components, ensuring authenticity and provenance. Furthermore, the drive for semiconductor sovereignty will lead to greater emphasis on modular and flexible manufacturing and the development of secure-by-design chips, particularly for critical infrastructure.

However, significant challenges remain. The persistent geopolitical friction and potential for inconsistent national policies create an unpredictable operating environment for multinational semiconductor companies. The immense cost and time required to build new fabs and diversify supply chains away from established Asian hubs are formidable hurdles, compounded by global talent shortages for skilled workers. Balancing the need for supply chain resilience with cost-effectiveness will be an ongoing struggle, potentially impacting the competitiveness of end products. Experts predict that the Nexperia crisis is a "pivotal case study" that will usher in a period of "rolling crises" with China, making government oversight and national security considerations a permanent fixture of corporate strategy. While temporary resolutions may offer breathing room, they do not resolve the underlying systemic issues, necessitating a sustained focus on robust and predictable frameworks for global trade and supply chain stability.

The Enduring Lessons of a Fractured Supply Chain

The Nexperia crisis stands as a pivotal moment in the ongoing saga of global semiconductor supply chain fragility, underscoring the profound impact of escalating geopolitical tensions on industrial production worldwide. Originating from U.S. export controls on its Chinese parent company, Wingtech Technology, and compounded by the Dutch government's unprecedented intervention and subsequent Chinese retaliation, the crisis has laid bare the extreme vulnerabilities of even "legacy" chip supplies. Its immediate fallout has reverberated through the automotive sector, forcing major automakers into production cuts and scrambling for alternative sources for essential components. This event is far more than a corporate dispute; it is a stark illustration of how deeply intertwined national security, technology, and global commerce have become.

The significance of this development in AI history, while not directly an AI advancement, lies in its profound implications for the foundational hardware that underpins all AI development. Stable and secure access to semiconductors is paramount for everything from AI accelerators to data center infrastructure. This crisis serves as a powerful catalyst, accelerating the industry's shift towards a resilience-driven supply chain model, emphasizing diversification, regionalization, and increased government oversight. It fundamentally challenges the decades-long pursuit of pure cost optimization in favor of security and stability, setting a precedent for how nations will approach critical technology assets in an era of heightened strategic competition.

In the long term, the Nexperia crisis will undoubtedly shape EU policy, driving more rigorous screening of foreign-controlled assets in sensitive sectors and potentially leading to new frameworks for emergency intervention. It will compel industries to diversify their chip sourcing, moving away from concentrated networks, and could spur Chinese capital to seek new manufacturing partnerships in Southeast Asia and the Middle East. For Europe, it is a "wake-up call" to solidify its technological sovereignty, transforming ambition into industrial reality. The weaponization of supply chains, as demonstrated by China's conditional agreement for civilian-use chip supply, suggests that geopolitical considerations will remain an integral part of corporate strategy for the foreseeable future.

In the coming weeks and months, the industry will be watching several key developments: the Dutch government's ongoing management of Nexperia and its negotiations with Beijing, the specifics of China's export policies and any further restrictions, and accelerated EU discussions on asset screening. Nexperia's progress in implementing workarounds and capacity expansions will be critical, as will any reports on the quality and authenticity of chips from its Chinese facilities. Finally, the production adjustments of major automakers and broader geopolitical signals in the U.S.-China-EU tech rivalry will continue to dictate the trajectory of the semiconductor market. The Nexperia crisis is a potent reminder that in the interconnected world of advanced technology, a single point of failure can trigger a cascade of global disruption, necessitating a profound rethinking of how we build and secure our digital future.

This content is intended for informational purposes only and represents analysis of current AI developments.

TokenRing AI delivers enterprise-grade solutions for multi-agent AI workflow orchestration, AI-powered development tools, and seamless remote collaboration platforms.

For more information, visit https://www.tokenring.ai/.