Quarterly earnings results are a good time to check in on a company’s progress, especially compared to its peers in the same sector. Today we are looking at Camden National Bank (NASDAQ: CAC) and the best and worst performers in the regional banks industry.

Regional banks, financial institutions operating within specific geographic areas, serve as intermediaries between local depositors and borrowers. They benefit from rising interest rates that improve net interest margins (the difference between loan yields and deposit costs), digital transformation reducing operational expenses, and local economic growth driving loan demand. However, these banks face headwinds from fintech competition, deposit outflows to higher-yielding alternatives, credit deterioration (increasing loan defaults) during economic slowdowns, and regulatory compliance costs. Recent concerns about regional bank stability following high-profile failures and significant commercial real estate exposure present additional challenges.

The 95 regional banks stocks we track reported a satisfactory Q4. As a group, revenues beat analysts’ consensus estimates by 1.4%.

Thankfully, share prices of the companies have been resilient as they are up 5.5% on average since the latest earnings results.

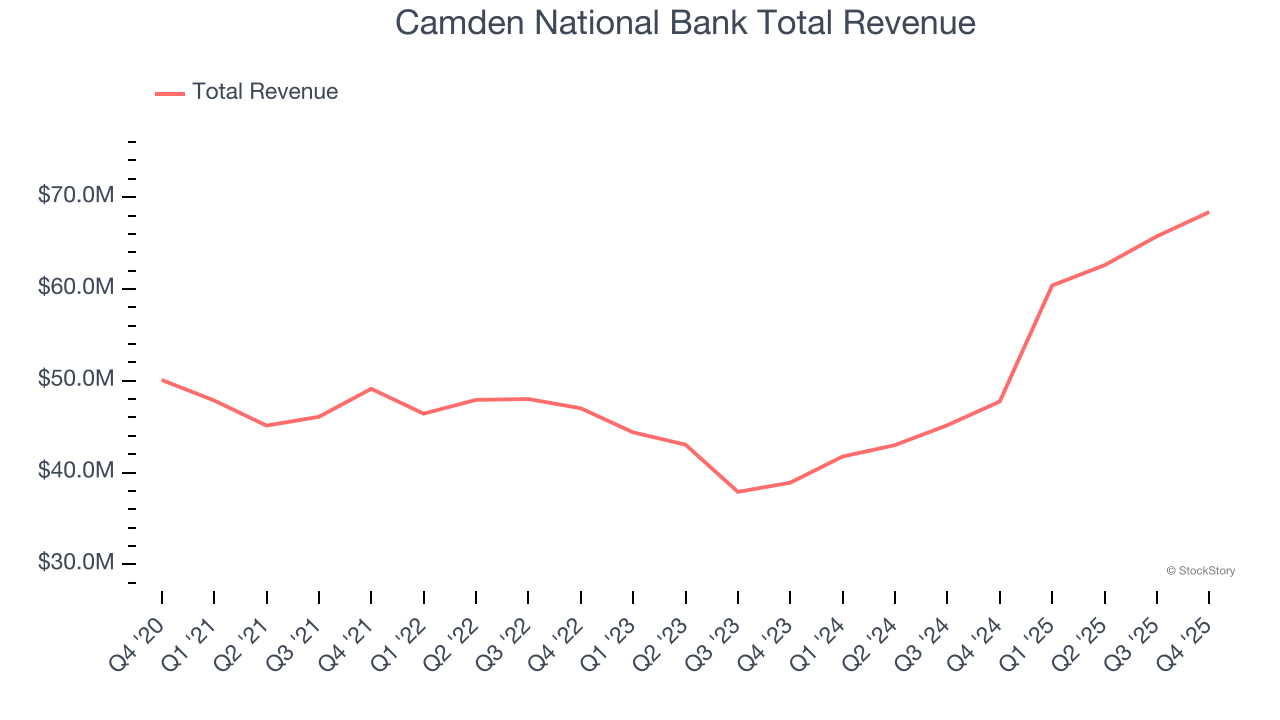

Camden National Bank (NASDAQ: CAC)

Rooted in Maine's coastal communities since 1875, Camden National (NASDAQ: CAC) is a regional bank holding company that provides banking, wealth management, and financial services to consumers and businesses throughout Maine and New Hampshire.

Camden National Bank reported revenues of $68.38 million, up 43.2% year on year. This print exceeded analysts’ expectations by 3.4%. Overall, it was a satisfactory quarter for the company with a solid beat of analysts’ revenue estimates but a narrow beat of analysts’ EPS estimates.

Interestingly, the stock is up 7.9% since reporting and currently trades at $50.94.

Is now the time to buy Camden National Bank? Access our full analysis of the earnings results here, it’s free.

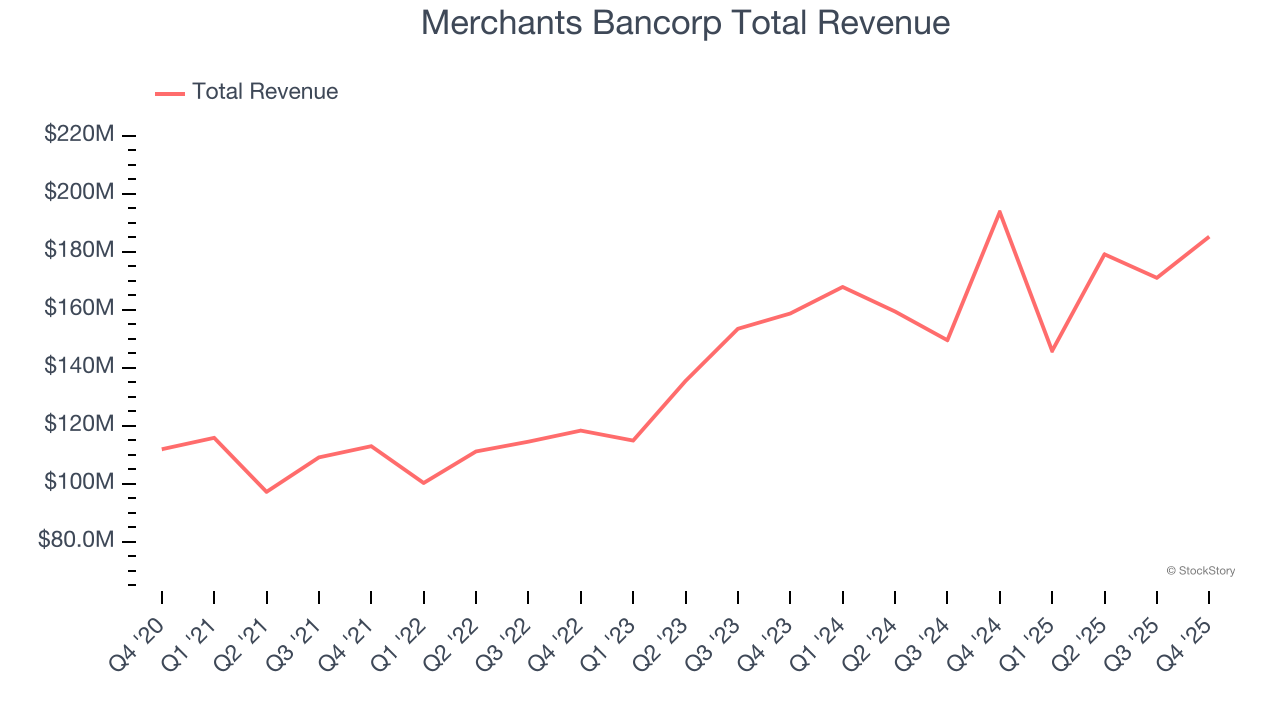

Best Q4: Merchants Bancorp (NASDAQ: MBIN)

With a strategic focus on low-risk, government-backed lending programs, Merchants Bancorp (NASDAQCM:MBIN) is an Indiana-based bank holding company specializing in multi-family mortgage banking, mortgage warehousing, and traditional banking services.

Merchants Bancorp reported revenues of $185.3 million, down 4.4% year on year, outperforming analysts’ expectations by 7.8%. The business had a stunning quarter with a beat of analysts’ EPS estimates and an impressive beat of analysts’ net interest income estimates.

The market seems happy with the results as the stock is up 22.2% since reporting. It currently trades at $42.70.

Is now the time to buy Merchants Bancorp? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: The Bancorp (NASDAQ: TBBK)

Operating behind the scenes of many popular fintech apps and prepaid cards you might use daily, The Bancorp (NASDAQ: TBBK) is a bank holding company that specializes in providing banking services to fintech companies and offering specialty lending products.

The Bancorp reported revenues of $172.7 million, up 8.2% year on year, falling short of analysts’ expectations by 11%. It was a disappointing quarter as it posted a significant miss of analysts’ tangible book value per share estimates and a significant miss of analysts’ revenue estimates.

As expected, the stock is down 14.7% since the results and currently trades at $60.20.

Read our full analysis of The Bancorp’s results here.

Community Bank (NYSE: CBU)

Tracing its roots back to 1866 in upstate New York, Community Financial System (NYSE: CBU) is a financial holding company that provides banking, employee benefits, wealth management, and insurance services to retail, commercial, and municipal customers.

Community Bank reported revenues of $215.6 million, up 10% year on year. This number topped analysts’ expectations by 1.6%. Taking a step back, it was a softer quarter as it logged a significant miss of analysts’ EPS estimates and a miss of analysts’ tangible book value per share estimates.

The stock is up 5.6% since reporting and currently trades at $65.23.

Read our full, actionable report on Community Bank here, it’s free.

Hope Bancorp (NASDAQ: HOPE)

With roots in serving Korean-American communities and now expanded to a multi-ethnic clientele across 12 states, Hope Bancorp (NASDAQ: HOPE) operates Bank of Hope, providing commercial and retail banking services with a focus on serving multi-ethnic communities across the United States.

Hope Bancorp reported revenues of $145.4 million, up 24.8% year on year. This print surpassed analysts’ expectations by 1.4%. Taking a step back, it was a mixed quarter as it also recorded a narrow beat of analysts’ revenue estimates but a miss of analysts’ net interest income estimates.

The stock is up 7.6% since reporting and currently trades at $12.68.

Read our full, actionable report on Hope Bancorp here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.