Beauty and waxing service franchise European Wax Center (NASDAQ: EWCZ) fell short of the market’s revenue expectations in Q2 CY2025, with sales falling 6.6% year on year to $55.91 million. The company’s full-year revenue guidance of $207 million at the midpoint came in 2.6% below analysts’ estimates. Its GAAP profit of $0.09 per share was in line with analysts’ consensus estimates.

Is now the time to buy European Wax Center? Find out by accessing our full research report, it’s free.

European Wax Center (EWCZ) Q2 CY2025 Highlights:

- Revenue: $55.91 million vs analyst estimates of $56.89 million (6.6% year-on-year decline, 1.7% miss)

- EPS (GAAP): $0.09 vs analyst estimates of $0.08 (in line)

- Adjusted EBITDA: $21.61 million vs analyst estimates of $18.37 million (38.7% margin, 17.7% beat)

- The company dropped its revenue guidance for the full year to $207 million at the midpoint from $212 million, a 2.4% decrease

- EBITDA guidance for the full year is $70 million at the midpoint, below analyst estimates of $70.64 million

- Operating Margin: 25.2%, up from 24% in the same quarter last year

- Free Cash Flow Margin: 0%, down from 23.8% in the same quarter last year

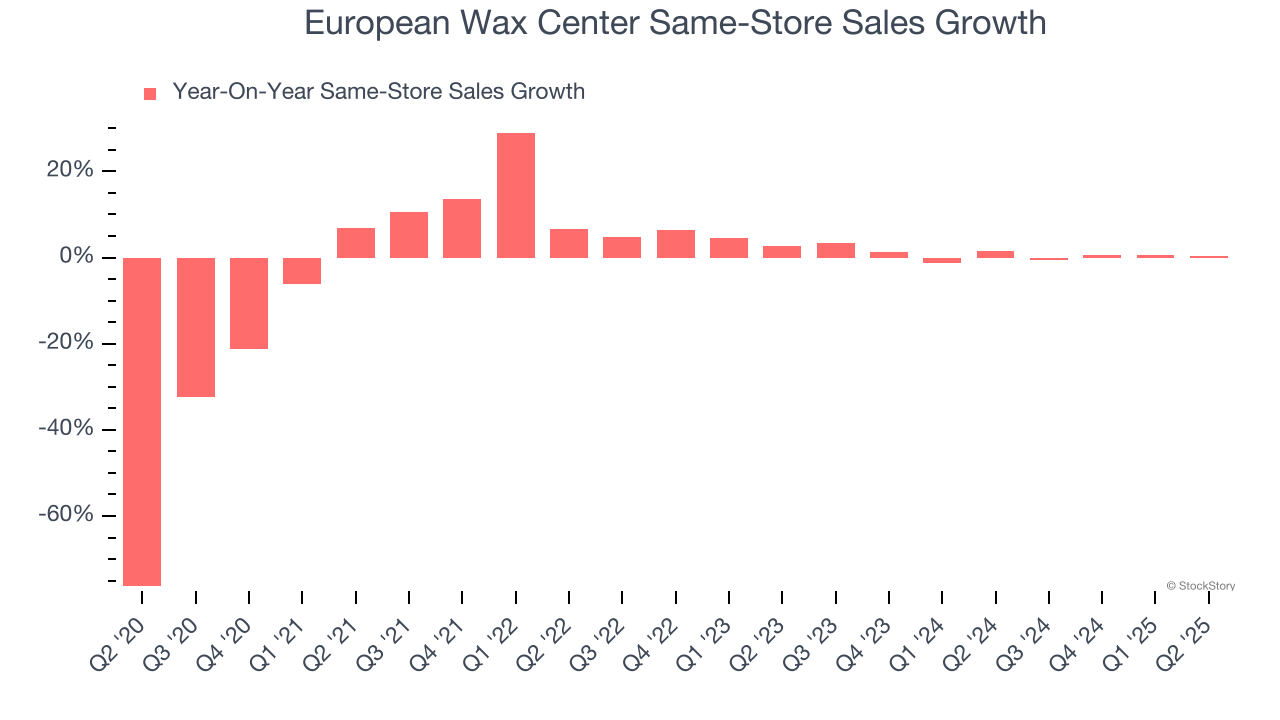

- Same-Store Sales were flat year on year (1.6% in the same quarter last year)

- Market Capitalization: $191.1 million

Chris Morris, Chairman and CEO of European Wax Center, Inc., stated: “In the second quarter, we began to see encouraging early signs that our strategies are taking hold, reinforcing the stability of our core business and the resilience of the European Wax Center brand. This is a transitional year in which we are strengthening the foundation of the business through data-driven decision making, disciplined execution, and a clear focus on our three strategic priorities: driving traffic and sales growth, improving four-wall profitability for franchisees, and pursuing thoughtful, profitable expansion.”

Company Overview

Founded by two siblings, European Wax Center (NASDAQ: EWCZ) is a beauty and waxing salon chain specializing in professional wax services and skincare products.

Revenue Growth

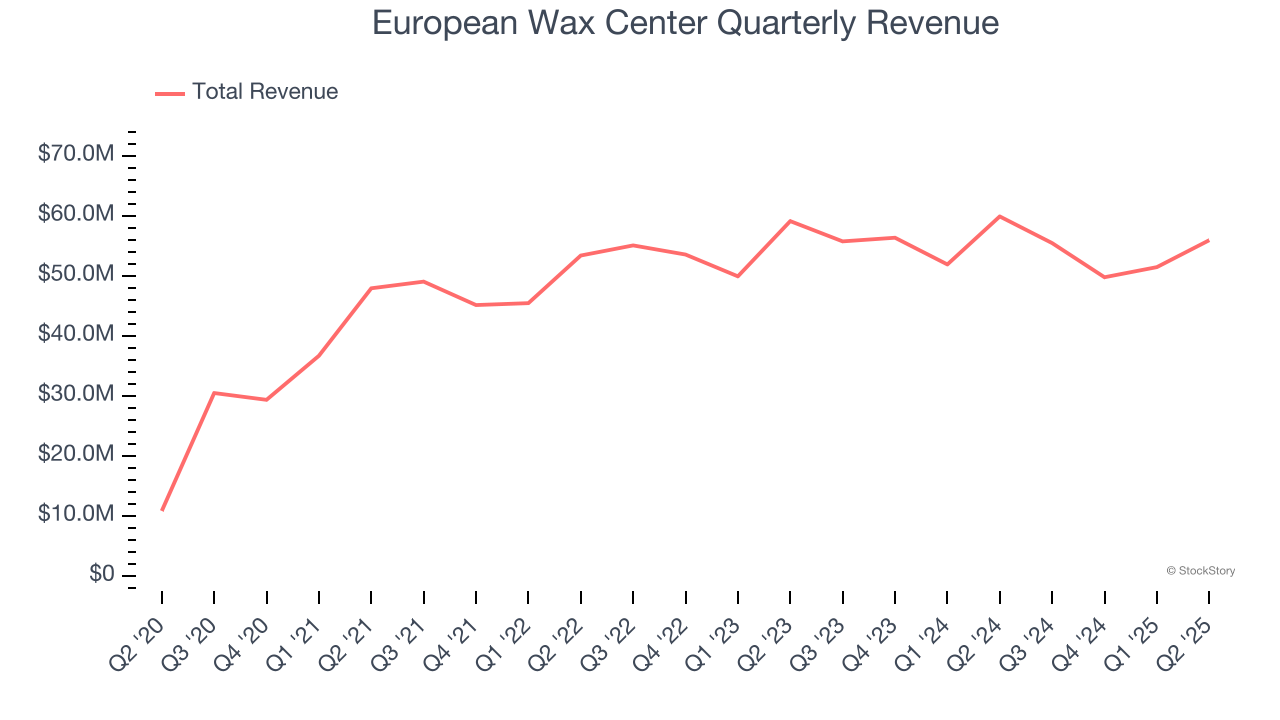

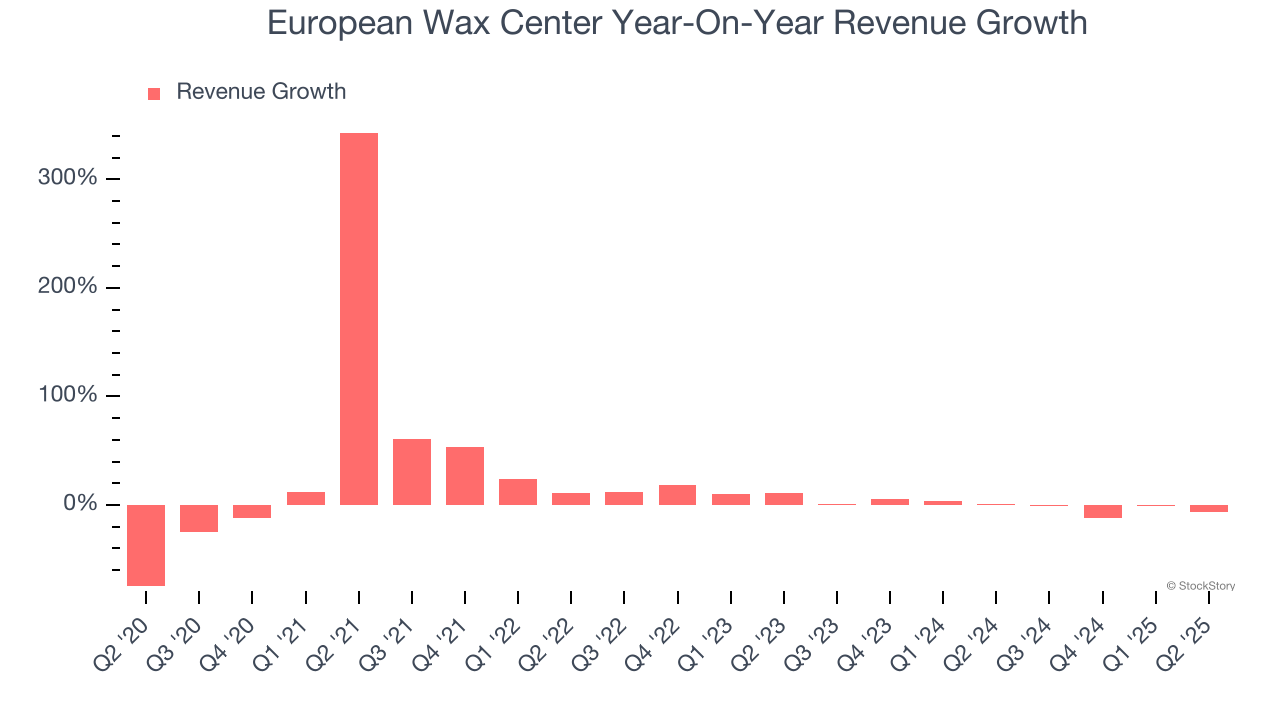

Reviewing a company’s long-term sales performance reveals insights into its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, European Wax Center grew its sales at a 12.5% compounded annual growth rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the consumer discretionary sector, which enjoys a number of secular tailwinds.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. European Wax Center’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 1.2% annually. Note that COVID hurt European Wax Center’s business in 2020 and part of 2021, and it bounced back in a big way thereafter.

We can better understand the company’s revenue dynamics by analyzing its same-store sales, which show how much revenue its established locations generate. Over the last two years, European Wax Center’s same-store sales were flat. Because this number is better than its revenue growth, we can see its sales from existing locations are performing better than its sales from new locations.

This quarter, European Wax Center missed Wall Street’s estimates and reported a rather uninspiring 6.6% year-on-year revenue decline, generating $55.91 million of revenue.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months. While this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

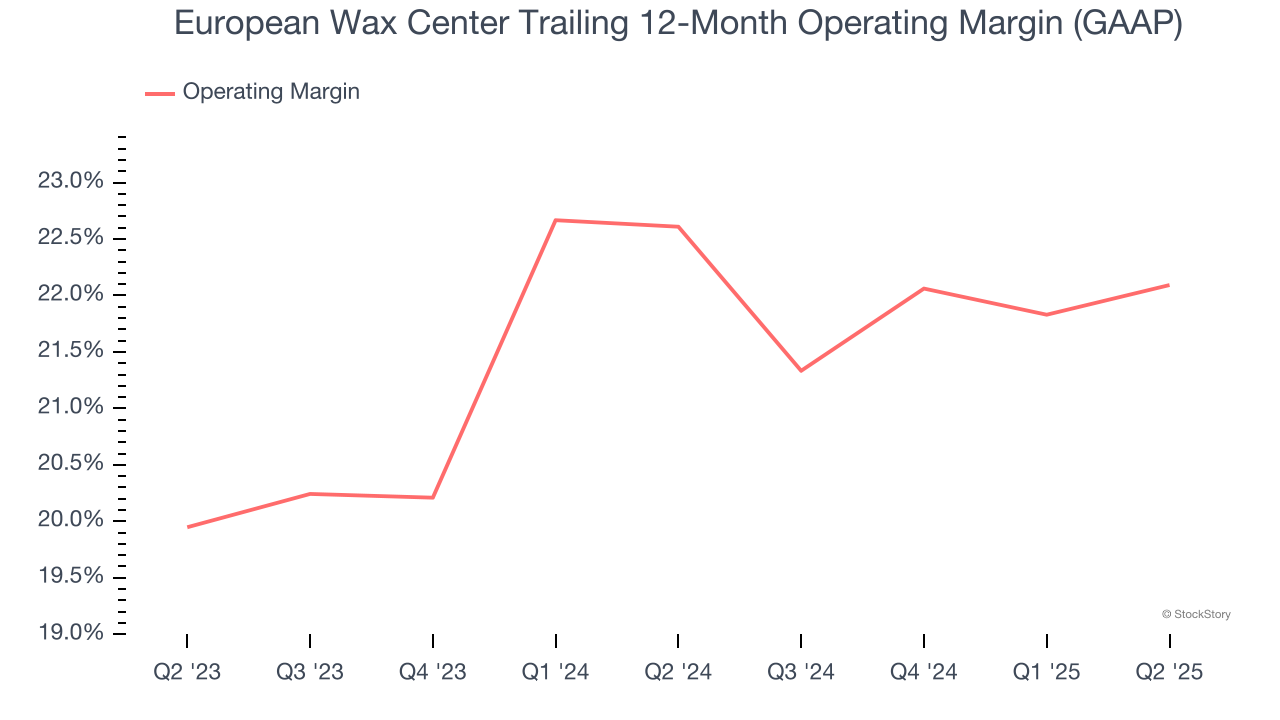

Operating Margin

European Wax Center’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 22.4% over the last two years. This profitability was elite for a consumer discretionary business thanks to its efficient cost structure and economies of scale.

In Q2, European Wax Center generated an operating margin profit margin of 25.2%, up 1.2 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

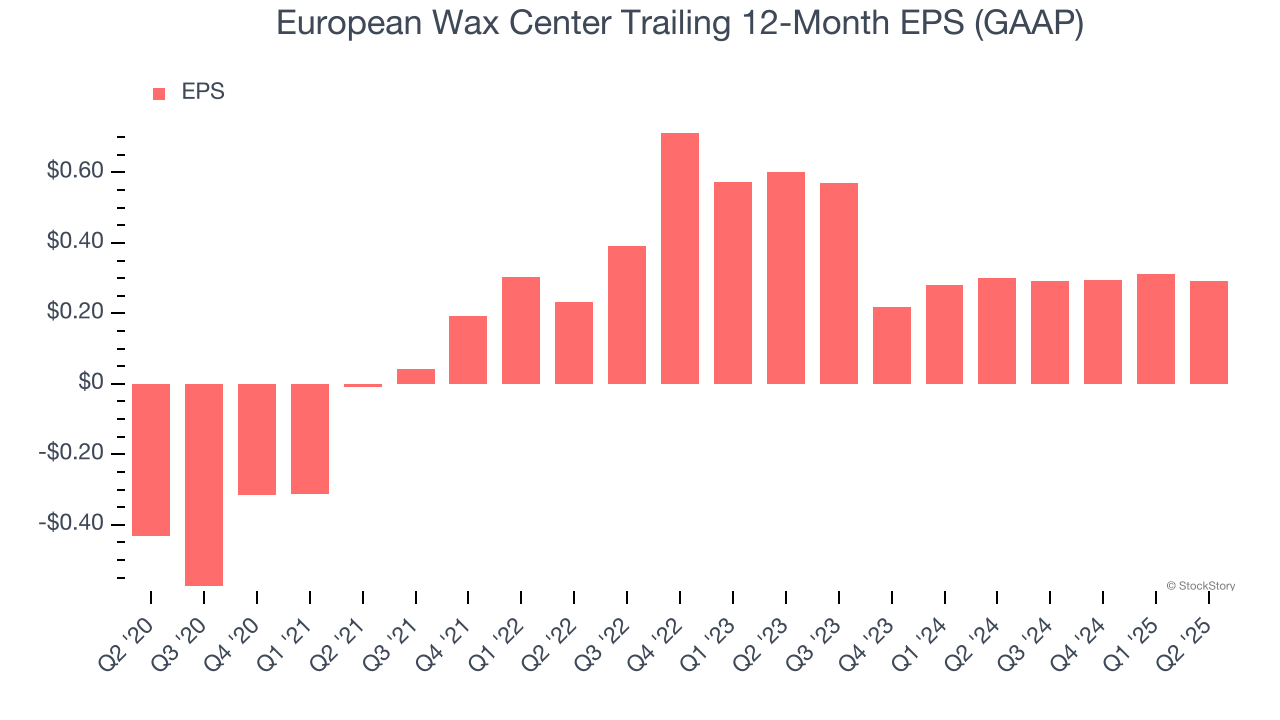

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

European Wax Center’s full-year EPS flipped from negative to positive over the last five years. This is encouraging and shows it’s at a critical moment in its life.

In Q2, European Wax Center reported EPS of $0.09, down from $0.11 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. We also like to analyze expected EPS growth based on Wall Street analysts’ consensus projections, but there is insufficient data.

Key Takeaways from European Wax Center’s Q2 Results

We enjoyed seeing European Wax Center beat analysts’ EBITDA expectations this quarter. We were also glad its EPS was in line with Wall Street’s estimates. On the other hand, its full-year revenue guidance missed and its revenue fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded up 1.1% to $4.47 immediately following the results.

So should you invest in European Wax Center right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.