Over the last six months, Allison Transmission’s shares have sunk to $92.73, producing a disappointing 15% loss while the S&P 500 was flat. This might have investors contemplating their next move.

Given the weaker price action, is this a buying opportunity for ALSN? Find out in our full research report, it’s free.

Why Does Allison Transmission Spark Debate?

Helping build race cars at one point, Allison Transmission (NYSE: ALSN) offers transmissions to original equipment manufacturers and fleet operators.

Two Positive Attributes:

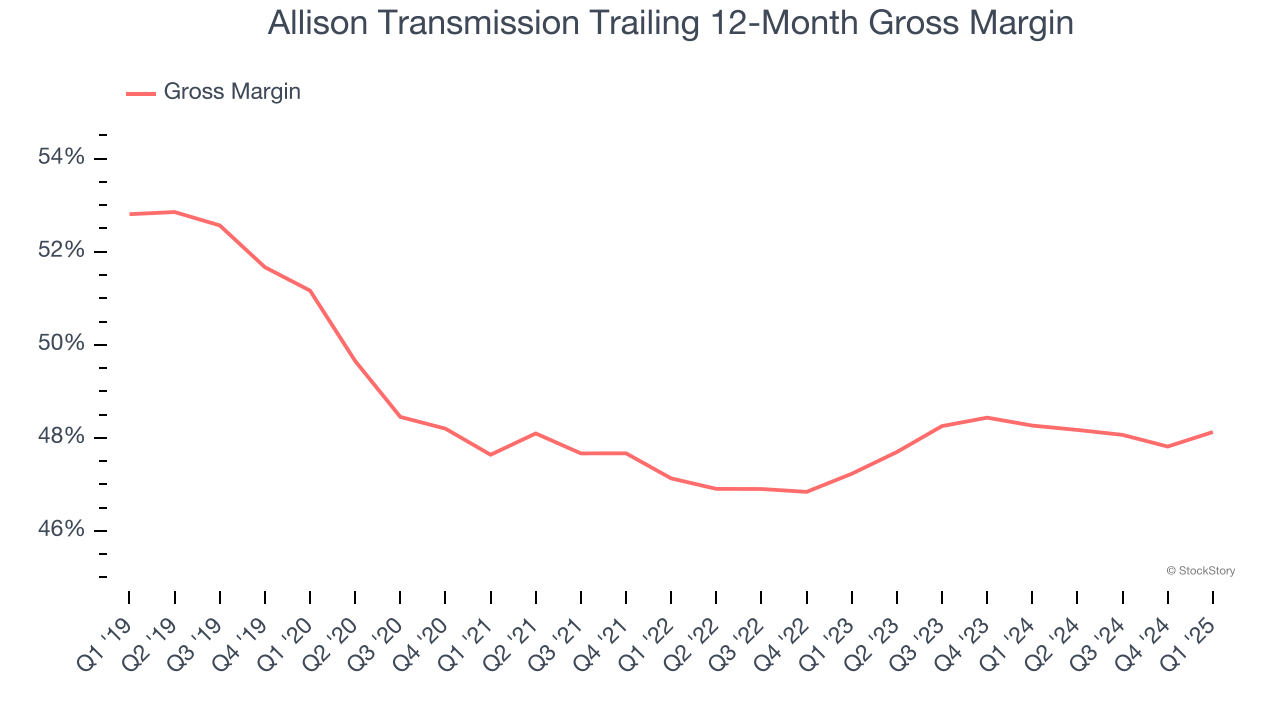

1. Elite Gross Margin Powers Best-In-Class Business Model

At StockStory, we prefer high gross margin businesses because they indicate the company has pricing power or differentiated products, giving it a chance to generate higher operating profits.

Allison Transmission has best-in-class unit economics for an industrials company, enabling it to invest in areas such as research and development. Its margin also signals it sells differentiated products, not commodities. As you can see below, it averaged an elite 47.7% gross margin over the last five years. That means Allison Transmission only paid its suppliers $52.28 for every $100 in revenue.

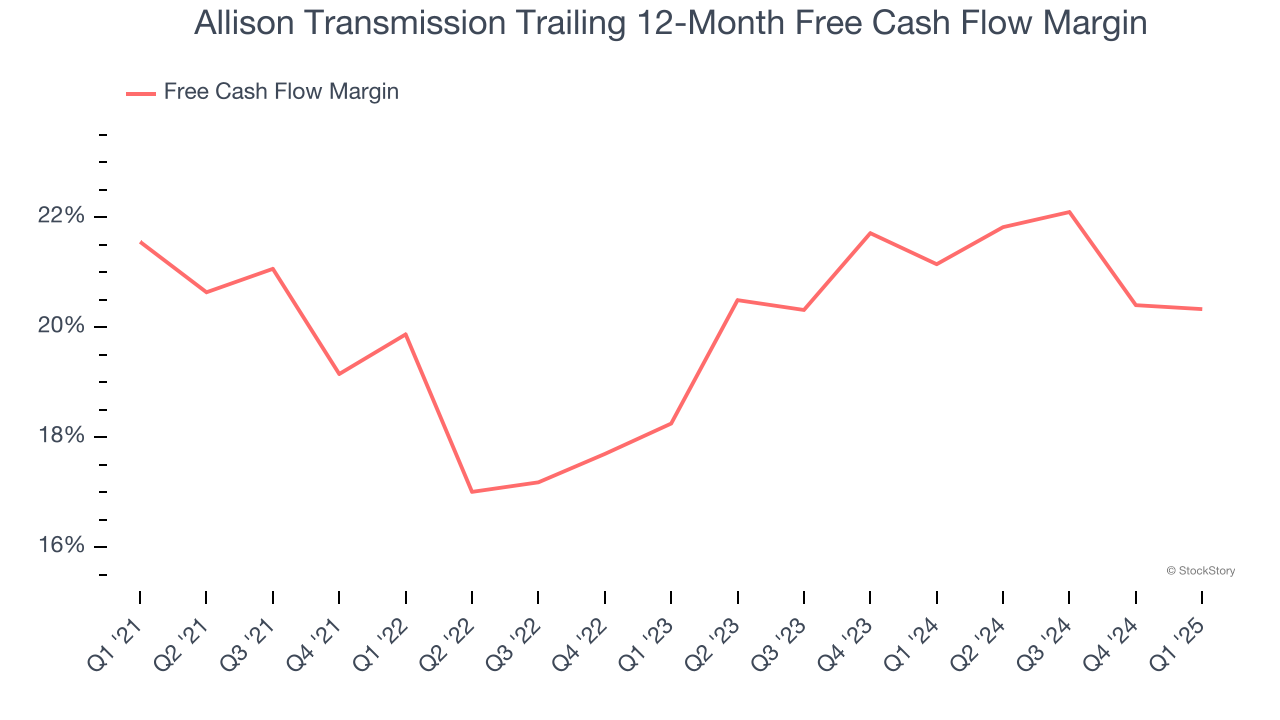

2. Excellent Free Cash Flow Margin Boosts Reinvestment Potential

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

Allison Transmission has shown terrific cash profitability, putting it in an advantageous position to invest in new products, return capital to investors, and consolidate the market during industry downturns. The company’s free cash flow margin was among the best in the industrials sector, averaging 20.2% over the last five years.

One Reason to be Careful:

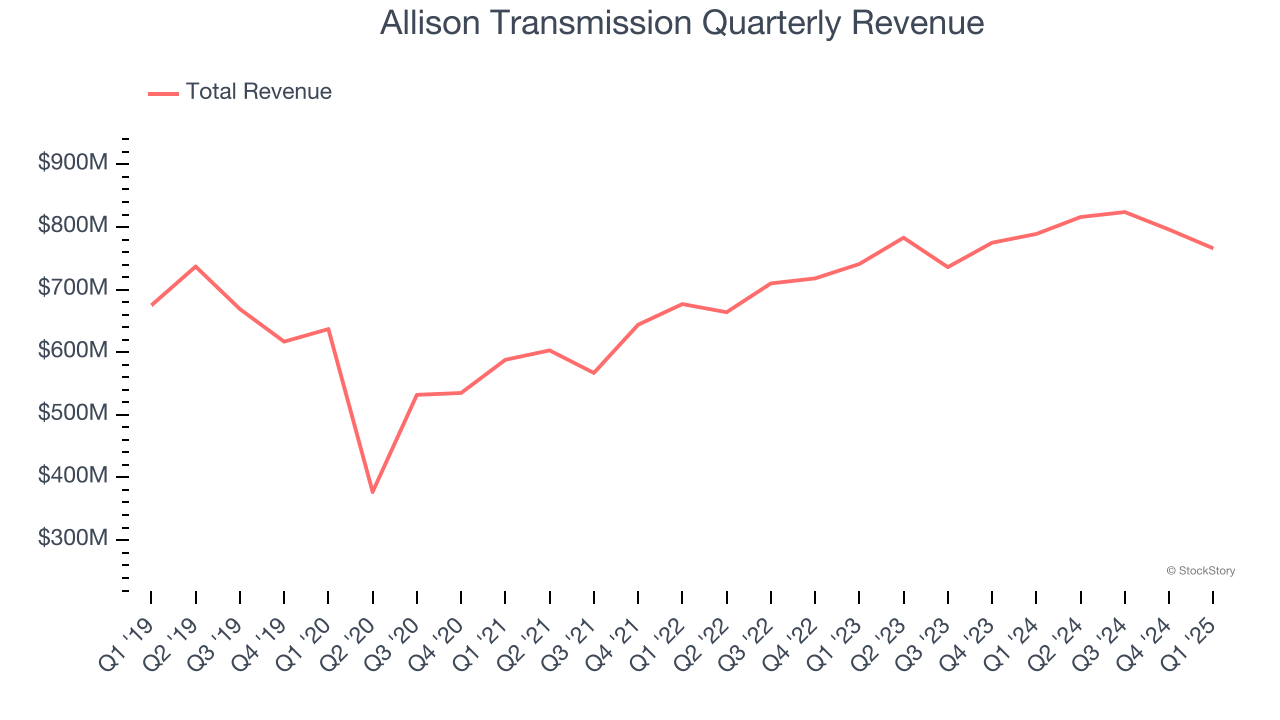

Long-Term Revenue Growth Disappoints

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Regrettably, Allison Transmission’s sales grew at a sluggish 3.8% compounded annual growth rate over the last five years. This wasn’t a great result compared to the rest of the industrials sector, but there are still things to like about Allison Transmission.

Final Judgment

Allison Transmission’s merits more than compensate for its flaws. With the recent decline, the stock trades at 9× forward EV-to-EBITDA (or $92.73 per share). Is now a good time to buy? See for yourself in our in-depth research report, it’s free.

High-Quality Stocks for All Market Conditions

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.