Dun & Bradstreet’s stock price has taken a beating over the past six months, shedding 25.9% of its value and falling to $9.08 per share. This might have investors contemplating their next move.

Is there a buying opportunity in Dun & Bradstreet, or does it present a risk to your portfolio? Get the full breakdown from our expert analysts, it’s free.

Why Do We Think Dun & Bradstreet Will Underperform?

Even though the stock has become cheaper, we're swiping left on Dun & Bradstreet for now. Here are three reasons why there are better opportunities than DNB and a stock we'd rather own.

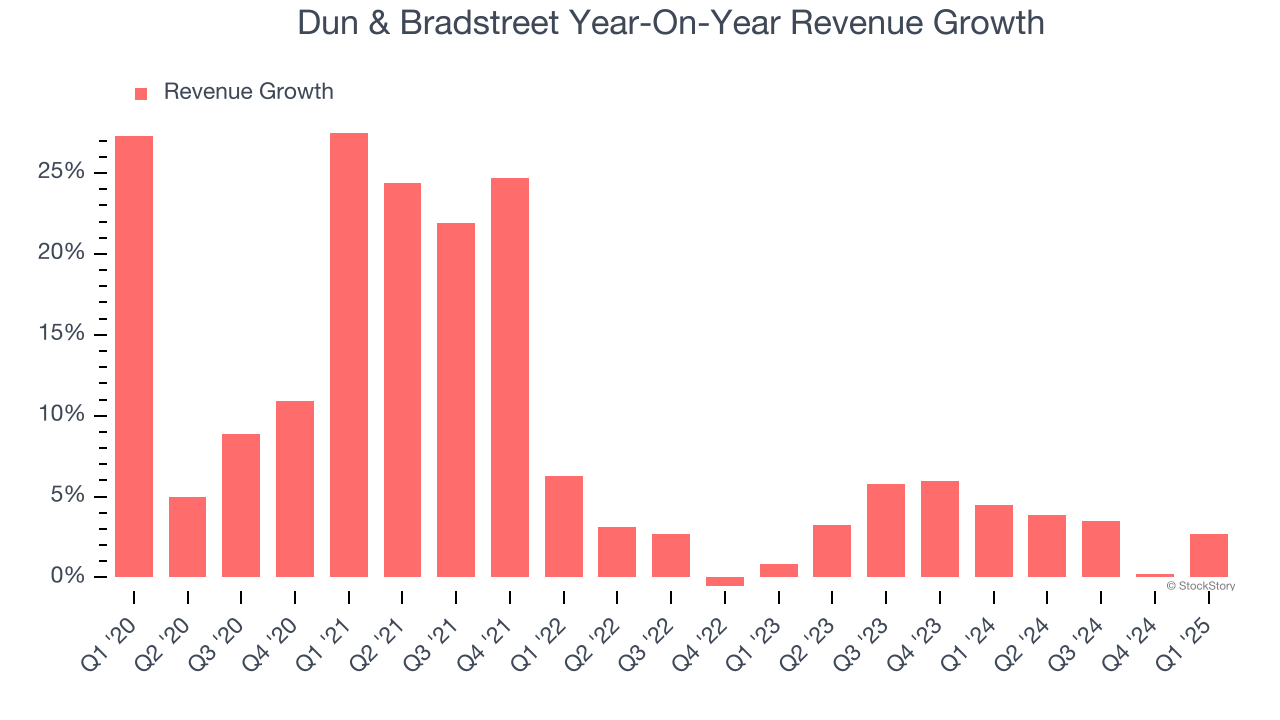

1. Lackluster Revenue Growth

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Dun & Bradstreet’s recent performance shows its demand has slowed as its annualized revenue growth of 3.7% over the last two years was below its five-year trend.

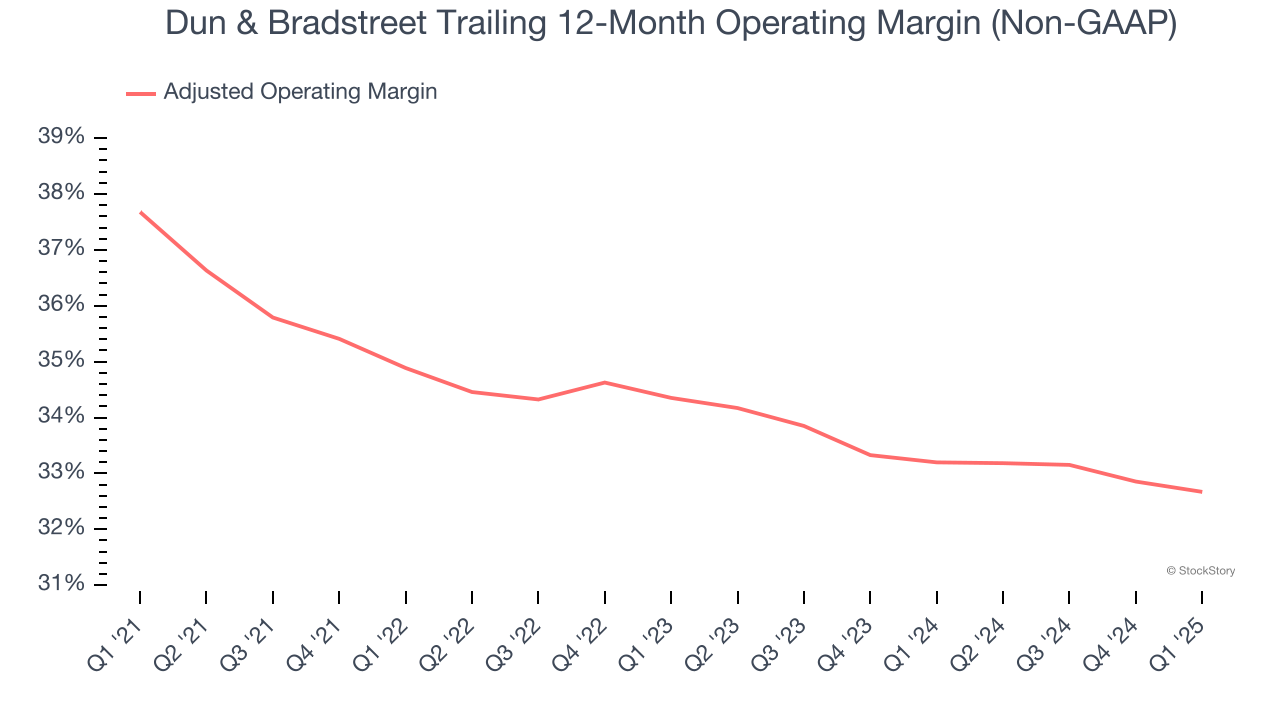

2. Shrinking Adjusted Operating Margin

Adjusted operating margin is a key measure of profitability. Think of it as net income (the bottom line) excluding the impact of non-recurring expenses, taxes, and interest on debt - metrics less connected to business fundamentals.

Analyzing the trend in its profitability, Dun & Bradstreet’s adjusted operating margin decreased by 5 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability. Its adjusted operating margin for the trailing 12 months was 32.7%.

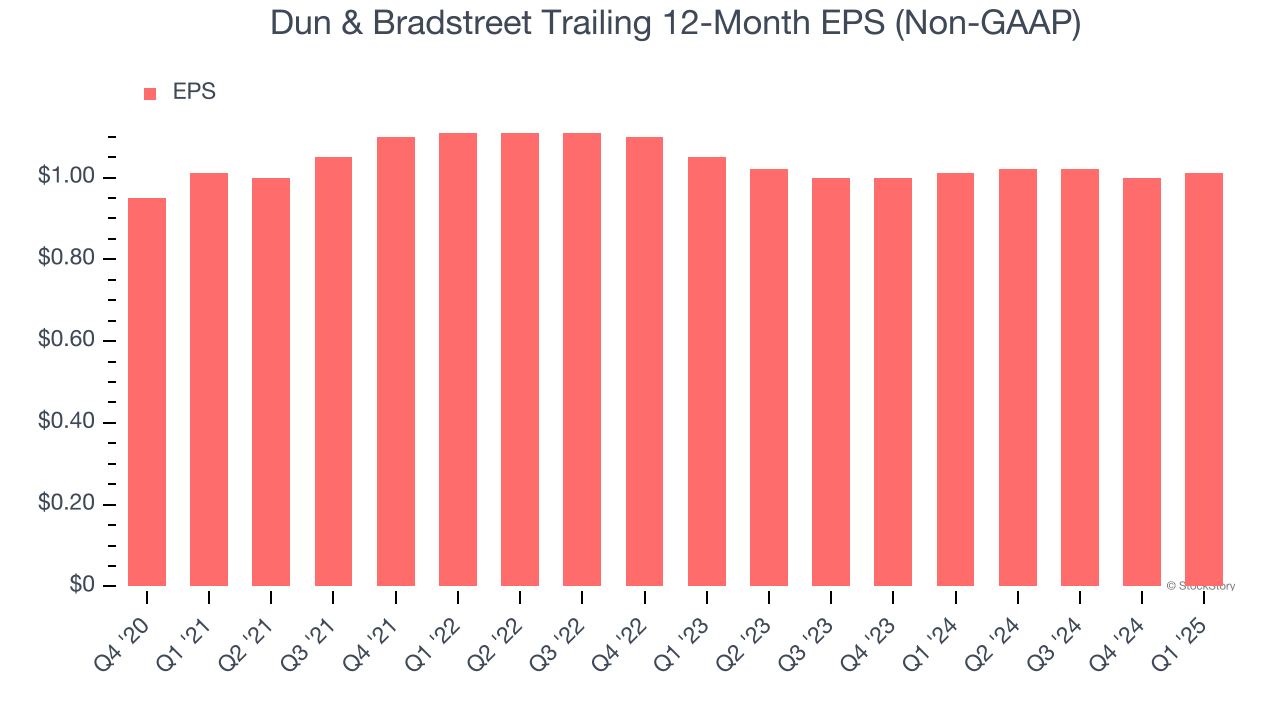

3. EPS Growth Has Stalled

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Dun & Bradstreet’s full-year EPS was flat over the last four years, worse than the broader business services sector.

Final Judgment

We cheer for all companies making their customers lives easier, but in the case of Dun & Bradstreet, we’ll be cheering from the sidelines. After the recent drawdown, the stock trades at 8.5× forward P/E (or $9.08 per share). While this valuation is optically cheap, the potential downside is huge given its shaky fundamentals. There are superior stocks to buy right now. Let us point you toward one of our all-time favorite software stocks.

High-Quality Stocks for All Market Conditions

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Comfort Systems (+782% five-year return). Find your next big winner with StockStory today.