Government engineering solutions provider Amentum Holdings (NYSE: AMTM) reported revenue ahead of Wall Street’s expectations in Q1 CY2025, with sales up 1.3% year on year to $3.49 billion. The company expects the full year’s revenue to be around $14 billion, close to analysts’ estimates. Its GAAP profit of $0.02 per share was 71.4% below analysts’ consensus estimates.

Is now the time to buy Amentum? Find out by accessing our full research report, it’s free.

Amentum (AMTM) Q1 CY2025 Highlights:

- Revenue: $3.49 billion vs analyst estimates of $3.42 billion (1.3% year-on-year growth, 2% beat)

- EPS (GAAP): $0.02 vs analyst expectations of $0.07 (71.4% miss)

- Adjusted EBITDA: $268 million vs analyst estimates of $255.9 million (7.7% margin, 4.7% beat)

- The company reconfirmed its revenue guidance for the full year of $14 billion at the midpoint

- EBITDA guidance for the full year is $1.08 billion at the midpoint, in line with analyst expectations

- Operating Margin: 3.2%, up from 2% in the same quarter last year

- Free Cash Flow Margin: 1.5%, down from 3.2% in the same quarter last year

- Backlog: $44.8 billion at quarter end

- Market Capitalization: $5.31 billion

“Amentum delivered solid results this quarter, underscoring the strength of our mission-focused portfolio and the consistency of demand across our markets,” said Amentum Chief Executive Officer John Heller.

Company Overview

With operations spanning approximately 80 countries and a workforce of specialized engineers and technical experts, Amentum Holdings (NYSE: AMTM) provides advanced engineering and technology solutions to U.S. government agencies, allied governments, and commercial enterprises across defense, energy, and space sectors.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $13.96 billion in revenue over the past 12 months, Amentum is larger than most business services companies and benefits from economies of scale, enabling it to gain more leverage on its fixed costs than smaller competitors. This also gives it the flexibility to offer lower prices. However, its scale is a double-edged sword because it’s harder to find incremental growth when you’ve penetrated most of the market. For Amentum to boost its sales, it likely needs to adjust its prices, launch new offerings, or lean into foreign markets.

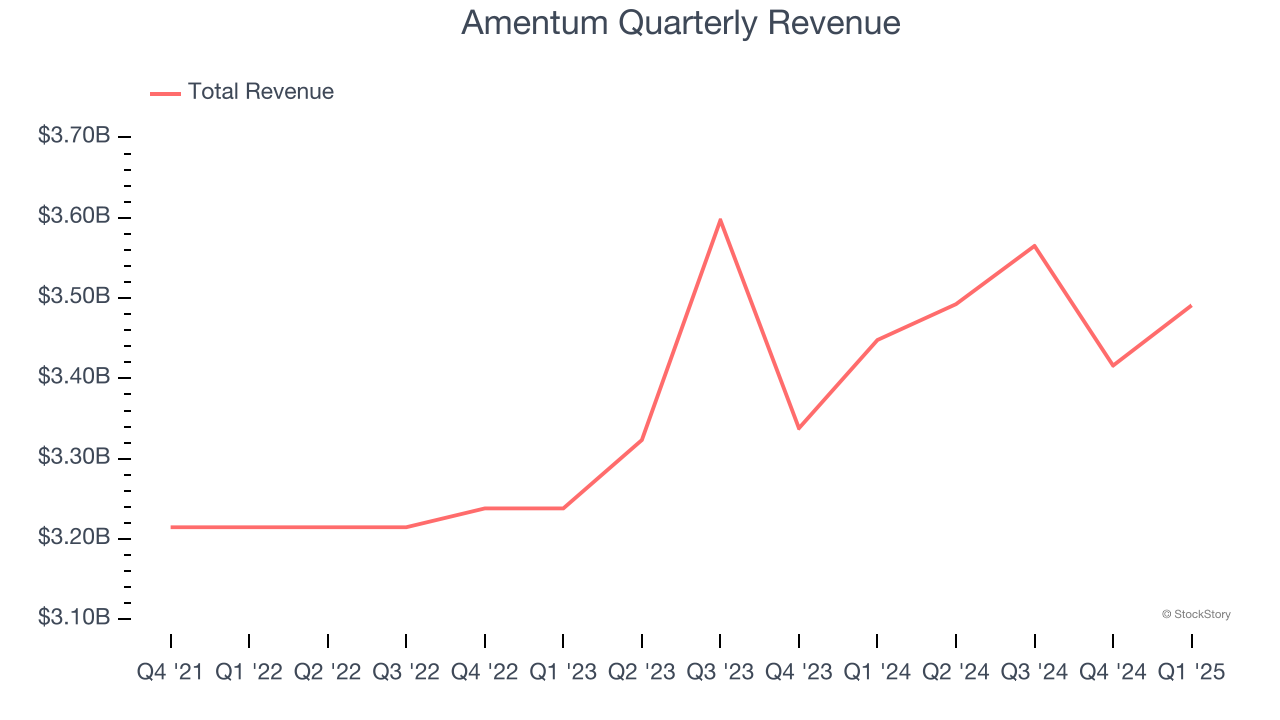

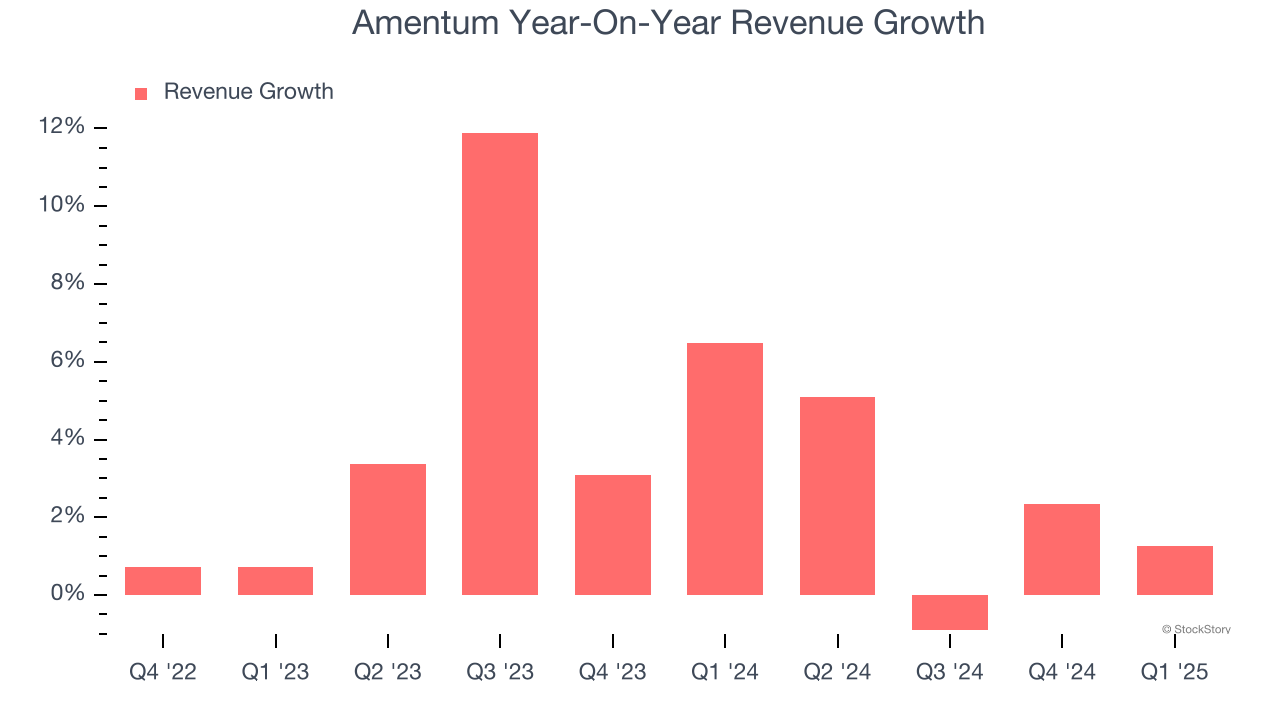

As you can see below, Amentum’s 2.4% annualized revenue growth over the last three years was sluggish. This shows it failed to generate demand in any major way and is a rough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within business services, a stretched historical view may miss recent innovations or disruptive industry trends. Amentum’s annualized revenue growth of 4% over the last two years is above its three-year trend, but we were still disappointed by the results.

This quarter, Amentum reported modest year-on-year revenue growth of 1.3% but beat Wall Street’s estimates by 2%.

Looking ahead, sell-side analysts expect revenue to grow 2% over the next 12 months, a slight deceleration versus the last two years. This projection doesn't excite us and suggests its products and services will face some demand challenges.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

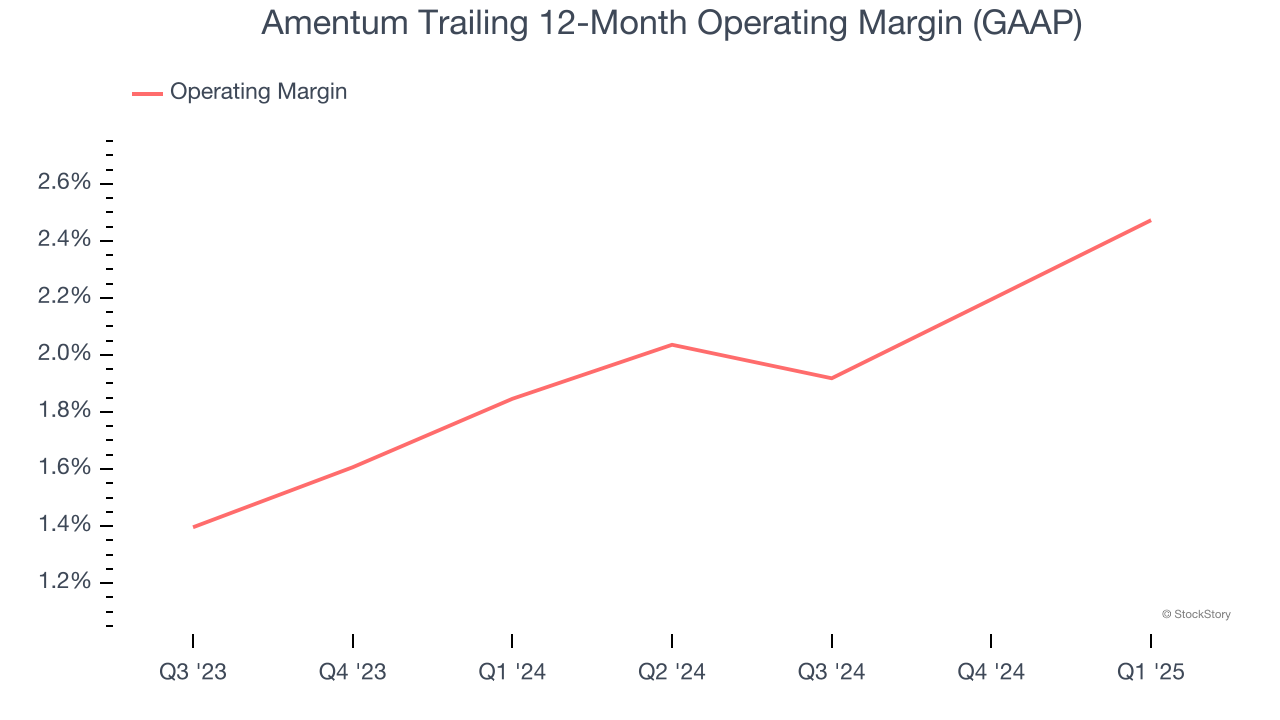

Amentum’s operating margin might fluctuated slightly over the last 12 months but has remained more or less the same, averaging 2% over the last three years. This profitability was inadequate for a business services business and caused by its suboptimal cost structure.

In Q1, Amentum generated an operating profit margin of 3.2%, up 1.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Cash Is King

If you’ve followed StockStory for a while, you know we emphasize free cash flow. Why, you ask? We believe that in the end, cash is king, and you can’t use accounting profits to pay the bills.

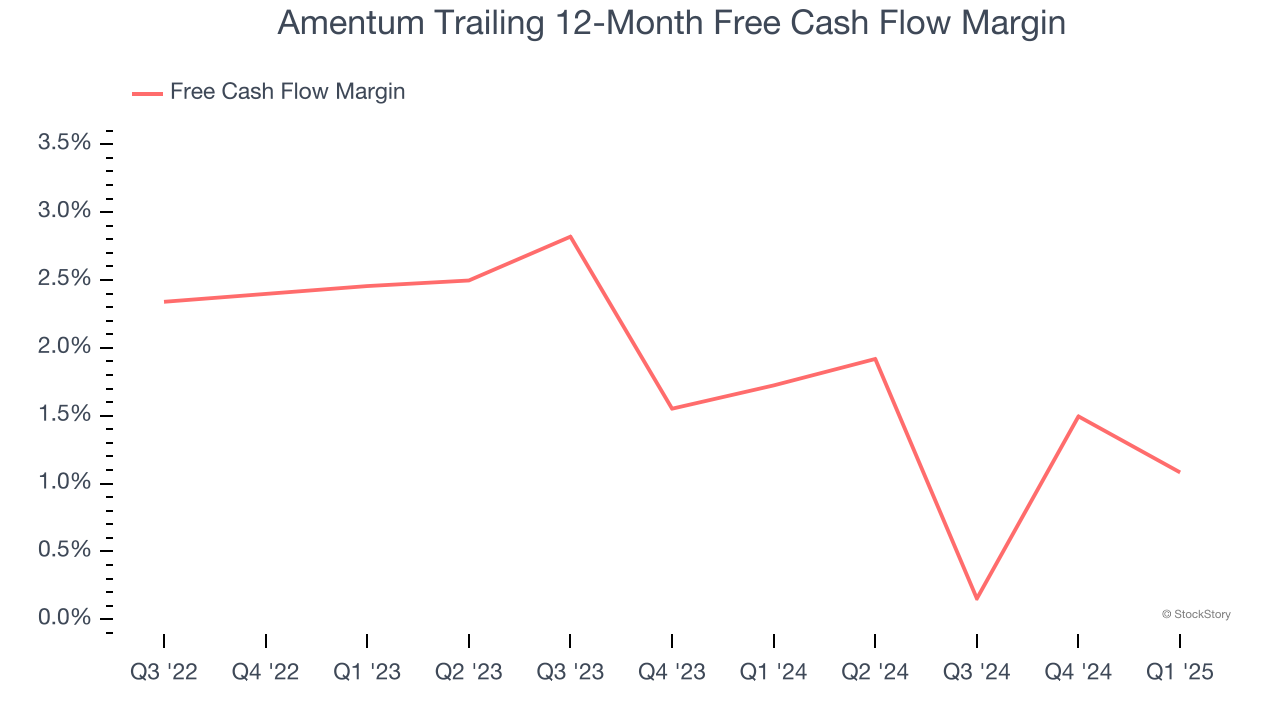

Amentum has shown poor cash profitability over the last four years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 1.8%, lousy for a business services business.

Taking a step back, we can see that Amentum failed to improve its margin during that time. Its unexciting margin and trend likely have shareholders hoping for a change.

Amentum’s free cash flow clocked in at $53 million in Q1, equivalent to a 1.5% margin. The company’s cash profitability regressed as it was 1.7 percentage points lower than in the same quarter last year, prompting us to pay closer attention. Short-term fluctuations typically aren’t a big deal because investment needs can be seasonal, but we’ll be watching to see if the trend extrapolates into future quarters.

Key Takeaways from Amentum’s Q1 Results

It was encouraging to see Amentum beat analysts’ revenue expectations this quarter. On the other hand, its EPS missed significantly and its full-year revenue guidance was in line with Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 2.7% to $21.53 immediately following the results.

Amentum’s latest earnings report disappointed. One quarter doesn’t define a company’s quality, so let’s explore whether the stock is a buy at the current price. If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free.