The end of the earnings season is always a good time to take a step back and see who shined (and who not so much). Let’s take a look at how leisure products stocks fared in Q1, starting with Ruger (NYSE: RGR).

Leisure products cover a wide range of goods in the consumer discretionary sector. Maintaining a strong brand is key to success, and those who differentiate themselves will enjoy customer loyalty and pricing power while those who don’t may find themselves in precarious positions due to the non-essential nature of their offerings.

The 10 leisure products stocks we track reported a mixed Q1. As a group, revenues beat analysts’ consensus estimates by 1.4% while next quarter’s revenue guidance was 5.2% below.

In light of this news, share prices of the companies have held steady as they are up 2.1% on average since the latest earnings results.

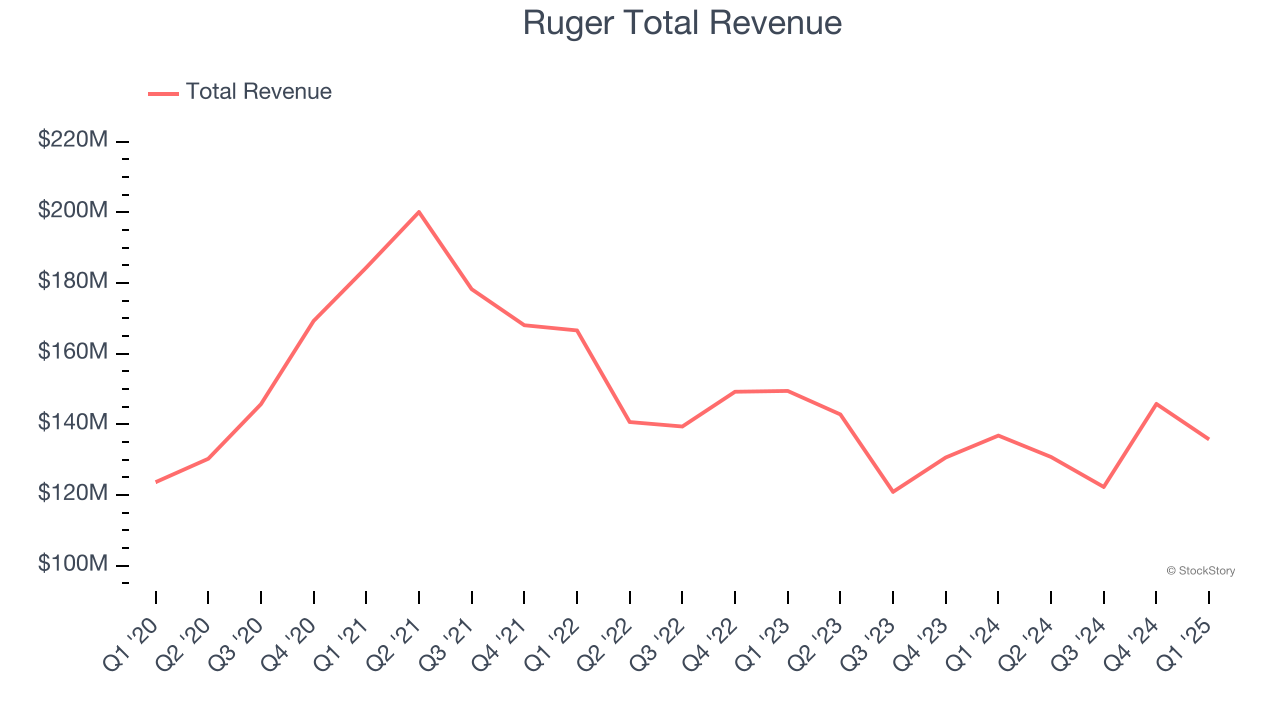

Weakest Q1: Ruger (NYSE: RGR)

Founded in 1949, Ruger (NYSE: RGR) is an American manufacturer of firearms for the commercial sporting market.

Ruger reported revenues of $135.7 million, flat year on year. This print fell short of analysts’ expectations by 8.3%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EPS estimates and a miss of analysts’ EBITDA estimates.

Ruger delivered the weakest performance against analyst estimates of the whole group. Unsurprisingly, the stock is down 12.3% since reporting and currently trades at $35.66.

Read our full report on Ruger here, it’s free.

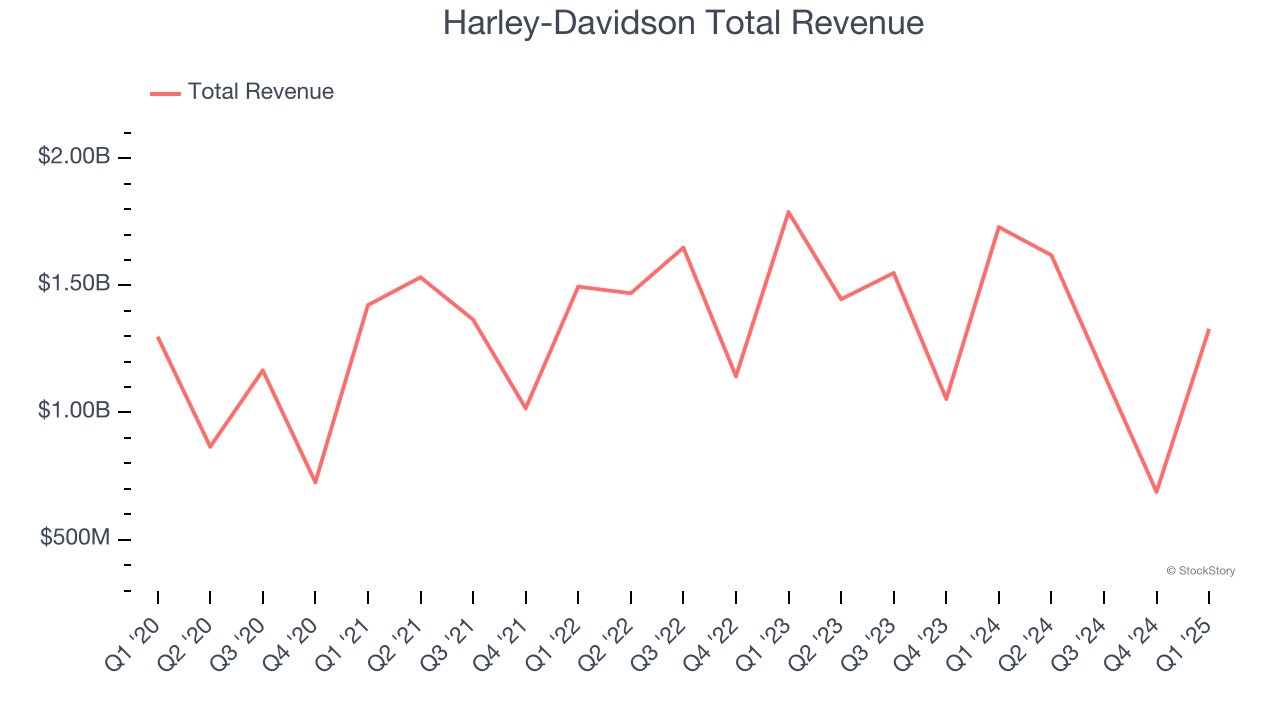

Best Q1: Harley-Davidson (NYSE: HOG)

Founded in 1903, Harley-Davidson (NYSE: HOG) is an American motorcycle manufacturer known for its heavyweight motorcycles designed for cruising on highways.

Harley-Davidson reported revenues of $1.33 billion, down 23.1% year on year, falling short of analysts’ expectations by 1.2%. However, the business still had a very strong quarter with an impressive beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

The market seems happy with the results as the stock is up 9% since reporting. It currently trades at $24.40.

Is now the time to buy Harley-Davidson? Access our full analysis of the earnings results here, it’s free.

Clarus (NASDAQ: CLAR)

Initially a financial services business, Clarus (NASDAQ: CLAR) designs, manufactures, and distributes outdoor equipment and lifestyle products.

Clarus reported revenues of $60.43 million, down 12.8% year on year, exceeding analysts’ expectations by 7.5%. Still, it was a softer quarter as it posted a significant miss of analysts’ adjusted operating income estimates.

As expected, the stock is down 12.1% since the results and currently trades at $3.08.

Read our full analysis of Clarus’s results here.

Brunswick (NYSE: BC)

Formerly known as Brunswick-Balke-Collender Company, Brunswick (NYSE: BC) is a designer and manufacturer of recreational marine products, including boats, engines, and marine parts.

Brunswick reported revenues of $1.22 billion, down 10.5% year on year. This print topped analysts’ expectations by 7.9%. More broadly, it was a mixed quarter as it also recorded an impressive beat of analysts’ EPS estimates but full-year EPS guidance missing analysts’ expectations significantly.

Brunswick delivered the biggest analyst estimates beat among its peers. The stock is up 10% since reporting and currently trades at $49.76.

Read our full, actionable report on Brunswick here, it’s free.

Latham (NASDAQ: SWIM)

Started as a family business, Latham (NASDAQ: SWIM) is a global designer and manufacturer of in-ground residential swimming pools and related products.

Latham reported revenues of $111.4 million, flat year on year. This result met analysts’ expectations. Overall, it was a strong quarter as it also recorded an impressive beat of analysts’ adjusted operating income estimates and full-year revenue guidance exceeding analysts’ expectations.

Latham pulled off the highest full-year guidance raise among its peers. The stock is down 4.6% since reporting and currently trades at $5.70.

Read our full, actionable report on Latham here, it’s free.

Market Update

Thanks to the Fed’s rate hikes in 2022 and 2023, inflation has been on a steady path downward, easing back toward that 2% sweet spot. Fortunately (miraculously to some), all this tightening didn’t send the economy tumbling into a recession, so here we are, cautiously celebrating a soft landing. The cherry on top? Recent rate cuts (half a point in September 2024, a quarter in November) have propped up markets, especially after Trump’s November win lit a fire under major indices and sent them to all-time highs. However, there’s still plenty to ponder — tariffs, corporate tax cuts, and what 2025 might hold for the economy.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.