Earnings results often indicate what direction a company will take in the months ahead. With Q1 behind us, let’s have a look at Telephone and Data Systems (NYSE: TDS) and its peers.

Terrestrial telecommunication companies face an uphill battle, as they mostly sell into a deflationary market, where the price of moving a bit tends to decrease over time with better technology. Without dependable volume growth, revenue growth could be challenged. Unfortunately, broadband penetration in their core US market is quite high already. On the other hand, data consumption from streaming entertainment and 5G expansion could provide a floor on growth for the next number of years. As if that wasn't enough to worry about, competition is intense, with larger telecom providers and hyperscalers expanding their own networks.

The 4 terrestrial telecommunication services stocks we track reported a slower Q1. As a group, revenues missed analysts’ consensus estimates by 1.1%.

In light of this news, share prices of the companies have held steady. On average, they are relatively unchanged since the latest earnings results.

Telephone and Data Systems (NYSE: TDS)

Operating primarily through its majority-owned subsidiary UScellular and wholly-owned TDS Telecom, Telephone and Data Systems (NYSE: TDS) provides wireless, broadband, video, and voice communications services to 4.6 million wireless and 1.2 million broadband customers across the United States.

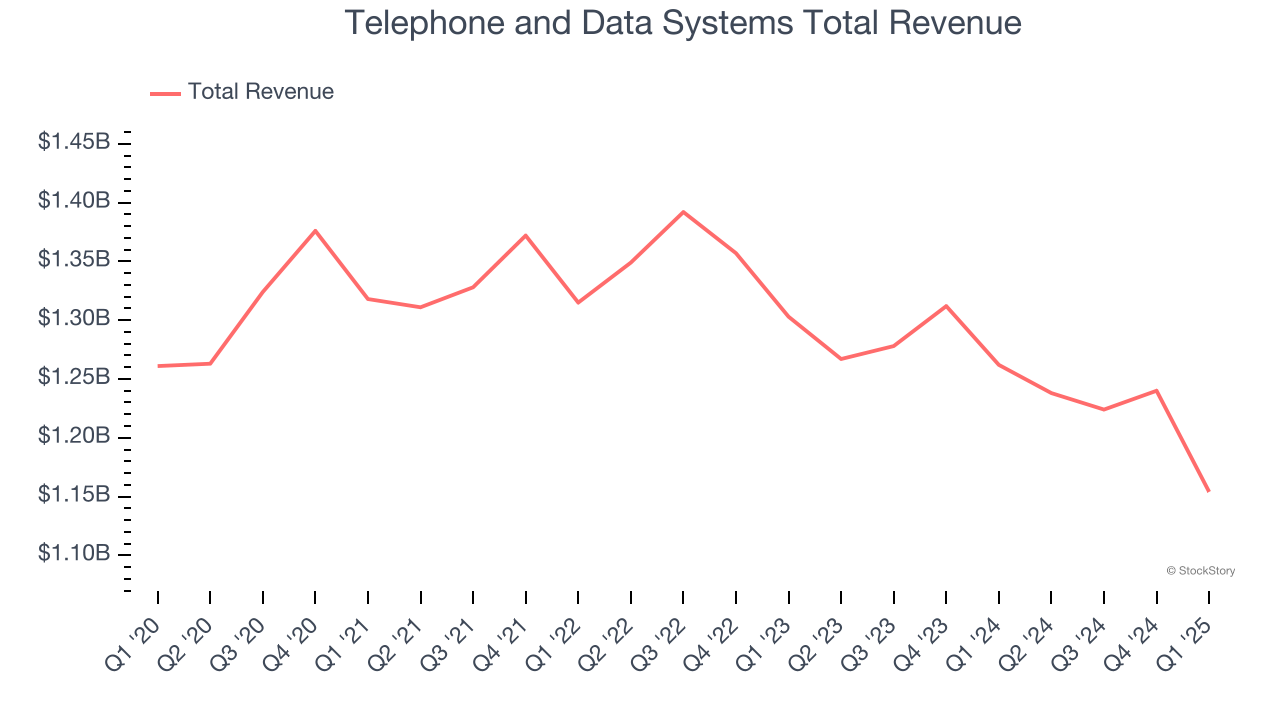

Telephone and Data Systems reported revenues of $1.15 billion, down 8.6% year on year. This print fell short of analysts’ expectations by 2.1%. Overall, it was a disappointing quarter for the company with a significant miss of analysts’ EPS estimates.

"As we work towards the expected mid-2025 closing of the sale of the wireless operations, the remaining businesses – fiber and towers – are making foundational changes that will support TDS' transformation," said Walter Carlson, TDS President and CEO.

Telephone and Data Systems delivered the slowest revenue growth of the whole group. Unsurprisingly, the stock is down 9.8% since reporting and currently trades at $33.90.

Read our full report on Telephone and Data Systems here, it’s free.

Best Q1: Lumen (NYSE: LUMN)

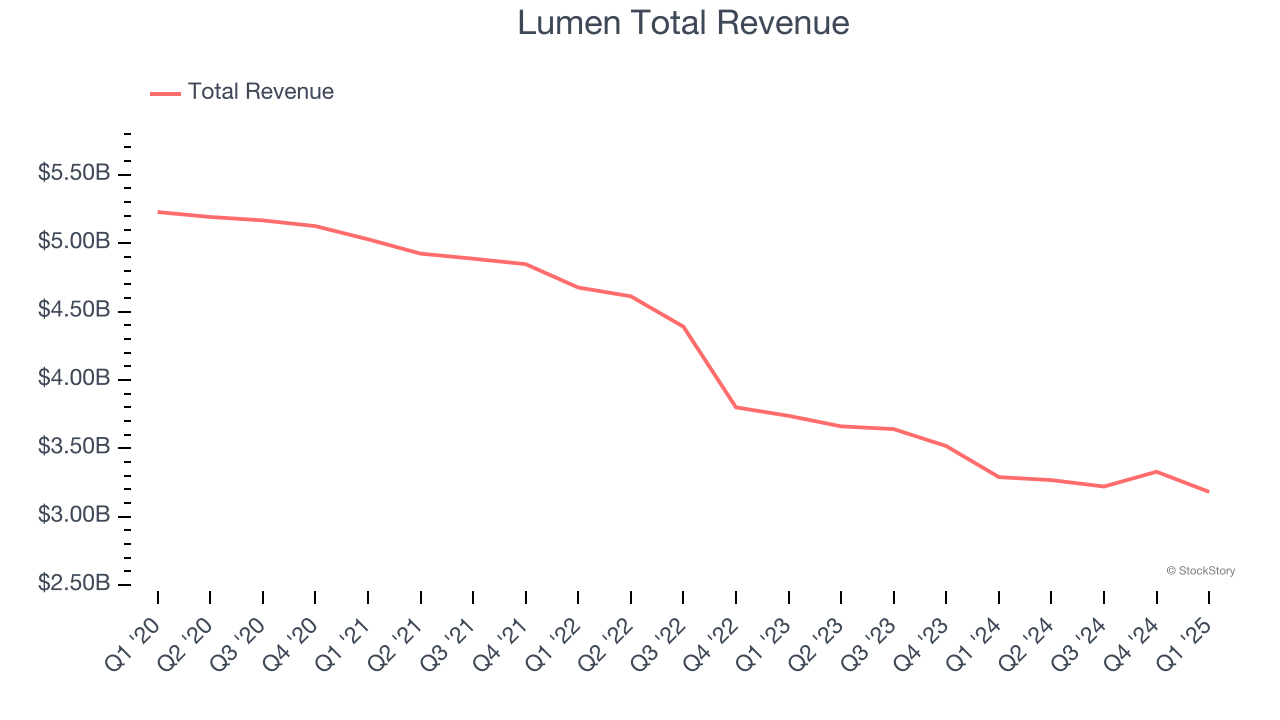

With approximately 350,000 route miles of fiber optic cable spanning North America and the Asia Pacific, Lumen Technologies (NYSE: LUMN) operates a vast fiber optic network that provides communications, cloud connectivity, security, and IT solutions to businesses and consumers.

Lumen reported revenues of $3.18 billion, down 3.3% year on year, outperforming analysts’ expectations by 1.9%. The business had an exceptional quarter with a solid beat of analysts’ EPS estimates.

Lumen scored the biggest analyst estimates beat and fastest revenue growth among its peers. The market seems happy with the results as the stock is up 25% since reporting. It currently trades at $4.40.

Is now the time to buy Lumen? Access our full analysis of the earnings results here, it’s free.

U.S. Cellular (NYSE: USM)

Operating as a majority-owned subsidiary of Telephone and Data Systems since its founding in 1983, US Cellular (NYSE: USM) is a regional wireless telecommunications provider serving 4.6 million customers across 21 states with mobile phone, internet, and IoT services.

U.S. Cellular reported revenues of $891 million, down 6.2% year on year, falling short of analysts’ expectations by 3.1%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

U.S. Cellular delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 12.5% since the results and currently trades at $60.11.

Read our full analysis of U.S. Cellular’s results here.

Cogent (NASDAQ: CCOI)

Operating a massive network spanning 20,000 miles of fiber optic cable and connecting to over 3,200 buildings worldwide, Cogent Communications (NASDAQ: CCOI) provides high-speed Internet access, private network services, and data center colocation to businesses and bandwidth-intensive organizations across 54 countries.

Cogent reported revenues of $247 million, down 7.2% year on year. This result came in 1% below analysts' expectations. Overall, it was a slower quarter for the company.

The stock is down 5.5% since reporting and currently trades at $50.20.

Read our full, actionable report on Cogent here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.