Wrapping up Q3 earnings, we look at the numbers and key takeaways for the vertical software stocks, including Alarm.com (NASDAQ: ALRM) and its peers.

Software is eating the world, and while a large number of solutions such as project management or video conferencing software can be useful to a wide array of industries, some have very specific needs. As a result, vertical software, which addresses industry-specific workflows, is growing and fueled by the pressures to improve productivity, whether it be for a life sciences, education, or banking company.

The 4 vertical software stocks we track reported a very strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.5% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 7.3% since the latest earnings results.

Best Q3: Alarm.com (NASDAQ: ALRM)

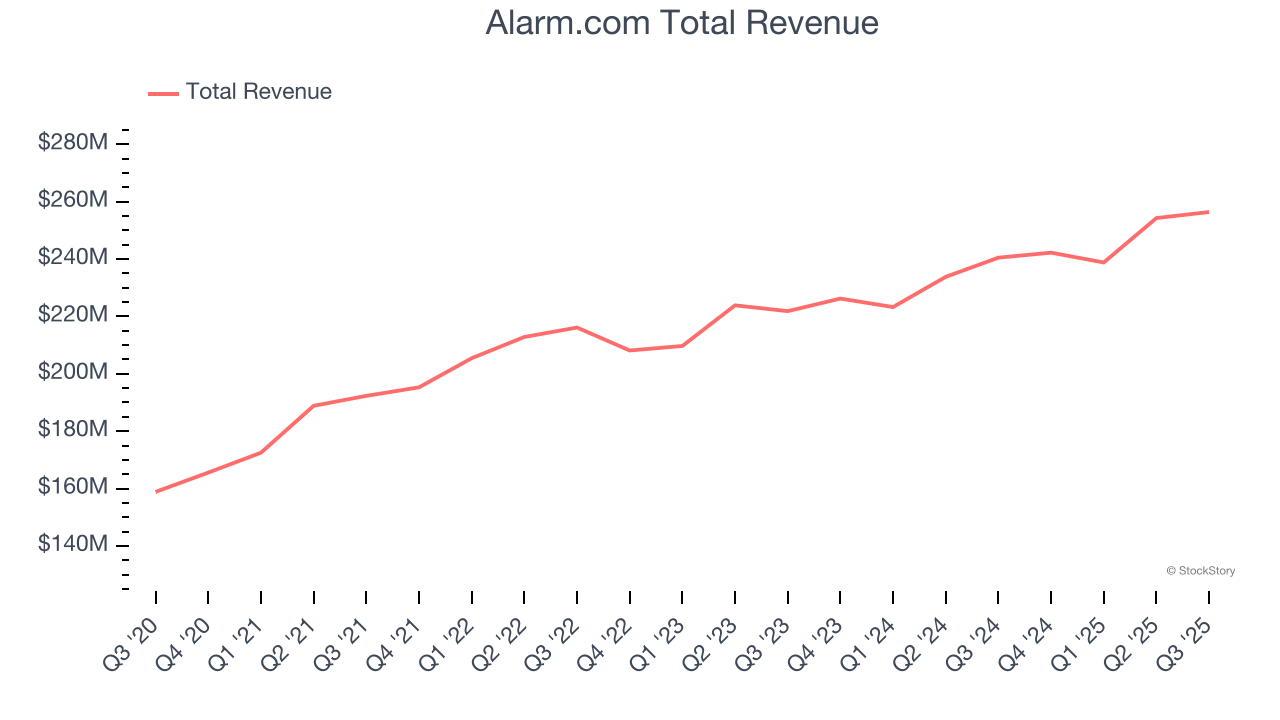

Processing over 325 billion data points annually from more than 150 million connected devices, Alarm.com (NASDAQ: ALRM) provides cloud-based platforms that enable residential and commercial property owners to remotely monitor and control their security, video, energy, and other connected devices.

Alarm.com reported revenues of $256.4 million, up 6.6% year on year. This print exceeded analysts’ expectations by 2.2%. Overall, it was an exceptional quarter for the company with an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

Interestingly, the stock is up 10% since reporting and currently trades at $51.84.

Is now the time to buy Alarm.com? Access our full analysis of the earnings results here, it’s free for active Edge members.

Manhattan Associates (NASDAQ: MANH)

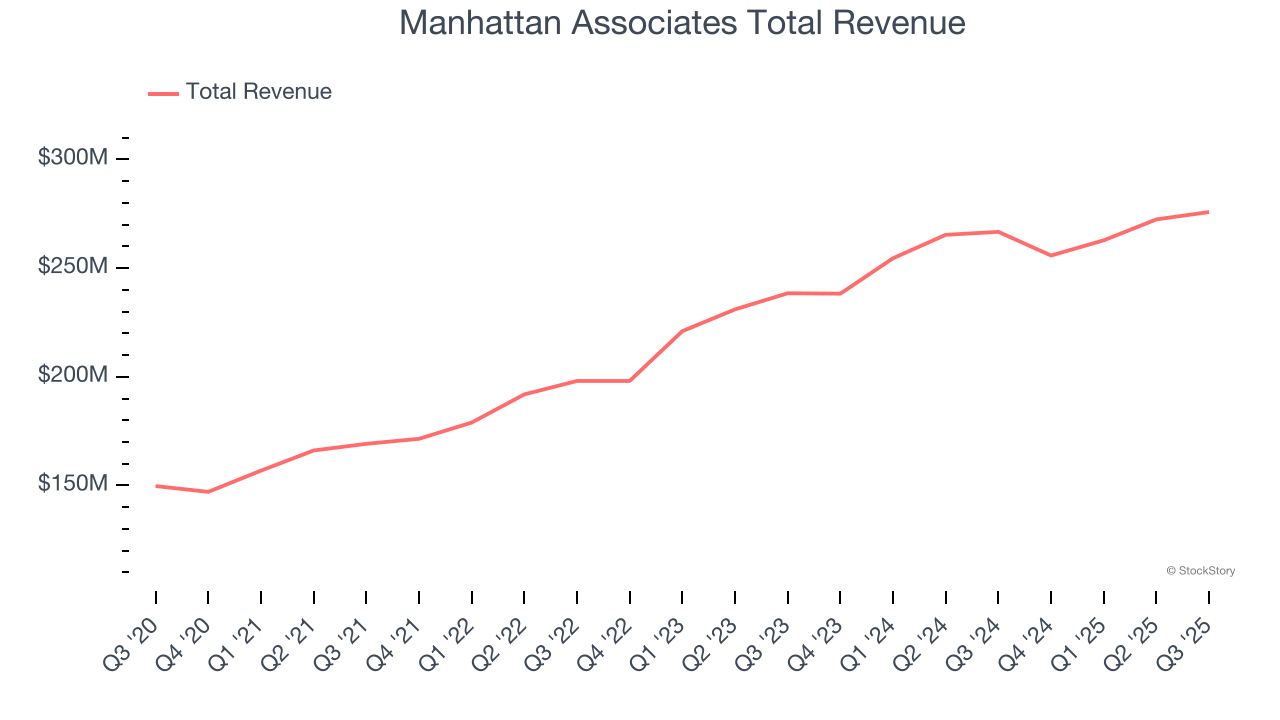

Built on a "versionless" cloud architecture that delivers quarterly updates to all customers, Manhattan Associates (NASDAQ: MANH) develops cloud-based software that helps retailers, wholesalers, and manufacturers manage their supply chains, inventory, and omnichannel operations.

Manhattan Associates reported revenues of $275.8 million, up 3.4% year on year, outperforming analysts’ expectations by 1.6%. The business had a very strong quarter with an impressive beat of analysts’ EBITDA estimates and full-year EPS guidance exceeding analysts’ expectations.

Manhattan Associates scored the highest full-year guidance raise among its peers. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 15.1% since reporting. It currently trades at $173.76.

Is now the time to buy Manhattan Associates? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Guidewire Software (NYSE: GWRE)

With its systems powering the operations of hundreds of insurance brands across 42 countries, Guidewire Software (NYSE: GWRE) provides a technology platform that helps property and casualty insurance companies manage their core operations, digital engagement, and analytics.

Guidewire Software reported revenues of $332.6 million, up 26.5% year on year, exceeding analysts’ expectations by 4.6%. It was a satisfactory quarter as it also posted an impressive beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

Guidewire Software delivered the weakest full-year guidance update in the group. As expected, the stock is down 5% since the results and currently trades at $206.24.

Read our full analysis of Guidewire Software’s results here.

Bentley Systems (NASDAQ: BSY)

Pioneering the concept of "digital twins" for infrastructure projects long before it became an industry buzzword, Bentley Systems (NASDAQ: BSY) provides software solutions that help engineers design, build, and operate infrastructure projects across sectors including roads, bridges, utilities, mining, and industrial facilities.

Bentley Systems reported revenues of $375.5 million, up 12% year on year. This result beat analysts’ expectations by 1.6%. It was a strong quarter as it also recorded a solid beat of analysts’ EBITDA estimates and a decent beat of analysts’ billings estimates.

Bentley Systems had the weakest performance against analyst estimates among its peers. The stock is down 19% since reporting and currently trades at $39.65.

Read our full, actionable report on Bentley Systems here, it’s free for active Edge members.

Market Update

The Fed’s interest rate hikes throughout 2022 and 2023 have successfully cooled post-pandemic inflation, bringing it closer to the 2% target. Inflationary pressures have eased without tipping the economy into a recession, suggesting a soft landing. This stability, paired with recent rate cuts (0.5% in September 2024 and 0.25% in November 2024), fueled a strong year for the stock market in 2024. The markets surged further after Donald Trump’s presidential victory in November, with major indices reaching record highs in the days following the election. Still, questions remain about the direction of economic policy, as potential tariffs and corporate tax changes add uncertainty for 2025.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.