Avocado company Mission Produce (NASDAQ: AVO) reported Q3 CY2025 results beating Wall Street’s revenue expectations, but sales fell by 10% year on year to $319 million. Its non-GAAP profit of $0.31 per share was 34.8% above analysts’ consensus estimates.

Is now the time to buy Mission Produce? Find out by accessing our full research report, it’s free for active Edge members.

Mission Produce (AVO) Q3 CY2025 Highlights:

- Revenue: $319 million vs analyst estimates of $293.9 million (10% year-on-year decline, 8.5% beat)

- Adjusted EPS: $0.31 vs analyst estimates of $0.23 (34.8% beat)

- Adjusted EBITDA: $41.4 million vs analyst estimates of $33.1 million (13% margin, 25.1% beat)

- Operating Margin: 8.8%, in line with the same quarter last year

- Free Cash Flow Margin: 17.4%, up from 8.8% in the same quarter last year

- Sales Volumes rose 13% year on year (0% in the same quarter last year)

- Market Capitalization: $927.9 million

Steve Barnard, CEO of Mission, stated, “Fiscal 2025 was a defining year for Mission Produce. We achieved record revenue of $1.39 billion, growing 13% on top of a strong 2024 driven by avocado volume growth of 7% through our Marketing & Distribution segment, and delivered record adjusted EBITDA in the fourth quarter. These results reflect the power of our integrated global platform and the exceptional execution of our team. Throughout the year, our connected commercial organization demonstrated remarkable agility—pivoting to capitalize on market opportunities across North America, Europe, and Asia—each of which experienced growth for the quarter and full year. We were able to optimize our owned Peruvian production across customers and markets in a balanced fashion that drove category penetration and deepened key customer relationships. Whether navigating pricing dynamics or managing supply across regions, our team leveraged the full breadth of our capabilities to drive volume growth and optimize per-unit margins. Combined with our company-wide effort to enhance collaboration, data-driven decision making, and disciplined execution, I'm confident Mission is well positioned to continue growing share through expanding our presence in the years ahead.”

Company Overview

Founded in 1983 in California, Mission Produce (NASDAQ: AVO) grows, packages, and distributes avocados.

Revenue Growth

A company’s long-term sales performance can indicate its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years.

With $1.39 billion in revenue over the past 12 months, Mission Produce is a small consumer staples company, which sometimes brings disadvantages compared to larger competitors benefiting from economies of scale and negotiating leverage with retailers. On the bright side, it can grow faster because it has a longer list of untapped store chains to sell into.

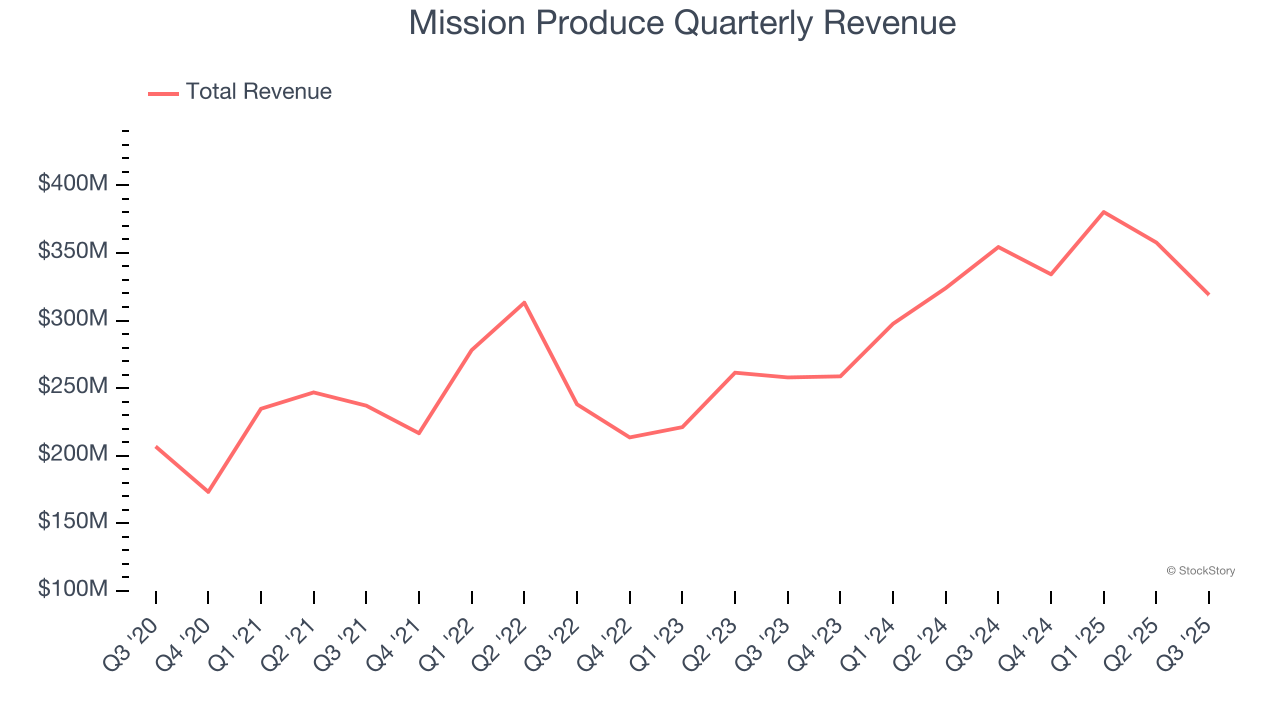

As you can see below, Mission Produce’s sales grew at a decent 10% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Mission Produce’s revenue fell by 10% year on year to $319 million but beat Wall Street’s estimates by 8.5%.

Looking ahead, sell-side analysts expect revenue to grow 1.2% over the next 12 months, a deceleration versus the last three years. This projection doesn't excite us and indicates its products will see some demand headwinds.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Volume Growth

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

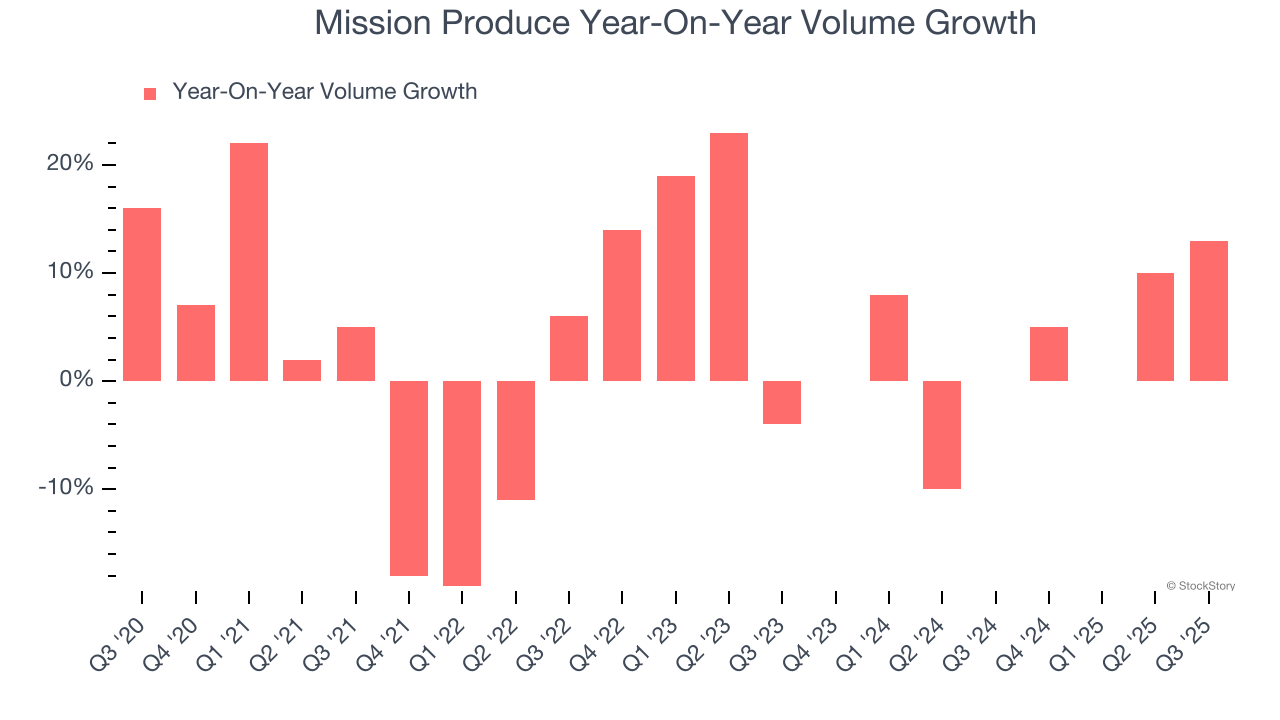

Mission Produce’s average quarterly volume growth was a healthy 3.3% over the last two years. This is pleasing because it shows consumers are purchasing more of its products.

In Mission Produce’s Q3 2025, sales volumes jumped 13% year on year. This result was an acceleration from its historical levels, certainly a positive signal.

Key Takeaways from Mission Produce’s Q3 Results

We were impressed by how significantly Mission Produce blew past analysts’ gross margin expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a solid print. The stock traded up 3.3% to $13.58 immediately following the results.

Mission Produce may have had a good quarter, but does that mean you should invest right now? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.