The end of an earnings season can be a great time to discover new stocks and assess how companies are handling the current business environment. Let’s take a look at how Seagate Technology (NASDAQ: STX) and the rest of the semiconductors stocks fared in Q3.

The semiconductor industry is driven by cyclical demand for advanced electronic products like smartphones, PCs, servers, and data storage. While analog chips serve as the building blocks of most electronic goods and equipment, processors (CPUs) and graphics chips serve as their brains. The growth of data and technologies like artificial intelligence, 5G, the Internet of Things, and smart cars are creating the next wave of secular growth for the industry.

The 41 semiconductors stocks we track reported a strong Q3. As a group, revenues beat analysts’ consensus estimates by 2.1% while next quarter’s revenue guidance was above.

Luckily, semiconductors stocks have performed well with share prices up 50.5% on average since the latest earnings results.

Seagate Technology (NASDAQ: STX)

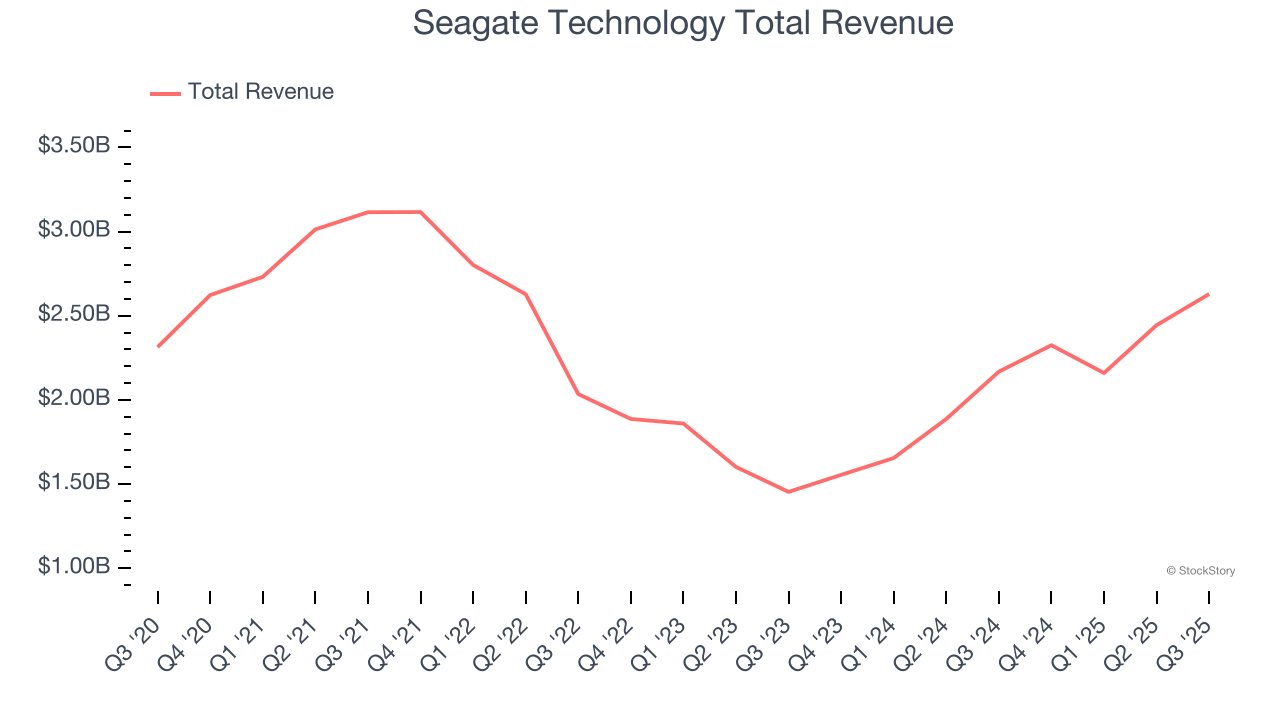

The developer of the original 5.25inch hard disk drive, Seagate (NASDAQ: STX) is a leading producer of data storage solutions, including hard drives and Solid State Drives (SSDs) used in PCs and data centers.

Seagate Technology reported revenues of $2.63 billion, up 21.3% year on year. This print exceeded analysts’ expectations by 3%. Overall, it was a very strong quarter for the company with a beat of analysts’ EPS estimates and a solid beat of analysts’ adjusted operating income estimates.

Interestingly, the stock is up 38% since reporting and currently trades at $307.70.

Is now the time to buy Seagate Technology? Access our full analysis of the earnings results here, it’s free for active Edge members.

Best Q3: Teradyne (NASDAQ: TER)

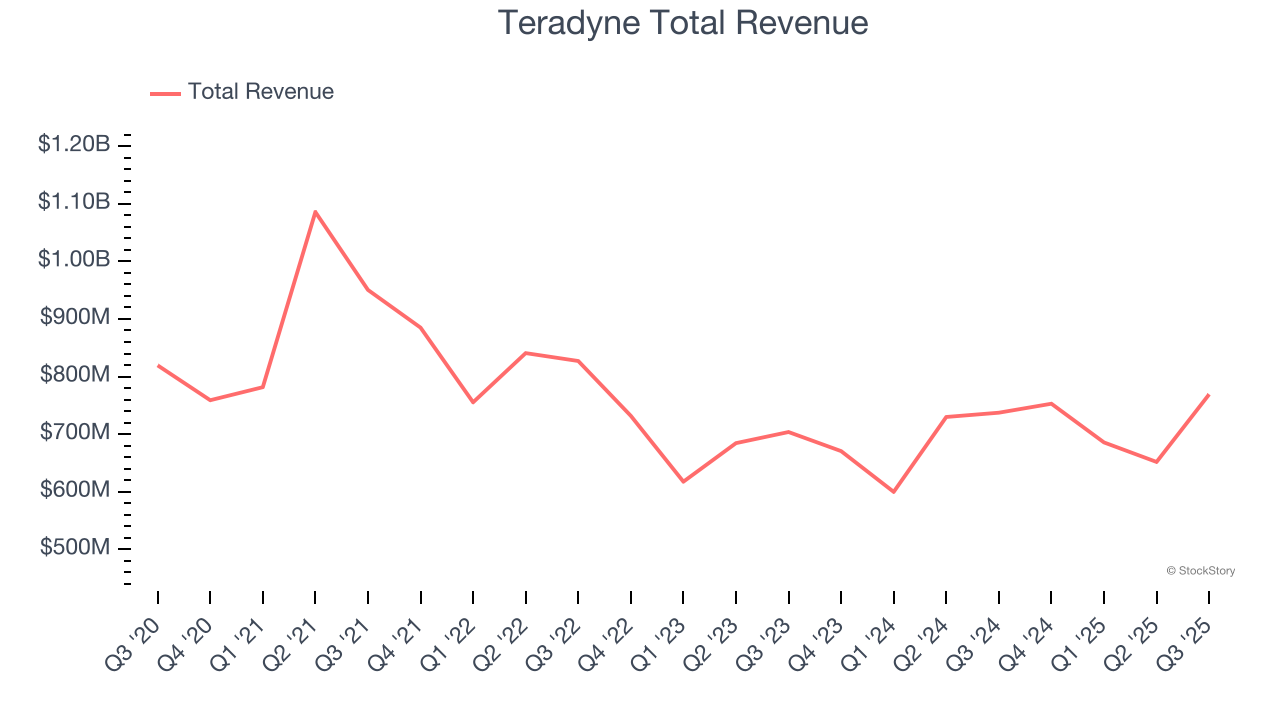

Sporting most major chip manufacturers as its customers, Teradyne (NASDAQ: TER) is a US-based supplier of automated test equipment for semiconductors as well as other technologies and devices.

Teradyne reported revenues of $769.2 million, up 4.3% year on year, outperforming analysts’ expectations by 3.3%. The business had a stunning quarter with a solid beat of analysts’ adjusted operating income estimates and revenue guidance for next quarter exceeding analysts’ expectations.

The market seems happy with the results as the stock is up 41.2% since reporting. It currently trades at $203.82.

Is now the time to buy Teradyne? Access our full analysis of the earnings results here, it’s free for active Edge members.

Weakest Q3: Universal Display (NASDAQ: OLED)

Serving major consumer electronics manufacturers, Universal Display (NASDAQ: OLED) is a provider of organic light emitting diode (OLED) technologies used in display and lighting applications.

Universal Display reported revenues of $139.6 million, down 13.6% year on year, falling short of analysts’ expectations by 15.9%. It was a disappointing quarter as it posted a significant miss of analysts’ revenue estimates and a significant miss of analysts’ adjusted operating income estimates.

Universal Display delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 10.6% since the results and currently trades at $121.12.

Read our full analysis of Universal Display’s results here.

Western Digital (NASDAQ: WDC)

Founded in 1970 by a Motorola employee, Western Digital (NASDAQ: WDC) is a leading producer of hard disk drives, SSDs and flash memory.

Western Digital reported revenues of $2.82 billion, up 27.4% year on year. This number surpassed analysts’ expectations by 2.8%. It was an exceptional quarter as it also put up a beat of analysts’ EPS estimates and an impressive beat of analysts’ adjusted operating income estimates.

The stock is up 34.6% since reporting and currently trades at $185.65.

Read our full, actionable report on Western Digital here, it’s free for active Edge members.

NXP Semiconductors (NASDAQ: NXPI)

Spun off from Dutch electronics giant Philips in 2006, NXP Semiconductors (NASDAQ: NXPI) is a designer and manufacturer of chips used in autos, industrial manufacturing, mobile devices, and communications infrastructure.

NXP Semiconductors reported revenues of $3.17 billion, down 2.4% year on year. This result was in line with analysts’ expectations. More broadly, it was a mixed quarter as it also recorded revenue guidance for next quarter topping analysts’ expectations but EPS in line with analysts’ estimates.

The stock is up 4.3% since reporting and currently trades at $231.04.

Read our full, actionable report on NXP Semiconductors here, it’s free for active Edge members.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.