Healthcare apparel company Figs (NYSE: FIGS) reported Q3 CY2025 results exceeding the market’s revenue expectations, with sales up 8.2% year on year to $151.7 million. Its non-GAAP profit of $0.05 per share was significantly above analysts’ consensus estimates.

Is now the time to buy Figs? Find out by accessing our full research report, it’s free for active Edge members.

Figs (FIGS) Q3 CY2025 Highlights:

- Revenue: $151.7 million vs analyst estimates of $142.5 million (8.2% year-on-year growth, 6.4% beat)

- Adjusted EPS: $0.05 vs analyst estimates of $0.02 (significant beat)

- Adjusted EBITDA: $18.85 million vs analyst estimates of $12.38 million (12.4% margin, 52.3% beat)

- Operating Margin: 6.4%, up from -6.2% in the same quarter last year

- Free Cash Flow Margin: 0.4%, down from 13.1% in the same quarter last year

- Active Customers: 2.78 million, up 108,000 year on year

- Market Capitalization: $1.24 billion

Company Overview

Rising to fame via TikTok and founded in 2013 by Heather Hasson and Trina Spear, Figs (NYSE: FIGS) is a healthcare apparel company known for its stylish approach to medical attire and uniforms.

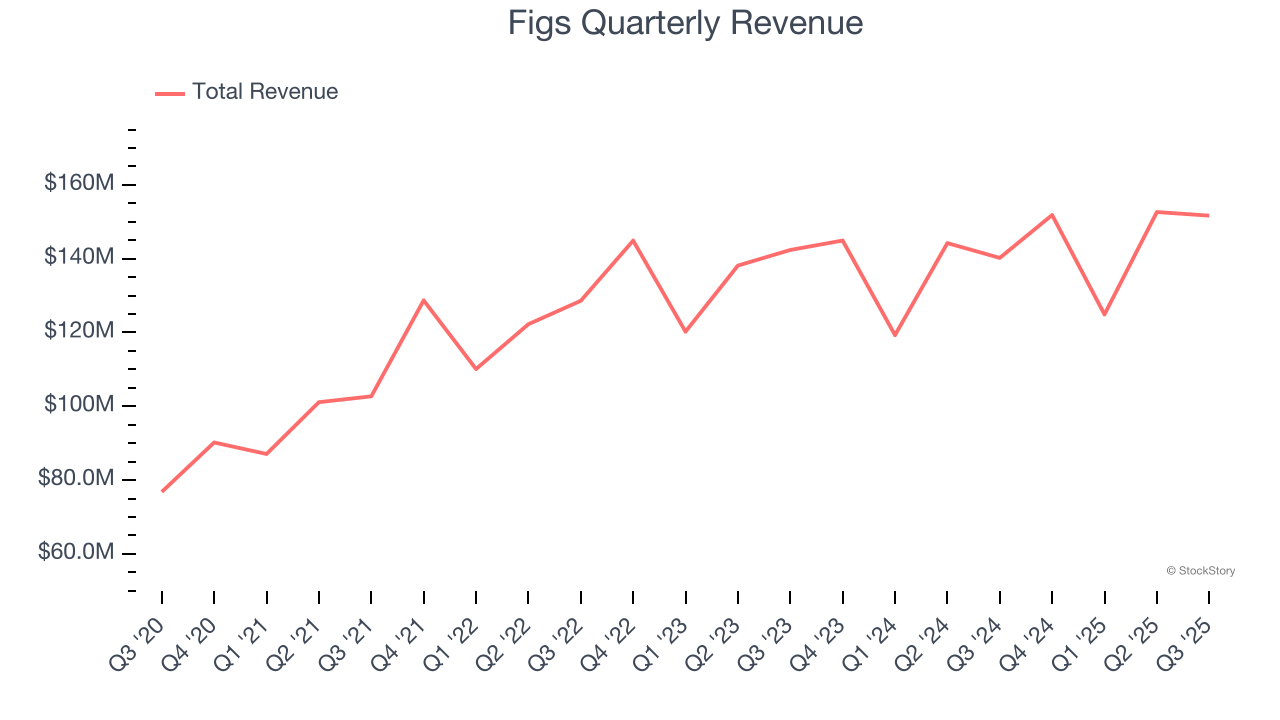

Revenue Growth

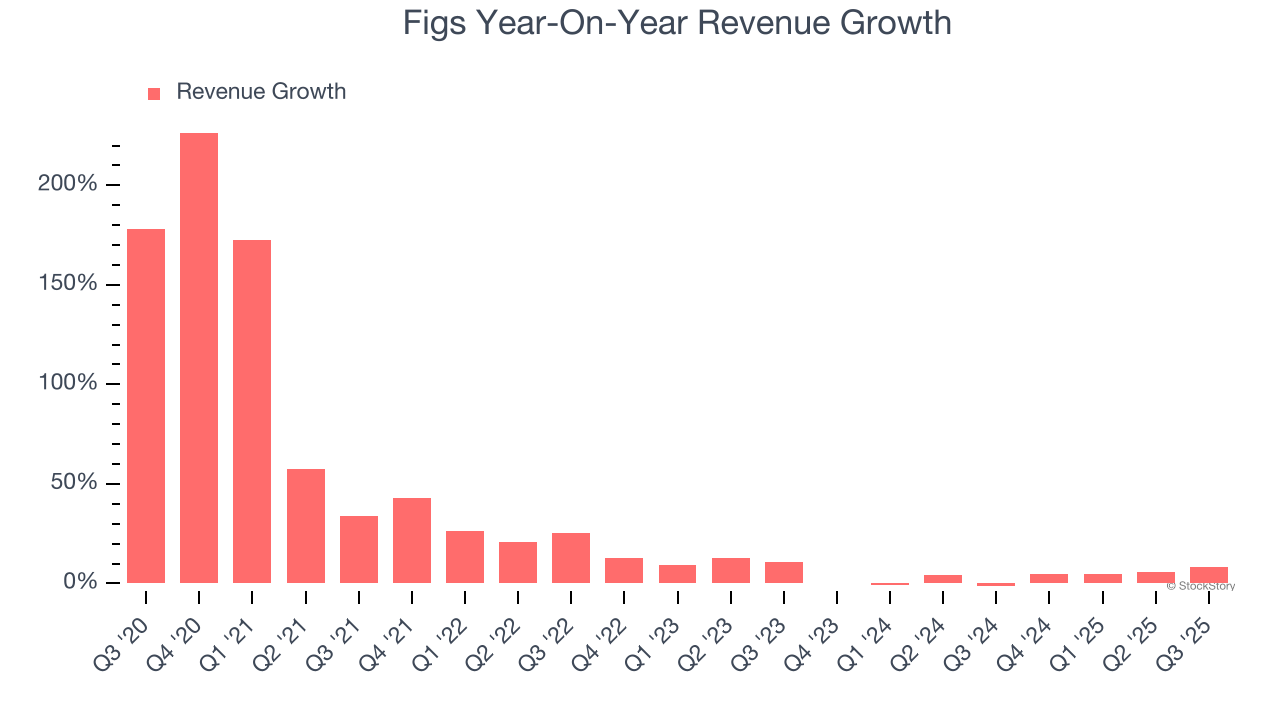

Reviewing a company’s long-term sales performance reveals insights into its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Thankfully, Figs’s 23.7% annualized revenue growth over the last five years was impressive. Its growth beat the average consumer discretionary company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within consumer discretionary, a stretched historical view may miss a company riding a successful new product or trend. Figs’s recent performance shows its demand has slowed significantly as its annualized revenue growth of 3.2% over the last two years was well below its five-year trend.

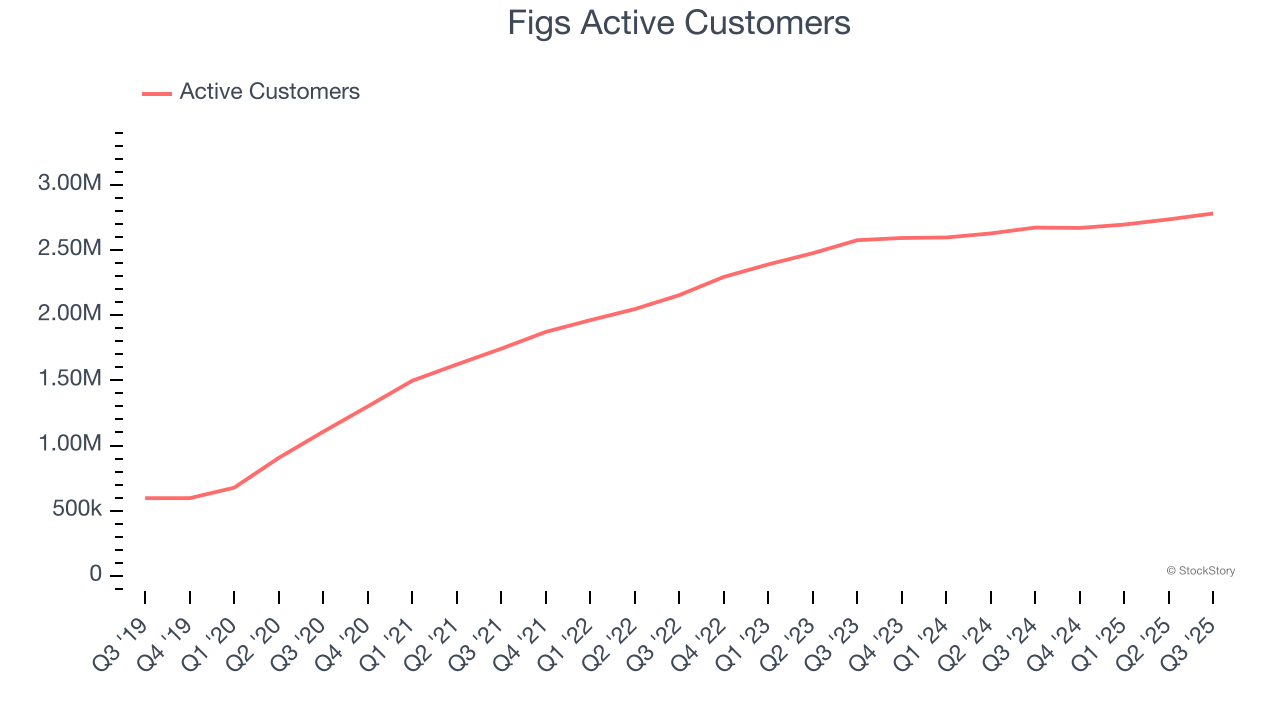

We can dig further into the company’s revenue dynamics by analyzing its number of active customers, which reached 2.78 million in the latest quarter. Over the last two years, Figs’s active customers averaged 5.8% year-on-year growth. Because this number is higher than its revenue growth during the same period, we can see the company’s monetization has fallen.

This quarter, Figs reported year-on-year revenue growth of 8.2%, and its $151.7 million of revenue exceeded Wall Street’s estimates by 6.4%.

Looking ahead, sell-side analysts expect revenue to remain flat over the next 12 months, a slight deceleration versus the last two years. This projection is underwhelming and suggests its products and services will see some demand headwinds.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

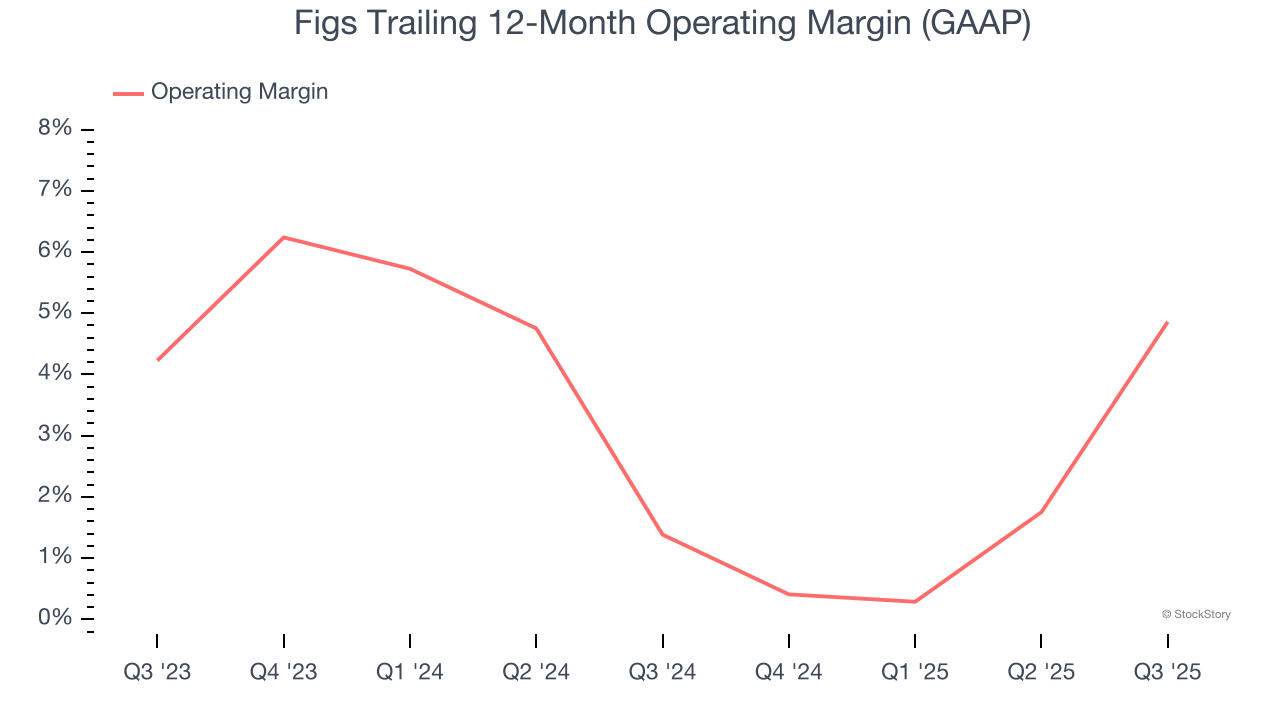

Operating Margin

Figs’s operating margin has risen over the last 12 months and averaged 3.2% over the last two years. The company’s higher efficiency is a breath of fresh air, but its suboptimal cost structure means it still sports lousy profitability for a consumer discretionary business.

In Q3, Figs generated an operating margin profit margin of 6.4%, up 12.5 percentage points year on year. This increase was a welcome development and shows it was more efficient.

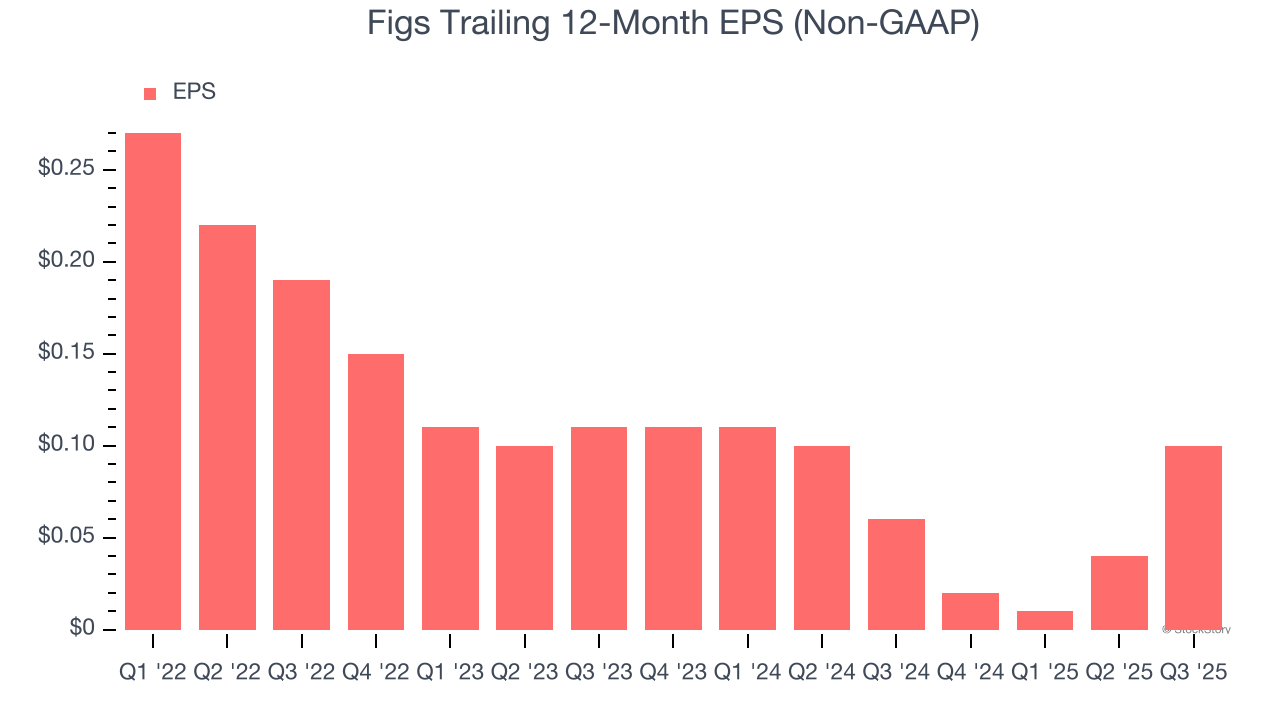

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

Figs’s full-year EPS dropped 40%, or 8.8% annually, over the last four years. We tend to steer our readers away from companies with falling revenue and EPS, where diminishing earnings could imply changing secular trends and preferences. Consumer Discretionary companies are particularly exposed to this, and if the tide turns unexpectedly, Figs’s low margin of safety could leave its stock price susceptible to large downswings.

In Q3, Figs reported adjusted EPS of $0.05, up from negative $0.01 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Figs’s full-year EPS of $0.10 to shrink by 30.4%.

Key Takeaways from Figs’s Q3 Results

It was good to see Figs beat analysts’ EPS expectations this quarter. We were also excited its EBITDA outperformed Wall Street’s estimates by a wide margin. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 16.2% to $8.75 immediately after reporting.

Figs had an encouraging quarter, but one earnings result doesn’t necessarily make the stock a buy. Let’s see if this is a good investment. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.