What Happened?

A number of stocks jumped in the afternoon session after comments from a key Federal Reserve official bolstered hopes for an interest rate cut. New York Federal Reserve President John Williams stated he sees “room for a further adjustment” in the near term, sparking a significant market rally. Following his remarks, the probability of the central bank cutting rates at its December meeting jumped from 39% to over 73%, according to the CME FedWatch tool. This positive sentiment provided relief to markets amid concerns over high valuations, particularly in AI-related stocks.

The stock market overreacts to news, and big price drops can present good opportunities to buy high-quality stocks.

Among others, the following stocks were impacted:

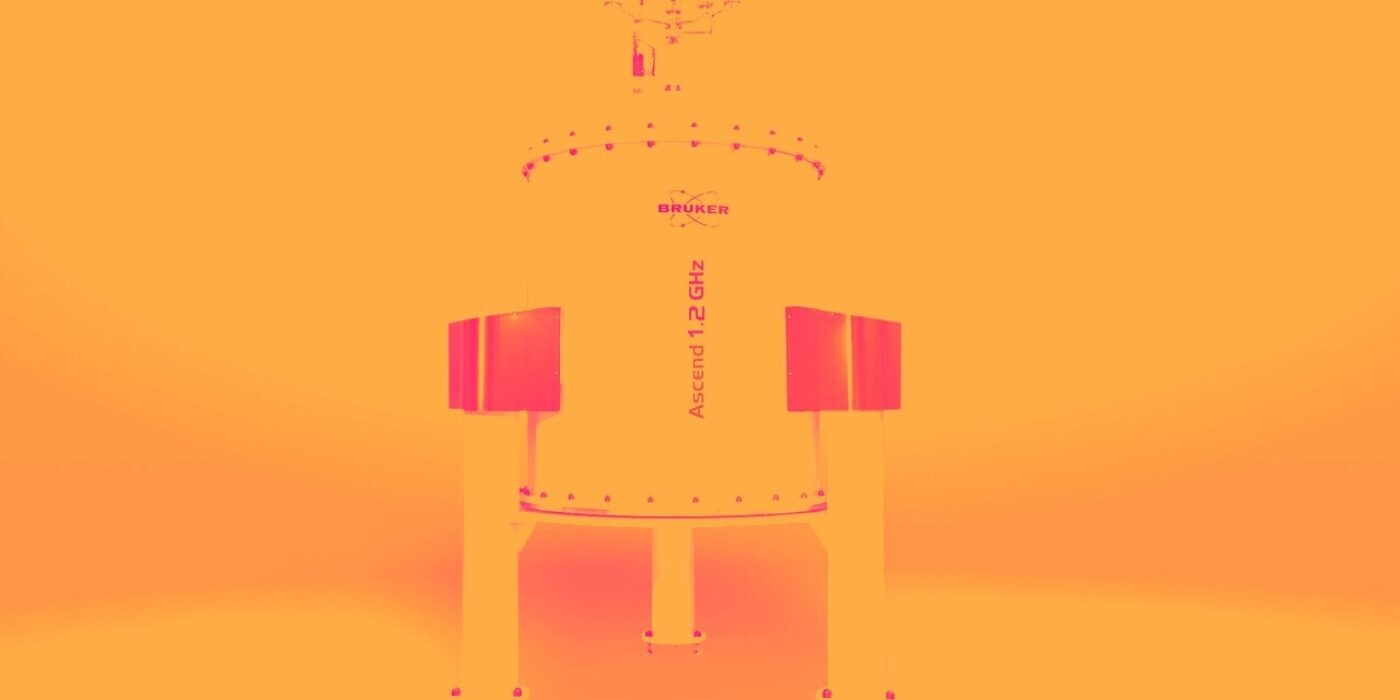

- Research Tools & Consumables company Bruker (NASDAQ: BRKR) jumped 7.8%. Is now the time to buy Bruker? Access our full analysis report here, it’s free for active Edge members.

- Genomics & Sequencing company 10x Genomics (NASDAQ: TXG) jumped 11.9%. Is now the time to buy 10x Genomics? Access our full analysis report here, it’s free for active Edge members.

- Genomics & Sequencing company PacBio (NASDAQ: PACB) jumped 17.8%. Is now the time to buy PacBio? Access our full analysis report here, it’s free for active Edge members.

- Medical Devices & Supplies - Cardiology, Neurology, Vascular company ICU Medical (NASDAQ: ICUI) jumped 6.3%. Is now the time to buy ICU Medical? Access our full analysis report here, it’s free for active Edge members.

- Dental Equipment & Technology company Dentsply Sirona (NASDAQ: XRAY) jumped 6.3%. Is now the time to buy Dentsply Sirona? Access our full analysis report here, it’s free for active Edge members.

Zooming In On PacBio (PACB)

PacBio’s shares are extremely volatile and have had 84 moves greater than 5% over the last year. But moves this big are rare even for PacBio and indicate this news significantly impacted the market’s perception of the business.

The previous big move we wrote about was 9 days ago when the stock dropped 7.5% on the news that the market continued to react negatively to the company's third-quarter financial results, which missed Wall Street expectations. Management pointed to a slowdown in instrument shipments, especially its Vega systems in Europe, and lower average selling prices for its Revio systems as the main reasons for the underperformance. The company's CEO also described the funding environment in the Americas as “challenging,” which made it take longer for some academic and government research customers to make purchases. Adding to investor concerns, the company is not yet profitable and reported a net loss of $38 million in the last quarter.

PacBio is up 22.2% since the beginning of the year, and at $2.20 per share, it is trading close to its 52-week high of $2.34 from October 2025. Investors who bought $1,000 worth of PacBio’s shares 5 years ago would now be looking at an investment worth $147.35.

Microsoft, Alphabet, Coca-Cola, Monster Beverage—all began as under-the-radar growth stories riding a massive trend. We’ve identified the next one: a profitable AI semiconductor play Wall Street is still overlooking.Go here for access to our full report.