Electrical safety company Atkore (NYSE: ATKR) reported Q3 CY2024 results topping the market’s revenue expectations, but sales fell by 9.4% year on year to $788.3 million. Its non-GAAP profit of $2.43 per share was 1.5% below analysts’ consensus estimates.

Is now the time to buy Atkore? Find out by accessing our full research report, it’s free.

Atkore (ATKR) Q3 CY2024 Highlights:

- Revenue: $788.3 million vs analyst estimates of $748.3 million (9.4% year-on-year decline, 5.3% beat)

- Adjusted EPS: $2.43 vs analyst expectations of $2.47 (1.5% miss)

- Adjusted EBITDA: $140.2 million vs analyst estimates of $144.3 million (17.8% margin, 2.9% miss)

- Adjusted EPS guidance for the upcoming financial year 2025 is $8.35 at the midpoint, missing analyst estimates by 28.4%

- EBITDA guidance for the upcoming financial year 2025 is $500 million at the midpoint, below analyst estimates of $641.8 million

- Operating Margin: 12.9%, down from 21.8% in the same quarter last year

- Free Cash Flow Margin: 19.6%, up from 17% in the same quarter last year

- Market Capitalization: $3.02 billion

“Atkore achieved annual volume growth of 3.5% with contributions from each of our key product categories in fiscal 2024,” said Bill Waltz, Atkore President and Chief Executive Officer.

Company Overview

Protecting the things that power our world, Atkore (NYSE: ATKR) designs and manufactures electrical safety products.

Electrical Systems

Like many equipment and component manufacturers, electrical systems companies are buoyed by secular trends such as connectivity and industrial automation. More specific pockets of strong demand include Internet of Things (IoT) connectivity and the 5G telecom upgrade cycle, which can benefit companies whose cables and conduits fit those needs. But like the broader industrials sector, these companies are also at the whim of economic cycles. Interest rates, for example, can greatly impact projects that drive demand for these products.

Sales Growth

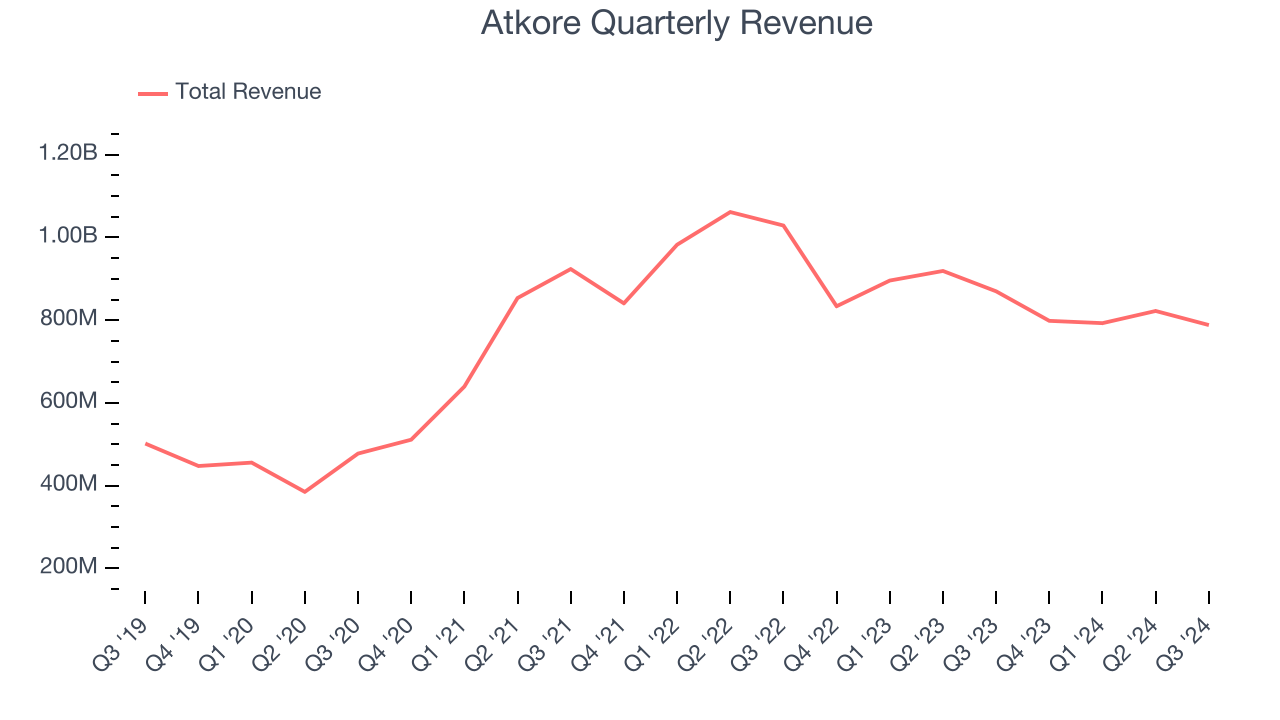

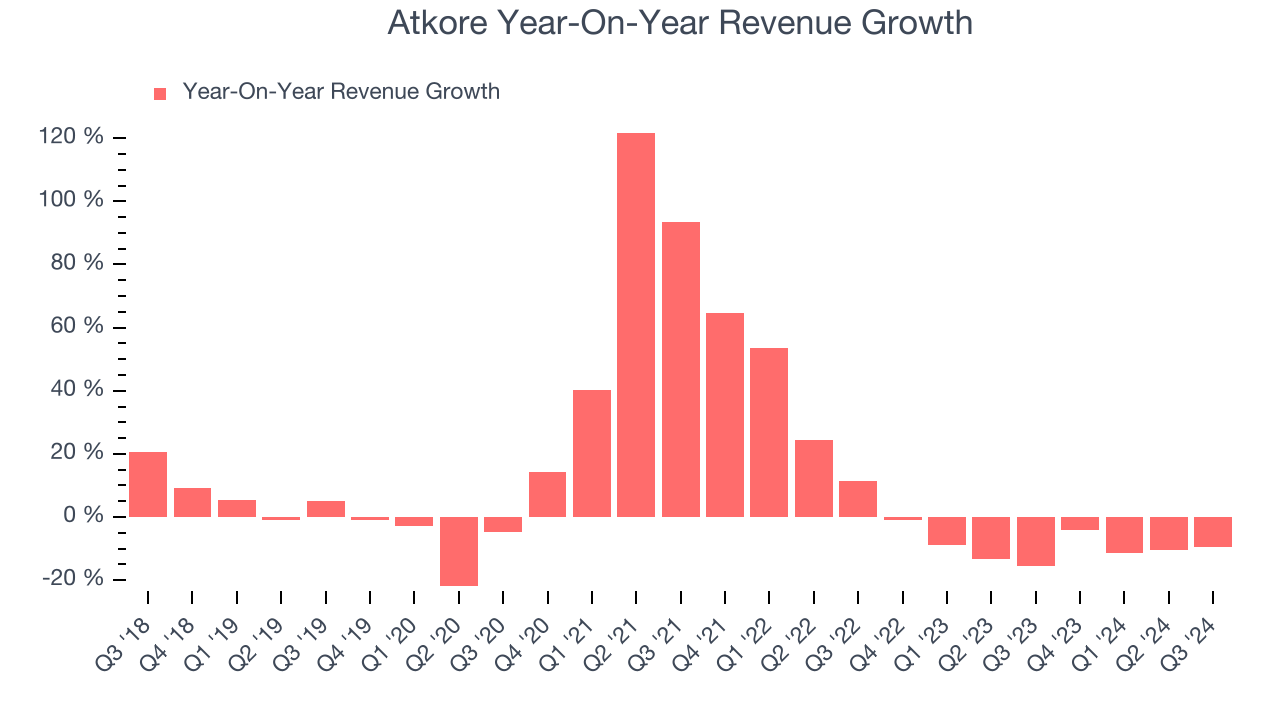

A company’s long-term sales performance signals its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Over the last five years, Atkore grew its sales at an impressive 10.8% compounded annual growth rate. Its growth beat the average industrials company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Atkore’s recent history marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 9.6% over the last two years.

This quarter, Atkore’s revenue fell by 9.4% year on year to $788.3 million but beat Wall Street’s estimates by 5.3%.

Looking ahead, sell-side analysts expect revenue to decline 5.4% over the next 12 months. While this projection is better than its two-year trend it's hard to get excited about a company that is struggling with demand.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

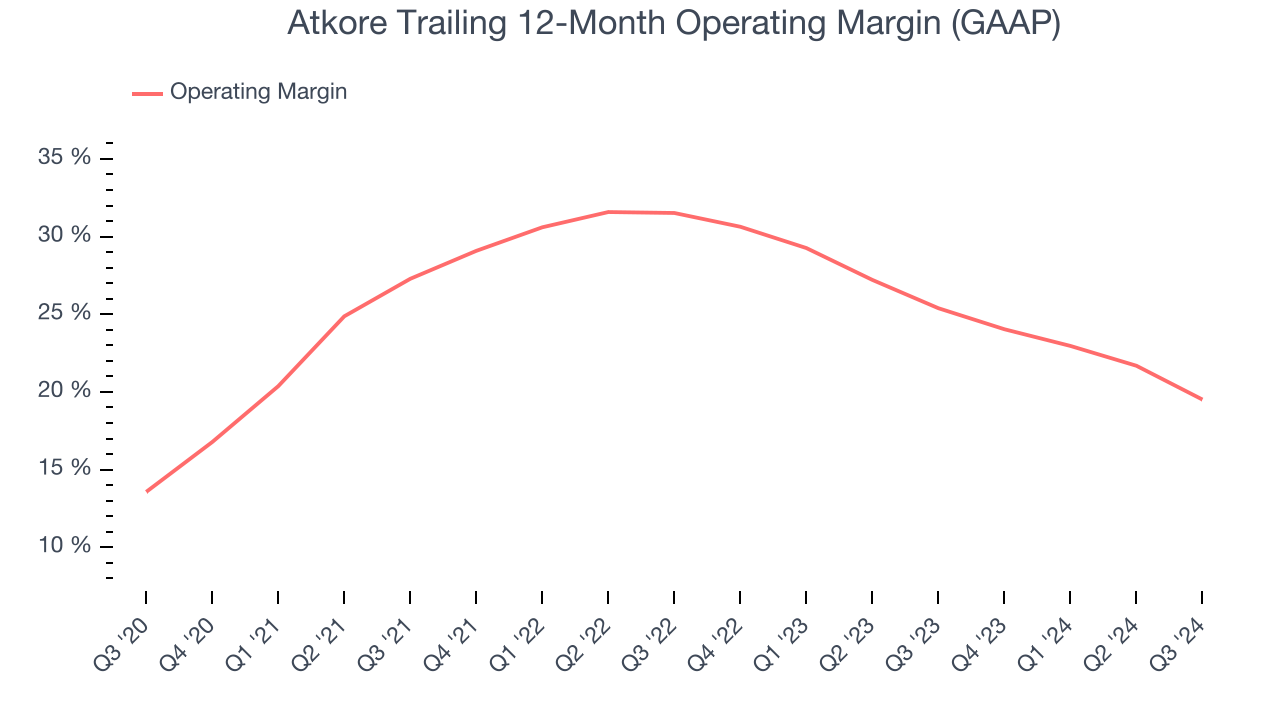

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Atkore has been a well-oiled machine over the last five years. It demonstrated elite profitability for an industrials business, boasting an average operating margin of 24.7%. This result isn’t surprising as its high gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Atkore’s annual operating margin rose by 5.9 percentage points over the last five years, as its sales growth gave it immense operating leverage.

In Q3, Atkore generated an operating profit margin of 12.9%, down 8.8 percentage points year on year. Since Atkore’s operating margin decreased more than its gross margin, we can assume it was recently less efficient because expenses such as marketing, R&D, and administrative overhead increased.

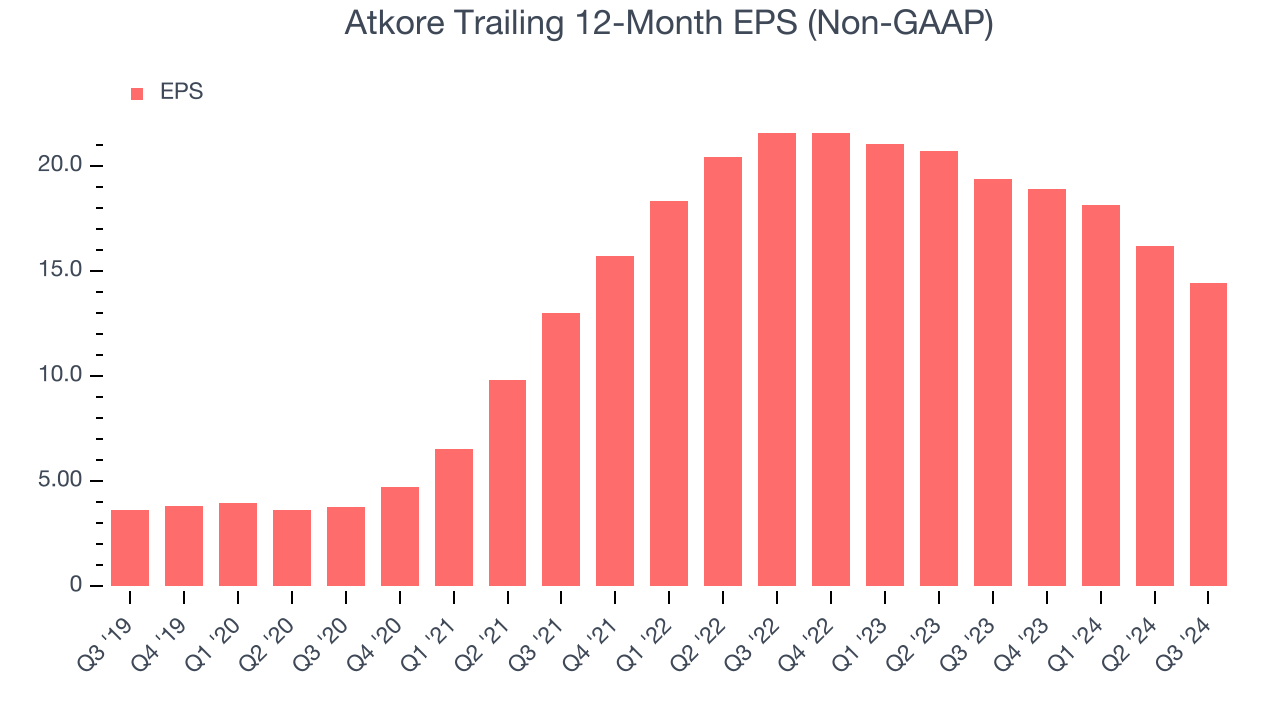

Earnings Per Share

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Atkore’s EPS grew at an astounding 31.9% compounded annual growth rate over the last five years, higher than its 10.8% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

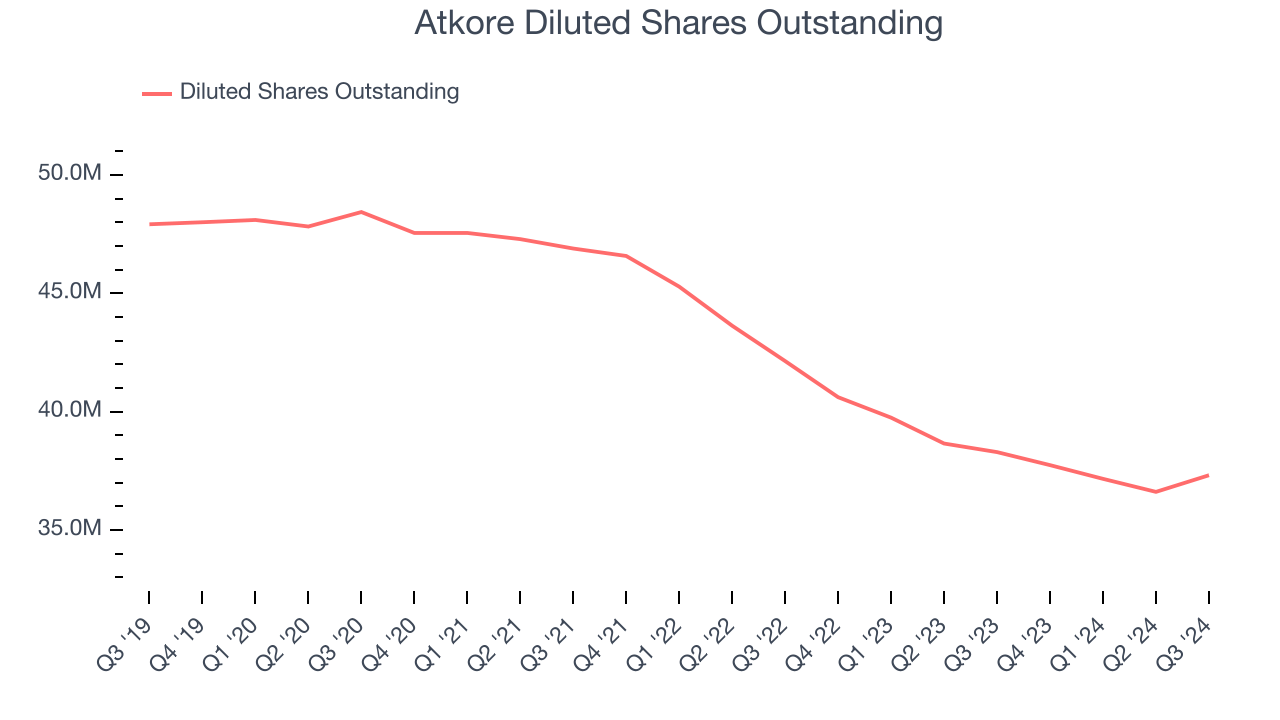

We can take a deeper look into Atkore’s earnings quality to better understand the drivers of its performance. As we mentioned earlier, Atkore’s operating margin declined this quarter but expanded by 5.9 percentage points over the last five years. Its share count also shrank by 22.1%, and these factors together are positive signs for shareholders because improving profitability and share buybacks turbocharge EPS growth relative to revenue growth.

Like with revenue, we analyze EPS over a shorter period to see if we are missing a change in the business.

For Atkore, its two-year annual EPS declines of 18.2% mark a reversal from its (seemingly) healthy five-year trend. We hope Atkore can return to earnings growth in the future.In Q3, Atkore reported EPS at $2.43, down from $4.21 in the same quarter last year. This print slightly missed analysts’ estimates, but we care more about long-term EPS growth than short-term movements. Over the next 12 months, Wall Street expects Atkore’s full-year EPS of $14.43 to shrink by 19.9%.

Key Takeaways from Atkore’s Q3 Results

We were impressed by how significantly Atkore blew past analysts’ revenue expectations this quarter. On the other hand, its EPS, EBITDA, and full-year guidance for both metrics missed Wall Street’s estimates, making it a weaker quarter. The stock traded down 10.9% to $75 immediately after reporting.

Atkore may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.