VANCOUVER, BC / January 31, 2023 / Noram Lithium Corp. (“ Noram ” or the “ Company “) (TSXV:NRM)(OTCQB:NRVTF)(Frankfurt:N7R) announces a significant increase in its estimated mineral resources at the Zeus Lithium Project, following the completion of the Phase VI drill program during the second quarter of 2022 (see Table 1 for the 2022 phase VI drill highlights).

Highlights of the Updated Resource Estimate

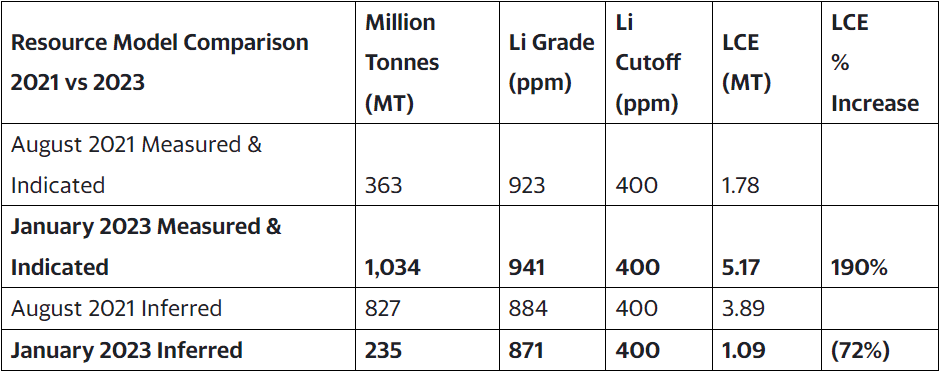

- An increase of 190% in Measured and Indicated (“M&I”) lithium carbonate equivalent (“LCE”) Resources from the August 2021 Mineral Resource Estimate.

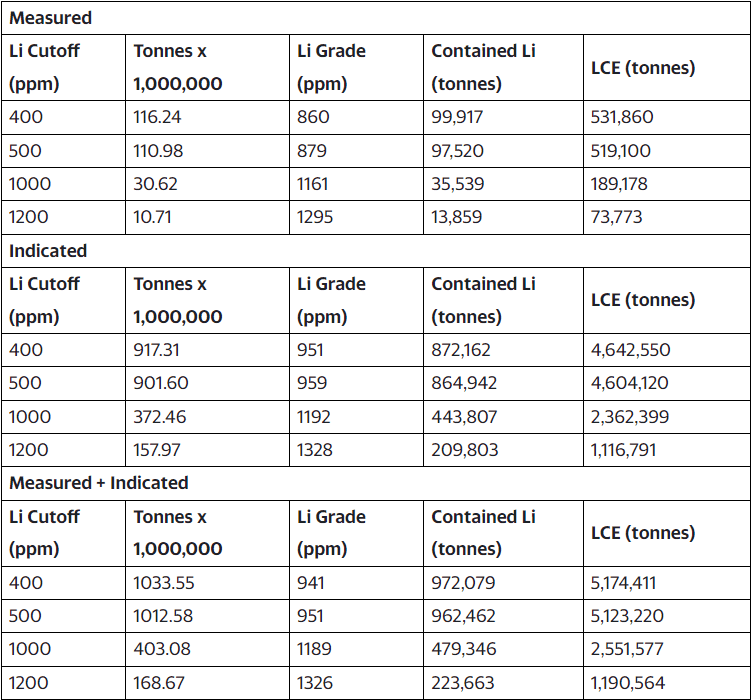

- M&I Resources increased to 5.17 million tonnes (“Mt”) LCE (1,034 Mt at 941 parts per million lithium (“ppm Li”)) at a 400 ppm Li cut-off grade.

- Substantial Inferred Resources remain from the 2022 Phase VI drill program.

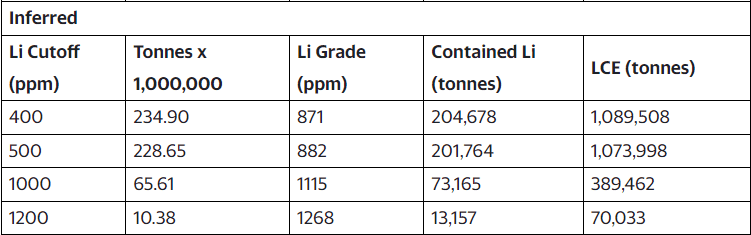

- Inferred Resources are 1.09 Mt LCE (235 Mt at 871 ppm Li) at a 400 ppm Li cut-off grade.

- Near Surface = Low Strip Ratio. The majority of the deposit occurs at or near the surface, resulting in relatively low mining costs. Results from the Preliminary Economic Study (“PEA”) 1 indicate that the life of mine strip ratio would be ~0.07:1 (waste: ore).

- High level of confidence in the deposit modelled given the density of the drill program with 82 holes drilled to-date. All holes were core holes for more precise sampling and stratigraphic correlations.

- High grade core (60 meters thick x 1.2 kilometers wide x 3.0 kilometers long) represents an opportunity for optimizing the mine plan. At a 1,200 ppm Li cut-off the Measured and Indicated Resources total 1.2 Mt LCE (169 Mt at 1,326 ppm Li).

“The updated mineral resource estimate, with 82 drill holes completed to-date, highlights that Noram’s Zeus Lithium Project is exceptionally well positioned in the United States amongst its peer deposits in terms of grade and contained Lithium Carbonate Equivalent,” stated Greg McCunn, Noram’s CEO. “The high-grade core of the deposit outcropping at surface provides a significant opportunity to optimize the project mine plan and enhance value. With a strong treasury and a strengthened technical team, we are expecting to move aggressively in 2023 to further de-risk the project with continued metallurgical testing and completion of a Prefeasibility Study.”

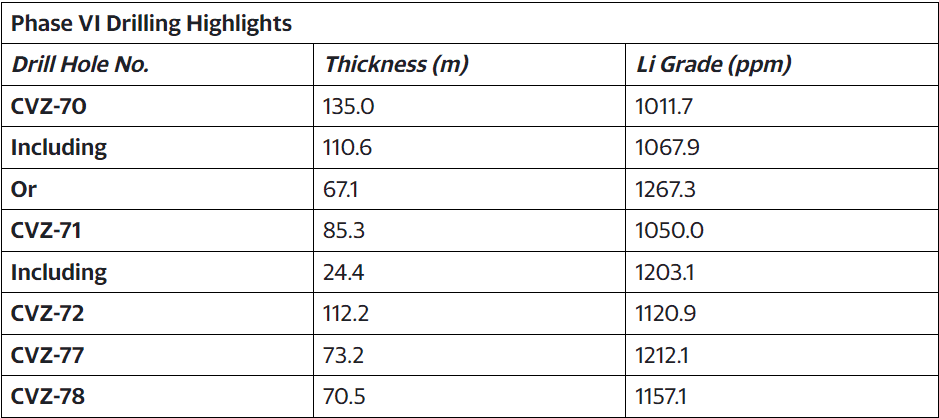

Table 1. Zeus Project – 2022 Phase VI Drill Highlights (Previously reported)

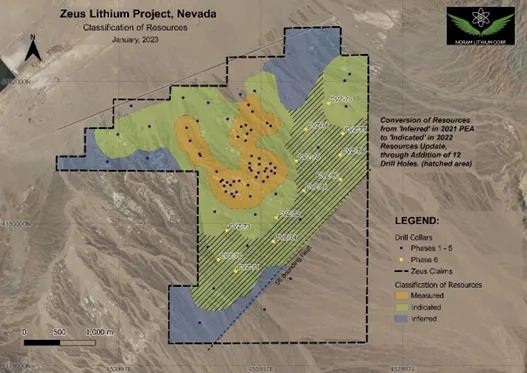

The Phase VI drilling as shown in the table below converted a significant amount of resources from Inferred to Measured and Indicated and increased the overall size of the resource.

Table 2. Zeus Project – Increase in Resource Size Following the Phase VI Drilling Program

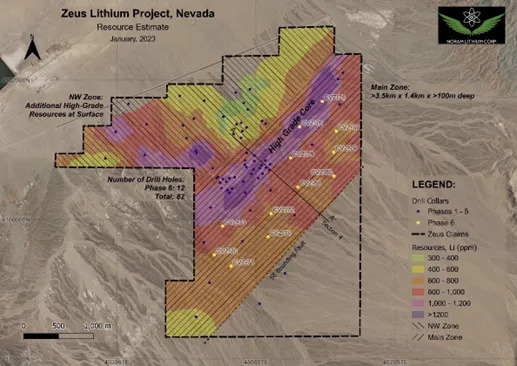

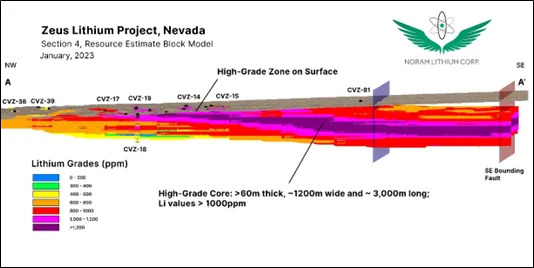

The Zeus Lithium Project as shown below has a higher-grade core to the deposit which outcrops at surface. Mine plan optimization is currently underway looking at options for a smaller high-grade pit which could support a 15-20 year mine life.

Figure 1 – Resource Model Plan View; colours represent Li grades as indicated on the right.

Noram Lithium Corp., Tuesday, January 31, 2023, Press release picture

The sensitivity to varying Lithium grade cut-offs is shown in the table below.

Table 3. Zeus lithium deposit resource estimate, 2023-01

NI 43-101 Compliant Technical Report

The Company expects to file an NI 43-101 compliant technical report on SEDAR no later than March 17, 2023.

Mineral Resource Estimate Preparation

The Mineral Resource estimate has been prepared by Damir Cukor, P. Geo of ABH Engineering in conformity with CIM “Estimation of Mineral Resource and Mineral Reserves Best Practices” guidelines and are reported in accordance with the Canadian Securities Administrators NI 43-101. Mineral resources are not mineral reserves and do not have demonstrated economic viability. There is no certainty that any mineral resource will be converted into mineral reserve.

QA/QC

To ensure reliable sample results, the Company has a rigorous QA/QC program that monitors the chain-of-custody of samples and includes the insertion of blanks and certified reference standards at statistically derived intervals within each batch of samples.

All samples were sent to ISO-17025 accredited ALS Laboratories in Reno, Nevada and North Vancouver, BC for analysis. ALS is a public company listed on the Australian stock exchange and is entirely independent of Noram. All samples were prepared using ALS’ PREP-31 sample preparation process, which is presented in the ALS Fee Schedule as: “Crush to 70% less than 2mm, riffle split off 250g, pulverize split to better than 85% passing 75 microns.” Each sample was then analyzed using ALS’ ME-MS61 analytical method which uses a Four Acid Digestion and MS-ICP technologies. All samples were analyzed for 48 elements. Samples were kept secure until shipped to the ALS lab in Reno, picked up by the ALS lab in Reno or shipped via FedEx to ALS in North Vancouver.

Qualified Persons

The technical information contained in this news release has been reviewed and approved by:

- Damir Cukor, P. Geo., who is an Independent Qualified Person as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects , with ABH Engineering Inc., consultants to Noram Lithium.

- Brad Peek, M.Sc., CPG, who is a Qualified Person with respect to Noram’s Clayton Valley Lithium Project as defined by National Instrument 43-101 Standards of Disclosure for Mineral Projects , and also Vice President of Exploration for Noram Lithium.

Investor Relations Services

The Company’s News Release dated November 30, 2022 and titled ‘Noram Highlights Milestones During 2022′ stated that Noram had engaged Native Ads, Inc. an arms-length party, to provide investor relations services. The services commenced in December 2022 pursuant to a consulting agreement dated November 23, 2022, and the Company agreed to and paid upfront the fees totaling $90,000 USD for an initial service period of 6 months.

About Noram Lithium Corp.

Noram Lithium Corp. (TSXV:NRM)(OTCQB:NRVTF)(Frankfurt:N7R) is focusing on advancing its 100%-owned Zeus Lithium Project located in Clayton Valley, Nevada an emerging lithium hub within the United States. With the upsurge in the electric vehicle and energy storage markets the Company aims to become a key participant in the domestic supply of lithium. The Company is committed to creating shareholder value through the strategic allocation of capital and is well-funded to advance through to the Definitive Feasibility Study.

The Zeus Lithium Project contains a current 43-101 measured and indicated resource estimate of 5.2 Mt LCE (1034 Mt at 941 ppm lithium), and an inferred resource of 1.1 Mt LCE (235 Mt at 871 ppm lithium) utilizing a 400 ppm Li cut-off.

In December 2021, a robust PEA 1 indicated an After-Tax NPV(8) of US$1.3 Billion and IRR of 31% using US$9,500/tonne Lithium Carbonate Equivalent (LCE). The PEA indicates an After-Tax NPV (8%) of approximately US$2.67 Billion and an IRR of 52% at US$14,250/tonne LCE. Note that the current daily prices have increased to over US$70,000/tonne LCE.

Please visit our web site for further information: www.noramlithiumcorp.com .

ON BEHALF OF THE BOARD OF DIRECTORS

Sandy MacDougall

Founder and Chairman

C: 778.999.2159

For additional information please contact:

Greg McCunn

Chief Executive Officer

greg@noramlithiumcorp.com

C: 778.991.3798

Footnote

1 Preliminary Economic Assessment Zeus Project, ABH Engineering (December 2021).

Cautionary Statement Regarding Forward Looking Information

This news release may contain forward-looking information which is not comprised of historical facts. Forward-looking information involves risks, uncertainties and other factors that could cause actual events, results, performance, prospects and opportunities to differ materially from those expressed or implied by such forward-looking information. Forward-looking information in this news release includes statements regarding, among other things, the intended timing for filing of a technical report in respect of the Zeus Lithium Project, intended testing and project work to completed in 2023 and the potential to complete a prefeasibility study for the project. Factors that could cause actual results to differ materially from such forward-looking information include, but are not limited to, the ability of third-parties to complete the preparation work necessary for the filing of a technical report, access to the project and completion of the necessary testing and analysis work to prepare a prefeasibility study and receipt of any required regulatory or governmental approvals in connection with ongoing work on the project. Although Noram believes that the assumptions used in preparing the forward-looking information in this news release are reasonable, including that all necessary regulatory approvals will be obtained in a timely manner, undue reliance should not be placed on such information, which only applies as of the date of this news release, and no assurance can be given that such events will occur in the disclosed time frames or at all. Noram disclaims any intention or obligation to update or revise any forward-looking information, whether as a result of new information, future events or otherwise, other than as required by applicable securities laws.

Neither the TSX Venture Exchange nor its Regulation Services Provider (as that term is defined in the policies of the TSX Venture Exchange) accepts responsibility for the adequacy or accuracy of this release.

SOURCE: Noram Lithium Corp.

Featured Image @ Depositphotos

Disclosure:

1) The author of the Article, or members of the author’s immediate household or family, do not own any securities of the companies set forth in this Article. The author determined which companies would be included in this article based on research and understanding of the sector.

2)The Article was issued on behalf of and sponsored by, Noram Lithium Corp. Market Jar Media Inc. has or expects to receive from Noram Lithium Corp.’s Digital Marketing Agency of Record (Native Ads Inc.) sixty-nine thousand, four hundred and eighty US dollars for 24 days (18 business days).

3) Statements and opinions expressed are the opinions of the author and not Market Jar Media Inc., its directors or officers. The author is wholly responsible for the validity of the statements. The author was not paid by Market Jar Media Inc. for this Article. Market Jar Media Inc. was not paid by the author to publish or syndicate this Article. Market Jar has not independently verified or otherwise investigated all such information. None of Market Jar or any of their respective affiliates, guarantee the accuracy or completeness of any such information. The information provided above is for informational purposes only and is not a recommendation to buy or sell any security. Market Jar Media Inc. requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Market Jar Media Inc. relies upon the authors to accurately provide this information and Market Jar Media Inc. has no means of verifying its accuracy.

4) The Article does not constitute investment advice. Each reader is encouraged to consult with his or her individual financial professional and any action a reader takes as a result of the information presented here is his or her own responsibility. By opening this page, each reader accepts and agrees to Market Jar Media Inc.’s terms of use and full legal disclaimer as set forth here. This Article is not a solicitation for investment. Market Jar Media Inc. does not render general or specific investment advice and the information on PressReach.com should not be considered a recommendation to buy or sell any security. Market Jar Media Inc. does not endorse or recommend the business, products, services or securities of any company mentioned on PressReach.com.

5) Market Jar Media Inc. and its respective directors, officers and employees hold no shares for any company mentioned in the Article.

6) This document contains forward-looking information and forward-looking statements, within the meaning of applicable Canadian securities legislation, (collectively, “forward-looking statements”), which reflect management’s expectations regarding Noram Lithium Corp.’s future growth, future business plans and opportunities, expected activities, and other statements about future events, results or performance. Wherever possible, words such as “predicts”, “projects”, “targets”, “plans”, “expects”, “does not expect”, “budget”, “scheduled”, “estimates”, “forecasts”, “anticipate” or “does not anticipate”, “believe”, “intend” and similar expressions or statements that certain actions, events or results “may”, “could”, “would”, “might” or “will” be taken, occur or be achieved, or the negative or grammatical variation thereof or other variations thereof, or comparable terminology have been used to identify forward-looking statements. These forward-looking statements include, among other things, statements relating to: (a) revenue generating potential with respect to Noram Lithium Corp.’s industry; (b) market opportunity; (c) Noram Lithium Corp.s business plans and strategies; (d) services that Noram Lithium Corp. intends to offer; (e) Noram Lithium Corp.’s milestone projections and targets; (f) Noram Lithium Corp.’s expectations regarding receipt of approval for regulatory applications; (g) Noram Lithium Corp.’s intentions to expand into other jurisdictions including the timeline expectations relating to those expansion plans; and (h) Noram Lithium Corp.’s expectations with regarding its ability to deliver shareholder value. Forward-looking statements are not a guarantee of future performance and are based upon a number of estimates and assumptions of management in light of management’s experience and perception of trends, current conditions and expected developments, as well as other factors that management believes to be relevant and reasonable in the circumstances, as of the date of this document including, without limitation, assumptions about: (a) the ability to raise any necessary additional capital on reasonable terms to execute Noram Lithium Corp.’s business plan; (b) that general business and economic conditions will not change in a material adverse manner; (c) Noram Lithium Corp.’s ability to procure equipment and operating supplies in sufficient quantities and on a timely basis; (d) Noram Lithium Corp.’s ability to enter into contractual arrangements with additional Pharmacies; (e) the accuracy of budgeted costs and expenditures; (f) Noram Lithium Corp.’s ability to attract and retain skilled personnel; (g) political and regulatory stability; (h) the receipt of governmental, regulatory and third-party approvals, licenses and permits on favorable terms; (i) changes in applicable legislation; (j) stability in financial and capital markets; and (k) expectations regarding the level of disruption to as a result of CV-19. Such forward-looking information involves a variety of known and unknown risks, uncertainties and other factors which may cause the actual plans, intentions, activities, results, performance or achievements of Noram Lithium Corp. to be materially different from any future plans, intentions, activities, results, performance or achievements expressed or implied by such forward-looking statements. Such risks include, without limitation: (a) Noram Lithium Corp.’s operations could be adversely affected by possible future government legislation, policies and controls or by changes in applicable laws and regulations; (b) public health crises such as CV-19 may adversely impact Noram Lithium Corp.’s business; (c) the volatility of global capital markets; (d) political instability and changes to the regulations governing Noram Lithium Corp.’s business operations (e) Noram Lithium Corp. may be unable to implement its growth strategy; and (f) increased competition.

Except as required by law, Noram Lithium Corp. undertakes no obligation to update or revise any forward-looking statements, whether as a result of new information, future event or otherwise, after the date on which the statements are made or to reflect the occurrence of unanticipated events. Neither does Noram Lithium Corp. nor any of its representatives make any representation or warranty, express or implied, as to the accuracy, sufficiency or completeness of the information in this document. Neither Noram Lithium Corp. nor any of its representatives shall have any liability whatsoever, under contract, tort, trust or otherwise, to you or any person resulting from the use of the information in this document by you or any of your representatives or for omissions from the information in this document.

7) Any graphs, tables or other information demonstrating the historical performance or current or historical attributes of Noram Lithium Corp. or any other entity contained in this document are intended only to illustrate historical performance or current or historical attributes of Noram Lithium Corp. or such entities and are not necessarily indicative of future performance of Noram Lithium Corp. or such entities.

Read more investing news on PressReach.com.Subscribe to the PressReach RSS feeds:- Featured News RSS feed

- Investing News RSS feed

- Daily Press Releases RSS feed

- Trading Tips RSS feed

- Investing Videos RSS feed

Follow PressReach on Twitter

Follow PressReach on TikTok

Follow PressReach on Instagram

Subscribe to us on Youtube