TOKYO, Jul 28, 2022 - (JCN Newswire) - Fujitsu and Hokuhoku Financial Group, Inc. (hereinafter Hokuhoku FG)(1) today announced the development of an algorithm to support information disclosure in line with the recommendations of the Task Force on Climate-related Financial Disclosures (hereinafter TCFD)(2). The two companies conducted trial demonstrations and confirmed the efficiency of the new algorithm in supporting customers in improving their operational efficiency when preparing for TCFD reporting.

|

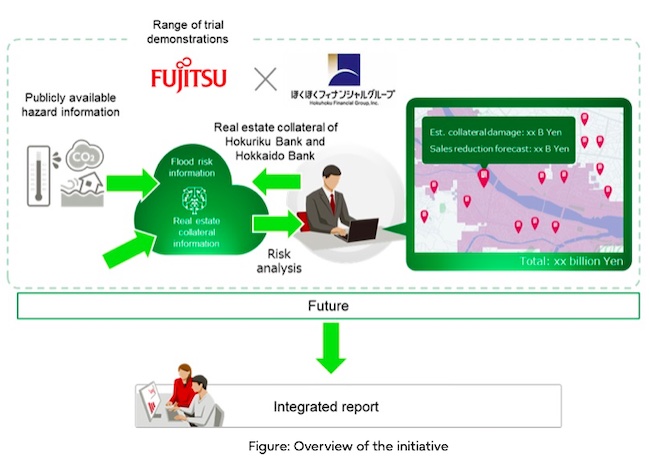

The new algorithm developed by Fujitsu automatically arranges customer data and hazard data issued by the government on a map to calculate the physical risk of a customer or asset in the event of a flood. The analysis results will be used in the integrated report of Hokuhoku FG that will be issued on July 29, 2022.

Moving forward, the two companies will continue to verify the effectiveness of the newly developed algorithm for customers in the financial industry with a large number of clients, and plan to expand it to customers in other industries in the future.

Background

Climate change poses a major, ongoing economic threat, and not only listed companies but also many affiliated companies are increasing their efforts to resolve the myriad issues related to global warming. Underlining the growing significance of this responsibility, players in various industries increasingly focus on TCFD as a measure to disclose climate-related financial information.

In Japan, since April 2022, companies listed on the Tokyo Stock Exchange's Prime Market are required to disclose TCFD information, and the impact of climate-related risks on companies and their measures to mitigate its impacts have been attracting growing attention. Companies situated in flood-prone areas are especially vulnerable, as they are continuously exposed to significant risks that can affect the continuity of their business.

The implementation of cross-industry measures that also include players such as logistics companies that transport goods and institutions that finance climate change initiatives represent an ongoing task.

To address this issue, Fujitsu and Hokuhoku FG developed new measures to accurately and efficiently measure flood risks, which represent a high-priority issue within climate-related risks.

Outline of the trial demonstrations

Fujitsu and Hokuhoku FG conducted trial demonstrations of the newly developed algorithm from November 2021 to March 2022 for real estate collateral of the Hokuriku Bank and the Hokkaido Bank. Leveraging Fujitsu's IT technology and Hokuhoku FG's knowledge of risk management practices, the two companies systematized a process to plot customers' properties on a hazard map and predict potential flood risks. As a result, Hokuhoku FG employees were able to streamline approximately 850 hours of manual work time and to improve efficiency in their preparation for TCFD reporting. The two companies further confirmed the effectiveness of the newly developed algorithm in correctly measuring flood risks.

Future Plans

With the aim to become an environmentally advanced financial group, Hokuhoku FG will utilize its broad customer base to explore new services that support suppliers' efforts to realize their ESG/SDGs related objectives and decarbonization.

Fujitsu will continue verifications of the newly developed algorithm starting with the financial sector where it expects to generate strong interest. Fujitsu further plans to combine this algorithm with initiatives aimed at reducing CO2 emissions of industries including the logistics industry, which remains one of the most important areas in which society's infrastructure faces disruption by potential flood risks. Both Fujitsu and Hokuhoku FG will continue their efforts to contribute to the sustainable development of local economies and communities.

(1) Hokuhoku Financial Group, Inc. :

Headquarters: Toyama Prefecture, Toyama City; President: Hiroshi Nakazawa

(2) TCFD: "Task Force on Climate-related Financial Disclosures" - Disclosure in line with the recommendations of the Task Force on Climate-related Financial Disclosures. Established by the Financial Stability Board (FSB) to examine how to conduct climate-related disclosure and respond to financial institutions. Companies listed on the Tokyo Stock Exchange's Prime Market are required to disclose information on climate change-related risks and opportunities in line with TCFD recommendations.

About Fujitsu

Fujitsu's purpose is to make the world more sustainable by building trust in society through innovation. As the digital transformation partner of choice for customers in over 100 countries, our 124,000 employees work to resolve some of the greatest challenges facing humanity. Our range of services and solutions draw on five key technologies: Computing, Networks, AI, Data & Security, and Converging Technologies, which we bring together to deliver sustainability transformation. Fujitsu Limited (TSE:6702) reported consolidated revenues of 3.6 trillion yen (US$32 billion) for the fiscal year ended March 31, 2022 and remains the top digital services company in Japan by market share. Find out more: www.fujitsu.com.

Copyright 2022 JCN Newswire. All rights reserved. www.jcnnewswire.com