Many investors wonder if they should invest by themselves or alongside a registered investment advisor (RIA). An RIA is a firm or individual that manages and advises the investments for clients. Alternately, more and more people are beginning to use online brokers, which allow for the purchase of securities independently. After this past decade’s bull market, it may seem easy to generate returns without any external assistance.

A vast majority of the younger generation has changed the way they invest their money after the COVID-19 pandemic. Novice investors saw the price drops in the market from the coronavirus as an opportunity to step into the world of investing. According to Central 1, “Major online brokers including Charles Schwab, TD Ameritrade, Etrade and Robinhood have seen growth in accounts spike as much as 170% in the first quarter of 2020.” These online brokers are attractive because there are no fees or minimum amounts for the accounts created, allowing inexperienced investors to purchase stocks easily. The internet has also shaped the “do it yourself” investing environment, providing more available information than ever such as articles or videos that encourage self-management of assets. This allows new investors to steer clear of RIA fees and invest small amounts of capital to their liking.

However, with the increase in demand for education regarding how to invest, it could actually be beneficial to use an RIA. Advisors can help translate complex topics or strategies in an understandable way for clients. With the average fee charged by investment advisors sitting around 1%, they can provide professional insight on topics that are less known. Investment advisors balance portfolios to withstand volatility and reduce downside exposure. They can help investors stay focused on long-term objectives and avoid common mistakes like trying to time the market. Also, advisors can help to remove the behavioral biases from investing. For example, loss aversion is a behavioral bias toward avoiding losses over gains. Loss aversion causes investors to avoid small risks even when they may be worth bearing for the long-term.

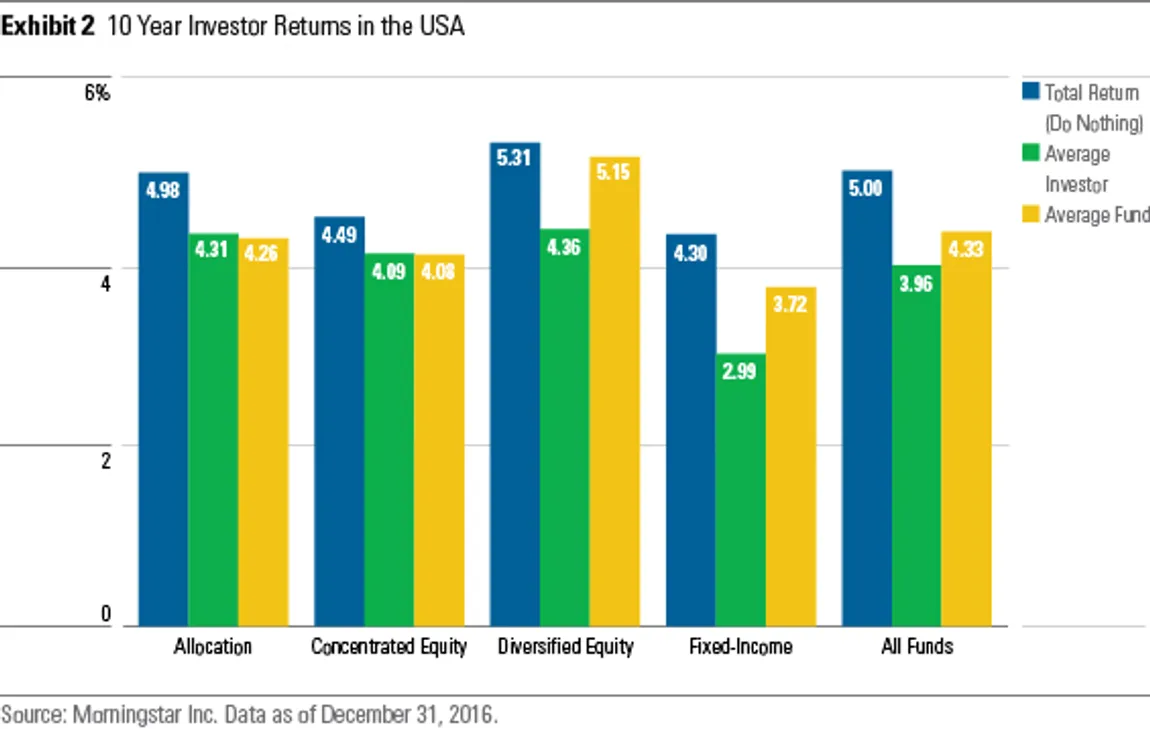

One of the biggest problems for individual investors is their timing. Jumping in and out of investments quickly is often not a great strategy because investors are unable to time the moves adequately. Significant macro events tend to have little effect on the long-term performance of a portfolio. Investors who sold during the 2008 market crash are still trying to make up for their losses while the people who held their positions have seen close to double in their returns. This leads to investors buying high and selling low. According to MorningStar, “Over the 10 years ended 2016, the average U.S. investor in diversified equity funds enjoyed a 4.36% return, even though the average diversified equity fund returned 5.15%.” This shows a close to 1% difference between poor timing for an individual investor.

Investors can use RIA’s to add alternative investments to their portfolio such as the Family Business Fund (FBF). The Family Business Fund has partnered with Nuview Trust and BelPointe Wealth Management, who are regulated custodians for alternative investments. RIAs and many other investment sponsors can now invest through their platforms into alternative investments such as LLCs, LPs, non-traded REITs & BDCs, private placements, hedge funds, debt offerings, and private stock. The Family Business Fund’s high-yield, fixed-income investment could add a 15% annual return and reduce the volatility of an investor’s portfolio.

Other Sources:

https://www.central1.com/blog_posts/millennials-are-investing-more-now-than-ever-before-why/

Media Contact

Company Name: The Family Business Fund

Contact Person: Douglas Muir

Email: Send Email

Phone: (888) 884-6442

Address:101 Plaza Real South Suite 216

City: Boca Raton

State: FL 33432

Country: United States

Website: www.familybusinessfund.com