89% of Massachusetts parents agree the value of a college education is worth the cost, though 32% of Massachusetts parents aren’t sure what the full sticker price of college will cost them.

New SECURE Act 2.0 legislation gives families greater flexibility for their 529 savings.

Amid the rising cost of college and inflation, Massachusetts families say saving for college is a priority now more than ever, according to data from Fidelity Investments® and MEFA’s (Massachusetts Educational Financing Authority) 2024 College Savings Indicator Study. Nearly 8-in-10 Massachusetts parents have started saving in 2024 compared to 70% in 2018, and the majority (89%) agree the value of a college education is worth the cost. Even so, 32% aren’t sure what college will cost by the time their child enrolls and 41% use “their own best guess” to estimate costs.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20240731850745/en/

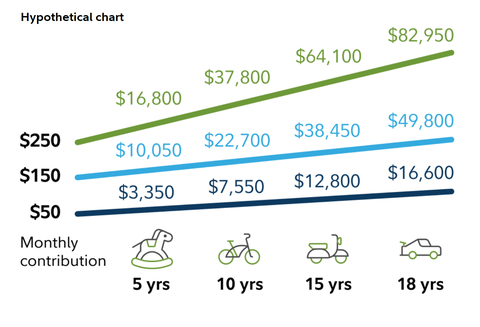

Source: Fidelity Investments *This hypothetical example illustrates the potential value of different regular monthly investments for different periods of time and assumes an average annual return of 4.5% rounded to the nearest $50. Contributions to a 529 plan account must be made with after-tax dollars. This does not reflect an actual investment and does not reflect any taxes, fees, expenses, or inflation. If it did, results would be lower. Returns will vary, and different investments may perform better or worse than this example. Periodic investment plans do not ensure a profit and do not protect against loss in a declining market. Past performance is no guarantee of future results.

Factors outside of parents’ control continue to weigh heavily on Massachusetts families’ minds. When it comes to saving for their child's education, Massachusetts parents are most concerned about inflation and the rising costs of college (93%), followed by changes to education costs such as free tuition or student debt forgiveness (93%). Additionally, nearly 1-in-5 Massachusetts parents (18%) say credit card debt is the most significant barrier to their ability to save more for college expenses.

Massachsetts parents say that saving for college is their top priority. What’s more, nearly two-thirds (62%) of parents say they have a plan in place to reach their college savings goals. The vast majority (82%) say they’ll either continue their regular college savings contributions or even increase the amount of their regular contributions for the remainder of the year. Regular contributions, even when small, can accumulate over time and help ease the financial burden of rising costs.

MEFA, the state administrator for the U.Fund 529 College Investing Plan, provides a host of tools and resources at mefa.org to help families achieve their child’s education dreams. The U.Fund, the Commonwealth’s 529 -College Investing Plan, offers federal tax benefits and in-state tax deductions, and every child who is a Massachusetts resident is eligible to receive a $50 jump-start into a U.Fund account within one year of their birth or adoption thanks to the BabySteps Savings Plan.

“Saving for college remains a top priority for many Massachusetts families, and MEFA understands the challenges that parents are facing as the cost of living continues to rise,” said Thomas Graf, Executive Director of MEFA. “Though saving for the future may seem overwhelming right now, MEFA reminds families that even the smallest amount of college savings will make a difference over time. And MEFA’s college planning guidance and resources help families plan, save and pay for their child’s future.”

Massachusetts Parents Have High Expectations About Paying for College

As the total cost of college continues to rise, Massachusetts parents have high expectations when it comes to the amount they plan to pay for their child’s education. However, while Massachusetts parent’s may have high expectations, they’re still falling short on funding their intended college savings goal – an important step in long-term financial mobility. Massachusetts parents hope to pay for 61% of their child’s education, (down from 78% in 2022), but are only on track to meet 26% of that goal (down from 46% in 2022).

New Legislation Makes 529 Plans Even More Flexible

While many Massachusetts parents expect their child to attend some form of higher education, a sizeable 26% admit their child has expressed the possibility of not doing so – leaving many parents questioning the fate of their hard-earned 529 plan savings. Fortunately, new legislative changes may ease some of these concerns, as under certain conditions, 529 plan assets can now be transferred to a Roth IRA for the beneficiary – giving them a retirement boost.1 The 529 account must be open for more than 15 years before being eligible for the rollover, which will be subject to annual Roth contribution limits and an aggregate lifetime limit of $35,000. In addition, the transfer amount must come from contributions made to the 529 account at least five years prior to the 529-to-Roth IRA transfer date. This new rule can help 529 account owners avoid taxes and penalties for withdrawals and can be particularly appealing for people looking to help their children get a head start on retirement.

“Leveraging savings tools such as a 529 plan can make a substantial difference when it comes to easing the financial burden for college,” says Tony Durkan, vice president, head of 529 relationship management at Fidelity Investments. “Thanks to recent legislation like SECURE 2.0, 529 plans have become even more flexible and enticing as a savings vehicle for parents.”

The Importance of Having a Plan

While saving for college is a top priority among Massachusetts parents (and many have a plan for achieving college savings), more than one-third (38%) do not have a financial plan in place to meet their broader goals. As a financial services firm dedicated to helping people live better lives, Fidelity has a long-standing commitment to providing resources and education, to help the next generation make informed financial decisions. MEFA offers college planning resources across mefa.org2, including videos, blog posts, podcasts and calculators as well as college planning experts available to guide families through the entire college planning process.

Among those with children nearing college age, over half (53%) believe their child understands how much their total college education could cost, and the total potential amount of student loan debt they may incur, yet 27% have not discussed the total cost of college with their child and 39% have not discussed the amount of student debt that their child may incur following graduation. Two-thirds (66%) of parents agree that concerns about student loan debt is a motivating factor in saving for their child’s college education. Yet parents continue to underestimate the amount of student debt their child will incur. MEFA provides guidance to help families understand the cost of borrowing, and resources such as Exploring College Loans2 to help families make wise borrowing decisions to minimize student loan debt. In addition, to assist families in understanding the true cost of student loan debt, Fidelity offers tools and resources at Fidelity.com/StudentDebtHelp.

Simply starting the conversation can help. The study found that most Massachusetts parents who have talked to their child have started saving (94% vs 57%). Additionally, 44% of Massachusetts parents who have talked to their child say they have a good understanding of how to save compared to the 32% who have not.

Fidelity and MEFA are committed to reducing barriers to saving and paying for education. Setting aside funds on a regular basis into a designated college savings account will help families prepare for rising education costs and minimize debt, while keeping the entire family focused on the goal of a college degree.

Need assistance with your college planning or help opening a U.Fund College Investing account? Fidelity and MEFA can help.

- Call us at (800) 544-2776 for access to dedicated U.Fund representatives to begin saving for your child’s education.

- Sign up for MEFA emails at mefa.org/sign-up-for-emails to learn more about saving for college2

- Subscribe to the MEFA Podcast at mefa.org/mefa-podcast2 to hear conversations with experts about every step of planning, saving, and paying for college and reaching financial goals

- Get our Viewpoints on college planning at www.fidelity.com/viewpoints/college-planning

- Register for a MEFA webinar at mefa.org/events2 to hear from college savings experts

- Access Fidelity’s College Savings Resource Center at fidelity.com/saving-for-college/overview

- Find a Fidelity Investor Center near you at www.fidelity.com/branchlocator/

- Ask friends and family to contribute to your child’s college savings fund at www.fidelity.com/529-plans/college-gifting

- Reach out to MEFA college planning experts, who are available to guide you through the entire college planning, saving, and paying process at (800) 449-MEFA (6332). Begin today.

About the 2024 College Savings Indicator Study

As part of the study, Fidelity conducted a survey of parents with college-bound children of all ages. Parents provided data on their current and projected household asset levels including college savings, use of an investment advisor and general expectations and attitudes toward financing their children's college education. Using Fidelity's proprietary asset-liability modeling engine, the company calculated future college savings levels per household against anticipated college costs. The results provided insight into the financial challenges parents face in saving for college. Any mentions of children “nearing college” refer to questions for parents of children either 15 years of age or older or 10th grade and higher. Data for the Indicator (number of children in household, time to matriculation, school type, current savings and expected future contributions) was collected by Boston Research Technologies, an independent research firm, through an online survey from April 15 – May 7, 2024, of 1,985 families nationwide, including 311 from Massachusetts, with children high school age and younger who are expected to attend college or other further education. The survey respondents had household incomes of at least $30,000 a year or more and were the financial decision makers in their household. Respondents are weighted to correct for any imbalances between the sample and the population of parents intending to send their children to college. College costs were sourced from the College Board's Trends in College Pricing 2023. Future assets per household were computed by Fidelity Personal and Workplace Advisors LLC (FPWA), a registered investment adviser and a Fidelity Investments company. Within Fidelity’s asset-liability model, Monte Carlo simulations were used to estimate future assets at a 75 percent confidence level. The results of the College Savings Indicator may not be representative of all parents and students meeting the same criteria as those surveyed for the study.

About MEFA

MEFA is a state authority, not reliant on state or federal appropriations, established under Massachusetts General Laws. MEFA's mission, since its founding in 1982, has been to help Massachusetts students and families access and afford higher education and reach financial goals through education programs, tax-advantaged savings plans, affordable loans, and expert guidance. All of MEFA's work aligns with the ever-present goal to support the independence, growth, and success of Massachusetts students and families. Visit mefa.org/about2 to learn more.

About Fidelity Investments

Fidelity’s mission is to strengthen the financial well-being of our customers and deliver better outcomes for the clients and businesses we serve. Fidelity’s strength comes from the scale of our diversified, market-leading financial services businesses that serve individuals, families, employers, wealth management firms, and institutions. With assets under administration of $14.1 trillion, including discretionary assets of $5.5 trillion as of June 30, 2024, we focus on meeting the unique needs of a broad and growing customer base. Privately held for 78 years, Fidelity employs more than 75,000 associates across the United States, Ireland, and India. For more information about Fidelity Investments, visit https://www.fidelity.com/about-fidelity/our-company.

Please carefully consider the plan's investment objectives, risks, charges, and expenses before investing. For this and other information on any 529 college savings plan managed by Fidelity, contact Fidelity for a free Fact Kit, or view one online. Read it carefully before you invest or send money.

**Units of the portfolios are municipal securities and may be subject to market volatility and fluctuation.**

Keep in mind that investing involves risk. The value of your investment will fluctuate over time, and you may gain or lose money.

Views expressed are as of the date indicated, based on the information available at that time, and may change based on market or other conditions. Unless otherwise noted, the opinions provided are those of the speaker or author and not necessarily those of Fidelity Investments or its affiliates. Fidelity does not assume any duty to update any of the information.

The student debt program is not a product or service of Fidelity Brokerage Services.

Fidelity Brokerage Services LLC, Member NYSE, SIPC

900 Salem Street, Smithfield, RI 02917

Fidelity Distributors Company LLC

900 Salem Street, Smithfield, RI 02917

National Financial Services LLC, Member NYSE, SIPC

245 Summer Street, Boston, MA 0211

1150238.1.0

©2024 FMR LLC. All rights reserved.

1 Beginning in January 2024, the SECURE 2.0 Act of 2022 (the “Act”) provides that you may transfer assets from your 529 account to a Roth IRA established for the Designated beneficiary of a 529 account under the following conditions: (i) the 529 account must be maintained for the Designated Beneficiary for at least 15 years, (ii) the transfer amount must come from contributions made to the 529 account at least 5 years prior to the 529-to-Roth transfer date, (iii) the Roth IRA must be established in the name of the Designated Beneficiary of the 529 account, (iv) the amount transferred to a Roth IRA is limited to the annual Roth IRA contribution limit, and (v) the aggregate amount transferred from a 529 account to a Roth IRA may not exceed $35,000 per individual. It is your responsibility to maintain adequate records and documentation on your accounts to ensure you comply with the 529-to-Roth IRA transfer requirements set forth in the Internal Revenue Code. The Internal Revenue Service (“IRS”) has not issued guidance on the 529-to-Roth IRA transfer provision in the Act but is anticipated to do so in the future. Based on forthcoming guidance, it may be necessary to change or modify some 529-to-Roth IRA transfer requirements. Please consult a financial or tax professional regarding your specific circumstances before making any investment decision.

2 You are leaving Fidelity.com for another website. The site owner is not affiliated with Fidelity and is solely responsible for the information and services it provides. Fidelity disclaims any liability arising from your use of such information or services. Review the new site's terms, conditions, and privacy policy, as they will be different from those of Fidelity's sites.

View source version on businesswire.com: https://www.businesswire.com/news/home/20240731850745/en/

Contacts

Fidelity Media Relations

FidelityMediaRelations@fmr.com

Katie Crimmins

(617) 563-9498

katie.crimmins@fmr.com

Lisa Rooney

(617) 224-4834

lrooney@mefa.org

Follow us on X @FidelityNews

Visit About Fidelity and our online newsroom