Forge Global Holdings, Inc. (“Forge,” or the “Company”) (NYSE: FRGE), a leading private securities marketplace, today announced the launch of the Forge Private Market Index, the benchmark for actively traded private companies. This first index represents the continued expansion of Forge’s private market data products and solutions – particularly for institutional asset managers – to drive increased adoption of the asset class.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230504005304/en/

The Forge Private Market Index marks a new milestone for Forge and the private market more broadly, as Forge leverages its 13 years of private market trading data and experience to enable investors to better measure their investment returns and gain insights on late-stage, venture-backed companies.

The index includes U.S. domiciled companies that have raised at least one round of primary funding and have higher relative secondary liquidity in the past 12 months, thereby reflecting the actively traded segment of the private market rather than overemphasizing primary valuations, which bring less continuous pricing and liquidity information.

“As more investors turn to the private markets for new sources of return and diversification, they need the tools that they rely on when investing in other asset classes. With the launch of the Forge Private Market Index, Forge is doubling down on its position as a leader in private market data and investment solutions to help investors analyze and gain insights into this growing asset class,” said Kelly Rodriques, CEO of Forge.

Made possible by the Forge Data platform, the Forge Private Market Index leverages the breadth and depth of Forge’s trading data and can be used by investors, shareholders, employees, and industry analysts to:

- Benchmark actively traded private companies with secondary liquidity

- Measure the performance of venture backed, late-state companies relative to other asset classes

- Research new investment ideas and manage existing private positions

“If we learned anything from the recent market cycle, it’s that primary round valuations are just one data point that investors can use when understanding the performance of private companies,” said Howe Ng, SVP, Head of Analytics and Investment Solutions at Forge. “The private market has historically lacked quality benchmarks and investors need tools that can more accurately reflect the increased volume and velocity of trading that occurs in this space. With our trading experience and extensive pricing data, Forge is uniquely positioned to create the Forge Private Market Index for investors to use as a benchmark for venture-backed, actively traded private companies.”

The Forge Private Market Index is priced daily and updated weekly on forgeglobal.com. All private market participants can view the index on Forge’s website and see regular insights and content from Forge regarding the Forge Private Market Index.

Forge is a leading provider of marketplace infrastructure, data services and technology solutions for private market participants. Brokerage products and services are offered by Forge Securities LLC, a registered broker-dealer and member FINRA/SIPC.

Forward-Looking Statements

This press release contains “forward-looking statements,” which generally are accompanied by words such as “believe,” “may,” ”could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “target,” “goal,” “expect,” “should,” “would,” “plan,” “predict,” “project,” “forecast,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict, indicate, or relate to future events, trends, or Forge’s future financial or operating performance, or that are not statements of historical matters. These forward-looking statements include, but are not limited to, statements regarding Forge’s beliefs regarding the Forge Private Market Index. Forward-looking statements are predictions, projections and other statements about future events that are based on current expectations and assumptions and, as a result, while considered reasonable by Forge and its management, are subject to risks and uncertainties that may cause actual results to differ materially from current expectations. You should carefully consider the risks and uncertainties described in Forge’s documents filed, or to be filed, with the SEC from time to time, including in its Quarterly Reports on Form 10-Q, Current Reports on Form 8-K, and Annual Reports on Form 10-K. There may be additional risks that Forge presently does not know of or that it currently believes are immaterial that could also cause actual results to differ materially from those contained in the forward-looking statements. In addition, forward-looking statements reflect Forge’s expectations, plans or forecasts of future events and views as of the date of this press release. Forge anticipates that subsequent events and developments will cause its assessments to change. However, while Forge may elect to update these forward-looking statements at some point in the future, Forge specifically disclaims any obligation to do so. These forward-looking statements should not be relied upon as representing Forge’s assessments as of any date subsequent to the date of this press release. Accordingly, undue reliance should not be placed upon the forward-looking statements.

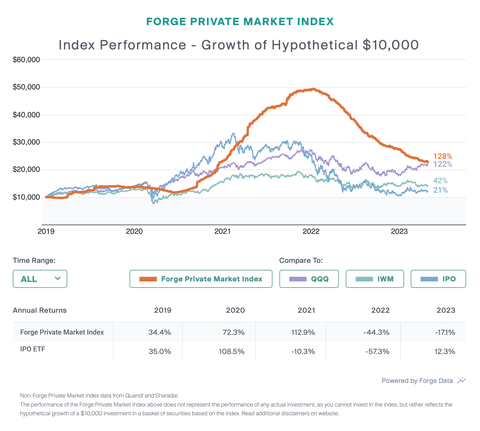

Private Market Index data as seen in "Index Performance – Growth of Hypothetical $10,000" chart from Quandl and Sharadar. Please see this link for additional disclaimers for “Index Performance – Growth of Hypothetical $10,000.”

Please click here for important disclaimers, disclosures and restrictions related to the Forge Private Market Index.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230504005304/en/

Contacts

Lindsay Riddell

SVP Global Communications

press@forgeglobal.com