The multifamily market continues to show signs of slowing, with few bright spots.

Today, Apartments.com — a CoStar Group company — published an in-depth report of multifamily rent trends for the first quarter of 2023. The negative trends in the multifamily market persisted at the start of the year.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20230410005244/en/

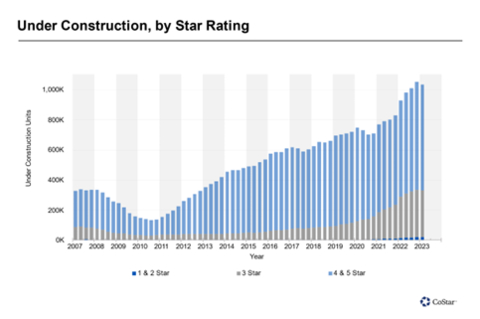

Under Construction, by Star Rating (Graphic: Business Wire)

“While we kicked off 2023 with positive monthly rent growth in January and February, we’ve still witnessed signs of weakness across the multifamily sector,” said Jay Lybik, National Director of Multifamily Analytics at CoStar Group. “Economic uncertainty has suppressed household formations, and consumer confidence sits at low levels due to high inflation, Fed interest rate hikes and recession fears. Despite these headwinds, the deterioration of multifamily fundamentals appears to be slowing. However, the record supply still under construction and the economic uncertainty continue to weigh on the multifamily market.”

BY THE NUMBERS

Despite continued weakness, the multifamily sector saw some improvements in the first quarter of 2023. Absorption turned positive, at 43,000 units nationwide. While 104,000 units were newly delivered, the vacancy rate increased only 30 basis points to 6.7%, the smallest increase since the second quarter of 2022. Additionally, although the supply-demand imbalance continued to put downward pressure on national year-over-year asking rent growth, it remained positive, declining by only 130 basis points to 2.5% since the end of 2022.

SUPPLY ADDITIONS LIKELY TO OUTSTRIP DEMAND

With just more than 1 million units under construction, the national multifamily market is expected to see the largest number of new units delivered since 531,000 units were delivered in the mid-1980s. As supply is likely to outpace demand, there will be upward pressure on vacancy rates and downward pressure on rents. This will likely be most pronounced in four- and five-star properties, which are typically luxury mid- to high-rises with resort-style amenities, where many new developments are occurring. At the end of the first quarter, four- and five-star properties had the highest vacancy rate, at 8.7%, and the lowest rent growth, at 1.5%.

Economic uncertainty will continue to pose risks for three-star, typically garden-style multifamily properties, with household formations down and some existing renter households being squeezed by high inflation and past rent increases. Vacancies at three-star properties have risen the most over the past six quarters, up 230 basis points to 6.4%, although three-star properties are still leading overall rent growth, with a 3.1% year-over-year gain.

MIAMI EXPERIENCES SIGNIFICANT SLOWDOWN IN RENT GROWTH

In the first quarter, 38 out of 40 markets experienced moderation in year-over-year rent growth. Miami saw the biggest slowdown, with year-over-year rent growth dropping by 300 basis points to 3.8%, a stark reversal from just a year before, when Miami’s rent growth stood at 18%.

Baltimore and Boston were the only two markets where rent growth did not decline in the first quarter.

INDIANAPOLIS, MIDWEST MARKETS POST HIGHEST RENT GROWTH

Indianapolis held the top spot for year-over-year rent growth, at 6.6%, alongside other Midwest markets like Cincinnati, St. Louis and Columbus. Just a year prior, rent increases were strongest in Sun Belt metros.

KEY CONSIDERATIONS AHEAD OF SPRING LEASING PERIOD

If absorption can match deliveries by the end of the second quarter, the multifamily market might see some stabilization. However, the downside risks dominate, including potential weakening in the labor market and tighter financial conditions. The next 90 days, which represent the critical spring leasing period, will set the tone for how multifamily will perform the rest of the year.

About CoStar Group, Inc.

CoStar Group, Inc. (NASDAQ: CSGP), a leading provider of online real estate marketplaces, information, and analytics in the property markets. Founded in 1987, CoStar conducts expansive, ongoing research to produce and maintain the largest and most comprehensive database of commercial real estate information. Our suite of online services enables clients to analyze, interpret and gain unmatched insight on commercial property values, market conditions and current availabilities. STR provides premium data benchmarking, analytics, and marketplace insights for the global hospitality industry. Ten-X provides a leading platform for conducting commercial real estate online auctions and negotiated bids. LoopNet is the most heavily trafficked commercial real estate marketplace online. Apartments.com, ApartmentFinder.com, ForRent.com, ApartmentHomeLiving.com, Westside Rentals, AFTER55.com, CorporateHousing.com, ForRentUniversity.com and Apartamentos.com form the premier online apartment resource for renters seeking great apartment homes and provide property managers and owners a proven platform for marketing their properties. Homesnap is an industry-leading online and mobile software platform that provides user-friendly applications to optimize residential real estate agent workflow and reinforce the agent-client relationship. Homes.com offers real estate professionals advertising and marketing services for residential properties. BureauxLocaux is one of the largest specialized property portals for buying and leasing commercial real estate in France. Business Immo is France’s leading commercial real estate news service. CoStar Group’s websites attract tens of millions of unique monthly visitors. Headquartered in Washington, DC, CoStar Group maintains offices throughout the U.S., Europe, Canada, and Asia. From time to time, we plan to utilize our corporate website, CoStarGroup.com, as a channel of distribution for material company information.

About Apartments.com

Apartments.com is the leading online apartment listing website, offering renters access to information on more than 1,000,000 available units for rent. Powered by CoStar, the Apartments.com network of sites includes Apartments.com, ApartmentFinder.com, ApartmentHomeLiving.com, Apartamentos.com, WestsideRentals.com, ForRent.com, ForRentUniversity.com, After55.com and CorporateHousing.com.

Apartments.com is supported by the industry's largest professional research team, which has visited and photographed over 500,000 properties nationwide. The team makes over one million calls each month to apartment owners and property managers, collecting and verifying current availabilities, rental rates, pet policies, fees, leasing incentives, concessions, and more. Apartments.com offers more rental listings than any other apartments website, and innovative features including a drawing tool that allows users to define their own search areas on a map, and a "Travel Time" feature that lets users search for rentals in proximity to a specific address. Apartments.com creates easy access to its listings through a responsive website and iOS and Android apps, and provides unmatched exposure for its advertisers through an intuitive name, strategic search engine placements and innovative emerging media.

The Apartments.com network reaches millions of renters nationwide, driving both qualified traffic and highly engaged renters to leasing offices.

This news release includes "forward-looking statements" including, without limitation, statements regarding CoStar's expectations or beliefs regarding the future. These statements are based upon current beliefs and are subject to many risks and uncertainties that could cause actual results to differ materially from these statements. The following factors, among others, could cause or contribute to such differences: the risk that new unit deliveries do not occur when expected, or at all; and the risk that multifamily vacancy rates are not as expected. More information about potential factors that could cause results to differ materially from those anticipated in the forward-looking statements include, but are not limited to, those stated in CoStar’s filings from time to time with the Securities and Exchange Commission, including in CoStar’s Annual Report on Form 10-K for the year ended December 31, 2022, which is filed with the SEC, including in the “Risk Factors” section of that filing, as well as CoStar’s other filings with the SEC available at the SEC’s website (www.sec.gov). All forward-looking statements are based on information available to CoStar on the date hereof, and CoStar assumes no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

View source version on businesswire.com: https://www.businesswire.com/news/home/20230410005244/en/

Contacts

News Media

Matthew Blocher

CoStar Group

(202) 346-6775

mblocher@costargroup.com