- In a strong seller’s market, some homeowners realize they can attract bidders without offering as high of a percentage to the buyer’s agent.

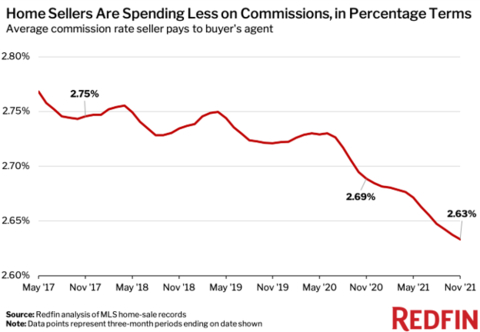

- While the buy-side commission has fallen in percentage terms, it has risen in dollar terms—a function of surging home prices; the typical seller pays the buyer’s agent $12,415, up from $11,608 in 2020 and $9,610 in 2017.

(NASDAQ: RDFN) — The typical commission rate paid to brokerages representing homebuyers has fallen to its lowest point in at least four years, according to a new report from Redfin (redfin.com), the technology-powered real estate brokerage. Redfin found the typical U.S. buyer’s agent commission was 2.63% of the home-sale price during the three months ending Nov. 30, 2021—down from 2.69% a year earlier and the lowest rate in Redfin’s records, which date back to 2017.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20220202005835/en/

(Graphic: Business Wire)

In a typical home sale transaction, the seller covers the cost of the fees of both their agent and the buyer’s agent. Redfin’s analysis focuses on the commission rate offered to the brokerage representing the buyer. Data on the typical commission rate paid to brokerages representing sellers is not available.

Fierce Competition May Be Contributing to the Falling Commission Rate

Today’s competitive housing market may be accelerating the decline in the buy-side commission rate, Redfin agents say. Sellers and their agents understand they’ll likely be able to find a buyer regardless of the commission they offer to the buyer’s agent.

“We’re experiencing a historic shortage of houses for sale. Sellers know their home is a hot commodity and will likely attract multiple offers no matter what, so they’ve started offering the buyer’s agents a 2% or 2.5% fee instead of 3%,” said Joe Hunt, Redfin’s market manager in Phoenix. “Why would you offer 3% when you know you could offer less and sell your home for the same price?”

Another factor at play is increasing transparency. Some real estate websites, including Redfin, last year started publishing buyer’s agent commission rates in select markets. In November, the National Association of Realtors passed a policy to allow brokerages and agents to display buyer’s agent commissions on their websites, which will bring commission transparency to even more markets in 2022. Consequently, more consumers may discover that some home sellers and home-selling companies, like iBuyers, are already paying lower commissions, and follow suit.

In Dollar Terms, Commissions Earned by Buyers’ Agents Have Climbed

While the average commission rate has been declining, the dollar value of buy-side commissions has been on the rise. At $12,415, the average commission fee a buyer’s agent received during the three months ending Nov. 30 was up 6.9% from a year earlier and up 29.2% from the same period in 2017. That’s a function of rising home prices. The median sale price of U.S. homes surged 15% year over year to $383,100 in November.

“One might think the surge in home prices that’s driving up commissions in dollar terms is also what’s causing sellers to offer lower commission in percentage terms, but that’s likely not the case,” Fairweather said. “Instead, sellers are probably offering lower commission rates because they realize that a well-priced home in this extreme seller’s market will likely attract buyers on its own.”

Fairweather continued: “With home prices so high, the seller, their agent and the buyer’s agent are splitting a pie of funds that’s bigger than ever. So even though the buyer’s agent is technically getting a smaller share of the pie, their check is 6.9% bigger than it was a year ago. That could change if home prices start to level off.”

New York and Massachusetts Have Relatively Low Commission Rates

In Nassau County, NY, home sellers paid a 1.98% average commission to the buyer’s agent during the three months ending Nov. 30—the lowest rate among the 32 metros in Redfin’s analysis. Nassau County was the only metro with an average commission rate below 2%. Next came Boston (2.21%), Riverside (2.22%), Anaheim (2.25%) and New Brunswick (2.3%).

At 2.94%, Kansas City, MO and Columbus, OH had the highest commission rates. Next came Austin, TX (2.92%), Virginia Beach, VA (2.91%), Houston (2.90%) and Dallas (2.88%).

To view the full report, including charts, local data and methodology, please visit: https://www.redfin.com/news/real-estate-commissions-november-2021/

About Redfin

Redfin (www.redfin.com) is a technology-powered real estate company. We help people find a place to live with brokerage, instant home-buying (iBuying), rentals, lending, title insurance, and renovations services. We sell homes for more money and charge half the fee. We also run the country's #1 real-estate brokerage site. Our home-buying customers see homes first with on-demand tours, and our lending and title services help them close quickly. Customers selling a home can take an instant cash offer from Redfin or have our renovations crew fix up their home to sell for top dollar. Our rentals business empowers millions nationwide to find apartments and houses for rent. Since launching in 2006, we've saved customers more than $1 billion in commissions. We serve more than 100 markets across the U.S. and Canada and employ over 6,000 people.

For more information or to contact a local Redfin real estate agent, visit www.redfin.com. To learn about housing market trends and download data, visit the Redfin Data Center. To be added to Redfin's press release distribution list, email press@redfin.com. To view Redfin's press center, click here.

View source version on businesswire.com: https://www.businesswire.com/news/home/20220202005835/en/

Contacts

Redfin Journalist Services:

Alina Ptaszynski, 206-588-6863

press@redfin.com