Continued momentum in revenue and normalizing margins and seasonality driving performance:

- Revenue in the first quarter was $230.3 million, growing $49.3 million, or 27.2%, year-over-year, and $81.7 million, or 55.0%, relative to pre-pandemic performance. 1

- Same-store revenue increased $34.6 million, or 19.9%, year-over-year, and grew $53.9 million, or 37.6%, vs. the comparable pre-pandemic period.1

- Net loss for the quarter was $33.5 million, driven by the non-cash expense related to the revaluation of the earnouts from the successful de-SPAC transaction ($40.8 million). Adjusted for the non-cash expense, normalized Net Income was $7.2 million.2

- Adjusted EBITDA2 in the first quarter was $65.3 million, $6.5 million, or 11.0%, higher vs. the prior year's quarter, and $40.4 million, or 162.0%, higher relative to pre-pandemic performance.1

- Adjusted EBITDA2 margin was 1,158 basis points higher than the pre-pandemic period, despite being lower than the prior year period. This normalization of the first quarter margin was in-line with management expectations as prior year period margins were higher due largely to lack of available staffing in the prior year.

- The Company repurchased 468,103 shares of Class A common stock during the first quarter at an average price of $11.67, bringing the total shares repurchased to 3,898,770 shares (average price per share of $10.26) and bringing the total Class A and Class B shares outstanding down to 162.7 million3 as of October 2, 2022. The Company has now repurchased 91% of the shares issued as a result of the warrant redemption in May of 2022.

- The Company added 3 new centers during the quarter. Total centers in operation as of October 2, 2022 were 319. Subsequent to the quarter-end, the Company acquired an additional 6 centers. bringing the updated center count to 325.

- The Company has signed definitive purchase agreements for an additional 3 new centers and signed leases for another 5 locations to be newly constructed.

Bowlero Corp. (NYSE: BOWL) (“Bowlero�� or the “Company”), the world’s largest owner and operator of bowling centers, today provided financial results for the first quarter of the 2023 fiscal year, which ended on October 2, 2022. Bowlero announced revenue of $230.3 million, which was driven by dramatic growth in event revenue, the recovery of league business, and solid walk-in retail performance. Event Revenue grew 90% ($20 million) vs. the prior year's quarter and 69% ($17 million) vs. pre-pandemic quarter. Total revenue grew by 27.2% on a year-over-year basis and 55.0% compared to pre-pandemic performance. Same-store sales rose by 19.9% year-over-year and 37.6% relative to pre-pandemic quarter.1

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20221116005932/en/

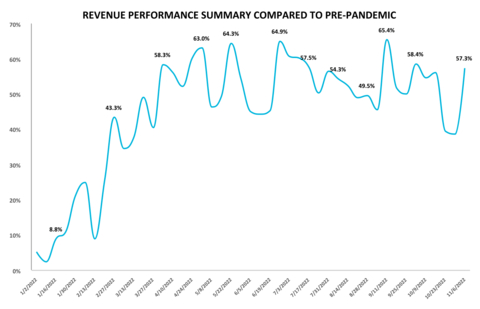

The revenue performance in individual weeks can be positively or negatively impacted by timing shift of holiday/sporting events, holidays moving to weekends, and extreme weather events. (Graphic: Business Wire)

“Bowling is booming and we are pleased with our continued world-class performance in the first quarter, particularly relative to the prior year's comparable period which reflected a rapid recovery from the pandemic and corresponding staffing shortages. We never lost focus on our goal to provide delightful experiences for our guests and are now well positioned to do so through fiscal year 2023. This showed in the tremendous results with year-over-year Revenue growth of nearly 30% and Adjusted EBITDA growth of more than 11%,” said Thomas Shannon, Founder and Chief Executive Officer. "Additionally, the development pipeline is extremely active and continues to provide strong results and opportunities to consolidate the industry. The Company has added 9 new centers in the current fiscal year and added 38 new centers since the start of fiscal year 2022 and we are just getting started," according to Shannon.

Financial Summary

- Powerful growth in Revenue during the quarter, totaling $230.3 million, up 27.2% on a year-over-year basis, and up 55.0% relative to pre-pandemic performance. Same-store sales increased 19.9% year-over-year, demonstrating the Company's ability to continue to drive organic growth.

- Net Loss for the quarter was $33.5 million, after giving effect to $40.8 million of non-cash expenses related to the increase in the fair value of earnouts. Net Income, adjusted for this was $7.2 million vs. a Net Income of $15.6 million in the same period of the prior year. The prior year Net Income was favorably impacted by a $6.2 million favorable tax adjustment as well as lower costs due to, among other factors, not having higher costs associated with being a public-reporting company and lower labor costs, as center and Corporate staffing was being normalized in the first quarter of fiscal 2023 to support the upcoming busy-season.2

- Adjusted EBITDA for the quarter was $65.3 million, up 11.0% year-over-year and 162.0% relative to pre-pandemic performance.2 The Adjusted EBITDA margin was 28.4%, 1,158 basis points higher than pre-pandemic quarter despite being 415 basis points lower than the prior year quarter. As previously stated by management, prior year margins were unnaturally high due to, among other things, lack of staff during the reopening following the COVID-19 business interruption. The Company is now well-prepared for the second and third quarters when the Company traditionally produces substantially higher revenues and requires greater staffing levels due to the seasonality of our business.

- Cash generated from Operations during the quarter was $35.6 million.

- In general, the Company is seeing a normalization of the seasonal curve in performance and looks forward to the second and third quarters where the significant structural tailwinds of event and league post-pandemic recovery as well as continued strong walk-in retail traffic are expected to drive material performance gains compared to prior year period and the pre-pandemic period.

“The first quarter saw both the event and league business return with a vengeance. We saw Event revenue nearly double and League business surge nearly 20% versus pre-pandemic levels,” said Brett Parker, President and CFO of Bowlero Corp. “Even more impressive, Adjusted EBITDA margin expanded almost 1,200 basis points relative to pre-pandemic levels, despite slight year-over-year margin contraction which reflects more normalized staffing levels compared to the first quarter of last year when we operated with pandemic related staffing shortages. This margin improvement demonstrates the inherent operating leverage that exists in the business and management’s strong focus on maximizing profitability. Furthermore, we have recently adjusted pricing to better reflect the current environment and offset macro input cost pressures.”

Total Bowling Center Revenue Performance Trend4

[Please see the Total Bowling Center Revenue Performance Trend Chart]

Investor Webcast Information

Listeners may access an investor webcast hosted by Bowlero. The webcast and results presentation will be accessible at 4:30 PM ET on November 16, 2022 in the Events & Presentations section of the Bowlero Investor Relations website at https://ir.bowlerocorp.com/overview/default.aspx.

About Bowlero Corp.

Bowlero Corp. is the worldwide leader in bowling entertainment. With more than 300 bowling centers across North America, Bowlero Corp. serves more than 27 million guests each year through a family of brands that includes Bowlero and AMF. Bowlero Corp. is also home to the Professional Bowlers Association, which boasts thousands of members and millions of fans across the globe. For more information on Bowlero Corp., please visit BowleroCorp.com.

Forward Looking Statements

Some of the statements contained in this press release are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. These forward-looking statements are generally identified by the use of words such as "anticipate," "believe," "could," "estimate," "expect," "intend," "may," "plan," "potential," "predict," "project," "should," "target," "will," "would" and, in each case, their negative or other various or comparable terminology and include preliminary results. These forward-looking statements reflect our views with respect to future events as of the date of this release and are based on our management’s current expectations, estimates, forecasts, projections, assumptions, beliefs and information. Although management believes that the expectations reflected in these forward-looking statements are reasonable, it can give no assurance that these expectations will prove to have been correct. All such forward-looking statements are subject to risks and uncertainties, many of which are outside of our control, and could cause future events or results to be materially different from those stated or implied in this document. It is not possible to predict or identify all such risks. These risks include, but are not limited to: the impact of COVID-19 or other adverse public health developments on our business; our ability to grow and manage growth profitably, maintain relationships with customers, compete within our industry and retain our key employees; changes in consumer preferences and buying patterns; the possibility that we may be adversely affected by other economic, business, and/or competitive factors; the risk that the market for our entertainment offerings may not develop on the timeframe or in the manner that we currently anticipate; general economic conditions and uncertainties affecting markets in which we operate and economic volatility that could adversely impact our business, including the COVID-19 pandemic and other factors described under the section titled “Risk Factors” in the Company's Annual Report on Form 10-K filed with the U.S. Securities and Exchange Commission (the “SEC”) by the Company on September 15, 2022, as well as other filings that the Company will make, or has made, with the SEC, such as Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. These factors should not be construed as exhaustive and should be read in conjunction with the other cautionary statements that are included in this press release and in other filings. We expressly disclaim any obligation to publicly update or review any forward-looking statements, whether as a result of new information, future developments or otherwise, except as required by applicable law.

GAAP Financial Information

Bowlero Corp. |

||||||||

Condensed Consolidated Balance Sheets |

||||||||

(Amounts in thousands, except share and per share amounts) |

||||||||

(Unaudited) |

||||||||

|

October 2,

|

|

July 3,

|

|||||

Assets |

|

|

|

|||||

Current assets: |

|

|

|

|||||

Cash and cash equivalents |

$ |

110,361 |

|

|

$ |

132,236 |

|

|

Marketable securities |

|

2,935 |

|

|

|

— |

|

|

Accounts and notes receivable, net of allowance for doubtful accounts of $527 and $504, respectively |

|

5,431 |

|

|

|

5,227 |

|

|

Inventories, net |

|

11,147 |

|

|

|

10,310 |

|

|

Prepaid expenses and other current assets |

|

14,488 |

|

|

|

12,732 |

|

|

Assets held-for-sale |

|

8,719 |

|

|

|

8,789 |

|

|

Total current assets |

|

153,081 |

|

|

|

169,294 |

|

|

|

|

|

|

|||||

Property and equipment, net |

|

577,260 |

|

|

|

534,721 |

|

|

Internal use software, net |

|

12,393 |

|

|

|

11,423 |

|

|

Property and equipment under capital leases, net |

|

261,618 |

|

|

|

262,703 |

|

|

Intangible assets, net |

|

92,119 |

|

|

|

92,593 |

|

|

Goodwill |

|

743,655 |

|

|

|

742,669 |

|

|

Other assets |

|

39,342 |

|

|

|

41,022 |

|

|

Total assets |

$ |

1,879,468 |

|

|

$ |

1,854,425 |

|

|

|

|

|

|

|||||

Liabilities, Temporary Equity and Stockholders’ Deficit |

|

|

|

|||||

Current liabilities: |

|

|

|

|||||

Accounts payable |

$ |

40,265 |

|

|

$ |

38,217 |

|

|

Accrued expenses |

|

61,732 |

|

|

|

62,854 |

|

|

Current maturities of long-term debt |

|

5,834 |

|

|

|

4,966 |

|

|

Other current liabilities |

|

13,906 |

|

|

|

13,123 |

|

|

Total current liabilities |

|

121,737 |

|

|

|

119,160 |

|

|

|

|

|

|

|||||

Long-term debt, net |

|

878,243 |

|

|

|

865,090 |

|

|

Long-term obligations under capital leases |

|

398,223 |

|

|

|

397,603 |

|

|

Earnout liability |

|

251,779 |

|

|

|

210,952 |

|

|

Other long-term liabilities |

|

58,344 |

|

|

|

54,418 |

|

|

Deferred income tax liabilities |

|

14,906 |

|

|

|

14,882 |

|

|

Total liabilities |

|

1,723,232 |

|

|

|

1,662,105 |

|

|

|

|

|

|

|||||

Temporary Equity |

|

|

|

|||||

Series A preferred stock |

|

206,002 |

|

|

|

206,002 |

|

|

|

|

|

|

|||||

|

October 2,

|

|

July 3,

|

|||||

Stockholders’ Deficit: |

|

|

|

|||||

Class A common stock |

$ |

11 |

|

|

$ |

11 |

|

|

Class B common stock |

|

6 |

|

|

|

6 |

|

|

Additional paid-in capital |

|

338,294 |

|

|

|

335,015 |

|

|

Treasury stock, at cost |

|

(40,019 |

) |

|

|

(34,557 |

) |

|

Accumulated deficit |

|

(346,385 |

) |

|

|

(312,851 |

) |

|

Accumulated other comprehensive loss |

|

(1,673 |

) |

|

|

(1,306 |

) |

|

Total stockholders’ deficit |

|

(49,766 |

) |

|

|

(13,682 |

) |

|

Total liabilities, temporary equity and stockholders' deficit |

$ |

1,879,468 |

|

|

$ |

1,854,425 |

|

|

Bowlero Corp. |

||||||||

Condensed Consolidated Statements of Operations |

||||||||

(Amounts in thousands) |

||||||||

(Unaudited) |

||||||||

|

Three Months Ended |

|||||||

|

October 2,

|

|

September 26,

|

|||||

Revenues |

$ |

230,260 |

|

|

$ |

180,978 |

|

|

Costs of revenues |

|

165,202 |

|

|

|

126,868 |

|

|

Gross profit |

|

65,058 |

|

|

|

54,110 |

|

|

|

|

|

|

|||||

Operating (income) expenses: |

|

|

|

|||||

Selling, general and administrative expenses |

|

32,494 |

|

|

|

21,415 |

|

|

Asset impairment |

|

84 |

|

|

|

— |

|

|

Gain on sale or disposal of assets |

|

(155 |

) |

|

|

(30 |

) |

|

Other operating expense |

|

1,362 |

|

|

|

477 |

|

|

Total operating expense |

|

33,785 |

|

|

|

21,862 |

|

|

|

|

|

|

|||||

Operating profit |

|

31,273 |

|

|

|

32,248 |

|

|

|

|

|

|

|||||

Other expenses: |

|

|

|

|||||

Interest expense, net |

|

23,570 |

|

|

|

22,928 |

|

|

Change in fair value of earnout liability |

|

40,760 |

|

|

|

— |

|

|

Other expense |

|

48 |

|

|

|

— |

|

|

Total other expense |

|

64,378 |

|

|

|

22,928 |

|

|

|

|

|

|

|||||

(Loss) income before income tax expense (benefit) |

|

(33,105 |

) |

|

|

9,320 |

|

|

|

|

|

|

|||||

Income tax expense (benefit) |

|

429 |

|

|

|

(6,244 |

) |

|

Net (loss) income |

$ |

(33,534 |

) |

|

$ |

15,564 |

|

|

Bowlero Corp. |

||||||||

Condensed Consolidated Statements of Cash Flows |

||||||||

(Amounts in thousands) |

||||||||

(Unaudited) |

||||||||

|

Three Months Ended |

|||||||

|

October 2, 2022 |

|

September 26,

|

|||||

Net cash provided by operating activities |

$ |

35,573 |

|

|

$ |

31,540 |

|

|

Net cash used in investing activities |

|

(62,492 |

) |

|

|

(95,724 |

) |

|

Net cash provided by (used in) financing activities |

|

5,167 |

|

|

|

(908 |

) |

|

Effect of exchange rate changes on cash |

|

(123 |

) |

|

|

61 |

|

|

Net decrease in cash and cash equivalents |

|

(21,875 |

) |

|

|

(65,031 |

) |

|

|

|

|

|

|||||

Cash and cash equivalents at beginning of period |

|

132,236 |

|

|

|

187,093 |

|

|

|

|

|

|

|||||

Cash and cash equivalents at end of period |

$ |

110,361 |

|

|

$ |

122,062 |

|

|

GAAP to non-GAAP Reconciliations |

||||||

|

|

Adjusted EBITDA Reconciliation |

||||

|

|

Three Months Ended |

||||

(in thousands) |

|

October 2,

|

September 26,

|

September 29,

|

||

Consolidated |

|

|

|

|

||

Revenues |

|

$230,260 |

|

$180,978 |

|

$148,570 |

Net (loss) income - GAAP |

|

(33,534) |

|

15,564 |

|

(19,719) |

Adjustments: |

|

|

|

|

||

Interest expense |

|

23,570 |

|

22,928 |

|

19,665 |

Income tax expense (benefit) |

|

429 |

|

(6,244) |

|

153 |

Depreciation, amortization and impairment charges |

|

26,351 |

|

22,841 |

|

21,102 |

Share-based compensation |

|

3,648 |

|

801 |

|

869 |

Closed center EBITDA (1) |

|

379 |

|

420 |

|

1,116 |

Foreign currency exchange (gain) loss |

|

(71) |

|

35 |

|

— |

Asset disposition (gain) loss |

|

(155) |

|

(30) |

|

66 |

Transactional and other advisory costs (2) |

|

2,226 |

|

2,829 |

|

1,308 |

Charges attributed to new initiatives (3) |

|

45 |

|

141 |

|

299 |

Extraordinary unusual non-recurring losses (gains) (4) |

|

1,661 |

|

(441) |

|

72 |

Changes in the value of earnouts (5) |

|

40,760 |

|

— |

|

— |

Adjusted EBITDA |

|

$65,309 |

|

$58,844 |

|

$24,931 |

Adjusted EBITDA Margin |

|

28.4% |

|

32.5% |

|

16.8% |

|

|

|

|

|

|

|

SG&A Expense |

|

24,495 |

|

16,914 |

|

19,357 |

Media & Other Income |

|

(3,745) |

|

(4,169) |

|

(184) |

Center EBITDA |

|

$86,059 |

|

$71,589 |

|

$44,104 |

(1) |

The closed center adjustment is to remove EBITDA for closed centers. Closed centers are those centers that are closed for a variety of reasons, including permanent closure, newly acquired or built centers prior to opening, centers closed for renovation or rebranding and conversion. Closed centers do not include centers closed in compliance with local, state and federal government restrictions due to COVID-19. If a center is not open on the last day of the reporting period, it will be considered closed for that reporting period. If the center is closed on the first day of the reporting period for permanent closure, the center will be considered closed for that reporting period. |

|

(2) |

The adjustment for transaction costs and other advisory costs is to remove charges incurred in connection with any transaction, including mergers, acquisitions, refinancing, amendment or modification to indebtedness, dispositions and costs in connection with an initial public offering, in each case, regardless of whether consummated. |

|

(3) |

The adjustment for charges is to remove charges attributed to new initiatives include charges with the undertaking and/or implementation of new initiatives, business optimization activities, cost savings initiatives, cost rationalization programs, operating expense reductions and/or synergies and/or similar initiatives and/or programs (including in connection with any integration, restructuring or transition, any reconstruction, decommissioning, recommissioning, or reconfiguration of fixed assets for alternative uses, any office or facility opening and/or pre-opening), including any inventory optimization program and/or any curtailment, any business optimization charge, any restructuring charge (including any charges relating to any tax restructuring), any charge relating to the closure or consolidation of any office or facility (including but not limited to rent terminations, moving costs and legal costs), any systems implementation charge, any severance charge, any one time compensation charge, any charge relating to entry into a new market, any charge relating to any strategic initiative or contract, any charge relating to any entry into new markets and contracts, any lease run-off charge, any charge associated with improvements to information technology (IT) or accounting functions, losses related to temporary decreases in work volume and expenses related to maintaining underutilized personnel, any charge relating to a new contract, any consulting charge and/or any corporate development charge; provided, that, in this case of any such charge, the results of any such action relating to such charge are projected by in good faith to be achieved with 24 months of undertaking. |

|

(4) |

The adjustment for extraordinary unusual non-recurring gains or losses is to remove extraordinary gains and losses, which include any gain or charge from any extraordinary item as determined in good faith by the Company and/or any non-recurring or unusual item as determined in good faith by the Company and/or any charge associated with and/or payment of any legal settlement, fine, judgment or order. |

|

(5) |

The adjustment for changes in the value of earnouts is to remove the impact of the revaluation of the earnouts. As a result of the Company's de-SPAC transaction, the Company recorded a liability for earnouts. Changes in the fair value of the earnout liability are recognized in the statement of operations. Decreases in the liability will have a favorable impact on the income statement and increases in the liability will have an unfavorable impact. |

|

Trailing twelve month Adjusted EBITDA Reconciliation |

||||||||||||||

Net loss - GAAP and Adjusted EBITDA |

||||||||||||||

(in thousands) |

March 28,

|

June 27,

|

September 26,

|

December 26,

|

March 27,

|

July 3,

|

October 2,

|

|||||||

Consolidated |

|

|

|

|

|

|

|

|||||||

Revenues |

$247,257 |

|

$395,234 |

|

$526,281 |

|

$657,483 |

|

$803,091 |

|

$911,705 |

|

$960,987 |

|

Net loss - GAAP |

$(197,748) |

|

$(126,461) |

|

$(70,125) |

|

$(55,442) |

|

$(50,338) |

|

$(29,934) |

|

$(79,032) |

|

Adjustments: |

|

|

|

|

|

|

|

|||||||

Interest expense |

86,352 |

|

88,857 |

|

90,612 |

|

92,239 |

|

92,229 |

|

94,460 |

|

95,102 |

|

Income tax expense (benefit) |

7,927 |

|

(1,035) |

|

(7,403) |

|

(7,147) |

|

(7,457) |

|

(690) |

|

5,983 |

|

Depreciation, amortization and impairment charges |

91,411 |

|

91,851 |

|

92,241 |

|

95,363 |

|

102,359 |

|

108,505 |

|

112,015 |

|

Share-based compensation |

3,226 |

|

3,164 |

|

3,116 |

|

44,975 |

|

47,169 |

|

50,236 |

|

53,083 |

|

Closed center EBITDA (1) |

3,259 |

|

4,039 |

|

3,880 |

|

3,374 |

|

3,179 |

|

1,480 |

|

1,439 |

|

Foreign currency exchange (gain) loss |

(146) |

|

(188) |

|

(155) |

|

126 |

|

(68) |

|

5 |

|

(101) |

|

Asset disposition (gain) loss |

613 |

|

(46) |

|

(77) |

|

(58) |

|

(1,723) |

|

(4,109) |

|

(4,234) |

|

Transactional and other advisory costs (2) |

5,573 |

|

10,737 |

|

12,056 |

|

40,474 |

|

43,379 |

|

38,140 |

|

37,537 |

|

Charges attributed to new initiatives (3) |

500 |

|

531 |

|

540 |

|

489 |

|

396 |

|

362 |

|

266 |

|

Extraordinary unusual non-recurring losses (4) |

360 |

|

1,670 |

|

65 |

|

3,374 |

|

3,009 |

|

5,131 |

|

7,233 |

|

Changes in the value of earnouts and warrants and settlement costs (5) |

— |

|

— |

|

— |

|

(22,472) |

|

44,145 |

|

52,789 |

|

93,549 |

|

Adjusted EBITDA |

$1,327 |

|

$73,119 |

|

$124,750 |

|

$195,295 |

|

$276,279 |

|

$316,375 |

|

$322,840 |

|

Adjusted EBITDA Margin |

0.5% |

|

18.5% |

|

23.7% |

|

29.7% |

|

34.4% |

|

34.7% |

|

33.6% |

|

(1) |

The closed center adjustment is to remove EBITDA for closed centers. Closed centers are those centers that are closed for a variety of reasons, including permanent closure, newly acquired or built centers prior to opening, centers closed for renovation or rebranding and conversion. Closed centers do not include centers closed in compliance with local, state and federal government restrictions due to COVID-19. If a center is not open on the last day of the reporting period, it will be considered closed for that reporting period. If the center is closed on the first day of the reporting period for permanent closure, the center will be considered closed for that reporting period. |

|

(2) |

The adjustment for transaction costs and other advisory costs is to remove charges incurred in connection with any transaction, including mergers, acquisitions, refinancing, amendment or modification to indebtedness, dispositions and costs in connection with an initial public offering, in each case, regardless of whether consummated. |

|

(3) |

The adjustment for charges is to remove charges attributed to new initiatives include charges with the undertaking and/or implementation of new initiatives, business optimization activities, cost savings initiatives, cost rationalization programs, operating expense reductions and/or synergies and/or similar initiatives and/or programs (including in connection with any integration, restructuring or transition, any reconstruction, decommissioning, recommissioning, or reconfiguration of fixed assets for alternative uses, any office or facility opening and/or pre-opening), including any inventory optimization program and/or any curtailment, any business optimization charge, any restructuring charge (including any charges relating to any tax restructuring), any charge relating to the closure or consolidation of any office or facility (including but not limited to rent terminations, moving costs and legal costs), any systems implementation charge, any severance charge, any one time compensation charge, any charge relating to entry into a new market, any charge relating to any strategic initiative or contract, any charge relating to any entry into new markets and contracts, any lease run-off charge, any charge associated with improvements to information technology (IT) or accounting functions, losses related to temporary decreases in work volume and expenses related to maintaining underutilized personnel, any charge relating to a new contract, any consulting charge and/or any corporate development charge; provided, that, in this case of any such charge, the results of any such action relating to such charge are projected by in good faith to be achieved with 24 months of undertaking. |

|

(4) |

The adjustment for extraordinary unusual non-recurring gains or losses is to remove extraordinary gains and losses, which include any gain or charge from any extraordinary item as determined in good faith by the Company and/or any non-recurring or unusual item as determined in good faith by the Company and/or any charge associated with and/or payment of any legal settlement, fine, judgment or order. |

|

(5) |

The adjustment for changes in the value of earnouts and warrants is to remove the impact of the revaluation of the earnouts and warrants. As a result of the Company's de-SPAC transaction, the Company recorded liabilities for earnouts and warrants. Changes in the fair value of the earnout and warrant liabilities are recognized in the statement of operations. Decreases in the liability will have a favorable impact on the income statement and increases in the liability will have an unfavorable impact. The adjustment also includes realized costs associated with the settlement of warrants during past reporting periods. |

|

NORMALIZED NET INCOME RECONCILIATION |

||||

October 2, 2022 |

||||

(in thousands) |

|

Three months ended |

||

|

|

|

||

Net loss - GAAP |

|

$ |

(33,534 |

) |

|

|

|

||

Change in fair value of earnouts |

|

|

40,760 |

|

|

|

|

||

Normalized Net Income |

|

$ |

7,226 |

|

Non-GAAP Financial Measures

To provide investors with information in addition to our results as determined under Generally Accepted Accounting Principles (“GAAP”), we disclose net income, normalized for extraordinary and non-recurring items, Adjusted EBITDA and trailing twelve month Adjusted EBITDA as “non-GAAP measures” which management believes provide useful information to investors because each measure assists both investors and management in analyzing and benchmarking the performance and value of our business. Accordingly, management believes that these measurements are useful for comparing general operating performance from period to period, and management relies on these measures for planning and forecasting of future periods. Additionally, these measures allow management to compare our results with those of other companies that have different financing and capital structures. These measures are not financial measures calculated in accordance with GAAP and should not be considered as a substitute for revenue, net income, net cash provided (used) by operating activities or any other operating performance or liquidity measure calculated in accordance with GAAP, and may not be comparable to a similarly titled measure reported by other companies.

Net income normalized for extraordinary and non-recurring items represents Net income (loss) before non-cash expenses or income related to Changes in the value of earnouts and warrants. Adjusted Earnings Before Interest, Taxes, Depreciation and Amortization (“Adjusted EBITDA”) represents Net income (loss) before Interest, Income Taxes, Depreciation and Amortization, Share-based Compensation, EBITDA from Closed Centers, Foreign Currency Exchange Loss (Gain), Asset Disposition Loss (Gain), Transactional and other advisory costs, Charges attributed to new initiatives, Extraordinary unusual non-recurring gains or losses and Changes in the value of earnouts and warrants and settlement costs. Trailing twelve month Adjusted EBITDA represents Adjusted EBITDA over the most recent twelve month period.

The Company considers net income normalized for extraordinary and non-recurring items as an important financial measure because it provides an indicator of performance that is not affected by fluctuations in certain costs or other items. However, this measure has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are that it does not reflect every cash expenditure and is not adjusted for all non-cash income or expense items that are reflected in our statements of cash flows.

The Company considers Adjusted EBITDA as an important financial measure because it provides a financial measure of the quality of the Company’s earnings. Other companies may calculate Adjusted EBITDA differently than we do, which might limit its usefulness as a comparative measure. Adjusted EBITDA is used by management in addition to and in conjunction with the results presented in accordance with GAAP. Additionally, we believe trailing twelve month Adjusted EBITDA provides the current run-rate for trending purposes, rather than annualizing the respective quarters, as the Company’s business is seasonal, with the second and third fiscal quarters being higher than the first and last quarters.

We have presented Adjusted EBITDA solely as a supplemental disclosure because we believe it allows for a more complete analysis of results of operations and assists investors and analysts in comparing our operating performance across reporting periods on a consistent basis by excluding items that we do not believe are indicative of our core operating performance.

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of our results as reported under GAAP. Some of these limitations are that Adjusted EBITDA and trailing twelve month Adjusted EBITDA:

- do not reflect every expenditure, future requirements for capital expenditures or contractual commitments;

- do not reflect changes in our working capital needs;

- do not reflect the interest expense, or the amounts necessary to service interest or principal payments, on our outstanding debt;

- do not reflect income tax (benefit) expense, and because the payment of taxes is part of our operations, tax expense is a necessary element of our costs and ability to operate;

- do not reflect non-cash equity compensation, which will remain a key element of our overall equity based compensation package; and

- do not reflect the impact of earnings or charges resulting from matters we consider not to be indicative of our ongoing operations.

1 Same-store sales are measured by comparing revenues for centers open for the entire duration of both the current and comparable measurement periods. The pre-pandemic comparable period for the quarter ended October 2, 2022 is the quarter ended on September 29, 2019.

2 Adjusted EBITDA and normalized net income are non-GAAP measures. "GAAP" stands for Generally Accepted Accounting Principles in the U.S. Please see the sections of this document titled "GAAP Financial Information" and "GAAP to non-GAAP Reconciliations" for more information on the Company's GAAP and non-GAAP measures. Certain figures in the tables throughout this document may not foot due to rounding.

3 Class A and Class B shares outstanding excludes 3.2 million shares that are subject to forfeiture contingent on certain stock price thresholds.

4Total Bowling Center Revenue excludes closed bowling center activity and media revenue, which is also a component of our bowling operations. Data for all weeks following the close of the quarter ended on October 2, 2022 are preliminary and have not been audited or reviewed and are forward-looking statements based solely on information available to us as of the date of this announcement. For weeks between 1/2/22 and 2/27/22, the percentages above are calculated by comparing each week to the comparable week in 2020. For weeks between 3/6/22 and 11/6/22, the percentages above are calculated by comparing each week to the comparable week in 2019.

View source version on businesswire.com: https://www.businesswire.com/news/home/20221116005932/en/

Contacts

For Media:

Bowlero Corp. Public Relations

PR@BowleroCorp.com

For Investors:

Bowlero Corp. Investor Relations

IRSupport@BowleroCorp.com

Ashley DeSimone

Ashley.DeSimone@icrinc.com