With a market cap of $269.9 billion, RTX Corporation (RTX) is a global aerospace and defense company serving commercial, military, and government customers through its three operating segments: Collins Aerospace, Pratt & Whitney, and Raytheon.

Shares of the Arlington, Virginia-based company have significantly outperformed the broader market over the past 52 weeks. RTX stock has jumped 56.5% over this time frame, while the broader S&P 500 Index ($SPX) has rallied 16.1%. Moreover, shares of the company are up 9.5% on a YTD basis, compared to SPX’s 1.9% rise.

Focusing more closely, shares of the aerospace and defense company has outpaced the State Street Industrial Select Sector SPDR ETF’s (XLI) 18.8% return over the past 52 weeks.

Shares of RTX rose 3.7% on Jan. 27 after the company reported Q4 2025 adjusted EPS of $1.55 and revenue of $24.24 billion, both topped forecasts. Investors were encouraged by sharply higher cash generation, with free cash flow of $3.2 billion and full-year 2025 free cash flow of $7.9 billion, up $3.4 billion year-over-year. The rally was further supported by a strong 2026 outlook, including adjusted EPS guidance of $6.60 - $6.80 and free cash flow of $8.25 billion - $8.75 billion.

For the fiscal year ending in December 2026, analysts expect RTX’s adjusted EPS to grow 6% year-over-year to $6.67. The company's earnings surprise history is promising. It topped the consensus estimates in the last four quarters.

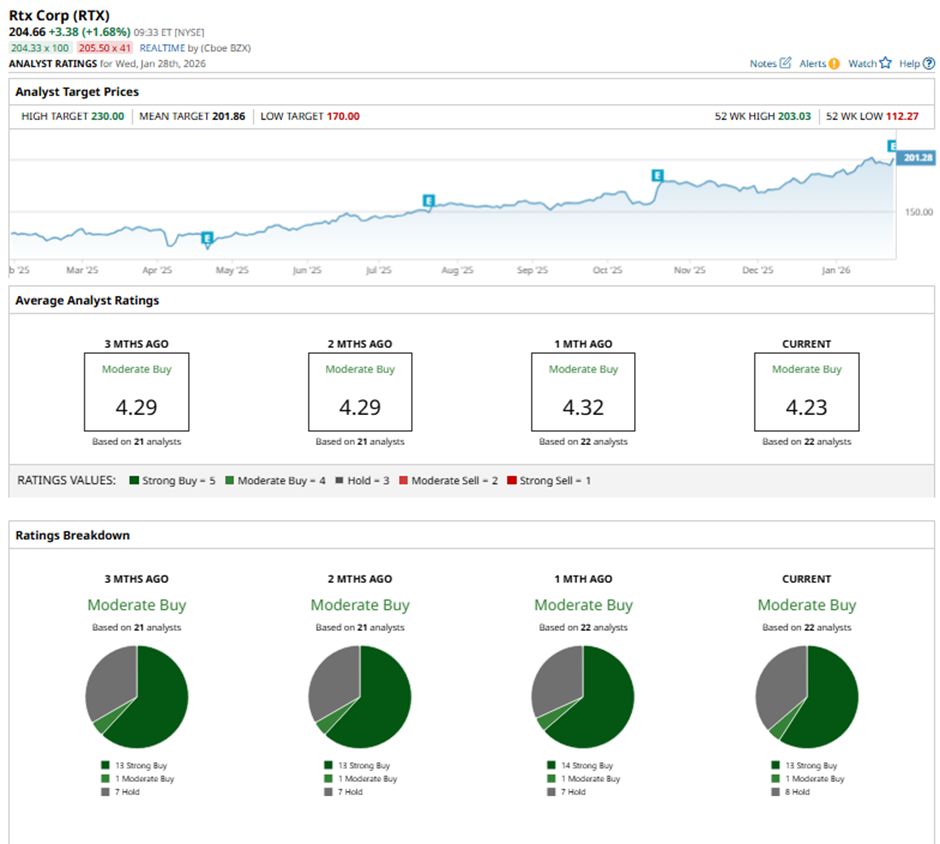

Among the 22 analysts covering the stock, the consensus rating is a “Moderate Buy.” That’s based on 13 “Strong Buy” ratings, one “Moderate Buy,” and eight “Holds.”

On Jan. 28, UBS analyst Gavin Parsons raised RTX’s price target to $208 while maintaining a “Neutral” rating.

As of writing, the stock is trading above the mean price target of $201.86. The Street-high price target of $230 suggests a 12.4% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart