Valued at $68.1 billion by market cap, Coinbase Global, Inc. (COIN) is a New York-based financial technology company. It operates one of the world’s largest cryptocurrency trading platforms. The company allows users to buy, sell, store, and stake digital assets such as Bitcoin and Ethereum. Coinbase serves both retail and institutional clients and focuses strongly on security and regulatory compliance.

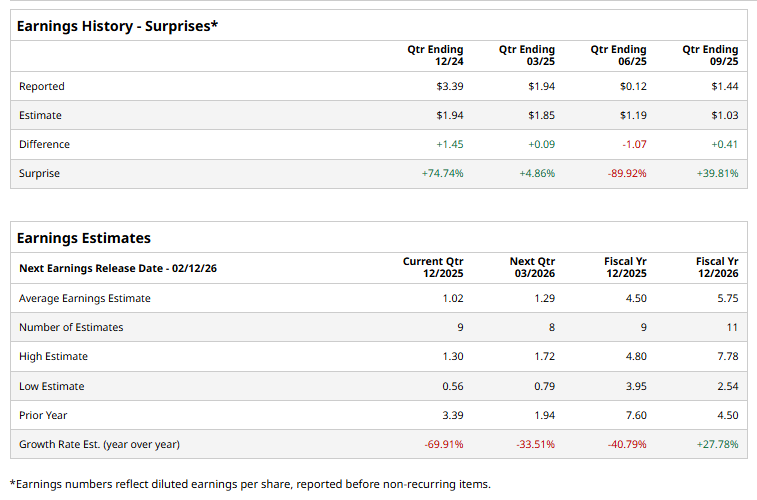

The crypto titan is expected to announce its fourth-quarter results soon. Ahead of this event, analysts expect COIN to deliver an adjusted profit of $1.02 per share, down a massive 69.9% from $3.39 per share reported in the year-ago quarter. While the company has missed the Street’s bottom-line estimates once over the past four quarters, it has surpassed the projections on three other occasions.

For fiscal 2025, its earnings are expected to stand at $4.50 per share, down 40.8% from $7.60 per share in 2024. However, its EPS is likely to rebound in FY2026, rising 27.8% year over year to $5.75.

COIN stock prices have soared marginally over the past 52 weeks, underperforming the Financial Select Sector SPDR Fund’s (XLF) 12.2% surge and the S&P 500 Index’s ($SPX) 18.6% gains during the same time frame.

On Jan. 5, shares of Coinbase Global climbed 7.7% after The Goldman Sachs Group, Inc. (GS) upgraded the stock from “Neutral” to “Buy” and raised its 12-month price target to around $303, citing the company’s shift toward more stable revenue streams such as custodial services, staking, and stablecoin rewards rather than reliance on trading fees. Analysts said this diversification could support more predictable growth and justify a premium valuation. The stock’s rise was also supported by broader strength in the digital-asset market, including a rebound in Bitcoin prices above $92,000.

The consensus view on COIN remains cautiously optimistic, with a “Moderate Buy” rating overall. Of the 34 analysts covering the stock, opinions include 20 “Strong Buys,” one “Moderate Buy,” 11 “Holds,” and two “Strong Sells.” Its mean price target of $359.18 implies an upswing potential of 40.4% from the current price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart