Charlotte, North Carolina-based Honeywell International Inc. (HON) engages in the aerospace technologies, industrial automation, building automation, and energy and sustainable solutions businesses. Valued at $131.7 billion by market cap, its business is aligned with three powerful megatrends - automation, the future of aviation and energy transition, underpinned by its Honeywell Accelerator operating system and Honeywell Forge IoT platform. The diversified industrial conglomerate is expected to announce its fiscal fourth-quarter earnings for 2025 before the market opens on Thursday, Jan. 29.

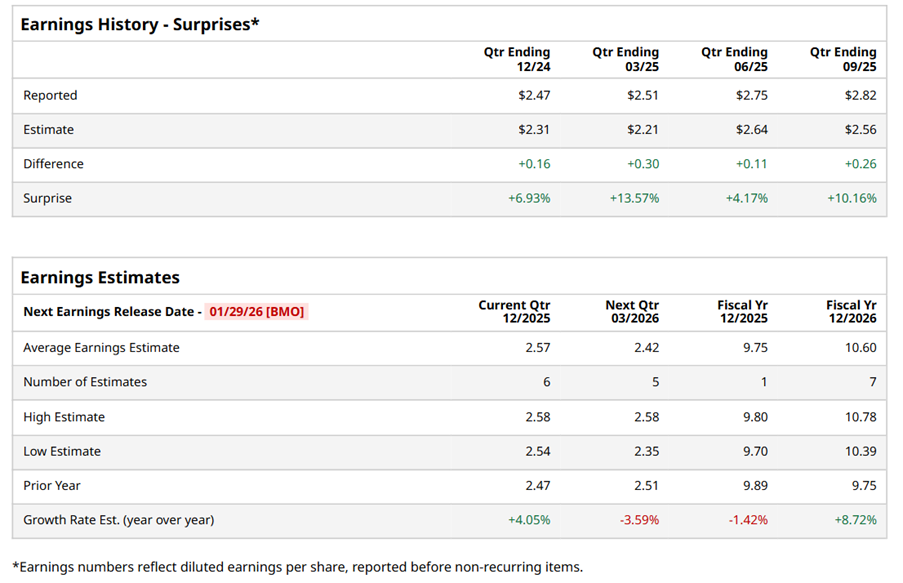

Ahead of the event, analysts expect HON to report a profit of $2.57 per share on a diluted basis, up 4.1% from $2.47 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect HON to report EPS of $9.75, down 1.4% from $9.89 in fiscal 2024. However, its EPS is expected to rise 8.7% year over year to $10.60 in fiscal 2026.

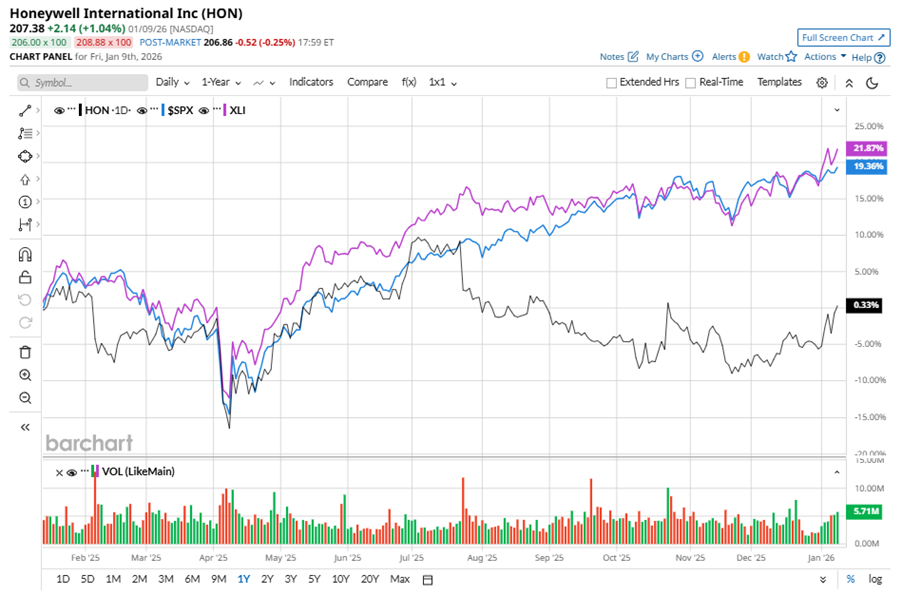

HON stock has underperformed the S&P 500 Index’s ($SPX) 17.7% gains over the past 52 weeks, with shares down marginally during this period. Similarly, it underperformed the Industrial Select Sector SPDR Fund’s (XLI) 21.9% gains over the same time frame.

HON's underperformance was driven by margin decline due to cost inflation, tariffs, and acquisition-related headwinds in Aerospace and Industrial Automation segment.

On Oct. 23, 2025, HON shares closed up by 6.8% after reporting its Q3 results. Its revenue was $10.4 billion, exceeding analyst estimates by 2.6%. The company’s adjusted EPS of $2.82 surpassed analyst estimates of $2.57.

Analysts’ consensus opinion on HON stock is moderately bullish, with a “Moderate Buy” rating overall. Out of 24 analysts covering the stock, 10 advise a “Strong Buy” rating, one suggests a “Moderate Buy,” 12 give a “Hold,” and one recommends a “Moderate Sell.” HON’s average analyst price target is $235.04, indicating a potential upside of 13.3% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart