The Hershey Company (HSY), headquartered in Hershey, Pennsylvania, manufactures and sells confectionery products and pantry items. Valued at $38.3 billion by market cap, the company's principal products include chocolate and sugar confectionery products, gum and mint refreshment products, and pantry items, such as baking ingredients, toppings, and beverages. The confectionery and snack giant is expected to announce its fiscal fourth-quarter earnings for 2025 before the market opens on Thursday, Feb. 5.

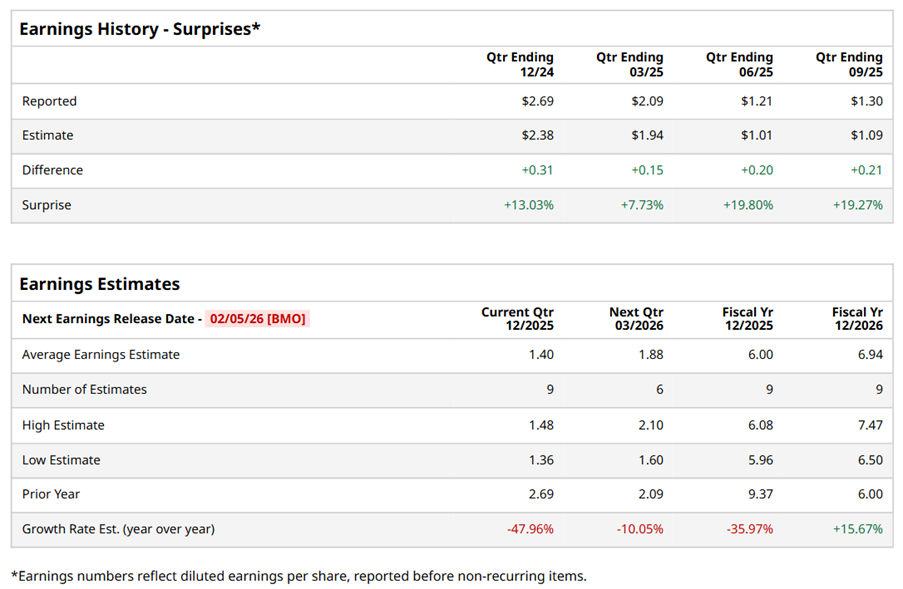

Ahead of the event, analysts expect HSY to report a profit of $1.40 per share on a diluted basis, down 48% from $2.69 per share in the year-ago quarter. The company has consistently surpassed Wall Street’s EPS estimates in its last four quarterly reports.

For the full year, analysts expect HSY to report EPS of $6, down 36% from $9.37 in fiscal 2024. However, its EPS is expected to rise 15.7% year-over-year to $6.94 in fiscal 2026.

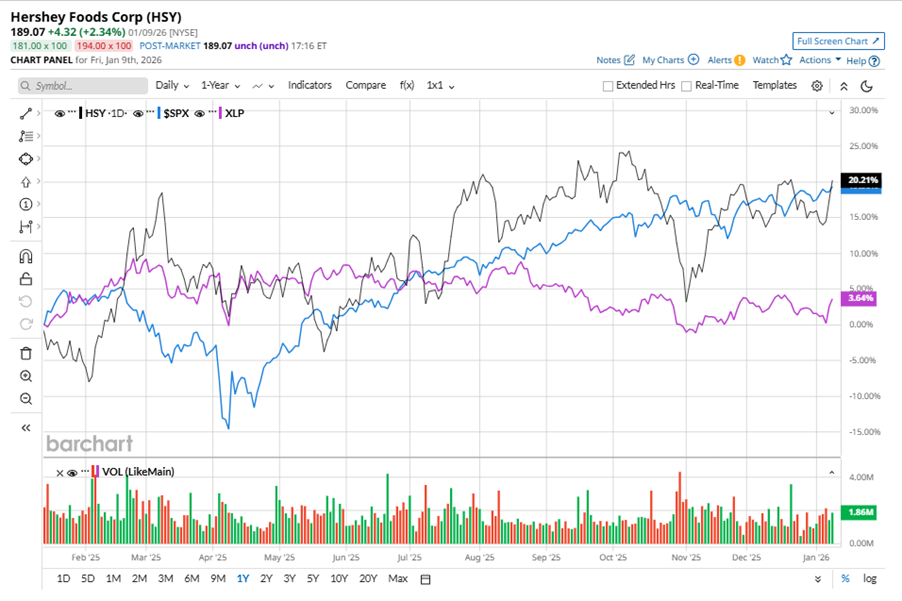

HSY stock has underperformed the S&P 500 Index’s ($SPX) 17.7% gains over the past 52 weeks, with shares up 16.6% during this period. However, it outperformed the Consumer Staples Select Sector SPDR Fund’s (XLP) 2.4% returns over the same time frame.

HSY's underperformance is due to challenges in its seasonal business, particularly Halloween, driven by timing, weather, and shifting consumer behavior, combined with margin compression from higher cocoa prices and increased brand investments. Despite innovation successes like REESE'S Oreo, the company expects moderate volume declines and is cautiously optimistic about cocoa cost inflation and tariff relief, focusing on rebuilding margins and driving growth.

On Oct. 30, 2025, HSY shares closed down more than 2% after reporting its Q3 results. Its adjusted EPS of $1.30 exceeded Wall Street expectations of $1.09. The company’s revenue was $3.2 billion, topping Wall Street forecasts of $3.1 billion. HSY expects full-year adjusted EPS in the range of $5.90 to $6.

Analysts’ consensus opinion on HSY stock is cautious, with a “Hold” rating overall. Out of 23 analysts covering the stock, four advise a “Strong Buy” rating, one suggests a “Moderate Buy,” 17 give a “Hold,” and one recommends a “Strong Sell.” HSY’s average analyst price target is $194.41, indicating a potential upside of 2.8% from the current levels.

On the date of publication, Neha Panjwani did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart