As the year comes to a close, mortgage rates remain high. Although the situation is improving, rates remain high enough to keep the housing market jittery. The Federal Open Market Committee (FOMC) of the U.S. Federal Reserve has cut interest rates three times this year, which should impact the housing market. However, mortgage rates don’t necessarily follow interest rates.

As of Dec. 24, the average 30-year fixed-rate mortgage rate had dropped by three basis points to 6.2%, lower than a year earlier. However, the rate remains stable and may not fall significantly next year or below the 6% mark anytime soon, as the housing market is in a crunch.

Amid this situation, commercial and residential mortgage finance services provider Rocket Companies (RKT) has outperformed its peers this year. The company’s stock has gained 72.42% this year, while the State Street Financial Select Sector SPDR ETF (XLF) has gained 14.47% over the same period.

Strategic moves such as the acquisitions of Redfin and Mr. Cooper Group have created a vertically integrated platform, which has bolstered its operations. Therefore, we take a deeper look into Rocket Companies now.

About Rocket Companies Stock

Headquartered in Detroit, Michigan, Rocket Companies is a premier fintech holding company transforming the homebuying and financial services experience. It operates through powerhouse brands, including Rocket Mortgage, one of the top U.S. retail mortgage lenders. Other brands include Rocket Homes for real estate matchmaking; Rocket Loans for personal and business financing; and Rocket Money for budgeting and credit tools.

By leveraging cutting-edge technology and data analytics, Rocket streamlines the entire home purchase process, from digital mortgage applications to seamless closings and post-purchase support. Their platform empowers customers with transparent, efficient solutions that foster financial wellness and accessibility in an often-complex industry. The company has a market capitalization of $40.85 billion.

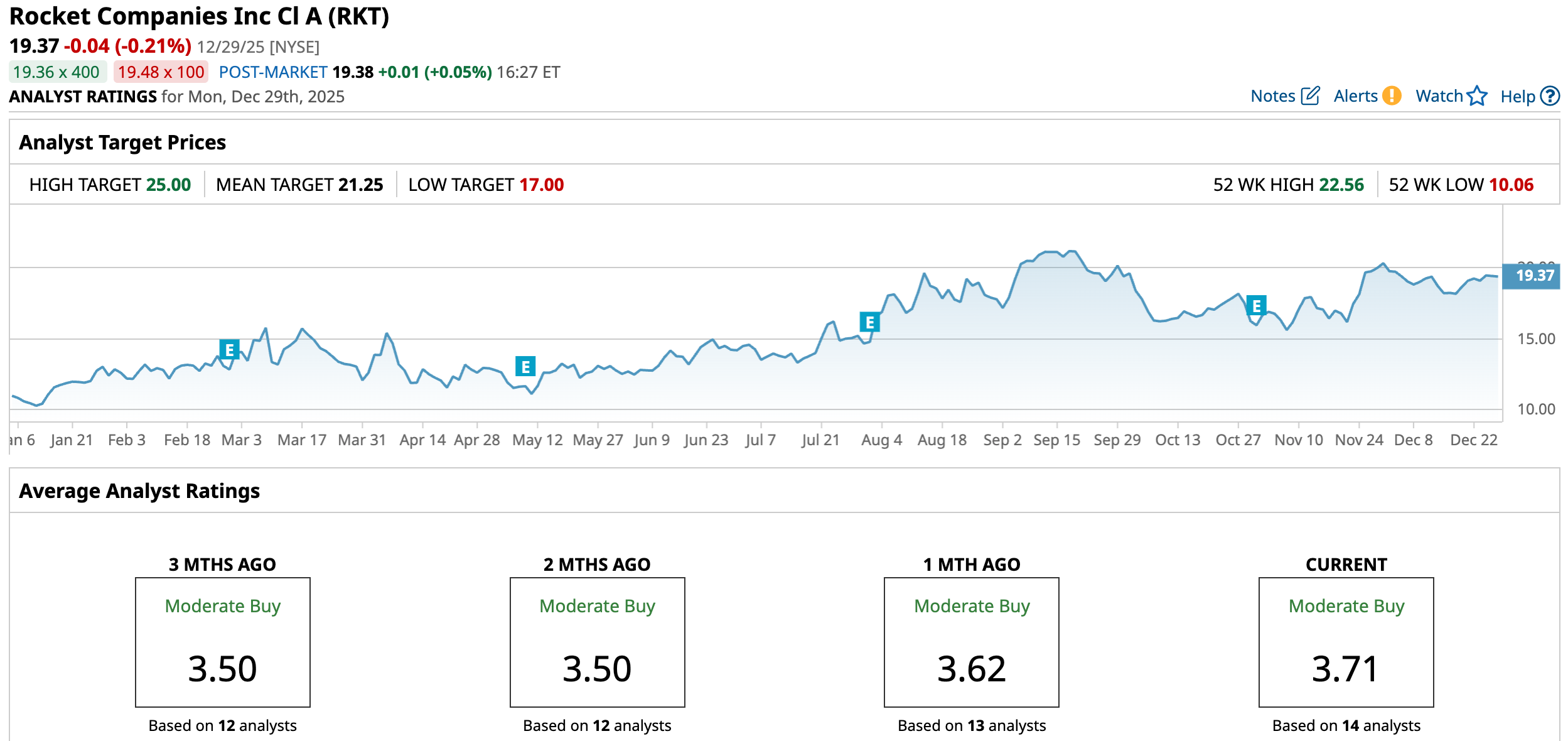

Based on strong sentiment, the stock has gained 74.91% over the past 52 weeks and 36.53% over the past six months. It had reached a 52-week high of $22.56 in September, but is down 16.47% from that level.

However, the stock is trading at a stretched valuation. Its price-to-earnings non-GAAP (TTM) ratio of 102.16x is considerably higher than the industry average of 12.01x.

Rocket Companies’ Reported Solid Growth In Its Q3 Results

On Oct. 30, Rocket reported its third-quarter results for fiscal 2025, showcasing solid growth. The company’s revenue increased 148.1% year-over-year (YOY) to $1.61 billion. Adjusted for change in fair value of MSRs due to valuation assumptions (net of hedges), its top line grew 34.8% from the prior year’s period to $1.78 billion.

Rocket generated $32.41 billion in mortgage closed loan origination volume, up 13.7% YOY. In addition, its gain on sale margin increased from 2.78% in Q3 2024 to 2.80% in Q3 2025.

As of Sept. 30, the unpaid principal balance of the servicing portfolio, including acquired and subserviced loans, stood at $613 billion, covering 2.9 million serviced loans. This portfolio produces about $1.70 billion in recurring servicing fee income annually.

Also, the company highlighted the artificial intelligence (AI) agents that it had launched during the quarter – the Pipeline Manager Agent, a tool that allows loan officers to identify and prioritize the right leads; the Purchase Agreement AI Agent, automating the review of purchase agreements; and the Rocket Pro Underwriting AI Agent, enabling mortgage broker partners to reach decisions faster.

By the end of Q3, Rocket Companies had $5.84 billion in cash and cash equivalents, exhibiting a solid liquidity position. The company’s adjusted EPS for the quarter was $0.07, which is lower than the $0.08 it had recorded a year earlier. But this was also higher than the $0.04 that Wall Street analysts had expected.

Wall Street analysts have a mixed view about RKT’s bottom-line trajectory. For the current fiscal year, its EPS is expected to drop by 38.9% YOY to $0.11. On the other hand, for fiscal 2026, the company’s EPS is projected to increase by 554.6% annually to $0.72.

What Do Analysts Think About Rocket Companies’ Stock?

Rocket Companies has received positive attention from Wall Street analysts lately. This month, analysts at Jefferies initiated coverage of the stock with a bullish “Buy” rating and a $25 price target. Jefferies analysts believe the company’s shares do not yet reflect its earnings power and strategic positioning following its acquisitions.

In the same month, analysts at Keefe Bruyette raised the price target on RKT’s stock from $18 to $20, while keeping a “Market Perform” rating. Keefe, Bruyette analysts are optimistic about the prospects of mortgage insurers, expecting double-digit growth in book value, making this market space lucrative.

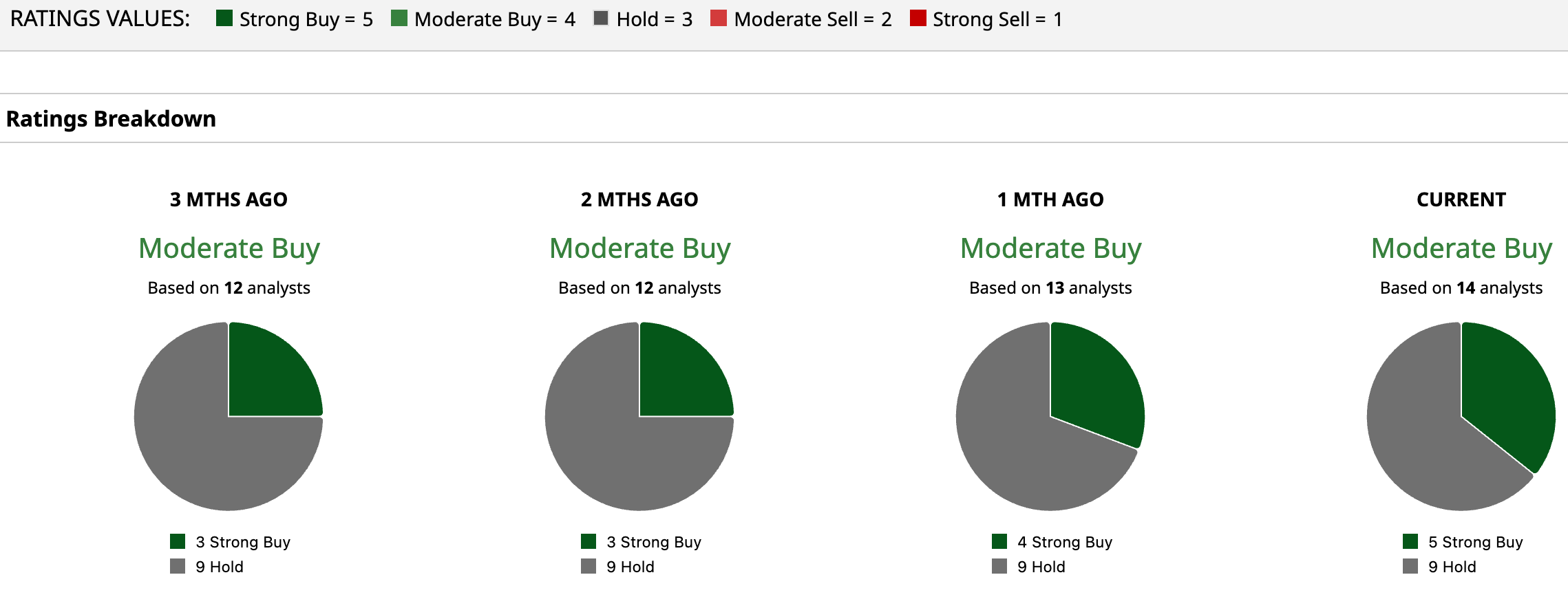

Wall Street analysts favor Rocket Companies’ stock, assigning it a consensus “Moderate Buy” rating. Of the 14 analysts rating the stock, five have given it a “Strong Buy,” and nine a “Hold.” The consensus price target of $21.25 represents 9.7% upside from current levels. The Street-high Jefferies-given price target of $25 indicates a 29% upside.

On the date of publication, Anushka Dutta did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- The Next Two Years Will Belong To Breakups: Investors Who Miss It Will Miss the Cycle

- As Mortgage Rates Remain High, This 1 Stock Has Been a Big Winner in 2025

- Robinhood Stock Was Red Hot in 2025. Should You Keep Buying Shares in 2026?

- Activist Investor Toms Capital Is Buying Up Target Stock. Should You?