Valued at a market cap of $48.5 billion, Copart, Inc. (CPRT) is a leading global provider of online vehicle auctions and remarketing services, specializing in used, salvage, and total-loss vehicles sourced from insurers, rental fleets, dealerships, and individuals. Headquartered in Dallas, Texas, the company operates hundreds of auction and processing sites worldwide, combining physical infrastructure with its proprietary online bidding platform to connect sellers and buyers efficiently.

Companies worth $10 billion or more are generally described as “large-cap stocks”, and Copart fits this criterion perfectly. Copart generates revenue primarily through auction-related fees, along with services like logistics, storage, and title processing. Its integrated digital and physical network gives it a strong competitive edge, making it a dominant player in the global vehicle salvage and remarketing market.

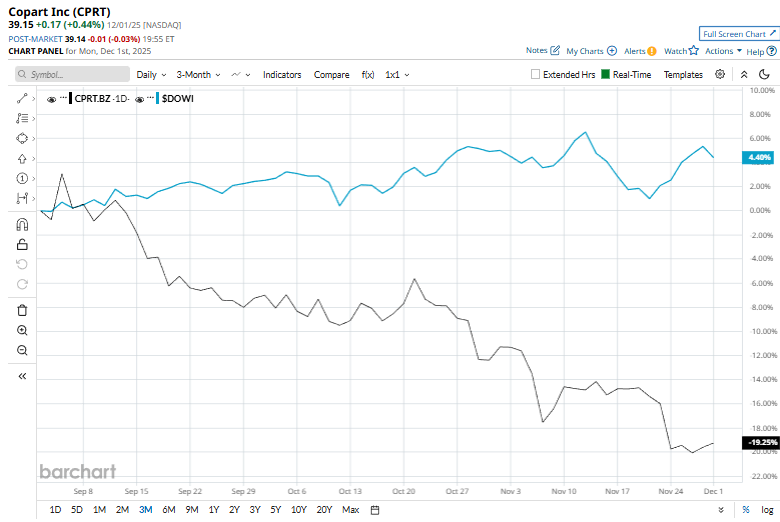

However, it’s not all sunshine and rainbows for the stock. Copart stock has dropped 38.7% from its 52-week high of $63.85. Shares of CPRT have dipped 6.7% in the past three months, lagging behind the Dow Jones Industrial Average’s ($DOWI) 3.8% rise over the same time frame.

In the longer term, CPRT stock has declined 12.7% YTD, whereas $DOWI has risen 11.2%. Moreover, shares of Copart have fallen 6.3% over the past 52 weeks, underperforming the SPX's 5.3% rise over the same time frame.

Since late May, the stock has traded consistently below both its 50-day and 200-day moving averages, reinforcing a downtrend.

On Nov. 20, Copart delivered resilient first-quarter earnings, posting revenue of approximately $1.16 billion, up marginally year over year. Gross profit rose 4.9% to around $537 million, while net income increased roughly 11.5% to $403.7 million, driving diluted EPS to $0.41, above last year’s $0.37. The company benefited from higher average selling prices, strong auction liquidity, and operational efficiencies, which helped offset pressure on sales volume, particularly from its global insurance-unit business. CPRT shares dropped marginally following the earnings release.

Moreover, when compared, rival Cintas Corporation (CTAS) has trailed CPRT stock. Shares of CTAS have dwindled 17.9% over the past 52 weeks and soared 1.5% on a YTD basis.

Although Copart has underperformed compared to the broader market over the past year, analysts are moderately optimistic about its prospects. The stock has a consensus rating of “Moderate Buy” from the 11 analysts covering it, and the mean price target of $51.67 implies an upswing potential of 32% from the prevailing price levels.

On the date of publication, Kritika Sarmah did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This Options Strategy Turns Your Stock Portfolio Into a Consistent Income Generator

- This ‘Strong Buy’ Dividend Stock Looks Set to Raise Payouts. Should You Buy Shares Now?

- JPMorgan Just Upgraded CleanSpark Stock. Should You Buy Shares Here?

- Dear Walmart Stock Fans, Mark Your Calendars for December 9