I’ll admit to being slow to understand what this “420” thing was about. Slow as it started in the 1970s in California. Because that’s what time each day a group of teenagers allegedly met to smoke pot.

Decades later, with marijuana legal in 24 states for recreational use, and in 40 more for medicinal purposes, the “420” crowd has come a long way. None other than Tesla (TSLA) CEO Elon Musk has repeatedly invoked 420 in social posts. Most notably back in 2018, when his message was simply “Am considering taking Tesla private at $420. Funding secured.”

That is still referred to by some as the “funding secured” tweet. These days, he’s making more news regarding his big pay package, which the Tesla board was about to announce its decision on as I wrote this on Thursday afternoon. With TSLA trading at around $450 a share.

So, 420 means different things to different people. To anyone who cares about the level and direction of the 10-year U.S. Treasury rate, 420 is quite timely. And if you don’t yet care about the 10-year UST, this is a great time to start.

How Does the Fed Impact Bond Prices?

Investors often mistake what the Federal Reserve does as impacting interest rates on mortgages and corporate borrowing. Indirectly, that is the case. But the Fed sets rates on overnight borrowing, which is more of a bank thing. The “benchmark” 10-year Treasury rate is more under the control of whatever the bond market does with it. So while we can point fingers at the Fed when rates are too high for our liking, the culprit is usually the bond market.

And that means the 10-year rate is much more important than most indicators, even for stock traders.

Bonds are potential competition for big money that can run after stocks and pump up their prices. But whenever money drains out of stocks, it often finds its way to bonds. Not to mention, with the U.S. running debt at sky-high levels, there’s a looming threat that frustrated non-U.S. investors, major holders of U.S. long-term bonds, will sell down their 10-year bond holdings in a meaningful way, causing higher yields for us in the states.

So yes, the 10-year rate is very important. Especially if you want to avoid a situation where you are wondering why your stock portfolio is getting crushed. Often it is as simple as what’s happening to the 10-year U.S. T-bond.

Why 420 Is Important to Investors Right Now

This chart of the 10-year Treasury rate shows that this critical indicator has been moving around a lot, but netting out to nothing. It currently sits around 4.00%, right where it was back in March 2023, and several times since then.

This has opened up all types of opportunities for those with just a bit of interest (pun intended) in bond investing. But even if bonds are not your thing, if rates break out strongly from here, it could be a dagger in the artificial intelligence bull market. So it bears watching (pun not intended).

So, what would signify a breakout level to watch closely? To me, it’s… you guessed it… 4.20%. 420!

If we zoom in on that same chart from above, we can see that 4.20% was the last “baby top” in the 10-year bond rate. And if it were to get a head of steam, 4.60%-4.80% would be “in play” later this year, or more likely into early next year.

How to Make Money from Changes in the 10-Year

Remember that for a very long time, longer than many investors have been adults, bond investing was pretty useless and boring. Rates were near zero. That’s not the case any more. And, that giant debt bubble creates much more volatility around rates, and thus bonds.

There are many ways to approach this, either to try to profit from a rise in the 10-year or a decline in it. Remember that bond prices move opposite of rates, so falling rates help ETFs that hold bonds. And rising rates help ETFs that short bonds.

Avoiding the leveraged ETFs, here are a pair that come closest to being proxies for long and short the 10-year U.S. Treasury. The long side is simpler, since there’s actually an ETF that buys that bond maturity.

Learn Bonds

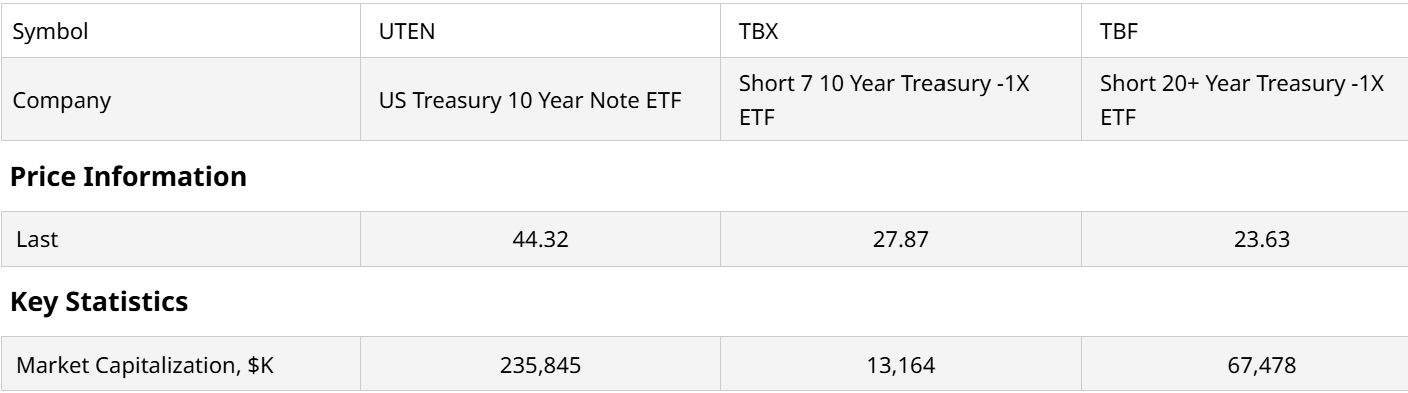

That’s the $235 million US Treasury 10 Year Note ETF (UTEN) which debuted just over three years ago. To try to profit from rising rates, there are a pair. Pro Shares Short 7-10 Year Treasury -1X ETF (TBX) is the better fit in terms of maturity years and volatility. However it is a very small ETF, versus the Pro Shares Short 20+ Year Treasury -1X ETF (TBF), which itself is not very large. Still, these have been around a long time, so they are tested. Just not popular.

The most important thing investors and traders can do is keep learning. That’s essentially the same thing as being aware, with your “head on a swivel” as they say. Part of that is taking a look at the bond market, and that all starts with the 10-year U.S. Treasury rate.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ServiceNow Just Announced a 5-for-1 Stock Split. So, Is Now the Time to Buy NOW Stock?

- Palantir Is Getting a Bigger Seat at the Defense Table. Does That Make PLTR Stock a Buy Here?

- Analysts Say ‘We Would Be Aggressive Buyers on Any Pullbacks’ in Microsoft Stock. Should You Be Too?

- A $5.5 Billion Reason to Buy Cipher Mining Stock Here