Michael Burry is a Wall Street investor who gained fame after accurately predicting the 2008 housing crisis. In Q3 2025, Burry made a surprising move into the healthcare sector, acquiring a new position at Molina Healthcare (MOH). Burry purchased 125,000 shares of Molina Healthcare, which is down over 60% from all-time highs.

Valued at a market capitalization of $7.8 billion, Molina Healthcare provides managed healthcare services to low-income families and individuals under the Medicaid and Medicare programs, as well as through state insurance marketplaces.

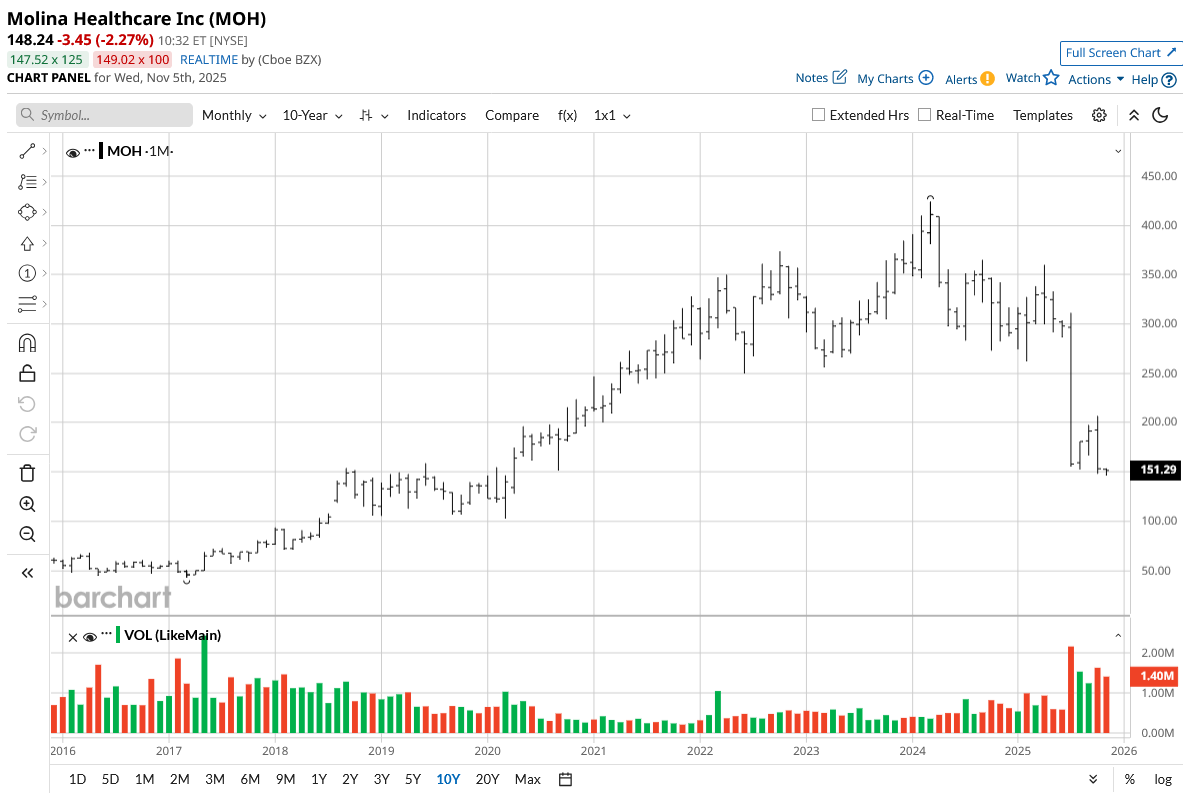

Molina recently slashed its 2025 earnings outlook as rising medical costs negatively impacted the marketplace business. Despite the ongoing pullback, the healthcare stock has returned more than 200% to shareholders over the past decade. Let’s see if you should follow Michael Burry and buy this under-the-radar healthcare stock right now.

How Did Molina Healthcare Perform in Q3 of 2025?

Molina Healthcare reported Q3 earnings that fell short of Wall Street expectations, as it continues to wrestle with persistent medical cost inflation across its business lines. The company reported adjusted earnings of $1.84 per share on premium revenue of $10.8 billion, which fell short of analyst forecasts.

The disappointing results indicate headwinds from rising healthcare utilization that continues to outpace state reimbursement rates. Molina slashed its full-year earnings guidance to $14 per share, down from $19 per share. At the start of 2025, Molina forecast earnings at $24.50 per share.

Molina pointed to an unprecedented spike in medical costs, with its consolidated medical care ratio hitting 92.6% in the quarter.

Roughly half of the earnings miss is attributed to the struggling Marketplace business, which accounts for just 10% of total revenue. The public exchange segment saw its medical care ratio surge to 95.6% as members used more healthcare services than anticipated. Management now expects Marketplace to post a $2-per-share loss for the year, a significant swing from the initial projection of over $3 per share in profits.

The core Medicaid business, which accounts for 75% of premium revenue, continues to perform relatively well despite headwinds. Medical cost trends in Medicaid reached 7% for the year, outpacing the 5.5% rate increases negotiated with states.

CEO Joe Zubretsky emphasized that rising costs in behavioral health, pharmacy, long-term care services, and inpatient care drove the surge in utilization. The company maintains that its Medicaid segment will still generate a 3.2% pretax margin and contribute roughly $0.16 per share to earnings.

Looking ahead to 2026, Molina expects premium revenue to reach approximately $46 billion, driven by new contract wins in Georgia and Texas. However, Molina plans to dramatically reduce its Marketplace footprint with rate increases averaging 30% and a 20% reduction in county coverage. Management believes early indications suggest state Medicaid rates will modestly exceed medical cost trends next year, providing a foundation for margin recovery.

Is MOH Stock Undervalued Right Now?

While analysts forecast sales to rise by 10% year-over-year (YoY) to $44.8 billion in 2025, adjusted earnings are forecast to decline by 34% to $15 per share. However, according to consensus estimates, earnings per share are expected to grow to $30.73 per share in 2029, indicating an annual growth rate of nearly 20%. Further, its free cash flow is forecast to increase from $477 million in 2025 to $1.87 billion in 2029.

MOH stock is priced at 12 times forward earnings, which is below its five-year average of 15.3 times. Even if it trades at 10x earnings, the healthcare stock could more than double within the next four years.

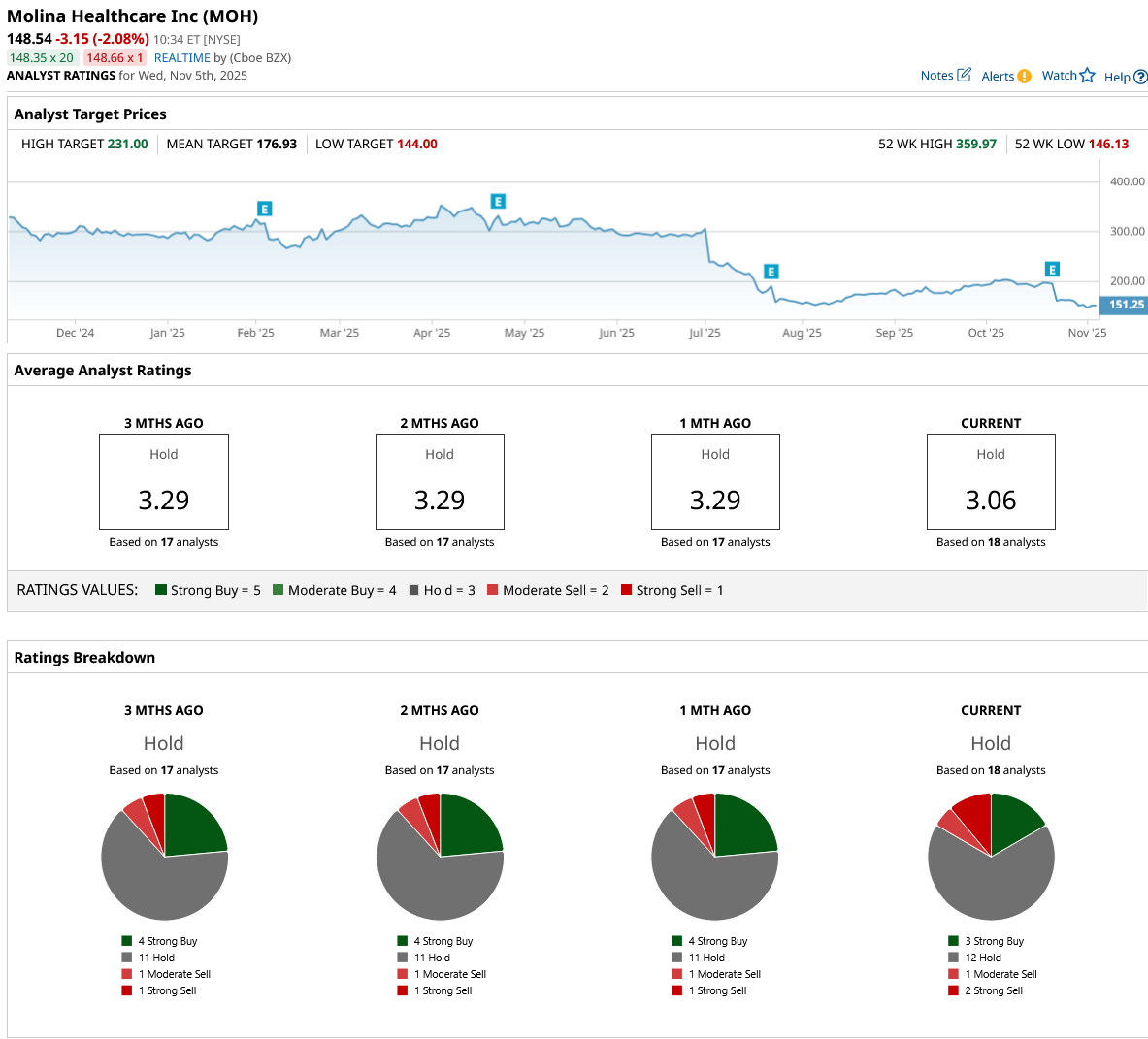

Out of the 18 analysts covering MOH stock, three recommend “Strong Buy,” 12 recommend “Hold,” one recommends “Moderate Sell,” and two recommend “Strong Sell.” The average Molina stock price target is $176.93, above the current price of $148.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.