The countdown is ticking for UnitedHealth Group (UNH) stock fans, as Jan. 30, 2026 could mark one of the most crucial dates in recent healthcare history. With President Donald Trump making it a top priority to have a new “Obamacare” alternative by the end of January, major U.S. insurers are entering a period of intense policy scrutiny and industry risk. Trump has repeatedly called out these companies in recent weeks, criticizing insurers as large, powerful businesses focused more on their own profits than on consumer well-being.

Healthcare giants such as UNH now face significant uncertainty as the administration pursues major policy changes. At the same time, the company is removing broker commissions on select Medicare Advantage plans. This is a step to regain margin control as it also manages the fallout from a Department of Justice (DOJ) probe into its Medicare billing practices. Every action connects to the growing pressures around reimbursement, compliance, and the broader drive for industry reform.

The scale of this challenge cannot be overstated. With much at stake, how should investors position themselves as the Jan. 30 deadline looms and policy uncertainty intensifies?

UnitedHealth Group’s Current Standing

UnitedHealth Group provides managed healthcare services and integrated benefits to over 50 million individuals across the U.S. and globally, with a market capitalization of approximately $289 billion. The company is set to pay an annual dividend of $8.84 per share, translating to a forward yield of 2.7%.

Year-to-date (YTD), shares are down 35.8%, and the 52-week performance is -46.4%.

Its forward price-earnings sits at 19.65x, just below the sector’s median of 19.35x. Meanwhile, its P/E to growth is 2.09x against a median of 1.81x. This places UnitedHealth as fundamentally more affordable than most peers on a sales basis, while in line with the industry on profit multiples.

Its third-quarter earnings report from Oct. 28, signals clear execution of its strategy. It records $113.2 billion in consolidated revenue, a 12% annual climb, driven by strong results in both health insurance and pharmacy services. The company posts $4.3 billion in operating earnings, translating to a margin of 2.1% that reflects ongoing cost pressures from elevated patient care and regulatory changes.

The consolidated adjusted EPS stands at $2.92 for the quarter, beating analyst expectations and marking a 6.18% earnings surprise. This medical care ratio lands at 89.9%, showing alignment with forecasts as care costs remain up. UnitedHealthcare revenue surged 16% to $87.1 billion, spurred by Medicare, retirement plans, and a membership gain of 795,000 for the year. Optum revenue advanced 8%, coming in at $69.2 billion, where growth in Optum Rx underpins segment momentum.

UnitedHealth Group’s Big Bets

The firm continues to attract some of the smartest capital in the market. Oracle of Omaha Warren Buffett and his Berkshire Hathaway (BRK.A) (BRK.B) conglomerate have accumulated about 5 million shares of UnitedHealth. That’s a stake valued at nearly $1.6 billion. This is not a speculative play as institutional and retail investors alike tend to take notice.

Buffett’s purchase is a statement about UnitedHealth’s resilience during tough times. He’s looking at America’s largest health insurer and seeing value through layers of market pressure. It’s a vote of confidence in both the firm’s cash generation and long-term capacity to adapt in an industry that’s anything but predictable these days.

Analysts’ View on UnitedHealth

Estimates are rolling in ahead of UnitedHealth Group’s next earnings release. For the current quarter ending in December, the average earnings estimate is $2.07, down from $6.81 last year, representing a year-over-year (YOY) change of -69.60%. In the following quarter, March 2026, the consensus estimate is $6.31. That compares with $7.20 a year earlier, resulting in a -12.36% YOY change.

This guidance comes hand in hand with UnitedHealth’s recently raised outlook for 2025. Management has put the floor at $14.90 per share for full-year earnings, and at least $16.25 for adjusted EPS. This speaks to a level of internal confidence in their resilience, even as political and reimbursement risks loom larger than ever.

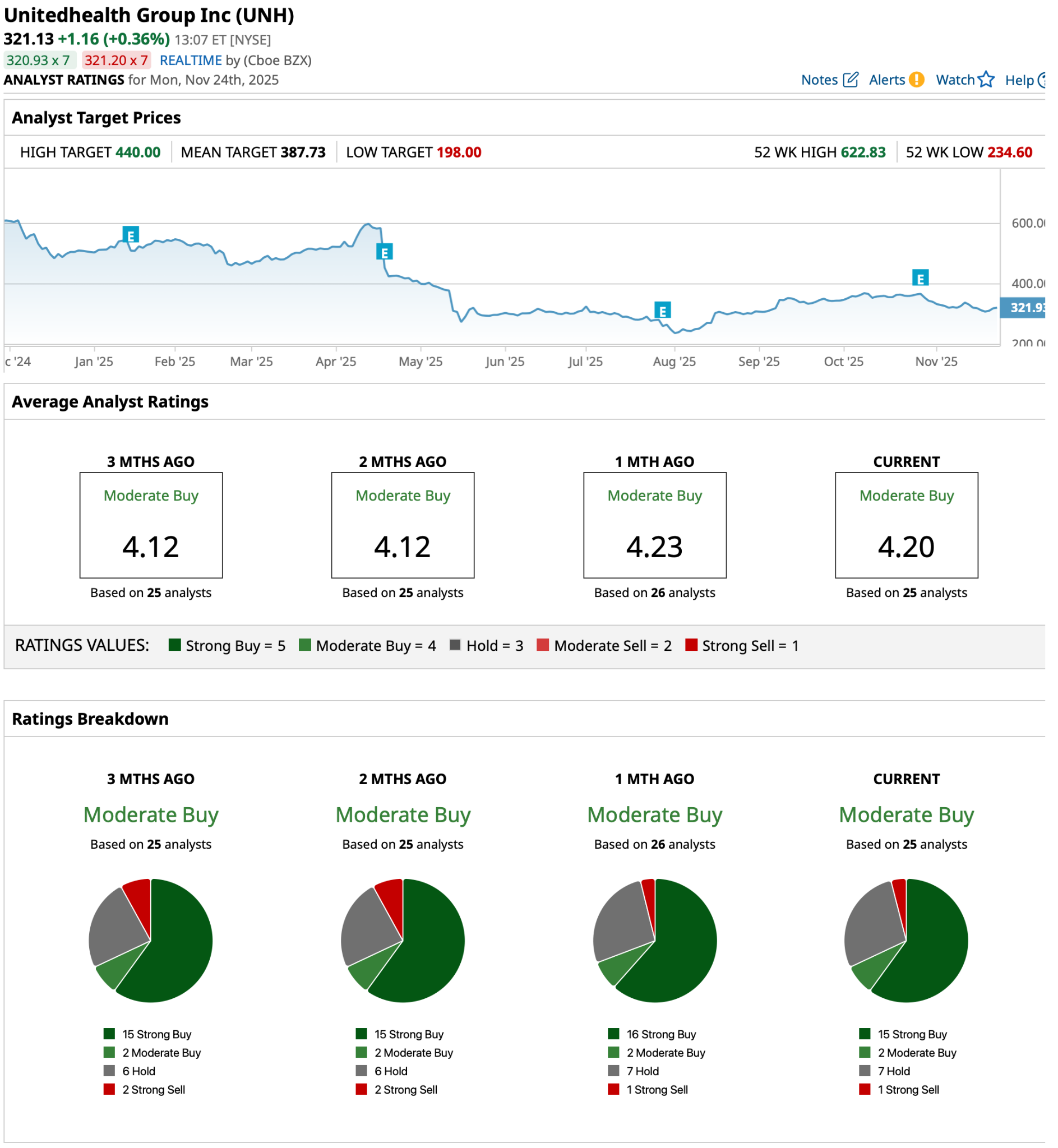

Meanwhile, optimism among Wall Street analysts is holding firm. UNH receives a consensus rating of “Moderate Buy” from 25 Wall Street analysts covering the stock. The average price target is $388.64, translating to a sizable upside of about 18.8% from the current price.

Conclusion

UnitedHealth Group has the scale, cash flow, and leadership to weather policy drama and surprises. With analysts eyeing upside and the company signaling growth, shares are most likely headed higher into 2026 if major new setbacks are avoided. Recent price action has been tough, but value buyers and Wall Street pros see opportunity. This story is not finished yet, as January could be the catalyst that bulls await.

On the date of publication, Ebube Jones did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- ‘Insatiable’ Demand Is Powering This ‘Picks and Shovels’ AI Stock up 245%. Should You Buy It Here?

- Using Probability Density to Extract a Huge Payout from Microchip’s Potential Breakout

- Dear UnitedHealth Stock Fans, Mark Your Calendars for January 30

- As Founder Ray Dalio Warns the Market Is in a Bubble, Bridgewater Associates Just Bought CoreWeave Stock