With roots stretching back to 1833, the Irving, Texas-based McKesson Corporation (MCK) stands among America’s oldest continuously operating businesses. Holding a market capitalization of nearly $105.6 billion, the company distributes pharmaceuticals, delivers medical supplies, and provides technology solutions.

McKesson’s expanding reach is evident in its market performance. Over the past 52 weeks, MCK stock has advanced 39.8% and climbed 51% year-to-date (YTD), delivering returns that far exceed the S&P 500 Index’s ($SPX) gains of 12.3% and 12.5% over the same periods, respectively.

Its leadership extends across the healthcare landscape as well, with the stock outpacing the S&P 500 Healthcare Sector SPDR’s (XLV) 7.5% surge over the past 52 weeks and 10.9% YTD rise.

On Nov. 6, McKesson’s shares advanced nearly 1.7%, adding $14.35 during the intra-day session. The uptick came on the heels of its second-quarter results for fiscal year 2026, reported on Nov. 5, after the market close. Revenue rose 10.1% year over year (YoY) to $103.2 billion, right in line with analyst expectations. Stronger prescription volumes and wider distribution of oncology and multispecialty products played a defining role in the growth.

EPS increased 377% annually to $8.92, outperforming expectations as it moved past charges tied to earlier divestitures and restructuring efforts. Reflecting the momentum, McKesson’s management has raised its adjusted EPS outlook to $38.35 to $38.85 range for fiscal year 2026.

Analysts are confident, forecasting 17% EPS growth to $38.66 on a diluted basis for the fiscal year that ends in March 2026. The company has also exceeded analyst expectations for three consecutive quarters, reinforcing a steady outlook, falling short on projections on just one occasion.

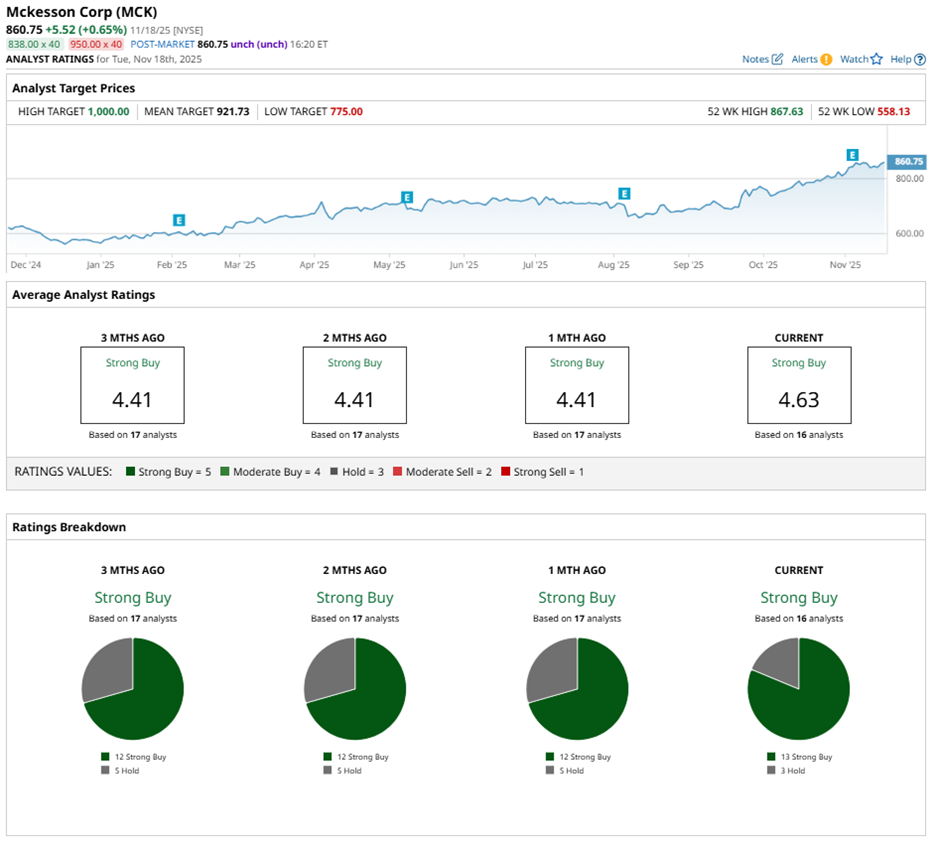

Among the 16 analysts covering MCK, the consensus rating stands at “Strong Buy.” That’s based on 13 “Strong Buy” calls and three “Hold” recommendations.

The setup is slightly more bullish than a month ago, when MCK stock held 12 “Strong Buy” ratings.

Following its Q2 results, Baird analyst Eric Coldwell raised MCK’s price target on Nov. 6 to $927 from $873, reinforcing its “Outperform” stance and signaling confidence in the company’s momentum.

MCK’s average price target of $921.73 represents potential upside of 7.1%. Meanwhile, the Street-high target of $1000 from TD Cowen analyst Charles Rhyee suggests room for potential upside of 16.2%. The firm maintains a “Buy” rating, reinforcing that MCK’s long-term fundamentals remain solid.

On the date of publication, Sristi Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- This High-Yield Dividend Stock Can Keep Your Portfolio Safe in a Storm

- Should You Buy the Dip in Cloudflare Stock or Stay Far Away After Widespread Internet Outages?

- AI Spending Is ‘NOT’ Slowing Down, According to Wedbush. That Makes Nvidia Stock a Buy Before November 19.

- This Consumer Stock is Already in a Bear Market. Smart Money Sees 20% More Downside Ahead.