With a market cap of $34.2 billion, Kimberly-Clark Corporation (KMB) is a global leader in the manufacture and marketing of personal care and tissue products. The company operates through distinct business segments serving both consumer and professional markets, offering well-known brands such as Huggies, Kotex, Kleenex, Scott, and Depend.

Shares of the Dallas, Texas-based company have underperformed the broader market over the past 52 weeks. KMB stock has decreased 22.7% over this time frame, while the broader S&P 500 Index ($SPX) has gained 14.1%. Moreover, shares of the company are down 21.4% on a YTD basis, compared to SPX’s 16.4% rise.

Narrowing the focus, shares of the consumer products maker have lagged behind the Consumer Staples Select Sector SPDR Fund’s (XLP) 3.9% dip over the past 52 weeks.

Shares of Kimberly-Clark rose nearly 3% on Oct. 30 after the company reported better-than-expected Q3 2025 net sales of $4.15 billion and adjusted EPS of $1.82. Investor sentiment improved as overall volumes grew 2.4% and organic sales rose 2.7% in North America, showing resilient demand for household staples despite pricing pressures. The stock also benefited from confidence in Kimberly-Clark’s cost-control and product-mix strategies, which helped offset tariff-related margin declines.

For the fiscal year ending in December 2025, analysts expect KMB’s adjusted EPS to decline 15.5% year-over-year to $6.17. However, the company’s earnings surprise history is promising. It beat or met the consensus estimates in the last four quarters.

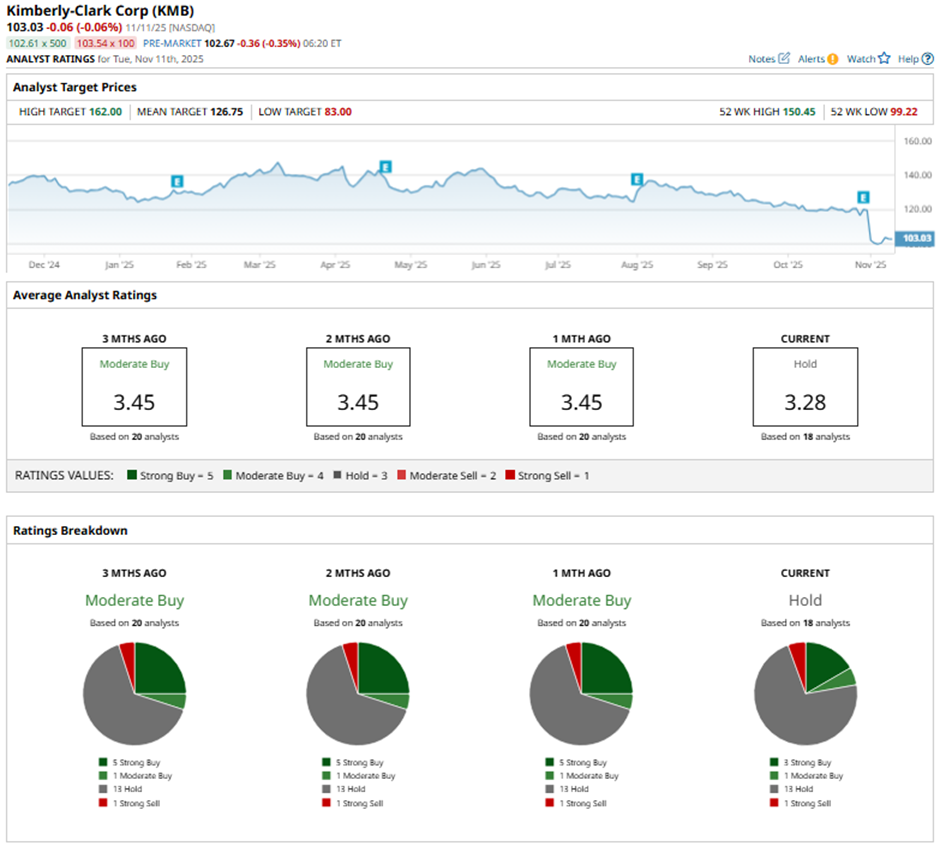

Among the 18 analysts covering the stock, the consensus rating is a “Hold.” That’s based on three “Strong Buy” ratings, one “Moderate Buy,” 13 “Holds,” and one “Strong Sell.”

This configuration is less bullish than three months ago, with five “Strong Buy” ratings on the stock.

On Nov. 4, Morgan Stanley cut its price target on Kimberly-Clark to $125, maintaining an “Equal Weight” rating.

The mean price target of $126.75 represents a 23% premium to KMB’s current price levels. The Street-high price target of $162 suggests a 57.2% potential upside.

On the date of publication, Sohini Mondal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

More news from Barchart

- I’m Preparing for a ‘Bang’ When the Nasdaq Crashes. Here’s How I’m Trading the QQQ ETF First.

- Bullish Tilt: Palantir Option Strategy Geared for Upside Gains

- S&P Futures Climb as U.S. Government Shutdown Nears End, Fed Speak on Tap

- This Buy-Rated Stock Just Raised Its Dividend 14%. Should You Buy Shares Here?