There's much to be said about being in the right markets at the right time. Graphite One (TSXV: GPH | OTC: GPHOF) checks that box. But there's something far more valuable to GPHOF's value proposition- the US Governments USGS has confirmed that GPHOF is sitting atop more than the largest graphite deposit in the country; it's believed to be the largest in the world. That news has done what's expected, created a bull run for GPHOF stock, now higher by over 31% year-to-date to $1.04 ahead of a holiday-shortened trading week.

Interestingly, despite being better positioned today than ever to capitalize on that inherent potential, share prices are off their 52-week high by over 58%. That's not necessarily bad news, however. With updates confirming deposits and GPHOF nearing its ability to monetize them, reclaiming that level is indeed a near-term target. The report on Tuesday supports that proposition.

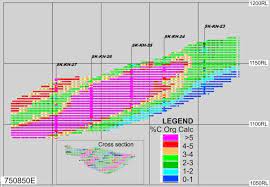

Again demonstrating the potential inherent to its Graphite Creek project, GPHOF updated resource estimates following its 2022 drill program analysis. In a published video, GPHOF said the company has seen an increase of 15.5% in Measured and Indicated tonnage, with 37.6 million tonnes at 5.14% graphite and an Inferred Resource of 243.7 million tonnes at 5.07% graphite. It's technical language. But, in layperson's terms, the note is more simple. The across-the-board estimate increase is a bullish indicator for potential revenues and increases the chances for GPHOF to score a partnership deal to expedite the development of its asset.

Proving Assets Is Valuable Without Drilling

Another planned drill program this year to delineate the scope and size of the resource could put the latter scenario into play. Remember, proving assets in the ground can be a significant balance sheet booster as well. And with precedent-setting a positive expectation of results, the next update, if confirmatory, could fuel another leg higher for GPHOF stock. That's on a pure asset valuation basis. The potential for appreciation can be exponentially higher from potential partnerships always in play for exploration companies.

Keep in mind that every company in the sector needs what GPHOF is indicated to have- graphite. The United States is currently 100% import-dependent for natural graphite. That means that the interest could be significant as Graphite One continues to complete plans to initiate a complete U.S.-based, advanced graphite supply chain solution anchored by its Graphite Creek resource. And the further GPHOF is along, the more likely its stock price to rise accordingly. In other words, time makes the company more valuable.

As a smallcap player, there is plenty to appreciate as it is. The Graphite One project plan includes an advanced graphite material and battery anode manufacturing plant expected to be built in Washington State to support project development. The location will have a recycling facility to reclaim graphite and other battery materials. The entire build will contribute to GPHOF's intent to be a complete life-cycle contributor to a global circular economy.

Potentially The Largest US Supplier Of Graphite

Its mission is well in progress, progressing on developing its Graphite One Project to become the most significant American producer of high-grade anode materials on a commercial scale integrated with a domestic graphite resource. The project's scope is to stay vertically integrated from enterprise to mine, processing, and manufacturing anode materials primarily for the lithium–ion EV battery market. Its 2022 Pre-Feasibility Study indicates it can score that goal.

In a multi-step process, graphite mineralization mined from its Alaska-based Graphite Creek Property would be processed into concentrate at an adjacent processing plant. Then, natural and artificial graphite anode materials and other value–added graphite products would be manufactured from the concentrate and other materials at its planned advanced graphite materials manufacturing facility in Washington State. A final feasibility study will guide the direction of the comprehensive project.

Meeting Soaring Global Graphite Demand

Believing GPHOF can be a significant contributor is not an overzealous presumption. Despite its smallcap size, GPHOF is positioning well to feed the demand of one of the most valued commodities to an industry still in relative infancy. Remember, while the EV sector is booming, it still has yet to reach all the way down to the mainstream consumer. But it will, especially with EV companies like Tesla (NASDAQ; TSLA), Ford (NYSE: F), General Motors (NYSE: GM), Mullen Automotive (NASDAQ: MULN), and others focused on bringing MSRP's of vehicles down to the $20,000 level.

The impact of that inclusion can be enormous. The World Bank has estimated graphite production will need to increase by 500% over the next 30 years to meet the demand for battery metals if it continues growing at its current pace. But the current speed is accelerating, so much so that CNBC has predicted that as many as 125 million electric vehicles will be on the road as soon as 2030.

Therefore, imagine what that number could look like by 2050 and beyond – and how much graphite will be needed to sustain it. Clearly, the EV and energy storage sectors aren't going anywhere, and it isn't too late to become a leading supplier of these industries' critical production materials. Graphite One's expansions target that opportunity. In fact, progress made positions them to turn its groundwork completed into dollars. And that could mean its over 38% YTD share price increase is the precursor of more.

They could get help to realize their full potential. It's no secret that the US has strongly supported the expansion of electric vehicle technologies, introducing legislation designed to incentivize their development and secure essential production components. For example, a $500 billion infrastructure bill passed in 2022 intends to facilitate building over 500,000 charging stations, with a goal of making at least half of the vehicles on the road electric by 2030.

Of course, reaching that goal entails unearthing substantially more graphite than what is currently being manufactured. The government – and Graphite One – recognize this. Proactively, the White House signed an executive order in 2021 to strengthen the nation's reserve of battery metals, with the United States Geological Survey categorizing graphite as one of the 35 minerals and metals considered critical to the United States. Furthermore, the US Department of Defense stated in 2021 that there would be an 83,000 metric ton shortfall of graphite supply in a potential conflict scenario.

Contributing more to the value proposition, the US government has identified graphite as an essential asset to national security and the technology economy, cementing the material's demand for decades. And by establishing its foundation to feed that need, Graphite One has a solid chance of becoming more than a provider to expedite EV adoption; it can help fortify national security.

Expediting A Potentially Lucrative Mission

Today, the EV industry exposes the most near-term revenue-generating opportunity. Targeting this potential, GPHOF is focused on developing its Graphite One Project. This interest and asset could transform this smallcap stock into one of the EV industry's largest suppliers of essential battery metals.

Graphite One's 100%-owned Graphite Creek project in Alaska is the most valuable asset powering the opportunity. Located about 60 kilometers north of Nome, Alaska, the property covers 23,680 acres and boasts 135 State of Alaska mining claims and 41 State-selected mining claims. The better news inherent to GPHOF is that Graphite One's preliminary economic assessment of the area indicates a potential 40-year mining life for the Graphite Creek deposit, supporting an annual production of 41,840 metric tons of coated spherical graphite and 13,500 metric tons of graphite powder.

Better, the material found at Graphite Creek has been noted to naturally exhibit the morphological characteristics of an already-processed material, a property that could bring significant efficiencies when producing the Coated Spherical Graphite required by Li-Ion and EV batteries. These unique characteristics have led the company to brand Graphite Creek's graphite by the acronym "STAX" or "Spherical Thin Aggregate Expanded." Preliminary research on STAX Graphite has indicated that it could be helpful for applications beyond EVs, such as high-purity nuclear-grade graphite, fire-suppressant graphite foam, and industrial diamonds for next-gen semiconductor substrates.

Its extraordinary properties and high yield sound promising enough. Still, its potential is amplified even further. The United States graphite supply has been 100% dependent on imports since 1990, with China supplying most of the materials. The government imported 58,000 metric tons of natural graphite in 2020, almost identical to Graphite One's potential annual output. Therefore, Graphite One and its Alaskan Graphite Creek project are in a position to quickly become the largest domestic producer of graphite, an enviable title that could inspire record-high revenues and investor attention. And not just investors are excited about what Graphite One could be on the verge of accomplishing.

Uncle Sam As A Partner?

The US government could be a satisfied customer, too, even a potential funding partner. They have emphasized strengthening the development and production of battery metals and minerals to incentivize cleaner energy sources and correct an over-reliance on foreign sources for these critical materials. Last year, they double-down by reiterating its vision to expand the domestic mining, production, processing, and recycling of essential minerals and materials. This means that in addition to Graphite One's 100% ownership of a domestic property rich in graphite, they may also have a deep-pocketed partner eager to support their efforts.

Graphite One has also built a strong relationship with the Alaska US Delegation, the State of Alaska and other relevant State Agencies, and the local Alaska Native Entities. In fact, Alaska Governor Mike Dunleavy nominated Graphite One as a High-Priority Infrastructure Project in 2019, stating, "Graphite Creek is the largest deposit of graphite in the Nation, and would be a superior domestic supply of this critical mineral, which is necessary for modern batteries, renewable energy technology, and many other high-tech uses."

This nomination allowed the company to present its project to the Federal Permitting Improvement Steering Council (FPISC), in which its operations were found to qualify under both the "renewable energy" and "manufacturing" sectors. All of this provides Graphite One a green light to continue the development of their Graphite Creek property in Alaska, supported by promising pre-feasibility studies showing potential to exploit one of the most substantial graphite deposits in the nation.

YTD Rally A Precursor To Higher Highs

Put simply, milestones reached last year can become 2023 catalysts. And after clearing a litany of regulatory hurdles, transitioning those milestones can be a near-term proposition. Undoubtedly, GPHOF is on the right track, already en route to becoming a leading graphite producer in the United States. But more important than leading, they can be one of the first and largest suppliers in the domestic market. Surveys of their owned projects show that they could achieve that status, contributing at a scale that nearly matches the nation's current annual demand for graphite.

Investors should keep this in mind too. The revenue-generating potential from the graphite market is expected to continue its steepening trajectory, topping the $29.5 billion mark set last year. Thus, it's easy to see why investors are bullish on GPHOF. They can be one of the first graphite producers within the United States and, more importantly, seize a considerable share of the inherent market opportunities.

If so, and indications point toward their ability to, current valuations are more than appreciably disconnected from a fair value; they present an investment opportunity at what appear to be ground floor prices.

Disclaimers: Shore Thing Media, LLC. (STM, LLC.) is responsible for the production and distribution of this content. STM, Llc. is not operated by a licensed broker, a dealer, or a registered investment adviser. It should be expressly understood that under no circumstances does any information published herein represent a recommendation to buy or sell a security. Our reports/releases are a commercial advertisement and are for general information purposes ONLY. We are engaged in the business of marketing and advertising companies for monetary compensation. Never invest in any stock featured on our site or emails unless you can afford to lose your entire investment. The information made available by STM, Llc. is not intended to be, nor does it constitute, investment advice or recommendations. The contributors may buy and sell securities before and after any particular article, report and publication. In no event shall STM, Llc. be liable to any member, guest or third party for any damages of any kind arising out of the use of any content or other material published or made available by STM, Llc., including, without limitation, any investment losses, lost profits, lost opportunity, special, incidental, indirect, consequential or punitive damages. Past performance is a poor indicator of future performance. The information in this video, article, and in its related newsletters, is not intended to be, nor does it constitute, investment advice or recommendations. STM, Llc. strongly urges you conduct a complete and independent investigation of the respective companies and consideration of all pertinent risks. Readers are advised to review SEC periodic reports: Forms 10-Q, 10K, Form 8-K, insider reports, Forms 3, 4, 5 Schedule 13D. For some content, STM, Llc., its authors, contributors, or its agents, may be compensated for preparing research, video graphics, and editorial content. STM, LLC has been compensated up to two-thousand-five-hundred dollars cash via wire transfer by a third party to produce and syndicate digital content for Graphite One, Inc. for a period of one month. As part of that content, readers, subscribers, and website viewers, are expected to read the full disclaimers and financial disclosures statement that can be found on our website by visiting primetimeprofiles.com/disclaimer.

Media Contact

Company Name: STM, LLC.

Contact Person: Michael Thomas

Email: contact@primetimeprofiles.com

Phone: 917-773-0072

Country: United States

Website: https://primetimeprofiles.com/