Tobacco company Philip Morris International (NYSE: PM) met Wall Streets revenue expectations in Q4 CY2025, with sales up 6.8% year on year to $10.36 billion. Its non-GAAP profit of $1.70 per share was in line with analysts’ consensus estimates.

Is now the time to buy Philip Morris? Find out by accessing our full research report, it’s free.

Philip Morris (PM) Q4 CY2025 Highlights:

- Revenue: $10.36 billion vs analyst estimates of $10.31 billion (6.8% year-on-year growth, in line)

- Adjusted EPS: $1.70 vs analyst estimates of $1.70 (in line)

- Operating Margin: 32.6%, down from 33.6% in the same quarter last year

- Market Capitalization: $283.3 billion

Company Overview

Founded in 1847, Philip Morris International (NYSE: PM) manufactures and sells a wide range of tobacco and nicotine-containing products, including cigarettes, heated tobacco products, and oral nicotine pouches.

Revenue Growth

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years.

With $40.65 billion in revenue over the past 12 months, Philip Morris is one of the most widely recognized consumer staples companies. Its influence over consumers gives it negotiating leverage with distributors, enabling it to pick and choose where it sells its products (a luxury many don’t have).

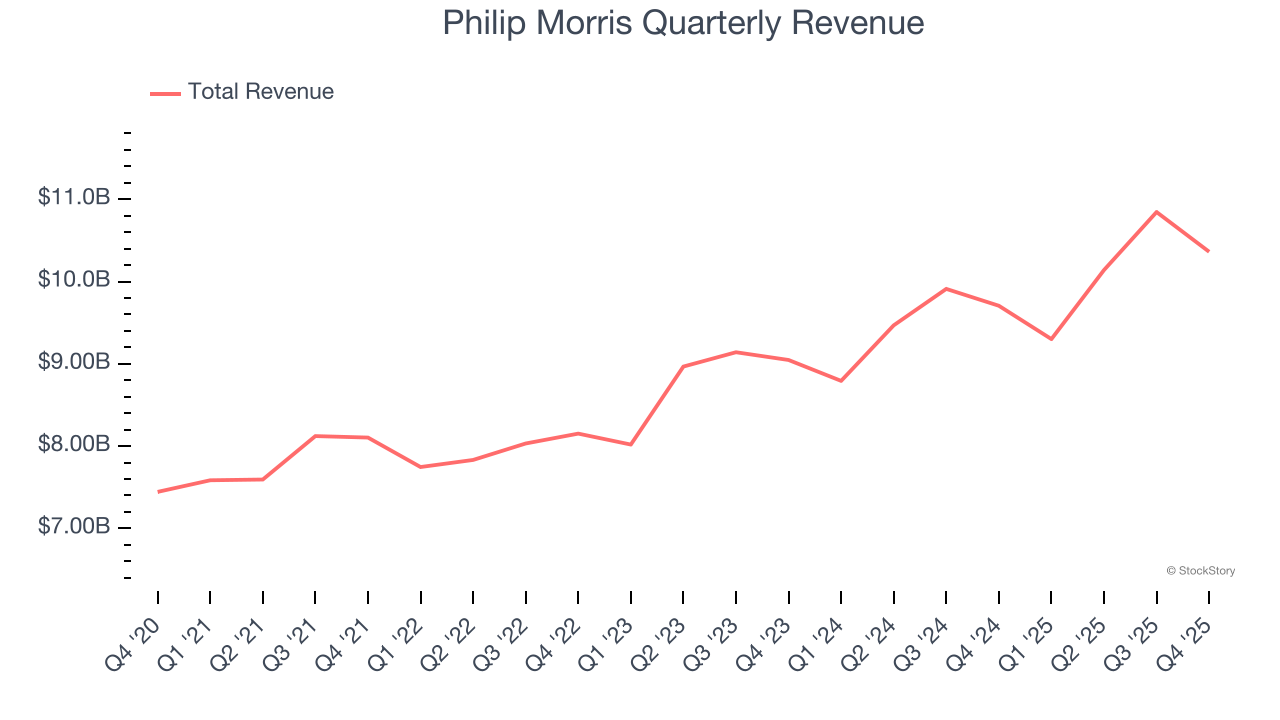

As you can see below, Philip Morris’s sales grew at a decent 8.6% compounded annual growth rate over the last three years as consumers bought more of its products.

This quarter, Philip Morris grew its revenue by 6.8% year on year, and its $10.36 billion of revenue was in line with Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 7.7% over the next 12 months, similar to its three-year rate. This projection is above average for the sector and suggests its newer products will help maintain its historical top-line performance.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Cash Is King

Although earnings are undoubtedly valuable for assessing company performance, we believe cash is king because you can’t use accounting profits to pay the bills.

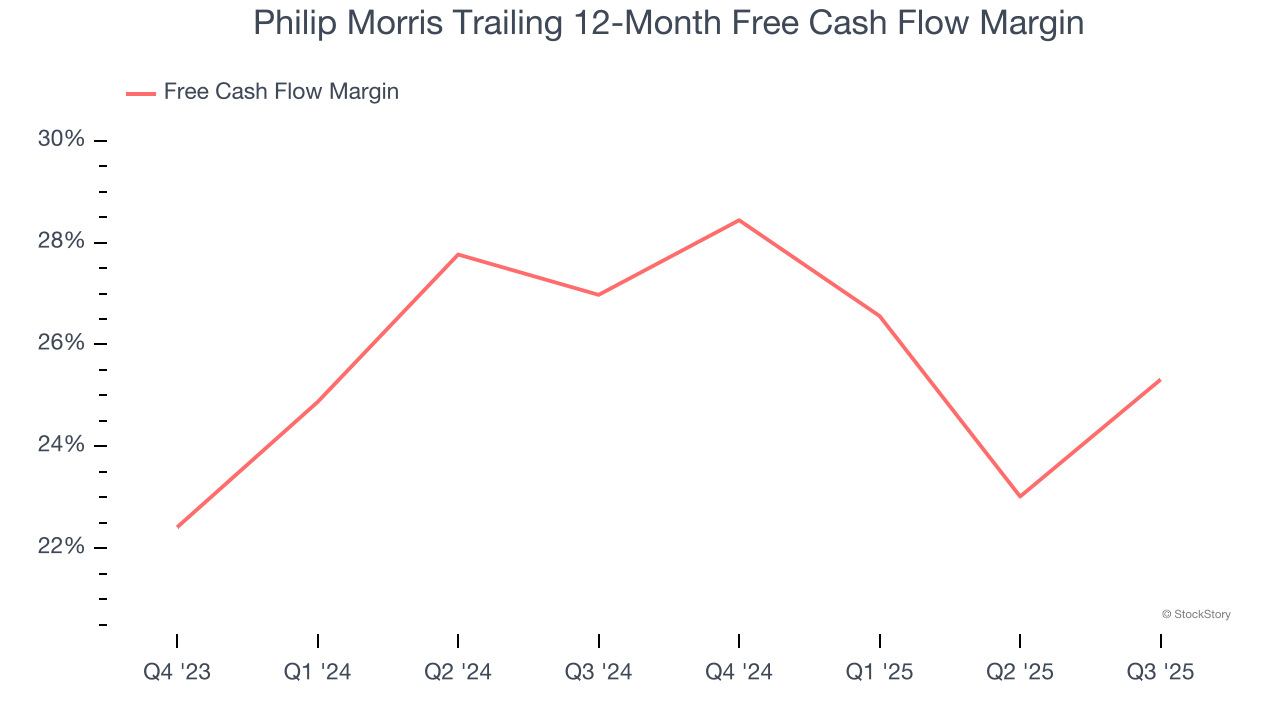

Philip Morris has shown terrific cash profitability, driven by its lucrative business model that enables it to reinvest, return capital to investors, and stay ahead of the competition. The company’s free cash flow margin was among the best in the consumer staples sector, averaging 25.2% over the last two years.

Key Takeaways from Philip Morris’s Q4 Results

We struggled to find many resounding positives or negatives in these results, as revenue and EPS were both just in line with expectations. Investors were likely hoping for more, and shares traded down 1.4% to $179.50 immediately following the results.

Should you buy the stock or not? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here (it’s free).