Consumer packaging solutions provider Graphic Packaging Holding (NYSE: GPK) reported revenue ahead of Wall Streets expectations in Q4 CY2025, but sales were flat year on year at $2.10 billion. The company expects the full year’s revenue to be around $8.5 billion, close to analysts’ estimates. Its non-GAAP profit of $0.29 per share was 16.9% below analysts’ consensus estimates.

Is now the time to buy Graphic Packaging Holding? Find out by accessing our full research report, it’s free.

Graphic Packaging Holding (GPK) Q4 CY2025 Highlights:

- Revenue: $2.10 billion vs analyst estimates of $2.03 billion (flat year on year, 3.5% beat)

- Adjusted EPS: $0.29 vs analyst expectations of $0.35 (16.9% miss)

- Adjusted EBITDA: $311 million vs analyst estimates of $318.1 million (14.8% margin, 2.2% miss)

- Adjusted EPS guidance for the upcoming financial year 2026 is $0.95 at the midpoint, missing analyst estimates by 46.5%

- EBITDA guidance for the upcoming financial year 2026 is $1.15 billion at the midpoint, below analyst estimates of $1.40 billion

- Operating Margin: 7.4%, down from 11.4% in the same quarter last year

- Free Cash Flow Margin: 19.4%, up from 8.5% in the same quarter last year

- Market Capitalization: $4.36 billion

Robbert Rietbroek, the Company's President and CEO said, "Consumer affordability created a challenging market for our customers and competitive pressure remains a near-term headwind. As we move into 2026, our priorities are clear: drive operational excellence; deliver exceptional customer service; improve our cost structure; and drive substantial free cash flow to strengthen the balance sheet and return capital to shareholders. I have initiated a comprehensive review of our organization structure, operations, and footprint, and a selective review of our portfolio to ensure that our resources are focused where we can create the greatest value for our shareholders."

Company Overview

Founded in 1991, Graphic Packaging (NYSE: GPK) is a provider of paper-based packaging solutions for a wide range of products.

Revenue Growth

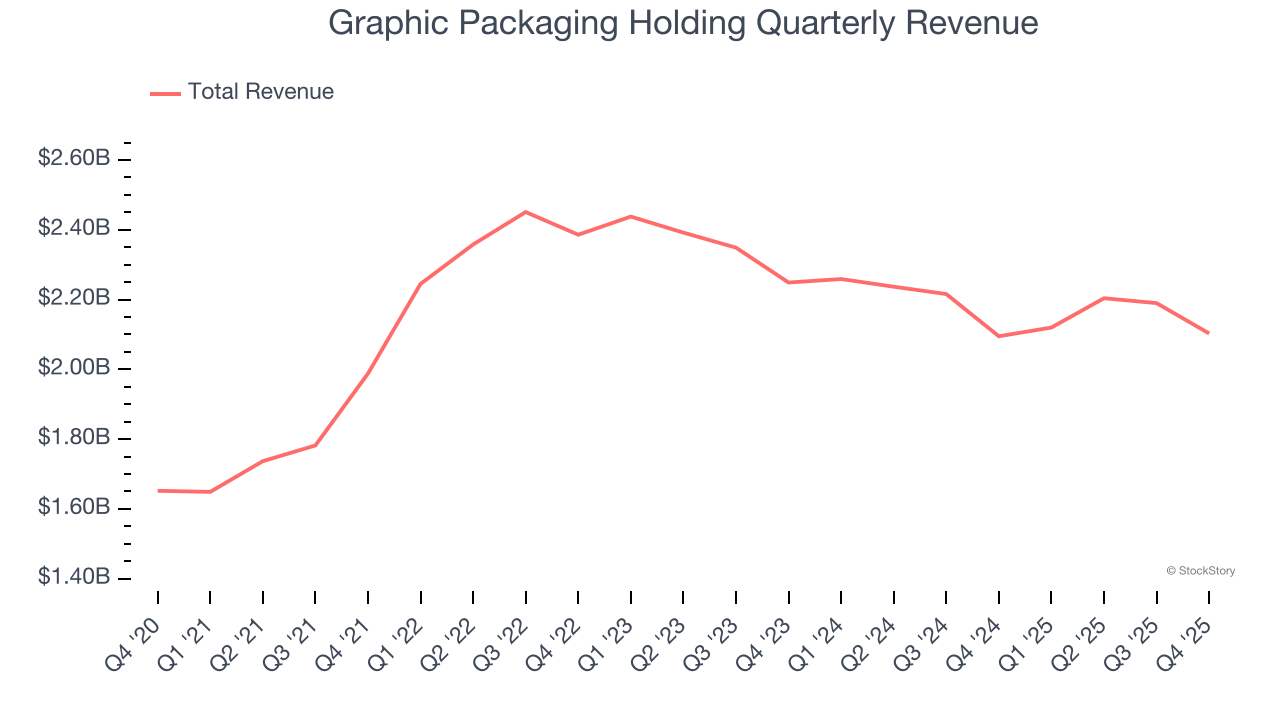

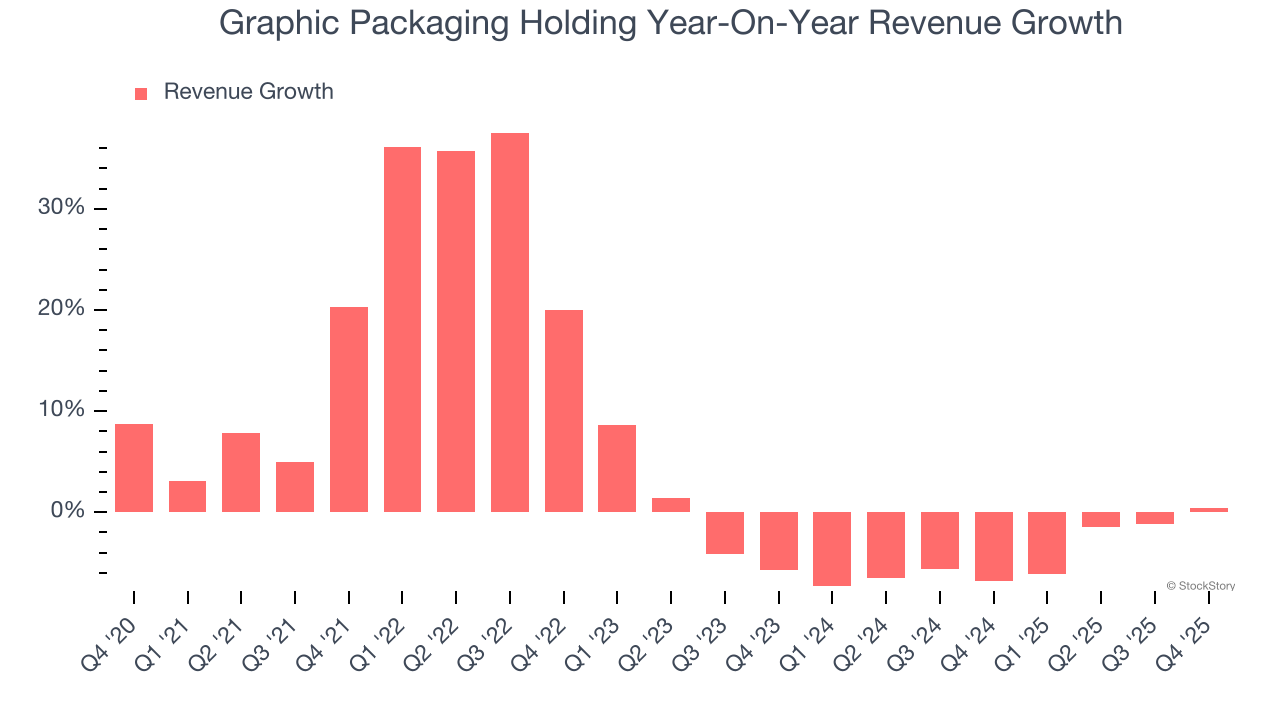

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Regrettably, Graphic Packaging Holding’s sales grew at a tepid 5.6% compounded annual growth rate over the last five years. This was below our standard for the industrials sector and is a rough starting point for our analysis.

Long-term growth is the most important, but within industrials, a half-decade historical view may miss new industry trends or demand cycles. Graphic Packaging Holding’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 4.4% annually.

This quarter, Graphic Packaging Holding’s $2.10 billion of revenue was flat year on year but beat Wall Street’s estimates by 3.5%.

Looking ahead, sell-side analysts expect revenue to decline by 1.2% over the next 12 months. Although this projection is better than its two-year trend, it’s tough to feel optimistic about a company facing demand difficulties.

While Wall Street chases Nvidia at all-time highs, an under-the-radar semiconductor supplier is dominating a critical AI component these giants can’t build without. Click here to access our free report one of our favorites growth stories.

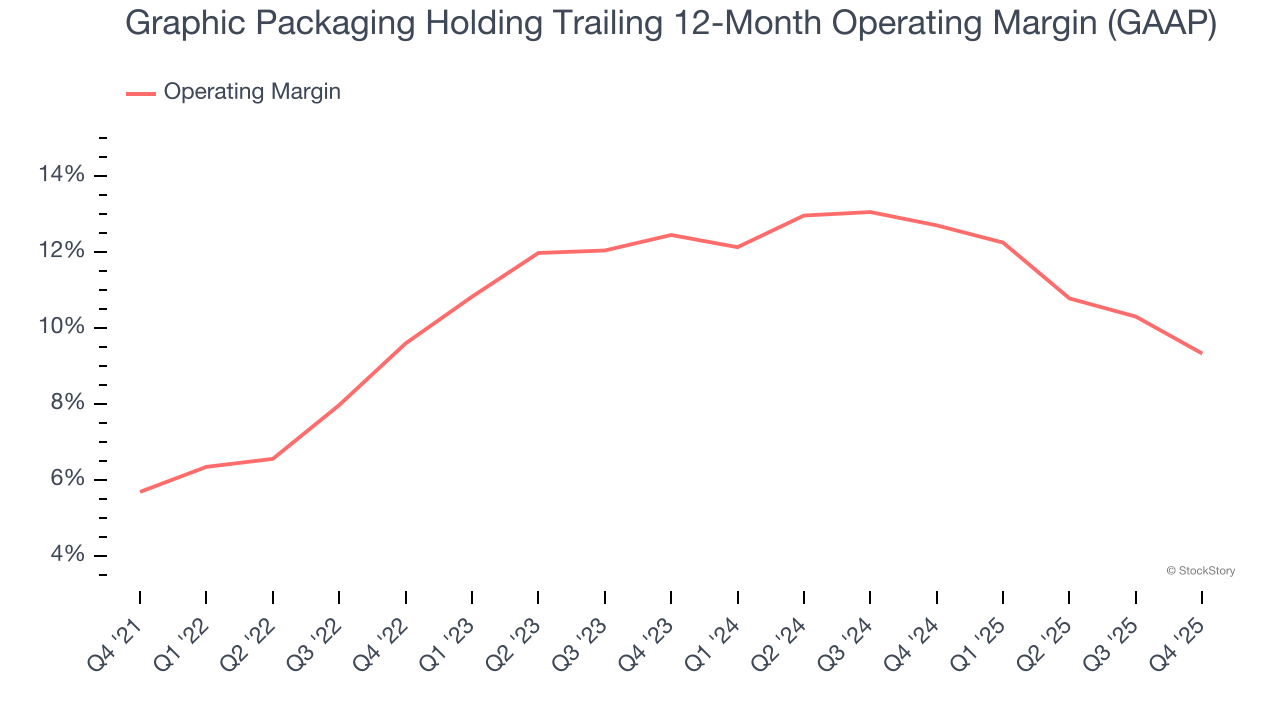

Operating Margin

Graphic Packaging Holding has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.2%. This result was particularly impressive because of its low gross margin, which is mostly a factor of what it sells and takes huge shifts to move meaningfully. Companies have more control over their operating margins, and it’s a show of well-managed operations if they’re high when gross margins are low.

Analyzing the trend in its profitability, Graphic Packaging Holding’s operating margin rose by 3.6 percentage points over the last five years, as its sales growth gave it operating leverage. Its expansion was impressive, especially when considering most Industrial Packaging peers saw their margins plummet.

In Q4, Graphic Packaging Holding generated an operating margin profit margin of 7.4%, down 4 percentage points year on year. Since Graphic Packaging Holding’s gross margin decreased more than its operating margin, we can assume its recent inefficiencies were driven more by weaker leverage on its cost of sales rather than increased marketing, R&D, and administrative overhead expenses.

Earnings Per Share

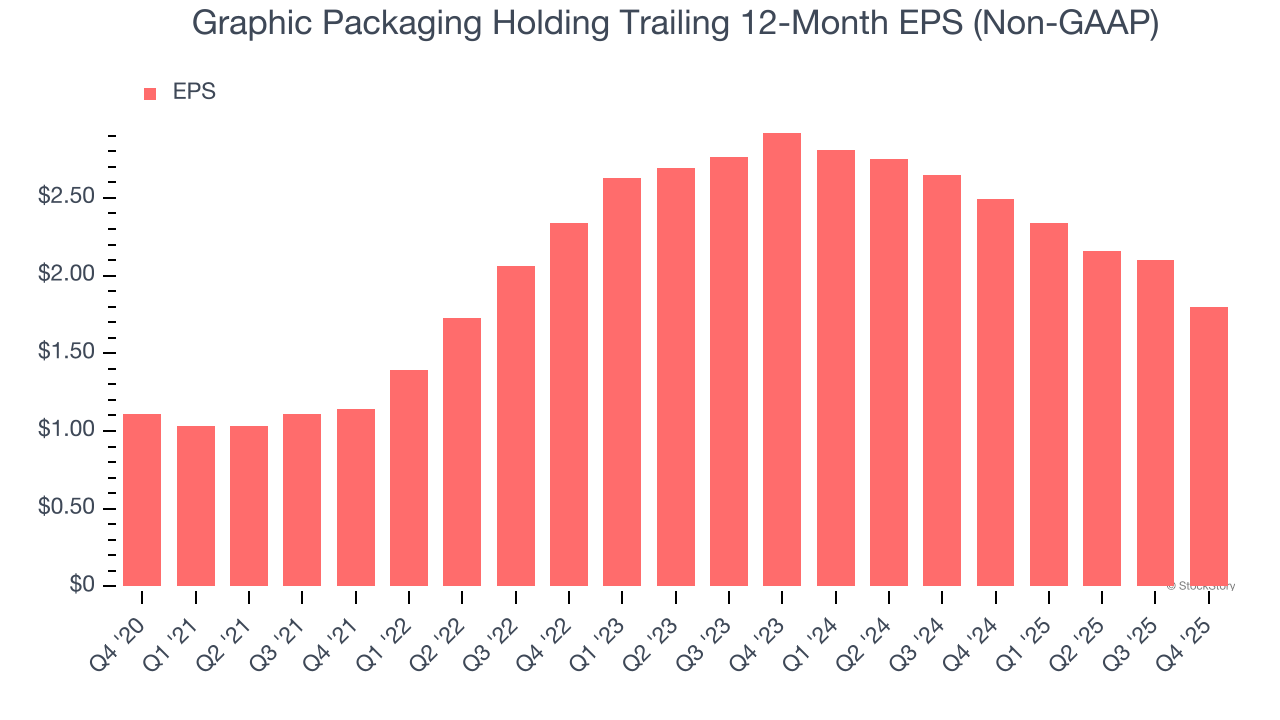

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Graphic Packaging Holding’s EPS grew at a solid 10.2% compounded annual growth rate over the last five years, higher than its 5.6% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Diving into Graphic Packaging Holding’s quality of earnings can give us a better understanding of its performance. As we mentioned earlier, Graphic Packaging Holding’s operating margin declined this quarter but expanded by 3.6 percentage points over the last five years. This was the most relevant factor (aside from the revenue impact) behind its higher earnings; interest expenses and taxes can also affect EPS but don’t tell us as much about a company’s fundamentals.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Graphic Packaging Holding, its two-year annual EPS declines of 21.5% mark a reversal from its (seemingly) healthy five-year trend. We hope Graphic Packaging Holding can return to earnings growth in the future.

In Q4, Graphic Packaging Holding reported adjusted EPS of $0.29, down from $0.59 in the same quarter last year. This print missed analysts’ estimates, but we care more about long-term adjusted EPS growth than short-term movements. Over the next 12 months, Wall Street expects Graphic Packaging Holding’s full-year EPS of $1.80 to shrink by 2.6%.

Key Takeaways from Graphic Packaging Holding’s Q4 Results

We enjoyed seeing Graphic Packaging Holding beat analysts’ revenue expectations this quarter. On the other hand, its full-year EBITDA guidance missed and its EPS fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 5.7% to $13.94 immediately following the results.

Graphic Packaging Holding may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here (it’s free).