Grocery retail giant Kroger (NYSE: KR) fell short of the markets revenue expectations in Q3 CY2025, with sales flat year on year at $33.86 billion. Its GAAP loss of $2.02 per share was significantly below analysts’ consensus estimates.

Is now the time to buy Kroger? Find out by accessing our full research report, it’s free for active Edge members.

Kroger (KR) Q3 CY2025 Highlights:

- Revenue: $33.86 billion vs analyst estimates of $34.21 billion (flat year on year, 1% miss)

- EPS (GAAP): -$2.02 vs analyst estimates of $1.05 (significant miss)

- Adjusted EBITDA: $1.83 billion vs analyst estimates of $1.83 billion (5.4% margin, in line)

- EPS (GAAP) guidance for the full year is $4.78 at the midpoint, beating analyst estimates by 4.3%

- Operating Margin: -4.6%, down from 2.5% in the same quarter last year

- Free Cash Flow was $29 million, up from -$28 million in the same quarter last year

- Locations: 2,789.7 at quarter end, up from 2,788.5 in the same quarter last year

- Same-Store Sales rose 2.6% year on year, in line with the same quarter last year

- Market Capitalization: $39.84 billion

Company Overview

With a sprawling network of over 2,400 locations offering digital pickup services, Kroger (NYSE: KR) operates supermarkets, pharmacies, and fuel centers across 35 states, offering customers groceries, household items, and private-label products.

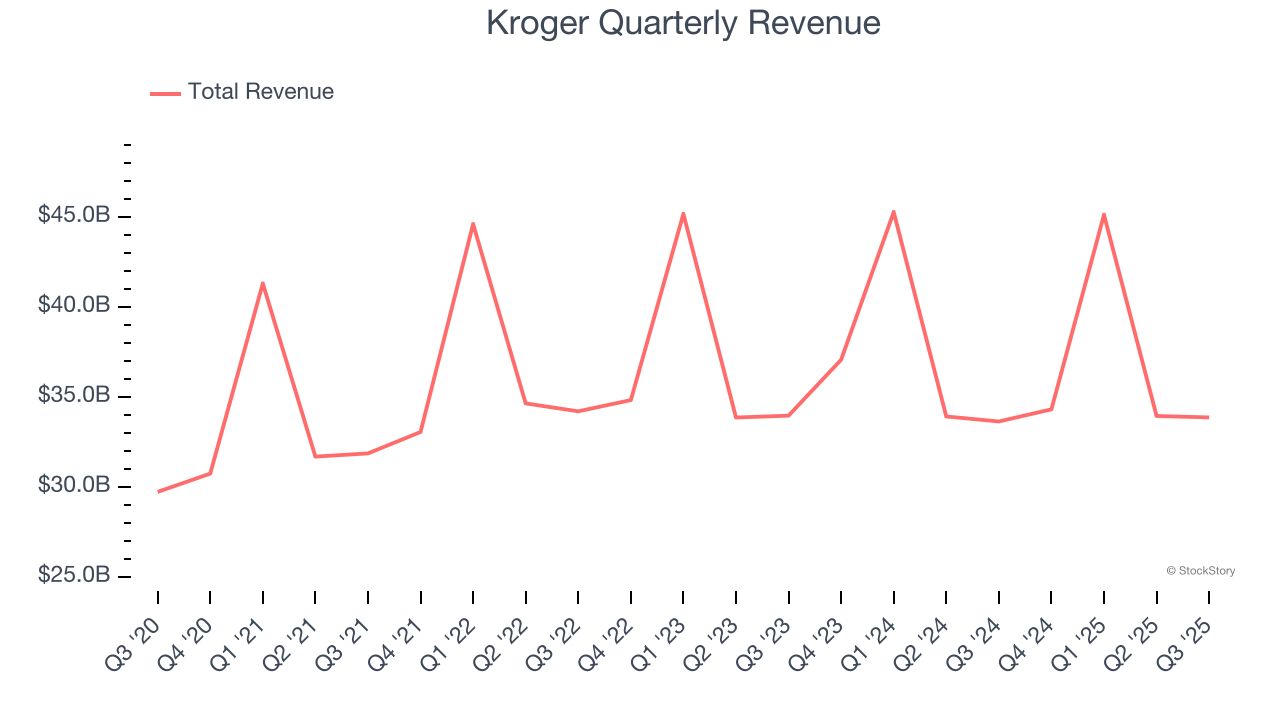

Revenue Growth

Examining a company’s long-term performance can provide clues about its quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $147.2 billion in revenue over the past 12 months, Kroger is a behemoth in the consumer retail sector and benefits from economies of scale, giving it an edge in distribution. This also enables it to gain more leverage on its fixed costs than smaller competitors and the flexibility to offer lower prices. However, its scale is a double-edged sword because there are only a finite number of places to build new stores, making it harder to find incremental growth. To expand meaningfully, Kroger likely needs to tweak its prices or enter new markets.

As you can see below, Kroger struggled to increase demand as its $147.2 billion of sales for the trailing 12 months was close to its revenue three years ago. This was mainly because it didn’t open many new stores.

This quarter, Kroger’s $33.86 billion of revenue was flat year on year, falling short of Wall Street’s estimates.

Looking ahead, sell-side analysts expect revenue to grow 1.7% over the next 12 months, similar to its three-year rate. While this projection suggests its newer products will catalyze better top-line performance, it is still below average for the sector.

Software is eating the world and there is virtually no industry left that has been untouched by it. That drives increasing demand for tools helping software developers do their jobs, whether it be monitoring critical cloud infrastructure, integrating audio and video functionality, or ensuring smooth content streaming. Click here to access a free report on our 3 favorite stocks to play this generational megatrend.

Store Performance

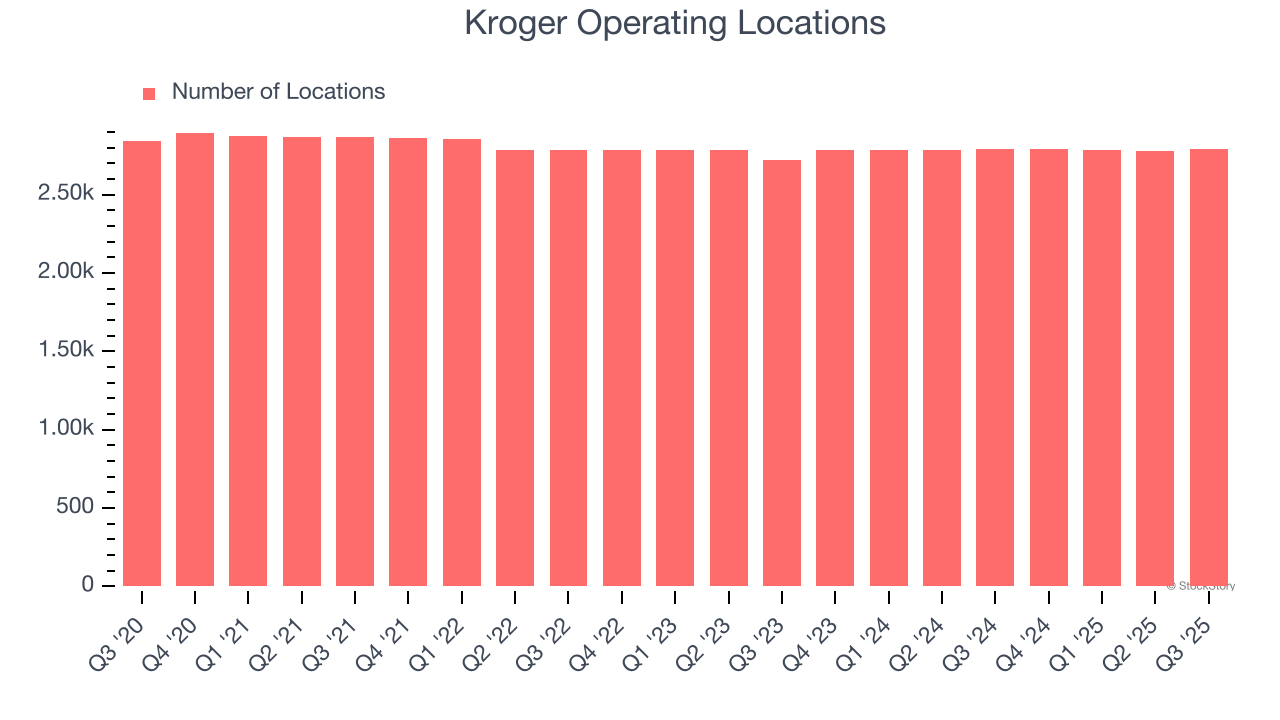

Number of Stores

A retailer’s store count often determines how much revenue it can generate.

Kroger operated 2,790 locations in the latest quarter, and over the last two years, has kept its store count flat while other consumer retail businesses have opted for growth.

When a retailer keeps its store footprint steady, it usually means demand is stable and it’s focusing on operational efficiency to increase profitability.

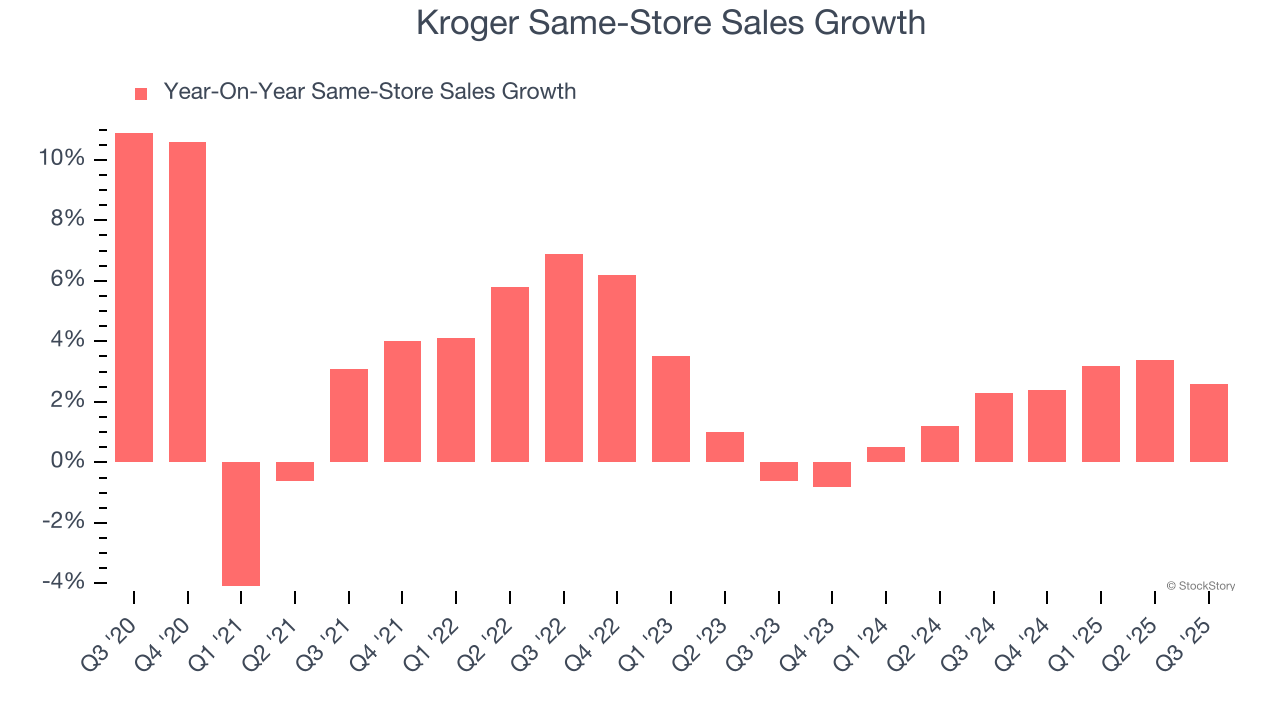

Same-Store Sales

The change in a company's store base only tells one side of the story. The other is the performance of its existing locations and e-commerce sales, which informs management teams whether they should expand or downsize their physical footprints. Same-store sales provides a deeper understanding of this issue because it measures organic growth at brick-and-mortar shops for at least a year.

Kroger’s demand within its existing locations has been relatively stable over the last two years but was below most retailers. On average, the company’s same-store sales have grown by 1.9% per year. Given its flat store base over the same period, this performance stems from a mixture of increased foot traffic at existing locations and higher e-commerce sales as demand shifts from in-store to online.

In the latest quarter, Kroger’s same-store sales rose 2.6% year on year. This performance was more or less in line with its historical levels.

Key Takeaways from Kroger’s Q3 Results

It was great to see Kroger’s full-year EPS guidance top analysts’ expectations. We were also happy its gross margin outperformed Wall Street’s estimates. On the other hand, its EPS missed and its revenue fell slightly short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 1.6% to $61.96 immediately following the results.

Big picture, is Kroger a buy here and now? If you’re making that decision, you should consider the bigger picture of valuation, business qualities, as well as the latest earnings. We cover that in our actionable full research report which you can read here, it’s free for active Edge members.