Regional banking company Zions Bancorporation (NASDAQ: ZION) reported Q4 CY2025 results exceeding the market’s revenue expectations, with sales up 8.5% year on year to $891 million. Its GAAP profit of $1.76 per share was 12.4% above analysts’ consensus estimates.

Is now the time to buy Zions Bancorporation? Find out by accessing our full research report, it’s free.

Zions Bancorporation (ZION) Q4 CY2025 Highlights:

- Net Interest Income: $683 million vs analyst estimates of $684.6 million (71.9% year-on-year decline, in line)

- Net Interest Margin: 3.3% vs analyst estimates of 3.3% (in line)

- Revenue: $891 million vs analyst estimates of $870.1 million (8.5% year-on-year growth, 2.4% beat)

- Efficiency Ratio: 62.3% vs analyst estimates of 61.4% (90.9 basis point miss)

- EPS (GAAP): $1.76 vs analyst estimates of $1.57 (12.4% beat)

- Tangible Book Value per Share: $40.79 vs analyst estimates of $40.25 (20.5% year-on-year growth, 1.4% beat)

- Market Capitalization: $8.80 billion

Company Overview

Founded in 1873 during Utah's pioneer era and named after Mount Zion in the Bible, Zions Bancorporation (NASDAQ: ZION) operates seven regional banks across the Western United States, providing commercial, retail, and wealth management services to over a million customers.

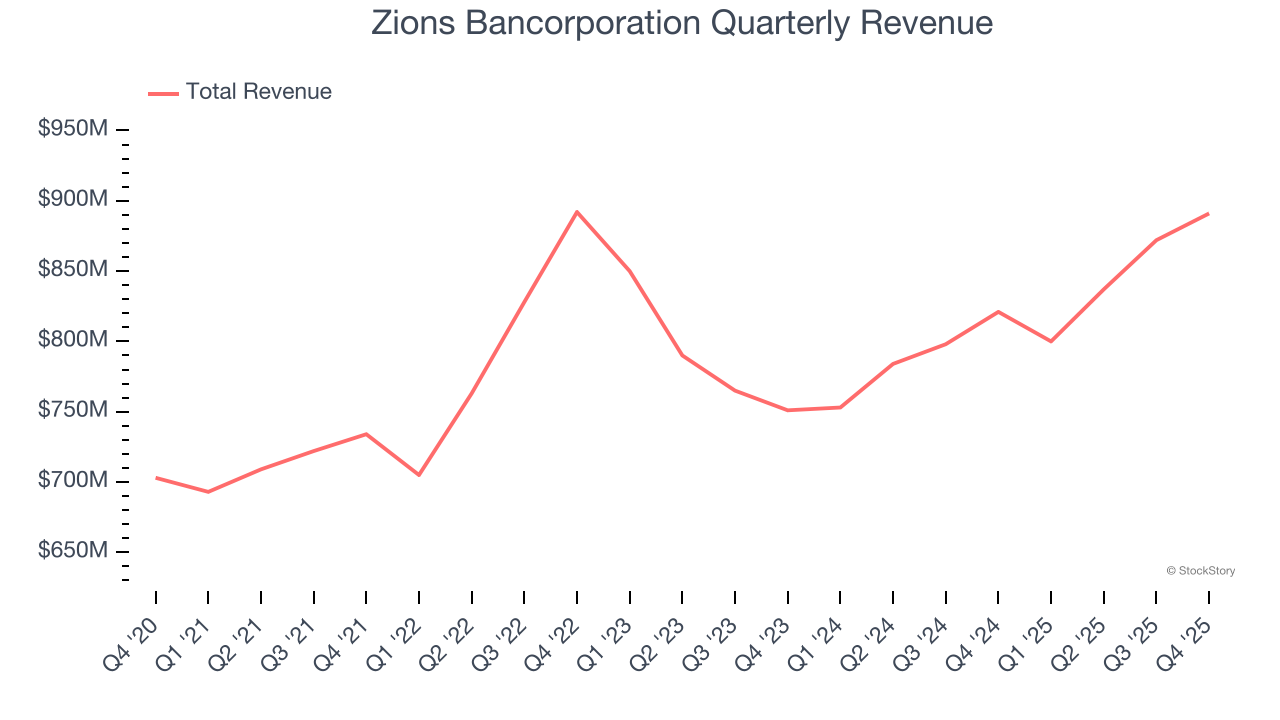

Sales Growth

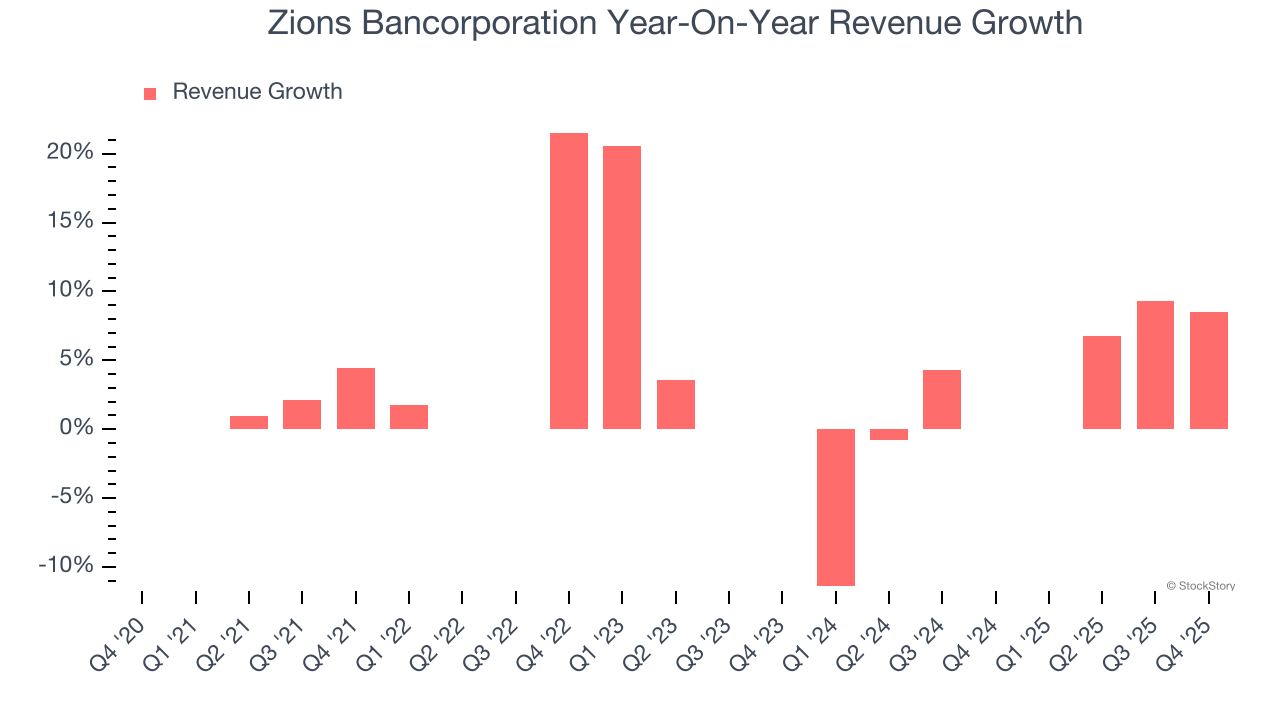

In general, banks make money from two primary sources. The first is net interest income, which is interest earned on loans, mortgages, and investments in securities minus interest paid out on deposits. The second source is non-interest income, which can come from bank account, credit card, wealth management, investing banking, and trading fees. Regrettably, Zions Bancorporation’s revenue grew at a sluggish 3.8% compounded annual growth rate over the last five years. This was below our standard for the banking sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within financials, a half-decade historical view may miss recent interest rate changes, market returns, and industry trends. Zions Bancorporation’s annualized revenue growth of 3.8% over the last two years aligns with its five-year trend, suggesting its demand was consistently weak.  Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

This quarter, Zions Bancorporation reported year-on-year revenue growth of 8.5%, and its $891 million of revenue exceeded Wall Street’s estimates by 2.4%.

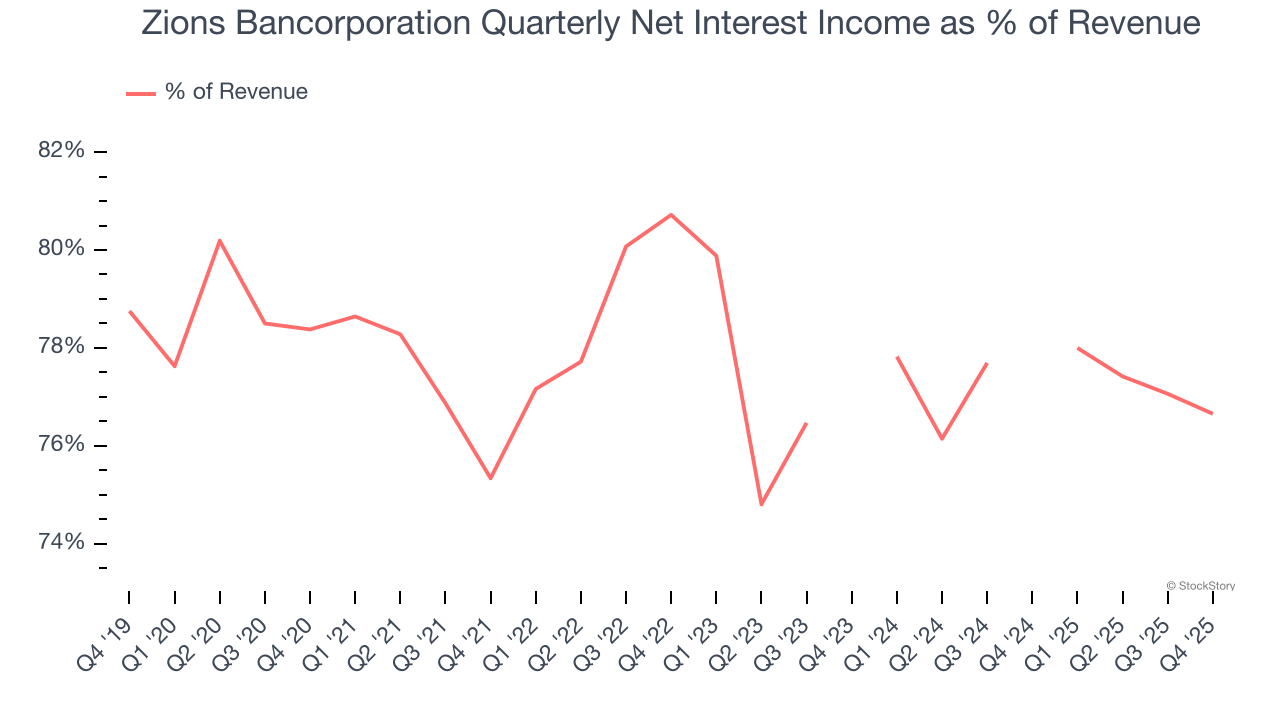

Since the company recorded losses on certain securities, it generated more net interest income than revenue during the last five years, meaning Zions Bancorporation lives and dies by its lending activities because non-interest income barely moves the needle.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.

Note: Quarters not shown were determined to be outliers, impacted by outsized investment gains/losses that are not indicative of the recurring fundamentals of the business.Markets consistently prioritize net interest income growth over fee-based revenue, recognizing its superior quality and recurring nature compared to the more unpredictable non-interest income streams.

The 1999 book Gorilla Game predicted Microsoft and Apple would dominate tech before it happened. Its thesis? Identify the platform winners early. Today, enterprise software companies embedding generative AI are becoming the new gorillas. a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

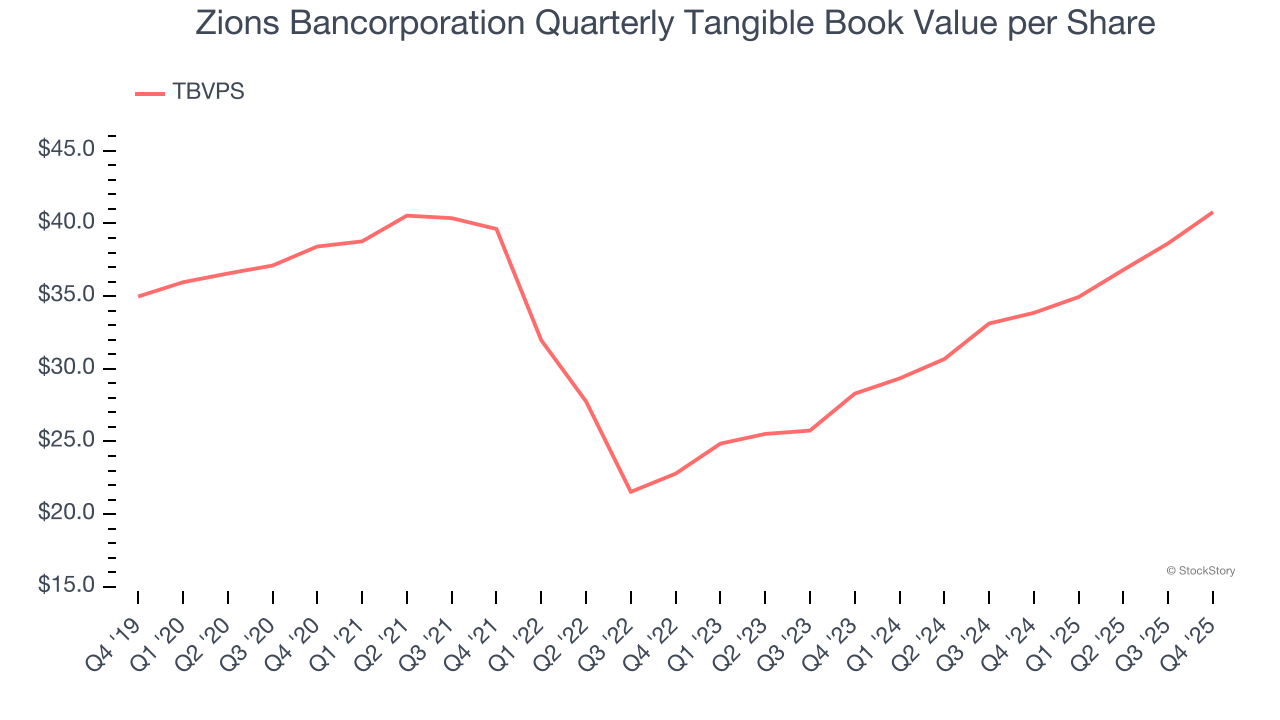

Tangible Book Value Per Share (TBVPS)

Banks profit by intermediating between depositors and borrowers, making them fundamentally balance sheet-driven enterprises. Market participants emphasize balance sheet quality and sustained book value growth when evaluating these institutions.

This explains why tangible book value per share (TBVPS) stands as the premier banking metric. TBVPS strips away questionable intangible assets, revealing concrete per-share net worth that investors can trust. Traditional metrics like EPS are helpful but face distortion from M&A activity and loan loss accounting rules.

Zions Bancorporation’s TBVPS grew at a sluggish 1.2% annual clip over the last five years. However, TBVPS growth has accelerated recently, growing by 20.1% annually over the last two years from $28.30 to $40.79 per share.

Over the next 12 months, Consensus estimates call for Zions Bancorporation’s TBVPS to grow by 11.2% to $45.37, mediocre growth rate.

Key Takeaways from Zions Bancorporation’s Q4 Results

It was good to see Zions Bancorporation beat analysts’ EPS expectations this quarter. We were also happy its revenue outperformed Wall Street’s estimates. Overall, we think this was a solid quarter with some key areas of upside. The stock traded up 1.2% to $59.83 immediately after reporting.

Sure, Zions Bancorporation had a solid quarter, but if we look at the bigger picture, is this stock a buy? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here (it’s free).