Over the last six months, Akamai Technologies’s shares have sunk to $78.88, producing a disappointing 6.3% loss - a stark contrast to the S&P 500’s 15.7% gain. This may have investors wondering how to approach the situation.

Is there a buying opportunity in Akamai Technologies, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Akamai Technologies Will Underperform?

Despite the more favorable entry price, we don't have much confidence in Akamai Technologies. Here are three reasons we avoid AKAM and a stock we'd rather own.

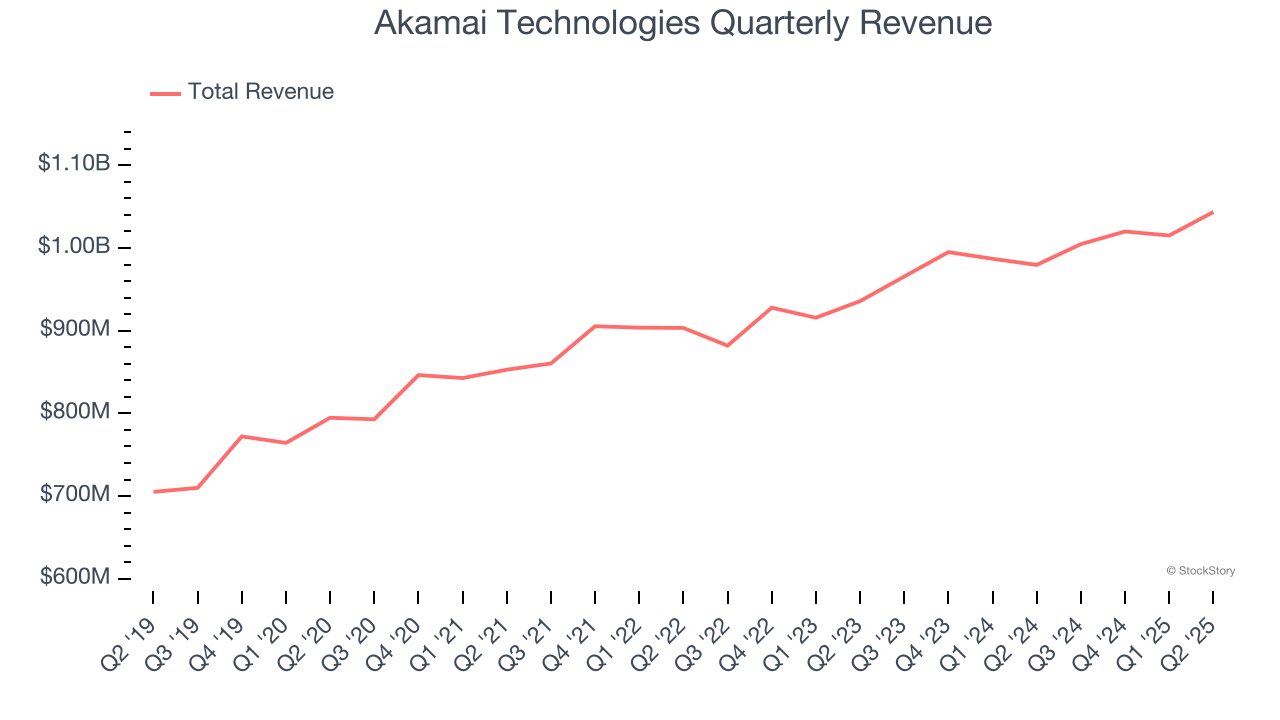

1. Long-Term Revenue Growth Disappoints

A company’s long-term performance is an indicator of its overall quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Akamai Technologies’s 4.6% annualized revenue growth over the last three years was weak. This was below our standard for the software sector.

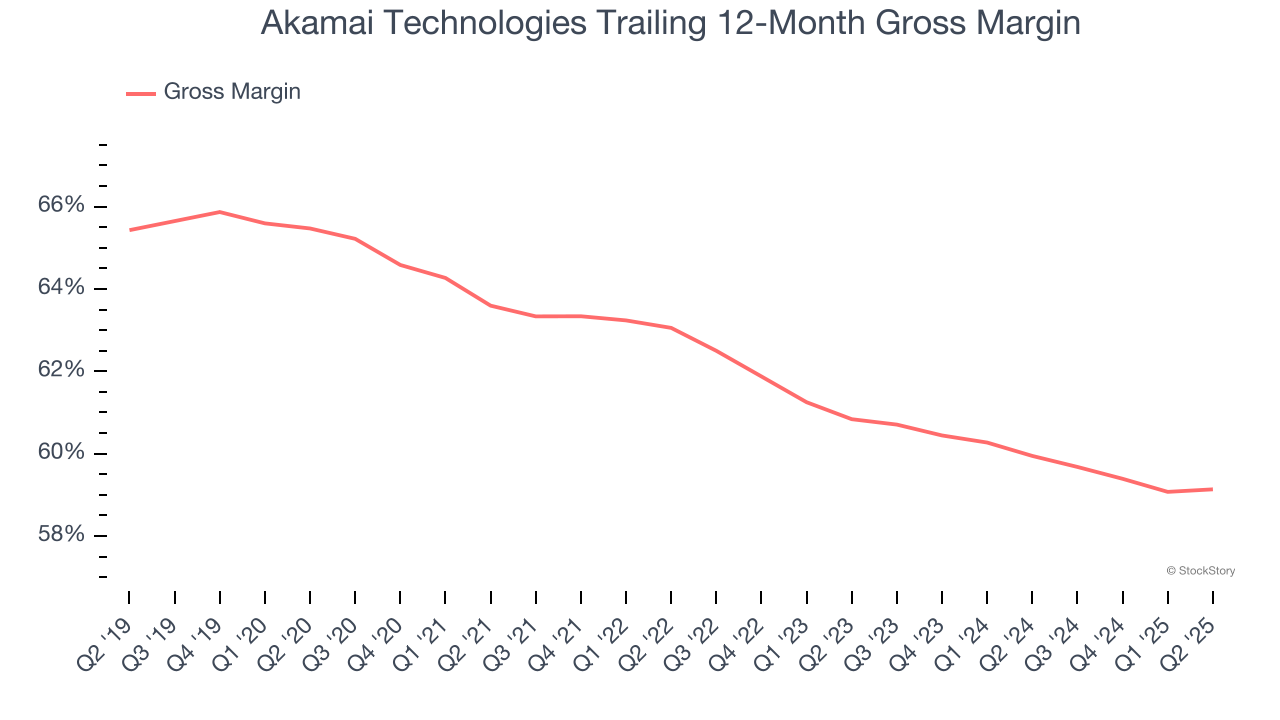

2. Low Gross Margin Reveals Weak Structural Profitability

For software companies like Akamai Technologies, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Akamai Technologies’s gross margin is substantially worse than most software businesses, signaling it has relatively high infrastructure costs compared to asset-lite businesses like ServiceNow. As you can see below, it averaged a 59.1% gross margin over the last year. That means Akamai Technologies paid its providers a lot of money ($40.87 for every $100 in revenue) to run its business.

3. Long Payback Periods Delay Returns

The customer acquisition cost (CAC) payback period represents the months required to recover the cost of acquiring a new customer. Essentially, it’s the break-even point for sales and marketing investments. A shorter CAC payback period is ideal, as it implies better returns on investment and business scalability.

Akamai Technologies’s recent customer acquisition efforts haven’t yielded returns as its CAC payback period was negative this quarter, meaning its incremental sales and marketing investments outpaced its revenue. The company’s inefficiency indicates it operates in a highly competitive environment where there is little differentiation between Akamai Technologies’s products and its peers.

Final Judgment

Akamai Technologies doesn’t pass our quality test. After the recent drawdown, the stock trades at 2.7× forward price-to-sales (or $78.88 per share). This valuation multiple is fair, but we don’t have much confidence in the company. There are more exciting stocks to buy at the moment. Let us point you toward a safe-and-steady industrials business benefiting from an upgrade cycle.

High-Quality Stocks for All Market Conditions

Trump’s April 2025 tariff bombshell triggered a massive market selloff, but stocks have since staged an impressive recovery, leaving those who panic sold on the sidelines.

Take advantage of the rebound by checking out our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-micro-cap company Kadant (+351% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.