F5 trades at $322.90 and has moved in lockstep with the market. Its shares have returned 21.3% over the last six months while the S&P 500 has gained 18.6%.

Is there a buying opportunity in F5, or does it present a risk to your portfolio? Dive into our full research report to see our analyst team’s opinion, it’s free.

Why Is F5 Not Exciting?

We're sitting this one out for now. Here are three reasons why FFIV doesn't excite us and a stock we'd rather own.

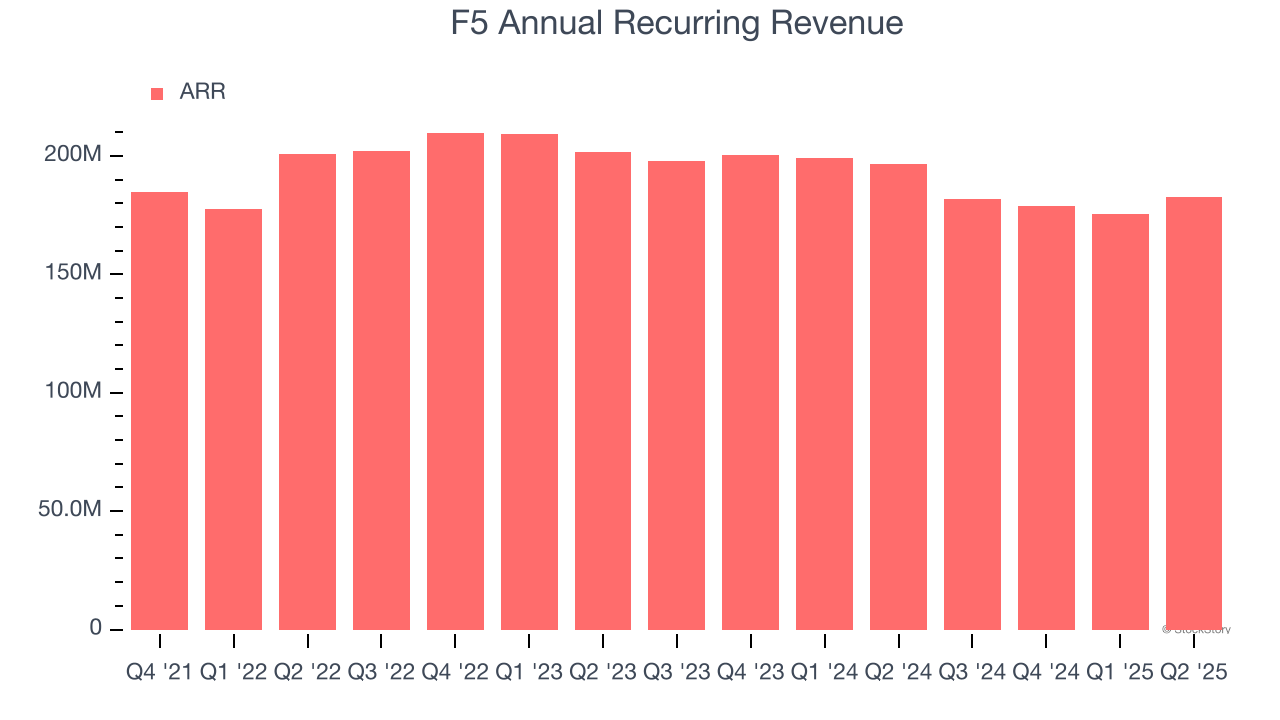

1. Recurring Revenue Slipping as ARR Falls

While reported revenue for a software company can include low-margin items like implementation fees, annual recurring revenue (ARR) is a sum of the next 12 months of contracted revenue purely from software subscriptions, or the high-margin, predictable revenue streams that make SaaS businesses so valuable.

F5’s ARR came in at $182.7 million in Q2, and it averaged 9.4% year-on-year declines over the last four quarters. This performance was underwhelming, showing the company lost long-term deals and renewals. It also suggests there may be increasing competition or market saturation.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect F5’s revenue to rise by 4.5%, close to its 5.3% annualized growth for the past five years. This projection doesn't excite us and suggests its newer products and services will not catalyze better top-line performance yet.

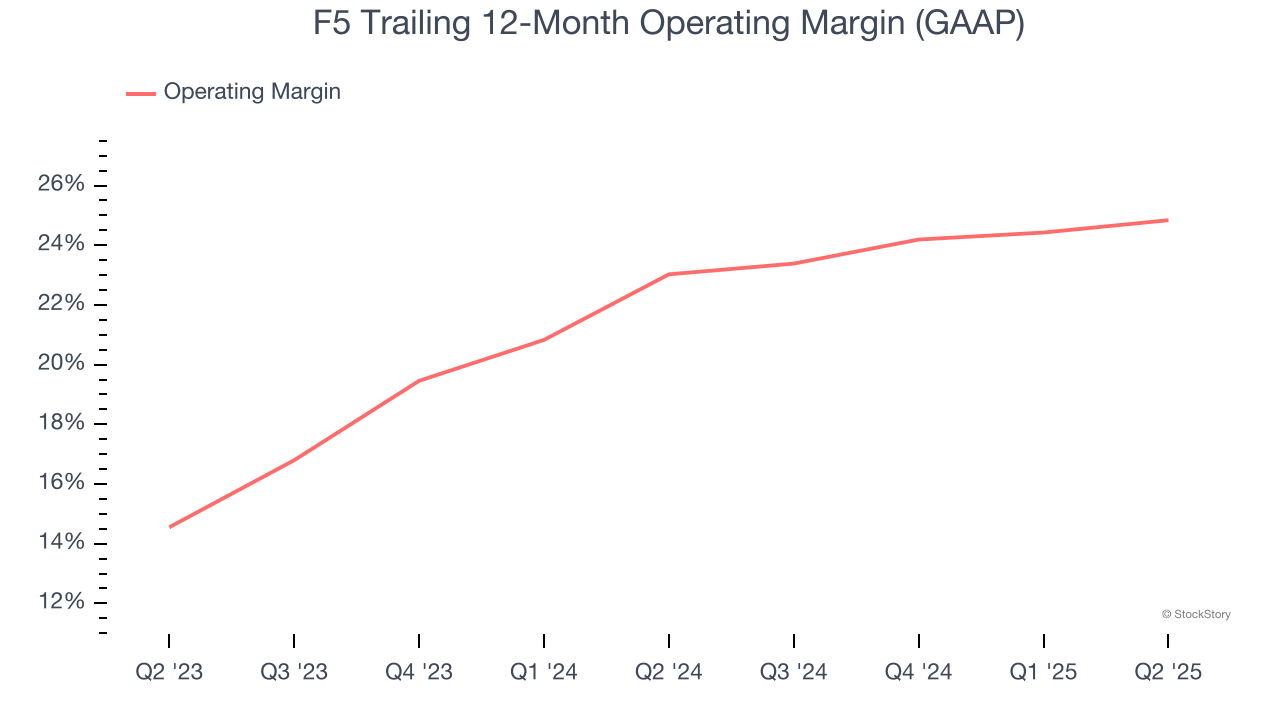

3. Operating Margin Rising, Profits Up

While many software businesses point investors to their adjusted profits, which exclude stock-based compensation (SBC), we prefer GAAP operating margin because SBC is a legitimate expense used to attract and retain talent. This is one of the best measures of profitability because it shows how much money a company takes home after developing, marketing, and selling its products.

Analyzing the trend in its profitability, F5’s operating margin rose by 1.8 percentage points over the last two years, as its sales growth gave it operating leverage. Its operating margin for the trailing 12 months was 24.8%.

Final Judgment

F5’s business quality ultimately falls short of our standards. That said, the stock currently trades at 6× forward price-to-sales (or $322.90 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're fairly confident there are better stocks to buy right now. We’d suggest looking at the most dominant software business in the world.

High-Quality Stocks for All Market Conditions

When Trump unveiled his aggressive tariff plan in April 2025, markets tanked as investors feared a full-blown trade war. But those who panicked and sold missed the subsequent rebound that’s already erased most losses.

Don’t let fear keep you from great opportunities and take a look at Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 183% over the last five years (as of March 31st 2025).

Stocks that made our list in 2020 include now familiar names such as Nvidia (+1,545% between March 2020 and March 2025) as well as under-the-radar businesses like the once-small-cap company Exlservice (+354% five-year return). Find your next big winner with StockStory today.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.