Glass and electronic component manufacturer Corning (NYSE: GLW) met Wall Street’s revenue expectations in Q2 CY2025, with sales up 18.8% year on year to $3.86 billion. The company expects next quarter’s revenue to be around $4.2 billion, coming in 4.2% above analysts’ estimates. Its non-GAAP profit of $0.60 per share was 5.1% above analysts’ consensus estimates.

Is now the time to buy Corning? Find out by accessing our full research report, it’s free.

Corning (GLW) Q2 CY2025 Highlights:

- Revenue: $3.86 billion vs analyst estimates of $3.87 billion (18.8% year-on-year growth, in line)

- Adjusted EPS: $0.60 vs analyst estimates of $0.57 (5.1% beat)

- Revenue Guidance for Q3 CY2025 is $4.2 billion at the midpoint, above analyst estimates of $4.03 billion

- Adjusted EPS guidance for Q3 CY2025 is $0.65 at the midpoint, above analyst estimates of $0.62

- Operating Margin: 14.8%, up from 5.7% in the same quarter last year

- Free Cash Flow Margin: 10.4%, similar to the same quarter last year

- Market Capitalization: $47.46 billion

Company Overview

Supplying windows for some of the United States’s earliest spacecraft, Corning (NYSE: GLW) provides glass and other electronic components for the consumer electronics, telecommunications, automotive, and healthcare industries.

Revenue Growth

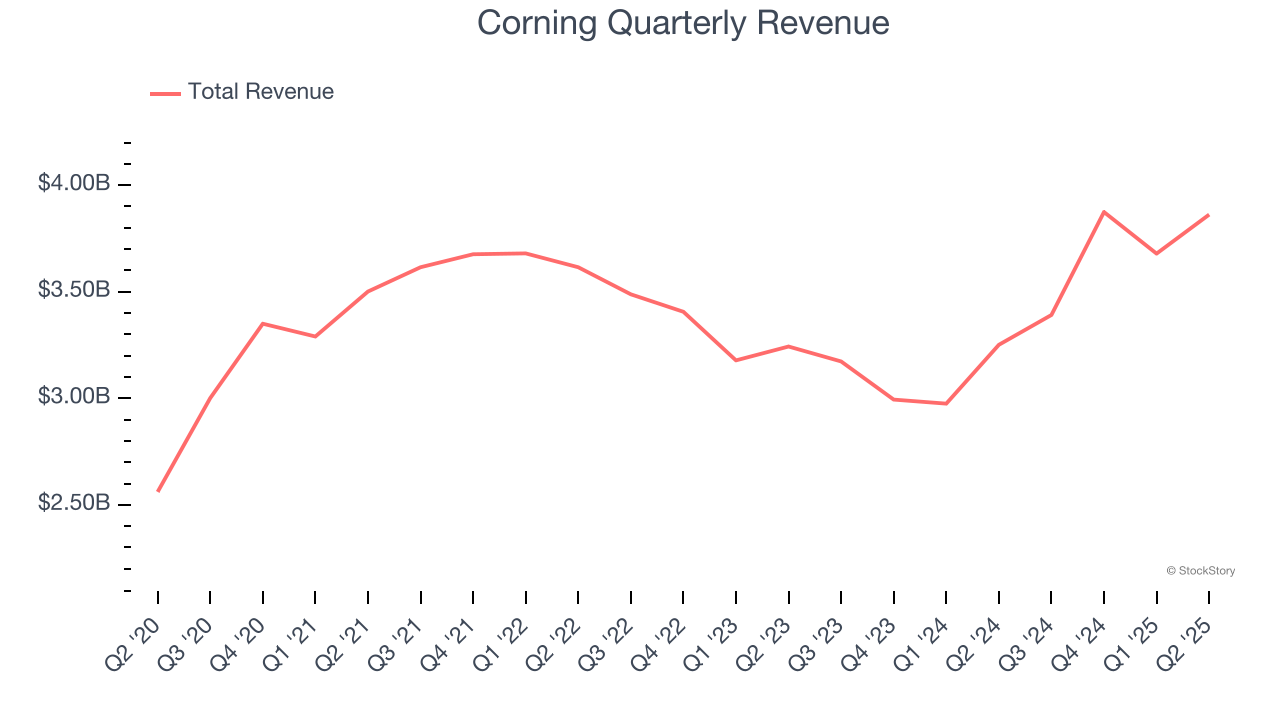

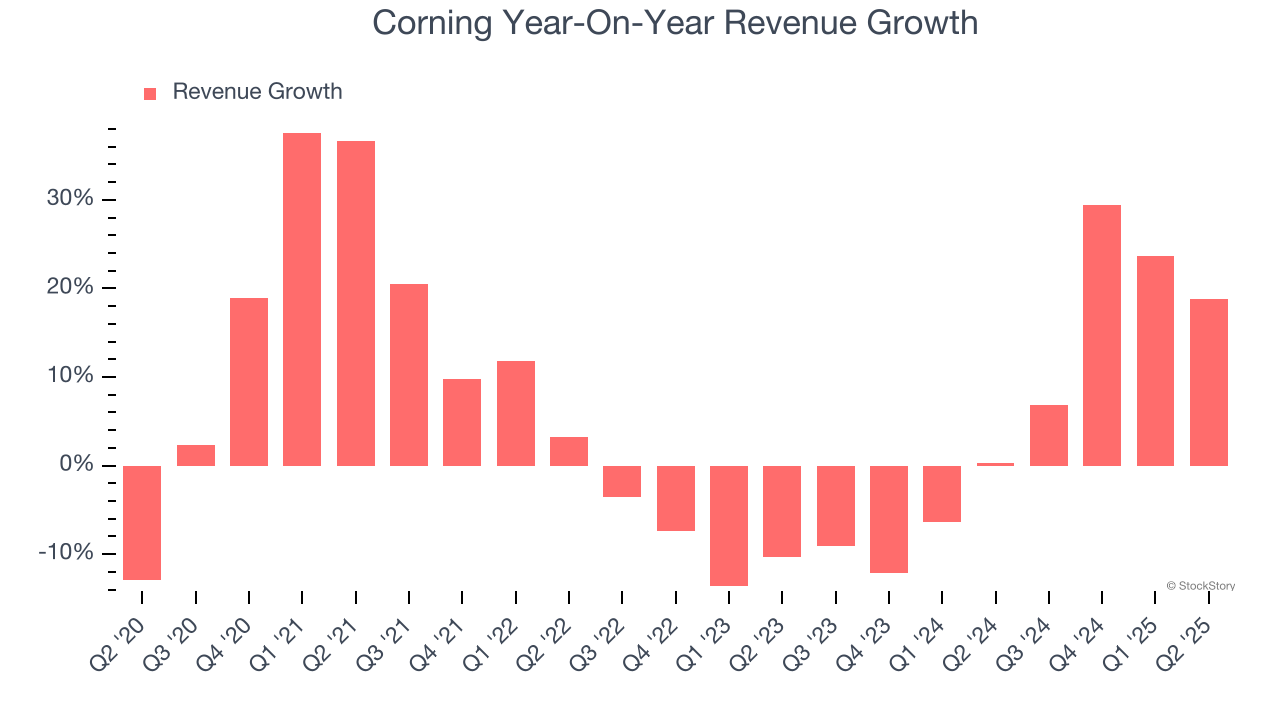

Examining a company’s long-term performance can provide clues about its quality. Even a bad business can shine for one or two quarters, but a top-tier one grows for years. Unfortunately, Corning’s 6.7% annualized revenue growth over the last five years was mediocre. This was below our standard for the industrials sector and is a poor baseline for our analysis.

We at StockStory place the most emphasis on long-term growth, but within industrials, a half-decade historical view may miss cycles, industry trends, or a company capitalizing on catalysts such as a new contract win or a successful product line. Corning’s recent performance shows its demand has slowed as its annualized revenue growth of 5.5% over the last two years was below its five-year trend. We also note many other Electronic Components businesses have faced declining sales because of cyclical headwinds. While Corning grew slower than we’d like, it did do better than its peers.

Corning also breaks out the revenue for its most important segments, Optical Communications and Display Technologies, which are 40.5% and 23.3% of revenue. Over the last two years, Corning’s Optical Communications revenue (optical fiber & cables) averaged 13.2% year-on-year growth while its Display Technologies revenue (glass for flat panel displays) averaged 10.6% growth.

This quarter, Corning’s year-on-year revenue growth was 18.8%, and its $3.86 billion of revenue was in line with Wall Street’s estimates. Company management is currently guiding for a 23.9% year-on-year increase in sales next quarter.

Looking further ahead, sell-side analysts expect revenue to grow 9.7% over the next 12 months, an improvement versus the last two years. This projection is particularly healthy for a company of its scale and suggests its newer products and services will catalyze better top-line performance.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

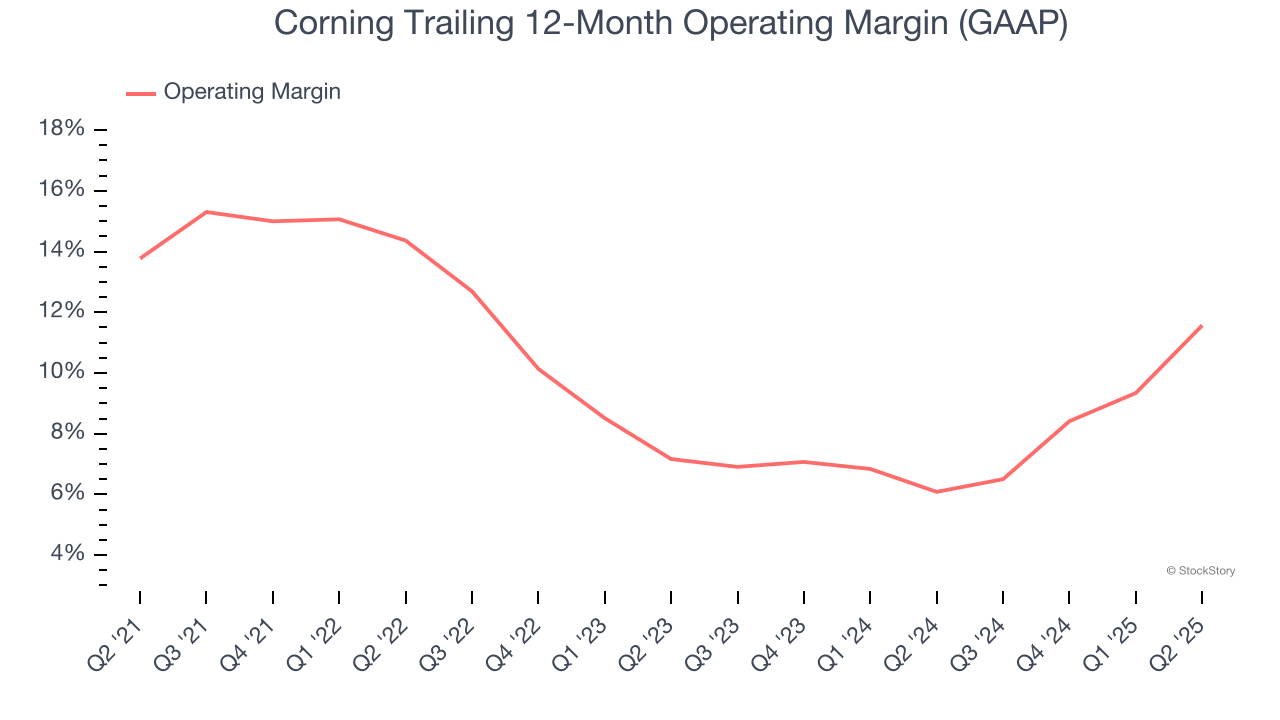

Corning has managed its cost base well over the last five years. It demonstrated solid profitability for an industrials business, producing an average operating margin of 10.7%. This result isn’t too surprising as its gross margin gives it a favorable starting point.

Analyzing the trend in its profitability, Corning’s operating margin decreased by 2.2 percentage points over the last five years. This raises questions about the company’s expense base because its revenue growth should have given it leverage on its fixed costs, resulting in better economies of scale and profitability.

This quarter, Corning generated an operating margin profit margin of 14.8%, up 9.1 percentage points year on year. The increase was solid, and because its operating margin rose more than its gross margin, we can infer it was more efficient with expenses such as marketing, R&D, and administrative overhead.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

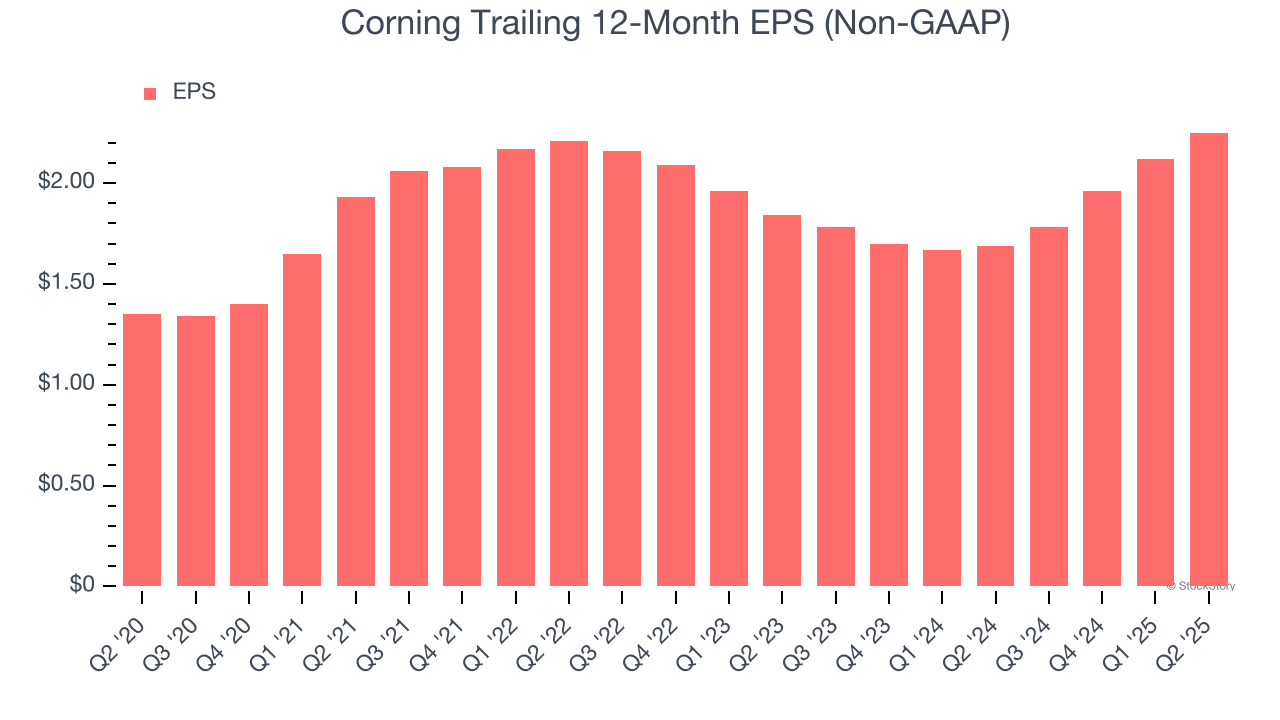

Corning’s EPS grew at a solid 10.8% compounded annual growth rate over the last five years, higher than its 6.7% annualized revenue growth. This tells us the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period because it can provide insight into an emerging theme or development for the business.

For Corning, its two-year annual EPS growth of 10.6% is similar to its five-year trend, implying strong and stable earnings power.

In Q2, Corning reported EPS at $0.60, up from $0.47 in the same quarter last year. This print beat analysts’ estimates by 5.1%. Over the next 12 months, Wall Street expects Corning’s full-year EPS of $2.25 to grow 11.1%.

Key Takeaways from Corning’s Q2 Results

It was great to see Corning’s revenue and EPS guidance for next quarter top analysts’ expectations. We were also glad this quarter's revenue and EPS exceeded Wall Street’s estimates. Overall, this print had some key positives. The stock traded up 5% to $58.25 immediately after reporting.

Is Corning an attractive investment opportunity at the current price? When making that decision, it’s important to consider its valuation, business qualities, as well as what has happened in the latest quarter. We cover that in our actionable full research report which you can read here, it’s free.