Healthcare products company West Pharmaceutical Services (NYSE: WST) reported revenue ahead of Wall Street’s expectations in Q2 CY2025, with sales up 9.2% year on year to $766.5 million. The company’s full-year revenue guidance of $3.05 billion at the midpoint came in 3.1% above analysts’ estimates. Its non-GAAP profit of $1.84 per share was 22% above analysts’ consensus estimates.

Is now the time to buy West Pharmaceutical Services? Find out by accessing our full research report, it’s free.

West Pharmaceutical Services (WST) Q2 CY2025 Highlights:

- Revenue: $766.5 million vs analyst estimates of $725.9 million (9.2% year-on-year growth, 5.6% beat)

- Adjusted EPS: $1.84 vs analyst estimates of $1.51 (22% beat)

- Adjusted EBITDA: $185.1 million vs analyst estimates of $176 million (24.1% margin, 5.2% beat)

- The company lifted its revenue guidance for the full year to $3.05 billion at the midpoint from $2.96 billion, a 3% increase

- Management raised its full-year Adjusted EPS guidance to $6.75 at the midpoint, a 8% increase

- Operating Margin: 20.1%, up from 18% in the same quarter last year

- Free Cash Flow Margin: 51.5%, up from 9.2% in the same quarter last year

- Market Capitalization: $16.33 billion

Company Overview

Founded in 1923 and serving as a critical link in the pharmaceutical supply chain, West Pharmaceutical Services (NYSE: WST) manufactures specialized packaging, containment systems, and delivery devices for injectable drugs and healthcare products.

Revenue Growth

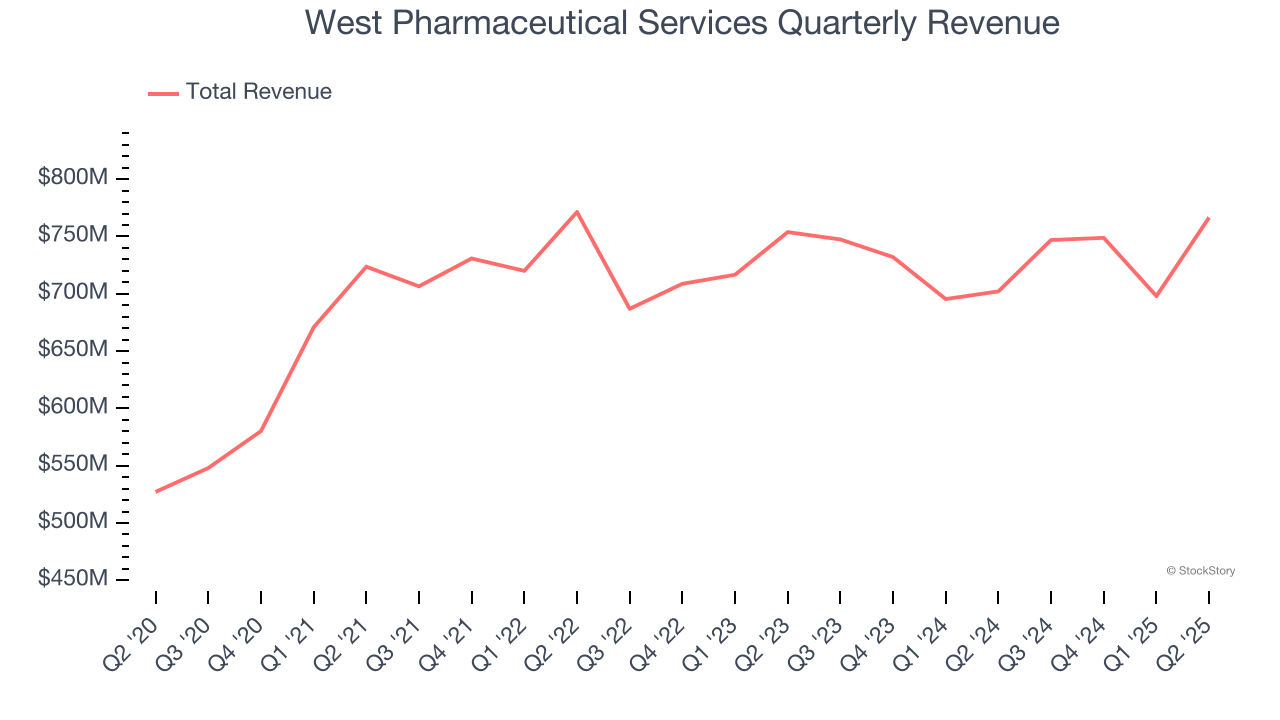

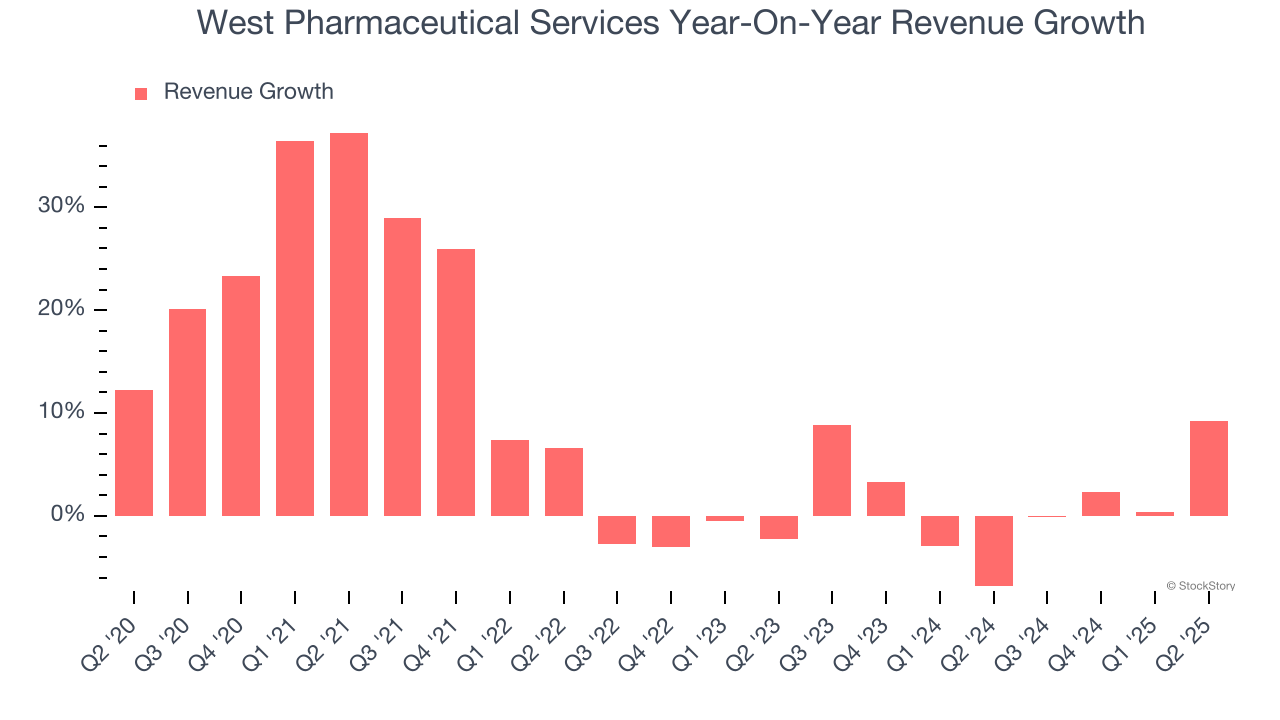

A company’s long-term sales performance is one signal of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul. Over the last five years, West Pharmaceutical Services grew its sales at a decent 8.8% compounded annual growth rate. Its growth was slightly above the average healthcare company and shows its offerings resonate with customers.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. West Pharmaceutical Services’s recent performance shows its demand has slowed as its annualized revenue growth of 1.6% over the last two years was below its five-year trend.

This quarter, West Pharmaceutical Services reported year-on-year revenue growth of 9.2%, and its $766.5 million of revenue exceeded Wall Street’s estimates by 5.6%.

Looking ahead, sell-side analysts expect revenue to grow 3.5% over the next 12 months. While this projection implies its newer products and services will spur better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Operating Margin

Operating margin is an important measure of profitability as it shows the portion of revenue left after accounting for all core expenses – everything from the cost of goods sold to advertising and wages. It’s also useful for comparing profitability across companies with different levels of debt and tax rates because it excludes interest and taxes.

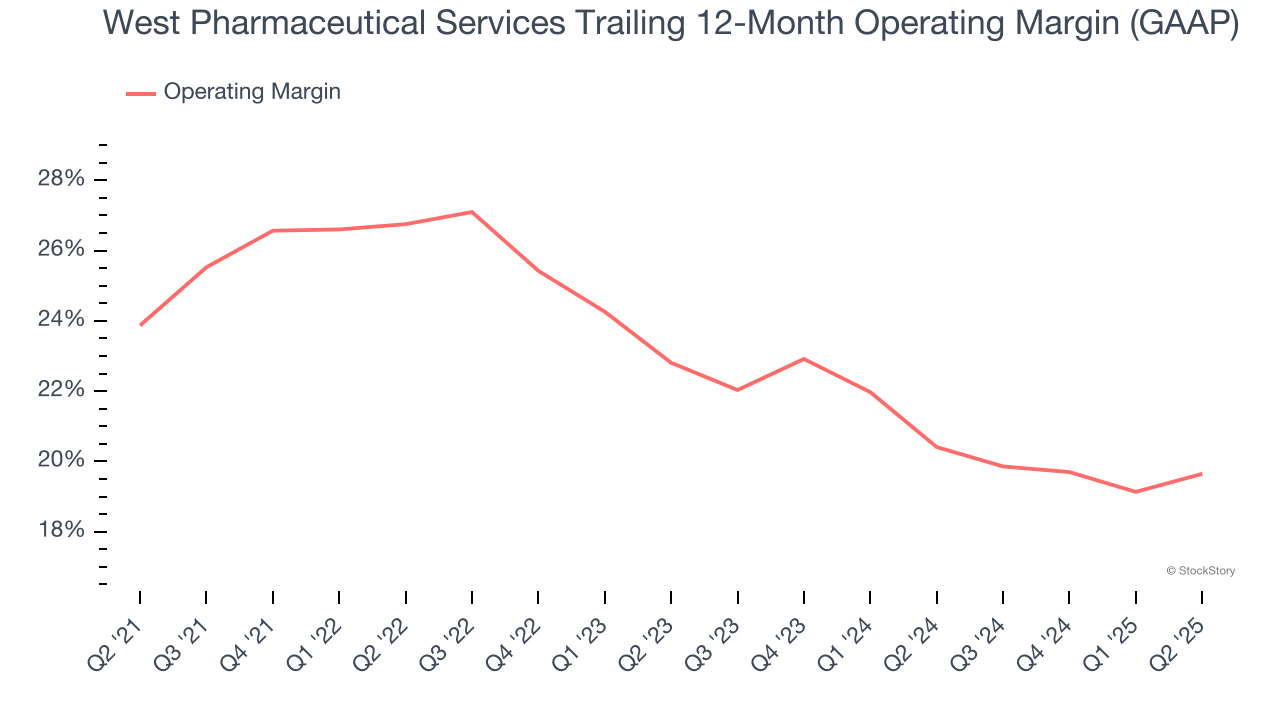

West Pharmaceutical Services has been an efficient company over the last five years. It was one of the more profitable businesses in the healthcare sector, boasting an average operating margin of 22.7%.

Analyzing the trend in its profitability, West Pharmaceutical Services’s operating margin decreased by 4.2 percentage points over the last five years. The company’s two-year trajectory also shows it failed to get its profitability back to the peak as its margin fell by 3.2 percentage points. This performance was poor no matter how you look at it - it shows its expenses were rising and it couldn’t pass those costs onto its customers.

This quarter, West Pharmaceutical Services generated an operating margin profit margin of 20.1%, up 2.1 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

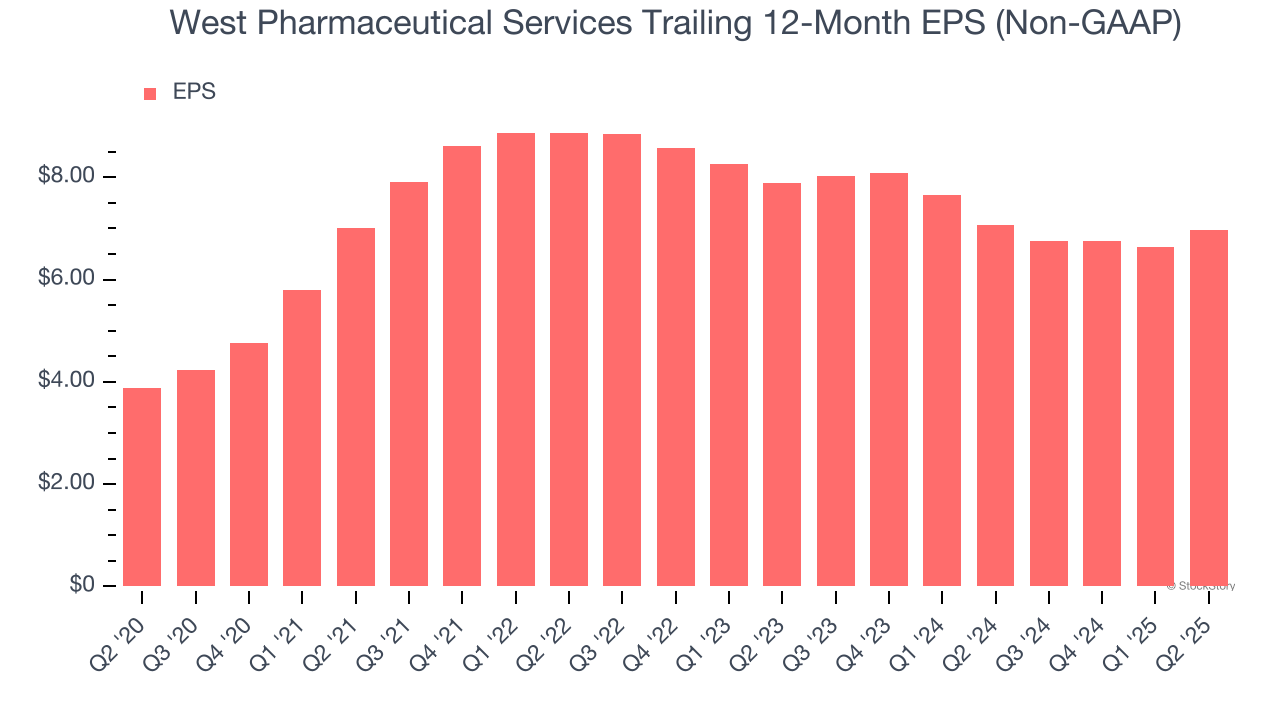

West Pharmaceutical Services’s EPS grew at a spectacular 12.4% compounded annual growth rate over the last five years, higher than its 8.8% annualized revenue growth. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t improve.

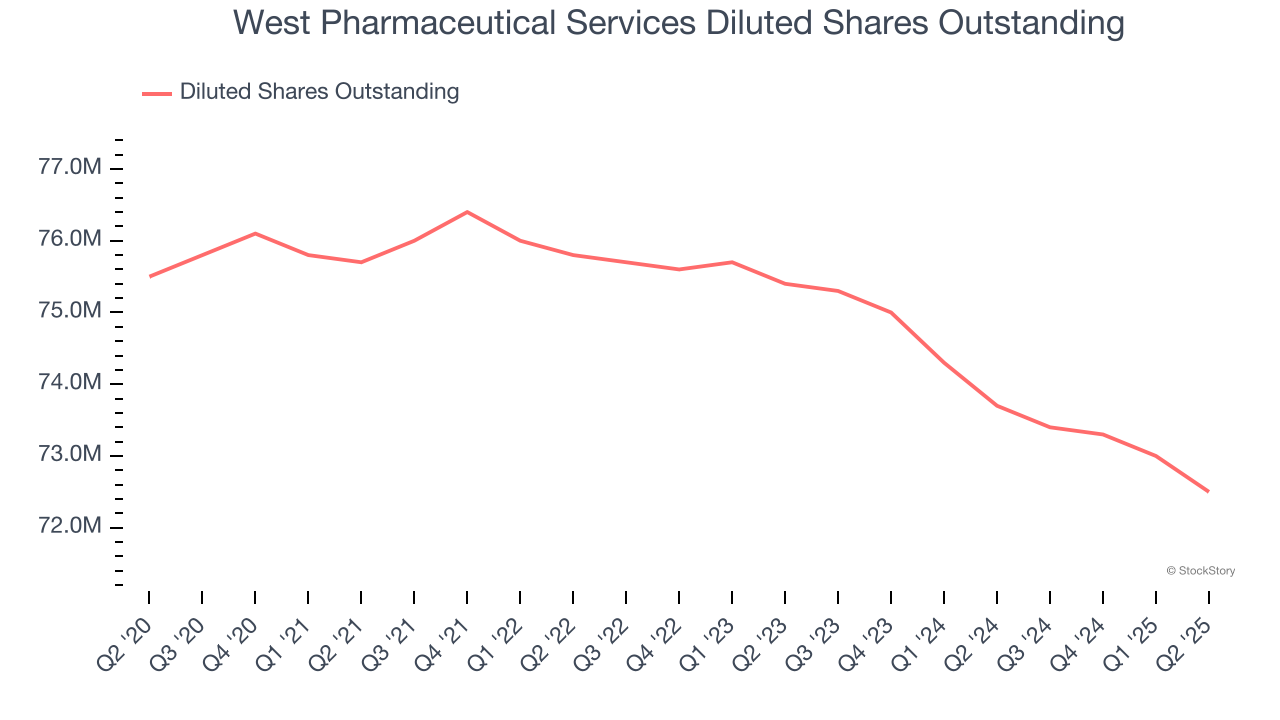

Diving into the nuances of West Pharmaceutical Services’s earnings can give us a better understanding of its performance. A five-year view shows that West Pharmaceutical Services has repurchased its stock, shrinking its share count by 4%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q2, West Pharmaceutical Services reported EPS at $1.84, up from $1.52 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects West Pharmaceutical Services’s full-year EPS of $6.96 to shrink by 4.8%.

Key Takeaways from West Pharmaceutical Services’s Q2 Results

This was a 'beat and raise' quarter. We were impressed by how significantly West Pharmaceutical Services blew past analysts’ revenue expectations this quarter. We were also excited its full-year EPS guidance outperformed Wall Street’s estimates by a wide margin after being raised. Zooming out, we think this was a good print with some key areas of upside. The stock traded up 11.1% to $252.50 immediately following the results.

Indeed, West Pharmaceutical Services had a rock-solid quarterly earnings result, but is this stock a good investment here? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.