As the Q1 earnings season comes to a close, it’s time to take stock of this quarter’s best and worst performers in the apparel and accessories industry, including Oxford Industries (NYSE: OXM) and its peers.

Thanks to social media and the internet, not only are styles changing more frequently today than in decades past but also consumers are shifting the way they buy their goods, favoring omnichannel and e-commerce experiences. Some apparel and accessories companies have made concerted efforts to adapt while those who are slower to move may fall behind.

The 17 apparel and accessories stocks we track reported a strong Q1. As a group, revenues beat analysts’ consensus estimates by 1.7% while next quarter’s revenue guidance was 0.5% below.

Thankfully, share prices of the companies have been resilient as they are up 8.4% on average since the latest earnings results.

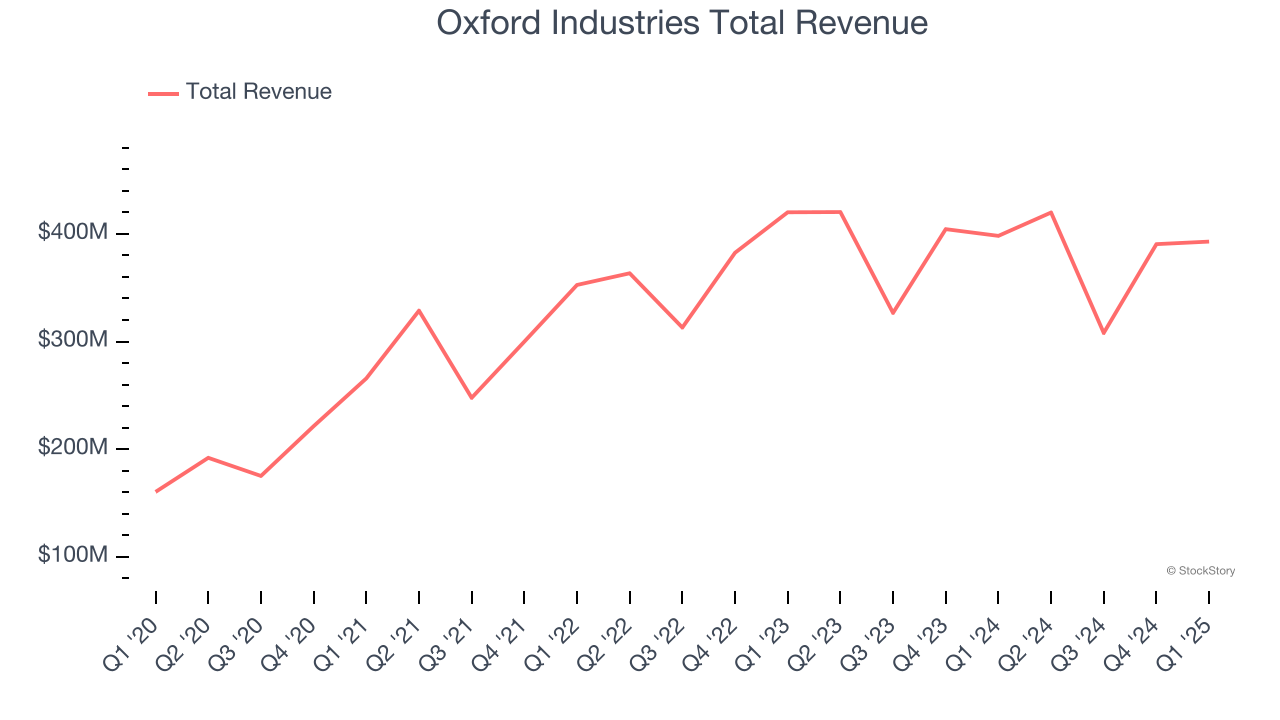

Oxford Industries (NYSE: OXM)

The parent company of Tommy Bahama, Oxford Industries (NYSE: OXM) is a lifestyle fashion conglomerate with brands that embody outdoor happiness.

Oxford Industries reported revenues of $392.9 million, down 1.3% year on year. This print exceeded analysts’ expectations by 2.1%. Despite the top-line beat, it was still a slower quarter for the company with full-year EPS guidance missing analysts’ expectations significantly and EPS guidance for next quarter missing analysts’ expectations significantly.

Tom Chubb, Chairman and CEO, commented, “We were able to deliver sales and adjusted EPS within our guidance ranges for the first quarter despite uncertain tariff and trade dynamics that are significantly impacting our industry and operating landscape. Despite the increasing headwinds, we were led by a low double digit increase at Lilly Pulitzer as the brand’s current assortment is resonating strongly with its core consumer, and overall sales were only modestly lower than last year. At the same time, we were able to maintain strong gross margins above 64%."

Unsurprisingly, the stock is down 9.7% since reporting and currently trades at $45.20.

Read our full report on Oxford Industries here, it’s free.

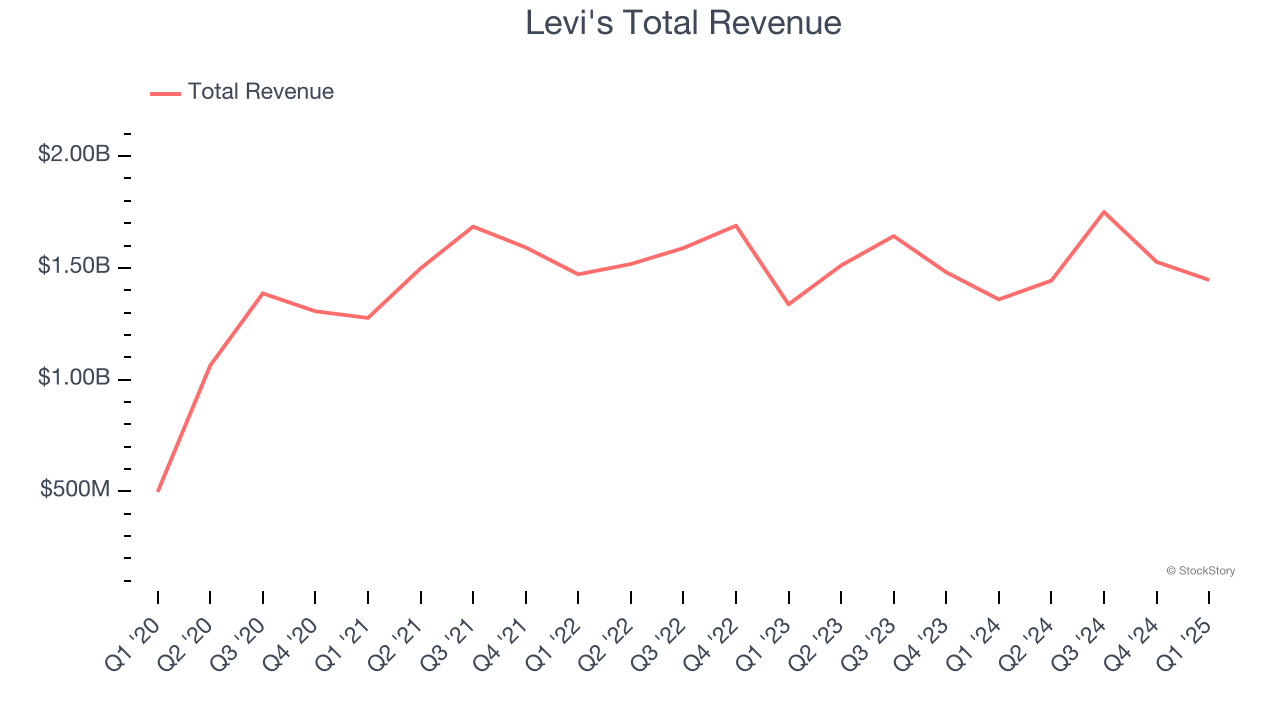

Best Q1: Levi's (NYSE: LEVI)

Credited for inventing the first pair of blue jeans in 1873, Levi's (NYSE: LEVI) is an apparel company renowned for its iconic denim products and classic American style.

Levi's reported revenues of $1.45 billion, up 6.4% year on year, outperforming analysts’ expectations by 5.8%. The business had an exceptional quarter with a solid beat of analysts’ constant currency revenue estimates and an impressive beat of analysts’ EPS estimates.

Levi's scored the biggest analyst estimates beat among its peers. The market seems happy with the results as the stock is up 6% since reporting. It currently trades at $20.93.

Is now the time to buy Levi's? Access our full analysis of the earnings results here, it’s free.

Weakest Q1: Movado (NYSE: MOV)

With its watches displayed in 20 museums around the world, Movado (NYSE: MOV) is a watchmaking company with a portfolio of watch brands and accessories.

Movado reported revenues of $131.8 million, down 1.9% year on year, falling short of analysts’ expectations by 7.3%. It was a disappointing quarter as it posted a significant miss of analysts’ EPS estimates.

Movado delivered the weakest performance against analyst estimates in the group. As expected, the stock is down 5.5% since the results and currently trades at $16.49.

Read our full analysis of Movado’s results here.

Columbia Sportswear (NASDAQ: COLM)

Originally founded as a hat store in 1938, Columbia Sportswear (NASDAQ: COLM) is a manufacturer of outerwear, sportswear, and footwear designed for outdoor enthusiasts.

Columbia Sportswear reported revenues of $778.5 million, up 1.1% year on year. This result beat analysts’ expectations by 2.9%. It was a strong quarter as it also logged an impressive beat of analysts’ constant currency revenue estimates and a solid beat of analysts’ EPS estimates.

The stock is flat since reporting and currently trades at $61.96.

Read our full, actionable report on Columbia Sportswear here, it’s free.

ThredUp (NASDAQ: TDUP)

Founded to revolutionize thrifting, ThredUp (NASDAQ: TDUP) is a leading online fashion resale marketplace offering a wide selection of gently-used clothing and accessories.

ThredUp reported revenues of $71.29 million, up 10.5% year on year. This number topped analysts’ expectations by 4.4%. Overall, it was an exceptional quarter as it also produced a solid beat of analysts’ EBITDA estimates and a solid beat of analysts’ adjusted operating income estimates.

ThredUp achieved the fastest revenue growth among its peers. The stock is up 82.8% since reporting and currently trades at $8.10.

Read our full, actionable report on ThredUp here, it’s free.

Market Update

Thanks to the Fed’s series of rate hikes in 2022 and 2023, inflation has cooled significantly from its post-pandemic highs, drawing closer to the 2% goal. This disinflation has occurred without severely impacting economic growth, suggesting the success of a soft landing. The stock market thrived in 2024, spurred by recent rate cuts (0.5% in September and 0.25% in November), and a notable surge followed Donald Trump’s presidential election win in November, propelling indices to historic highs. Nonetheless, the outlook for 2025 remains clouded by potential trade policy changes and corporate tax discussions, which could impact business confidence and growth. The path forward holds both optimism and caution as new policies take shape.

Want to invest in winners with rock-solid fundamentals? Check out our Hidden Gem Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory is growing and hiring equity analyst and marketing roles. Are you a 0 to 1 builder passionate about the markets and AI? See the open roles here.