Household products company Spectrum Brands (NYSE: SPB) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 6% year on year to $675.7 million. Its non-GAAP profit of $0.68 per share was 50.7% below analysts’ consensus estimates.

Is now the time to buy Spectrum Brands? Find out by accessing our full research report, it’s free.

Spectrum Brands (SPB) Q1 CY2025 Highlights:

- Revenue: $675.7 million vs analyst estimates of $691.1 million (6% year-on-year decline, 2.2% miss)

- Adjusted EPS: $0.68 vs analyst expectations of $1.38 (50.7% miss)

- Adjusted EBITDA: $71.3 million vs analyst estimates of $86.47 million (10.6% margin, 17.5% miss)

- Operating Margin: 2.9%, down from 10.6% in the same quarter last year

- Free Cash Flow was $13.9 million, up from -$9 million in the same quarter last year

- Organic Revenue fell 4.6% year on year (-1.6% in the same quarter last year)

- Market Capitalization: $1.63 billion

“In response to the most recent tariff pressures, we pivoted our operating strategy to maximize cash. In addition, we have paused the import of virtually all finished goods purchases from China until the tariff levels decline to an amount where we can maintain our profitability and margins. I am happy to report that the transition of supply for the U.S. market out of China for our H&G and GPC businesses is happening relatively quickly. For H&G, we expect to have virtually eliminated this exposure by fiscal year-end. For GPC, after beginning the fiscal year with approximately $100 million of U.S. bound product purchases from China, we expect to reduce that exposure to approximately $20 million by fiscal year-end. Our HPC business faces more of a challenge, and our teams are accelerating plans to supply appliances from lower-tariffed countries. On the positive front, HPC is our most globalized business and historically approximately 80% of its profits come from outside of the U.S. market. Our best in class operations teams are hard at work securing new sources from outside of China. We believe that our long-standing relationships with suppliers and strong financial position will result in suppliers prioritizing our products in the transition out of China,” said David Maura, Chairman and Chief Executive Officer of Spectrum Brands.

Company Overview

A leader in multiple consumer product categories, Spectrum Brands (NYSE: SPB) is a diversified company with a portfolio of trusted brands spanning home appliances, garden care, personal care, and pet care.

Sales Growth

A company’s long-term performance is an indicator of its overall quality. Any business can put up a good quarter or two, but the best consistently grow over the long haul.

With $2.93 billion in revenue over the past 12 months, Spectrum Brands carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

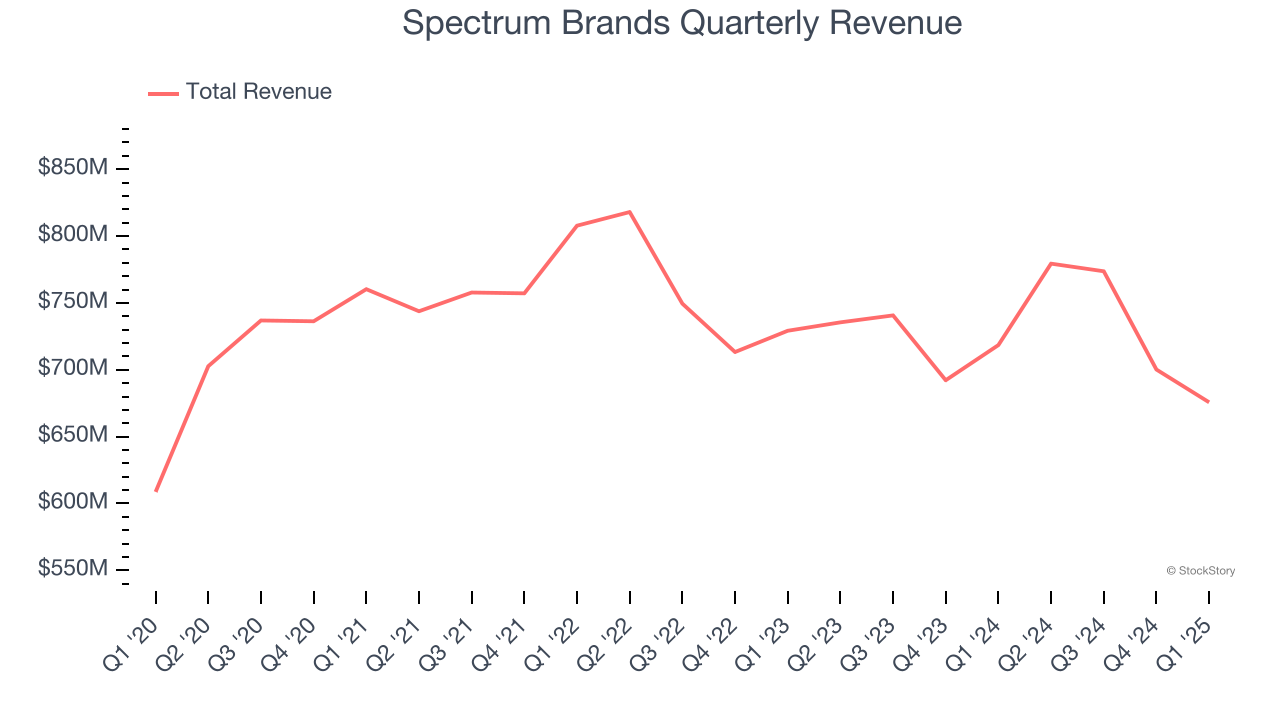

As you can see below, Spectrum Brands struggled to generate demand over the last three years. Its sales dropped by 1.5% annually, a tough starting point for our analysis.

This quarter, Spectrum Brands missed Wall Street’s estimates and reported a rather uninspiring 6% year-on-year revenue decline, generating $675.7 million of revenue.

Looking ahead, sell-side analysts expect revenue to grow 1.4% over the next 12 months. Although this projection implies its newer products will catalyze better top-line performance, it is still below the sector average.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

Organic Revenue Growth

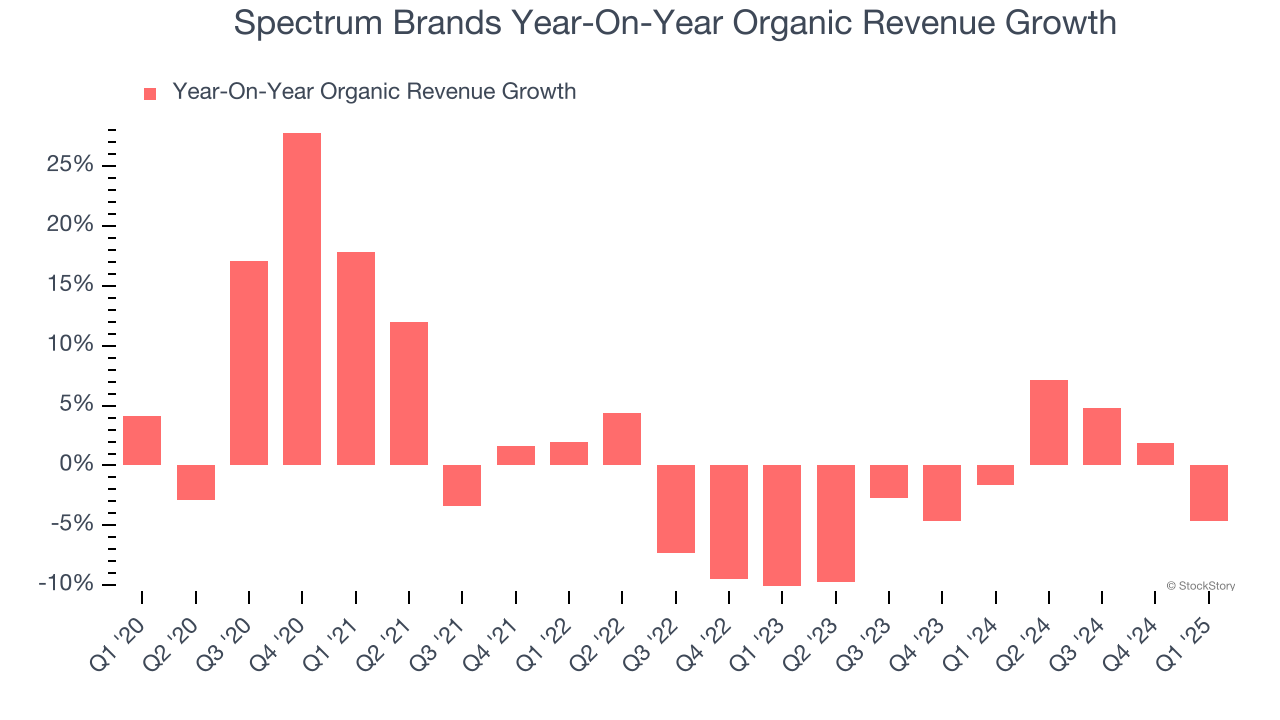

When analyzing revenue growth, we care most about organic revenue growth. This metric captures a business’s performance excluding one-time events such as mergers, acquisitions, and divestitures as well as foreign currency fluctuations.

Spectrum Brands’s demand has been falling over the last eight quarters, and on average, its organic sales have declined by 1.2% year on year.

In the latest quarter, Spectrum Brands’s organic sales fell by 4.6% year on year. This decrease represents a further deceleration from its historical levels. We hope the business can get back on track.

Key Takeaways from Spectrum Brands’s Q1 Results

We struggled to find many positives in these results. Its EBITDA missed significantly and its EPS fell short of Wall Street’s estimates. Overall, this was a weaker quarter. The stock traded down 6.6% to $57.74 immediately following the results.

Spectrum Brands’s earnings report left more to be desired. Let’s look forward to see if this quarter has created an opportunity to buy the stock. What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.