Shareholders of Saia would probably like to forget the past six months even happened. The stock dropped 53.3% and now trades at $254.53. This was partly due to its softer quarterly results and may have investors wondering how to approach the situation.

Is there a buying opportunity in Saia, or does it present a risk to your portfolio? Check out our in-depth research report to see what our analysts have to say, it’s free.

Why Is Saia Not Exciting?

Even though the stock has become cheaper, we're sitting this one out for now. Here are three reasons why SAIA doesn't excite us and a stock we'd rather own.

1. Weak Sales Volumes Indicate Waning Demand

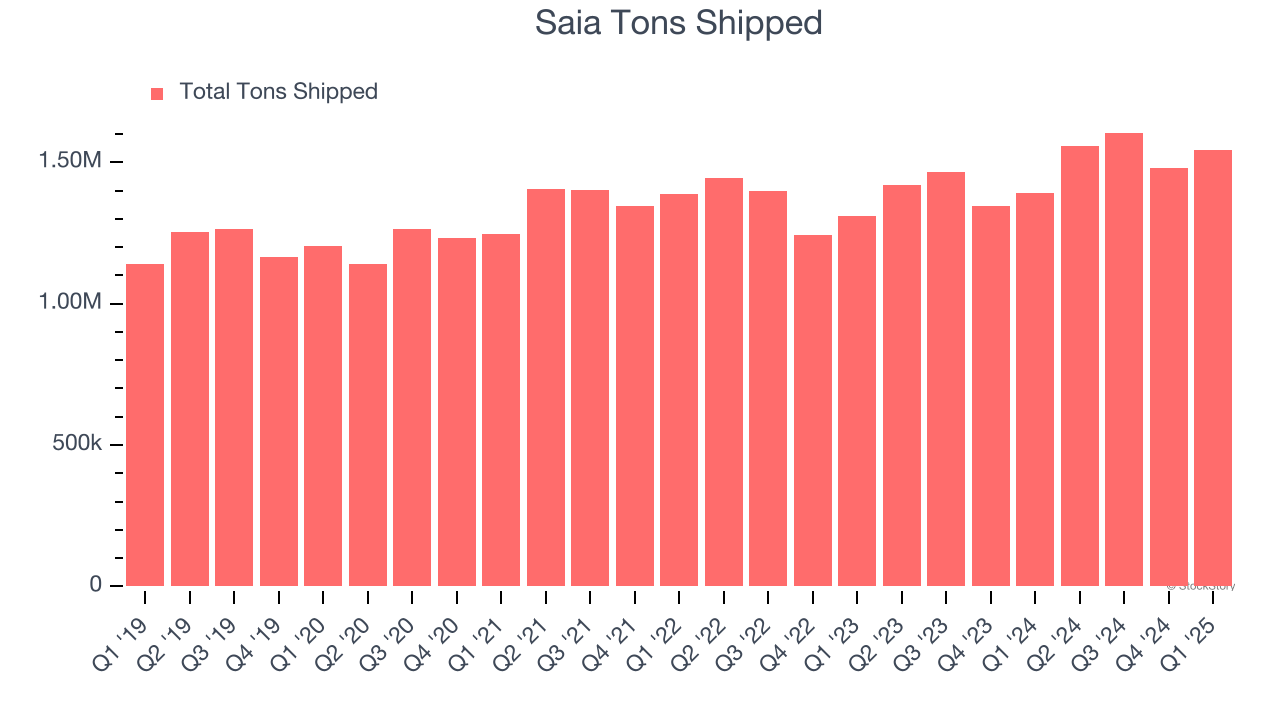

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful Ground Transportation company because there’s a ceiling to what customers will pay.

Saia’s tons shipped came in at 1.55 million in the latest quarter, and over the last two years, averaged 7.2% year-on-year growth. This performance slightly lagged the sector and suggests it might have to lower prices or invest in product improvements to accelerate growth, factors that can hinder near-term profitability.

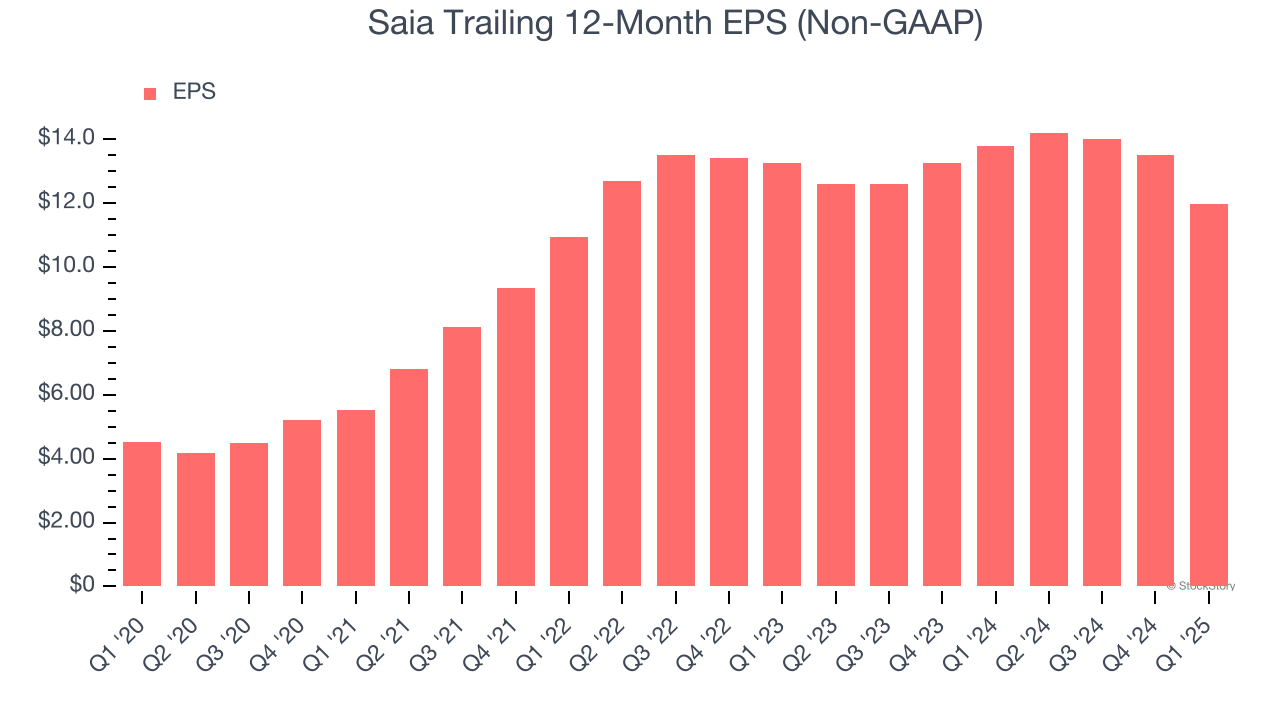

2. EPS Took a Dip Over the Last Two Years

Although long-term earnings trends give us the big picture, we like to analyze EPS over a shorter period to see if we are missing a change in the business.

Sadly for Saia, its EPS declined by 5% annually over the last two years while its revenue grew by 7.8%. This tells us the company became less profitable on a per-share basis as it expanded.

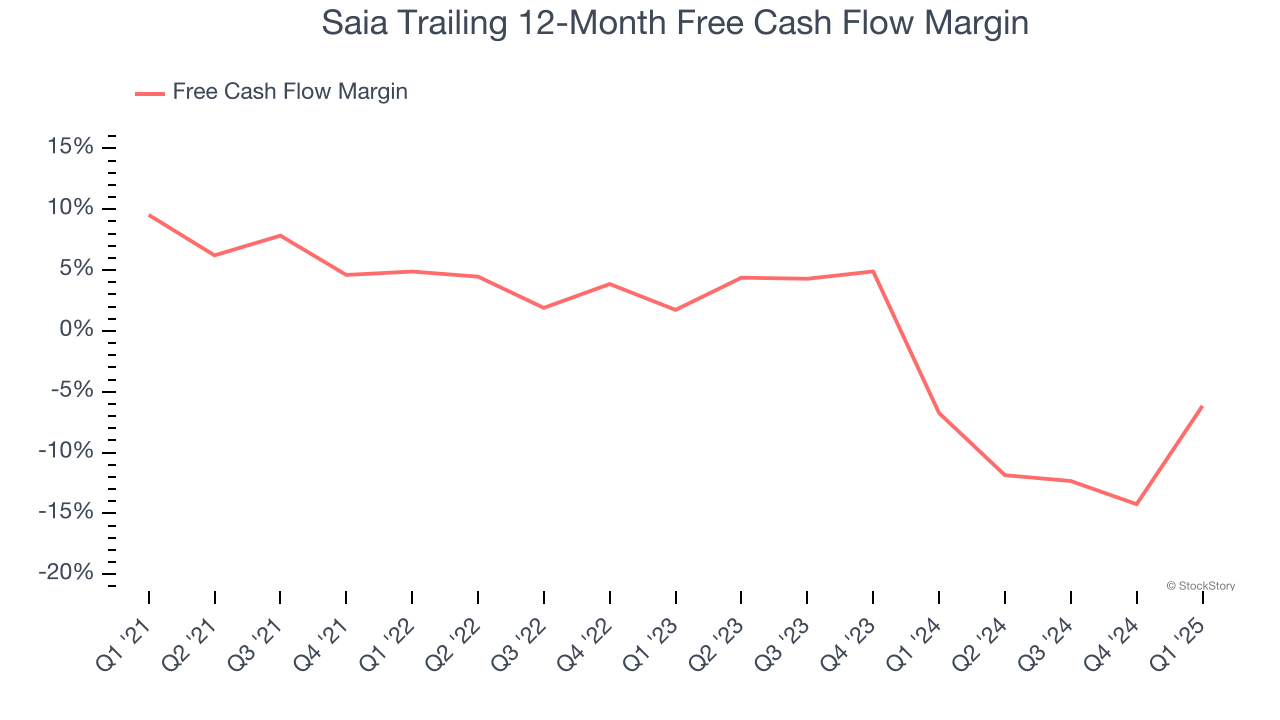

3. Free Cash Flow Margin Dropping

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

As you can see below, Saia’s margin dropped by 15.7 percentage points over the last five years. Almost any movement in the wrong direction is undesirable because of its already low cash conversion. If the trend continues, it could signal it’s becoming a more capital-intensive business. Saia’s free cash flow margin for the trailing 12 months was negative 6.2%.

Final Judgment

Saia’s business quality ultimately falls short of our standards. Following the recent decline, the stock trades at 16.3× forward P/E (or $254.53 per share). Beauty is in the eye of the beholder, but our analysis shows the upside isn’t great compared to the potential downside. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at a top digital advertising platform riding the creator economy.

Stocks That Overcame Trump’s 2018 Tariffs

Market indices reached historic highs following Donald Trump’s presidential victory in November 2024, but the outlook for 2025 is clouded by new trade policies that could impact business confidence and growth.

While this has caused many investors to adopt a "fearful" wait-and-see approach, we’re leaning into our best ideas that can grow regardless of the political or macroeconomic climate. Take advantage of Mr. Market by checking out our Top 5 Strong Momentum Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Comfort Systems (+751% five-year return). Find your next big winner with StockStory today.