Let’s dig into the relative performance of Victoria's Secret (NYSE: VSCO) and its peers as we unravel the now-completed Q4 apparel retailer earnings season.

Apparel sales are not driven so much by personal needs but by seasons, trends, and innovation, and over the last few decades, the category has shifted meaningfully online. Retailers that once only had brick-and-mortar stores are responding with omnichannel presences. The online shopping experience continues to improve and retail foot traffic in places like shopping malls continues to stall, so the evolution of clothing sellers marches on.

The 9 apparel retailer stocks we track reported a satisfactory Q4. As a group, revenues were in line with analysts’ consensus estimates while next quarter’s revenue guidance was 1.6% below.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 11.5% since the latest earnings results.

Victoria's Secret (NYSE: VSCO)

Spun off from L Brands in 2020, Victoria’s Secret (NYSE: VSCO) is an intimate clothing and beauty retailer that sells its own brands of lingerie, undergarments, and personal fragrances.

Victoria's Secret reported revenues of $2.11 billion, up 1.1% year on year. This print exceeded analysts’ expectations by 1%. Overall, it was a strong quarter for the company with an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ EPS estimates.

“I am pleased with the strength of our fourth quarter holiday results, which saw sales up in both our Victoria’s Secret and PINK brands and our powerhouse Beauty business. Sales increased across most major merchandise categories, in our stores and digital channels, and in both our North America and International businesses. We won in the big moments of the quarter and gained more than our fair share of the traffic in the mall and online. The teams focused on execution and drove healthy margins, controlled costs, and managed inventory levels extremely well in a highly competitive and promotional holiday environment,” said VS&Co CEO Hillary Super.

Victoria's Secret delivered the weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 13.9% since reporting and currently trades at $19.10.

Is now the time to buy Victoria's Secret? Access our full analysis of the earnings results here, it’s free.

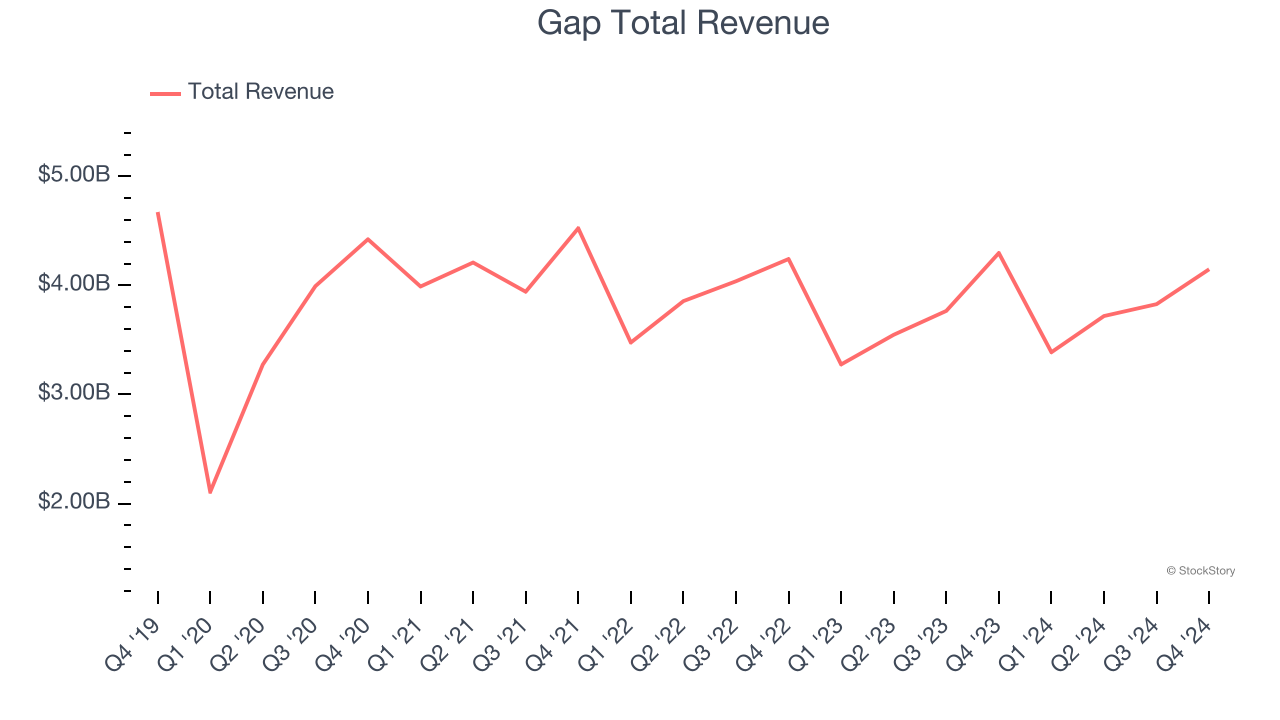

Best Q4: Gap (NYSE: GAP)

Operating under the Gap, Old Navy, Banana Republic, and Athleta brands, Gap (NYSE: GAP) is an apparel and accessories retailer selling casual clothing to men, women, and children.

Gap reported revenues of $4.15 billion, down 3.5% year on year, outperforming analysts’ expectations by 1.9%. The business had a very strong quarter with an impressive beat of analysts’ EPS estimates and an impressive beat of analysts’ EBITDA estimates.

The market seems happy with the results as the stock is up 15.9% since reporting. It currently trades at $22.60.

Is now the time to buy Gap? Access our full analysis of the earnings results here, it’s free.

Weakest Q4: Abercrombie and Fitch (NYSE: ANF)

Founded as an outdoor and sporting brand, Abercrombie & Fitch (NYSE: ANF) evolved to become a specialty retailer that sells its own brand of fashionable clothing to young adults.

Abercrombie and Fitch reported revenues of $1.58 billion, up 9.1% year on year, exceeding analysts’ expectations by 1.2%. Still, it was a slower quarter as it posted EPS guidance for next quarter missing analysts’ expectations significantly and a miss of analysts’ gross margin estimates.

As expected, the stock is down 28.6% since the results and currently trades at $68.62.

Read our full analysis of Abercrombie and Fitch’s results here.

Lululemon (NASDAQ: LULU)

Originally serving yogis and hockey players, Lululemon (NASDAQ: LULU) is a designer, distributor, and retailer of athletic apparel for men and women.

Lululemon reported revenues of $3.61 billion, up 12.7% year on year. This result beat analysts’ expectations by 0.8%. Taking a step back, it was a mixed quarter as it also recorded a solid beat of analysts’ EBITDA estimates but EPS guidance for next quarter missing analysts’ expectations significantly.

Lululemon scored the fastest revenue growth among its peers. The stock is down 18.5% since reporting and currently trades at $278.48.

Read our full, actionable report on Lululemon here, it’s free.

Urban Outfitters (NASDAQ: URBN)

Founded as a purveyor of vintage items, Urban Outfitters (NASDAQ: URBN) now largely sells new apparel and accessories to teens and young adults seeking on-trend fashion.

Urban Outfitters reported revenues of $1.64 billion, up 9.4% year on year. This print was in line with analysts’ expectations. It was a very strong quarter as it also recorded an impressive beat of analysts’ EBITDA estimates and a solid beat of analysts’ gross margin estimates.

The stock is up 3.8% since reporting and currently trades at $55.

Read our full, actionable report on Urban Outfitters here, it’s free.

Market Update

As a result of the Fed’s rate hikes in 2022 and 2023, inflation has come down from frothy levels post-pandemic. The general rise in the price of goods and services is trending towards the Fed’s 2% goal as of late, which is good news. The higher rates that fought inflation also didn't slow economic activity enough to catalyze a recession. So far, soft landing. This, combined with recent rate cuts (half a percent in September 2024 and a quarter percent in November 2024) have led to strong stock market performance in 2024. The icing on the cake for 2024 returns was Donald Trump’s victory in the U.S. Presidential Election in early November, sending major indices to all-time highs in the week following the election. Still, debates around the health of the economy and the impact of potential tariffs and corporate tax cuts remain, leaving much uncertainty around 2025.

Want to invest in winners with rock-solid fundamentals? Check out our Strong Momentum Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

Join Paid Stock Investor Research

Help us make StockStory more helpful to investors like yourself. Join our paid user research session and receive a $50 Amazon gift card for your opinions. Sign up here.