Healthcare tech company Premier (NASDAQ: PINC) beat Wall Street’s revenue expectations in Q1 CY2025, but sales fell by 23.7% year on year to $261.4 million. On the other hand, the company’s full-year revenue guidance of $975 million at the midpoint came in 1.2% below analysts’ estimates. Its non-GAAP profit of $0.44 per share was 45% above analysts’ consensus estimates.

Is now the time to buy Premier? Find out by accessing our full research report, it’s free.

Premier (PINC) Q1 CY2025 Highlights:

- Revenue: $261.4 million vs analyst estimates of $243.4 million (23.7% year-on-year decline, 7.4% beat)

- Adjusted EPS: $0.44 vs analyst estimates of $0.30 (45% beat)

- Adjusted EBITDA: $71.75 million vs analyst estimates of $60.09 million (27.4% margin, 19.4% beat)

- The company reconfirmed its revenue guidance for the full year of $975 million at the midpoint

- Management raised its full-year Adjusted EPS guidance to $1.40 at the midpoint, a 7.7% increase

- EBITDA guidance for the full year is $251 million at the midpoint, above analyst estimates of $242 million

- Operating Margin: 12.9%, up from -23% in the same quarter last year

- Free Cash Flow Margin: 41.1%, up from 39.8% in the same quarter last year

- Market Capitalization: $1.87 billion

"Our overall revenue and profitability grew sequentially and exceeded our expectations for the third quarter largely due to better-than-anticipated results in our Supply Chain Services segment," said Michael J. Alkire, Premier's President and CEO.

Company Overview

Operating one of the largest healthcare group purchasing organizations in the United States with over 4,350 hospital members, Premier (NASDAQ: PINC) is a technology-driven healthcare improvement company that helps hospitals, health systems, and other providers reduce costs and improve clinical outcomes.

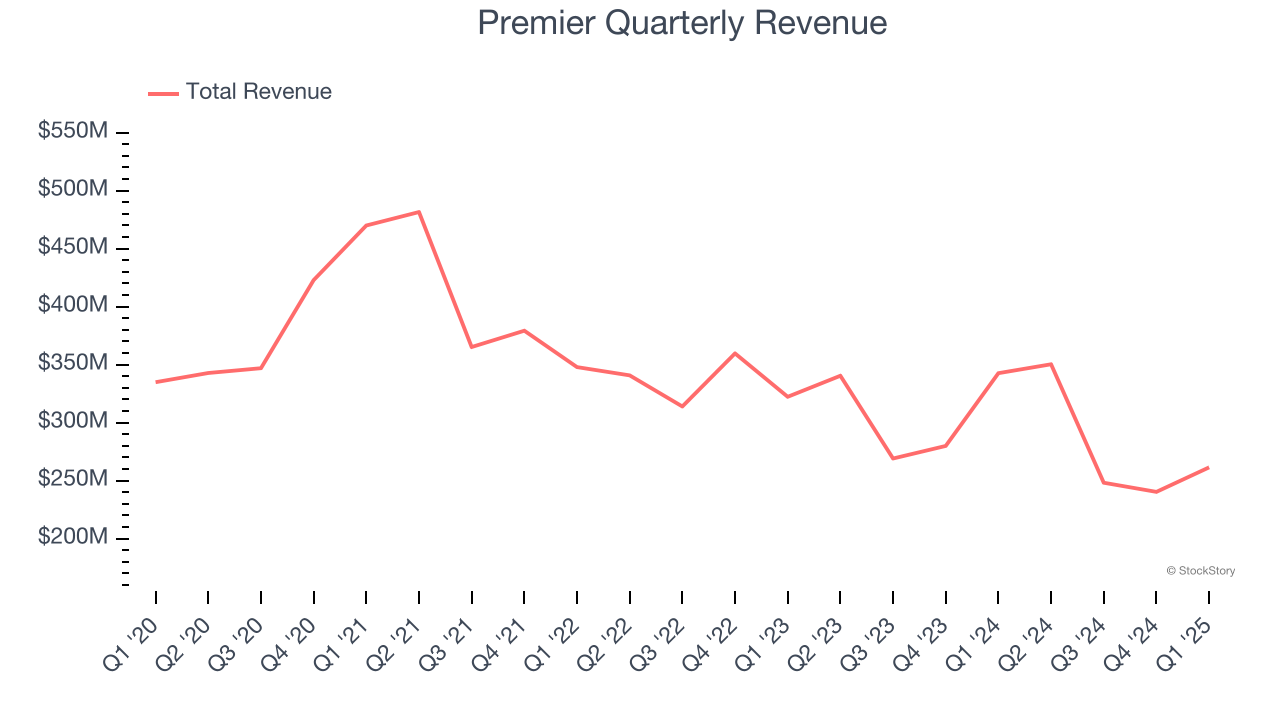

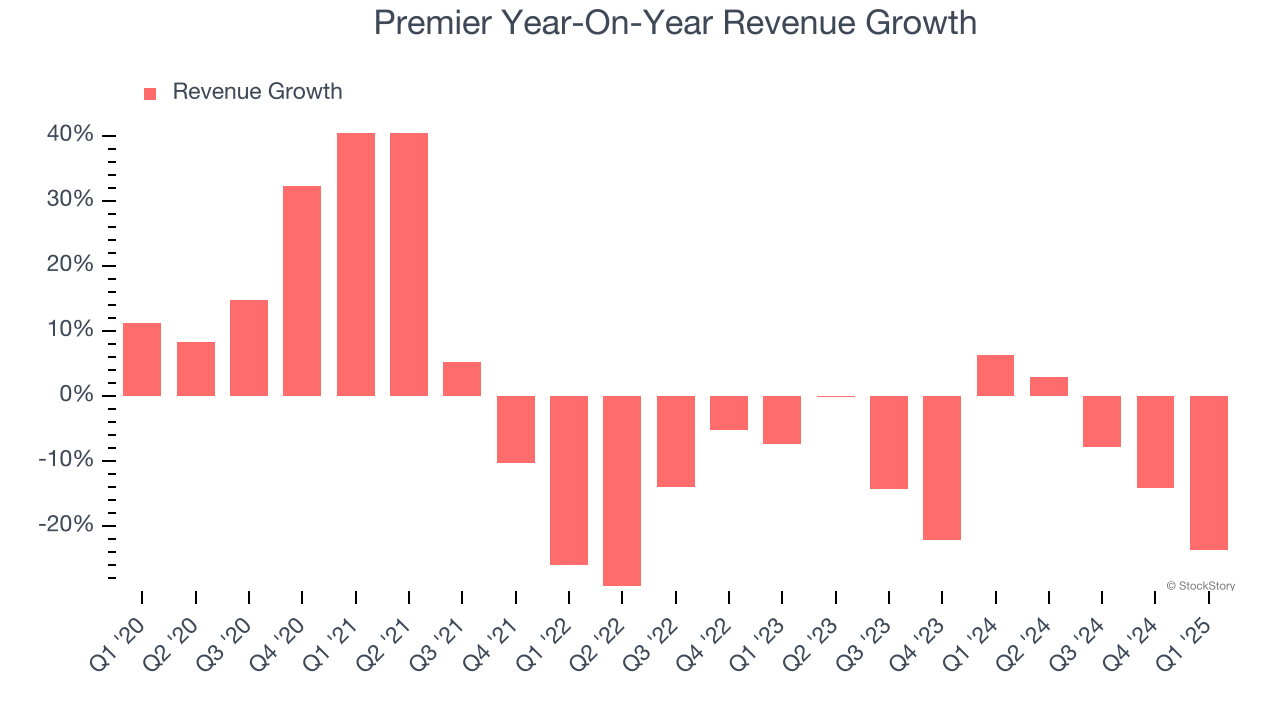

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Premier struggled to consistently generate demand over the last five years as its sales dropped at a 2.9% annual rate. This wasn’t a great result and suggests it’s a low quality business.

Long-term growth is the most important, but within healthcare, a half-decade historical view may miss new innovations or demand cycles. Premier’s recent performance shows its demand remained suppressed as its revenue has declined by 9.3% annually over the last two years.

Premier also breaks out the revenue for its most important segments, Supply Chain and Performance Service, which are 61.6% and 38.4% of revenue. Over the last two years, Premier’s Supply Chain revenue averaged 12.2% year-on-year declines while its Performance Service revenue averaged 2% declines.

This quarter, Premier’s revenue fell by 23.7% year on year to $261.4 million but beat Wall Street’s estimates by 7.4%.

Looking ahead, sell-side analysts expect revenue to decline by 10.1% over the next 12 months, similar to its two-year rate. This projection doesn't excite us and suggests its newer products and services will not catalyze better top-line performance yet.

Unless you’ve been living under a rock, it should be obvious by now that generative AI is going to have a huge impact on how large corporations do business. While Nvidia and AMD are trading close to all-time highs, we prefer a lesser-known (but still profitable) stock benefiting from the rise of AI. Click here to access our free report one of our favorites growth stories.

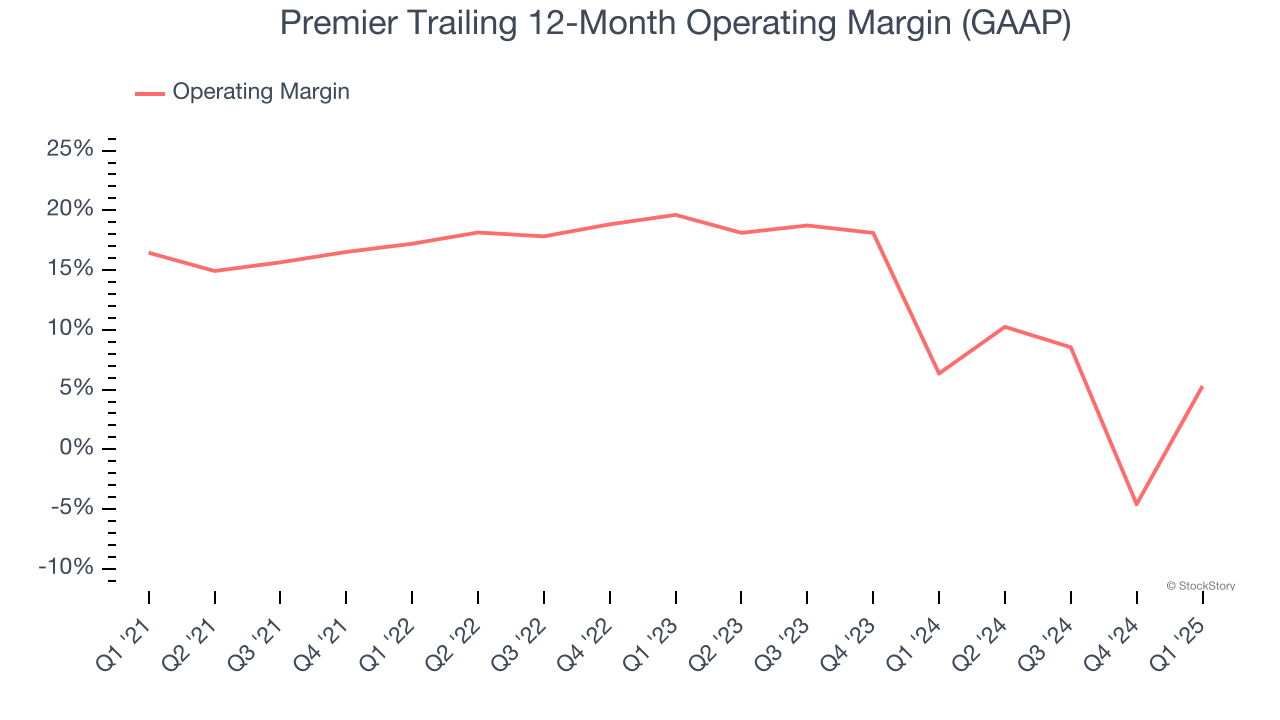

Operating Margin

Operating margin is a key measure of profitability. Think of it as net income - the bottom line - excluding the impact of taxes and interest on debt, which are less connected to business fundamentals.

Premier has done a decent job managing its cost base over the last five years. The company has produced an average operating margin of 13.6%, higher than the broader healthcare sector.

Looking at the trend in its profitability, Premier’s operating margin decreased by 11.2 percentage points over the last five years. This performance was caused by more recent speed bumps as the company’s margin fell by 14.3 percentage points on a two-year basis. We’re disappointed in these results because it shows its expenses were rising and it couldn’t pass those costs onto its customers.

In Q1, Premier generated an operating profit margin of 12.9%, up 35.9 percentage points year on year. This increase was a welcome development, especially since its revenue fell, showing it was more efficient because it scaled down its expenses.

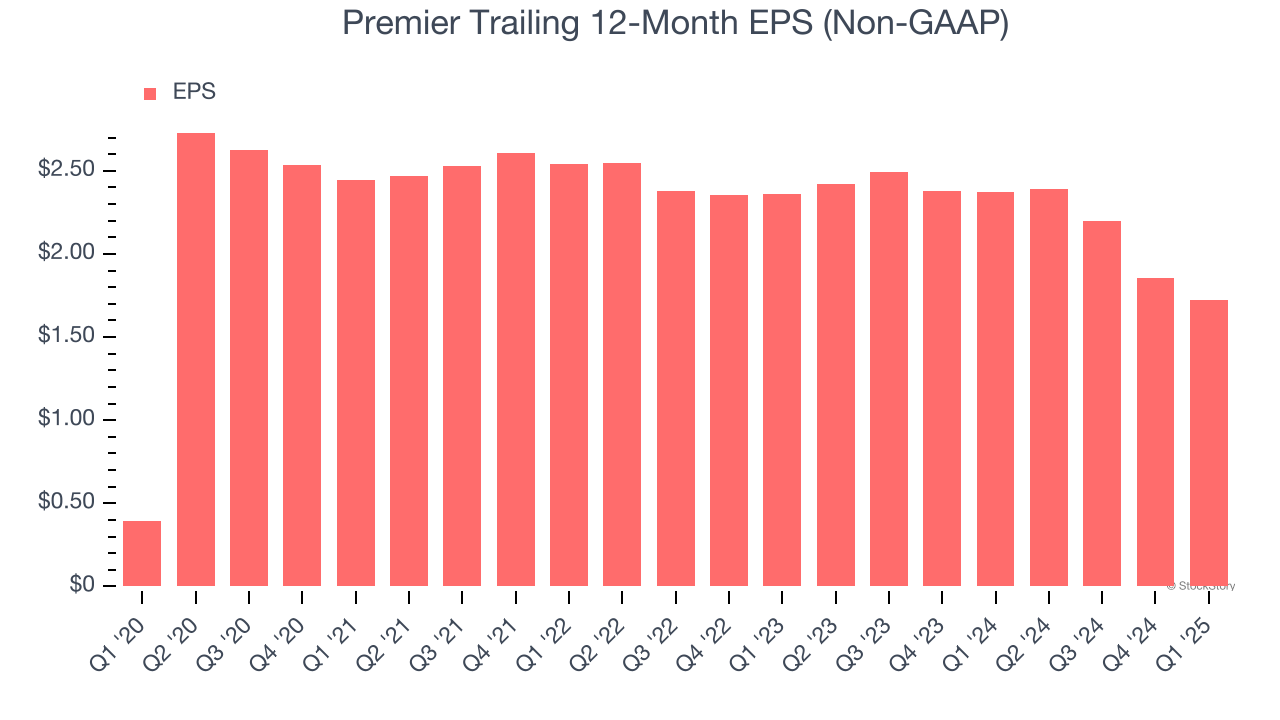

Earnings Per Share

Revenue trends explain a company’s historical growth, but the long-term change in earnings per share (EPS) points to the profitability of that growth – for example, a company could inflate its sales through excessive spending on advertising and promotions.

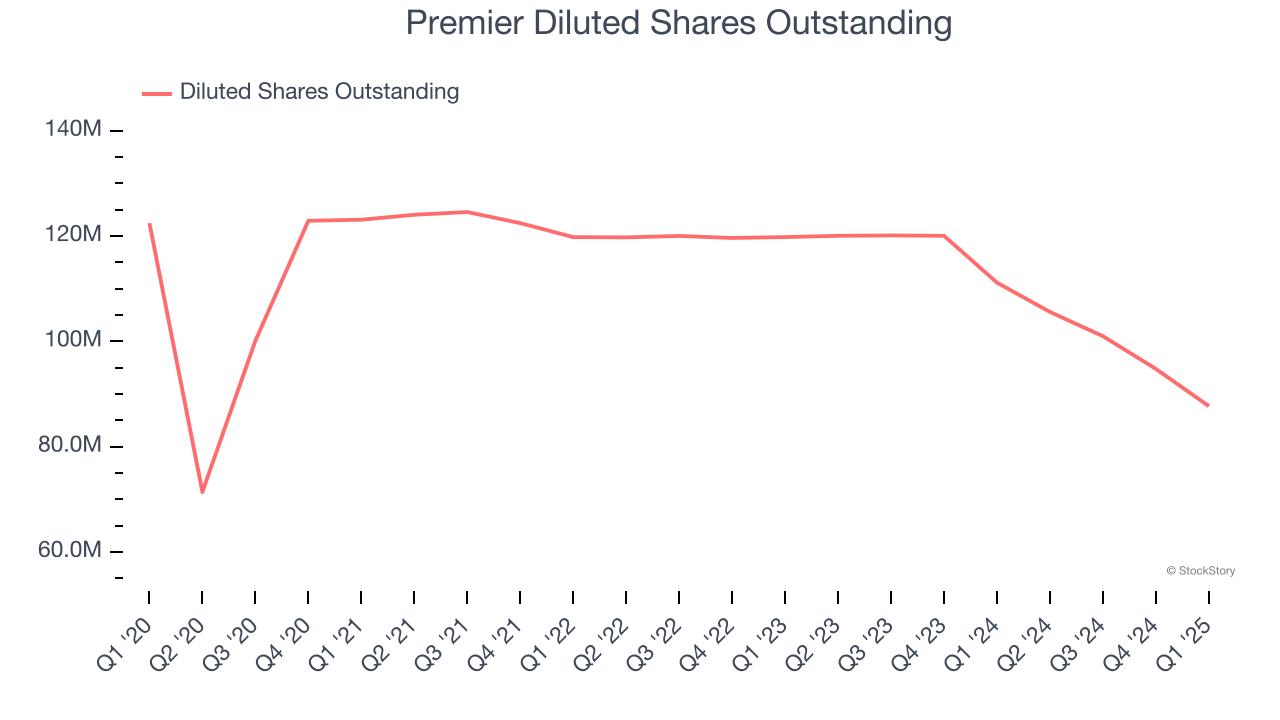

Premier’s EPS grew at an astounding 34.5% compounded annual growth rate over the last five years, higher than its 2.9% annualized revenue declines. However, this alone doesn’t tell us much about its business quality because its operating margin didn’t expand.

We can take a deeper look into Premier’s earnings quality to better understand the drivers of its performance. A five-year view shows that Premier has repurchased its stock, shrinking its share count by 28.4%. This tells us its EPS outperformed its revenue not because of increased operational efficiency but financial engineering, as buybacks boost per share earnings.

In Q1, Premier reported EPS at $0.44, down from $0.57 in the same quarter last year. Despite falling year on year, this print easily cleared analysts’ estimates. Over the next 12 months, Wall Street expects Premier’s full-year EPS of $1.72 to shrink by 21.9%.

Key Takeaways from Premier’s Q1 Results

We were impressed by how significantly Premier blew past analysts’ EPS expectations this quarter. We were also excited its revenue outperformed Wall Street’s estimates by a wide margin. On the other hand, its full-year revenue guidance slightly missed. Zooming out, we think this was a good print with some key areas of upside. The stock remained flat at $20.52 immediately after reporting.

So do we think Premier is an attractive buy at the current price? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.