Healthcare tech company Omnicell (NASDAQ: OMCL) reported Q1 CY2025 results topping the market’s revenue expectations, with sales up 9.6% year on year to $269.7 million. On the other hand, next quarter’s revenue guidance of $275 million was less impressive, coming in 1.8% below analysts’ estimates. Its non-GAAP profit of $0.26 per share was 27.1% above analysts’ consensus estimates.

Is now the time to buy Omnicell? Find out by accessing our full research report, it’s free.

Omnicell (OMCL) Q1 CY2025 Highlights:

- Revenue: $269.7 million vs analyst estimates of $260 million (9.6% year-on-year growth, 3.7% beat)

- Adjusted EPS: $0.26 vs analyst estimates of $0.20 (27.1% beat)

- Adjusted EBITDA: $23.59 million vs analyst estimates of $21.46 million (8.7% margin, 9.9% beat)

- The company reconfirmed its revenue guidance for the full year of $1.13 billion at the midpoint

- Management lowered its full-year Adjusted EPS guidance to $1.33 at the midpoint, a 24.3% decrease

- EBITDA guidance for the full year is $122.5 million at the midpoint, below analyst estimates of $145.1 million

- Operating Margin: -4.3%, up from -8.9% in the same quarter last year

- Free Cash Flow Margin: 3.8%, down from 16.7% in the same quarter last year

- Market Capitalization: $1.43 billion

Company Overview

Driven by the vision of an "Autonomous Pharmacy" with zero medication errors, Omnicell (NASDAQ: OMCL) provides medication management automation and adherence tools that help healthcare systems and pharmacies reduce errors and improve efficiency.

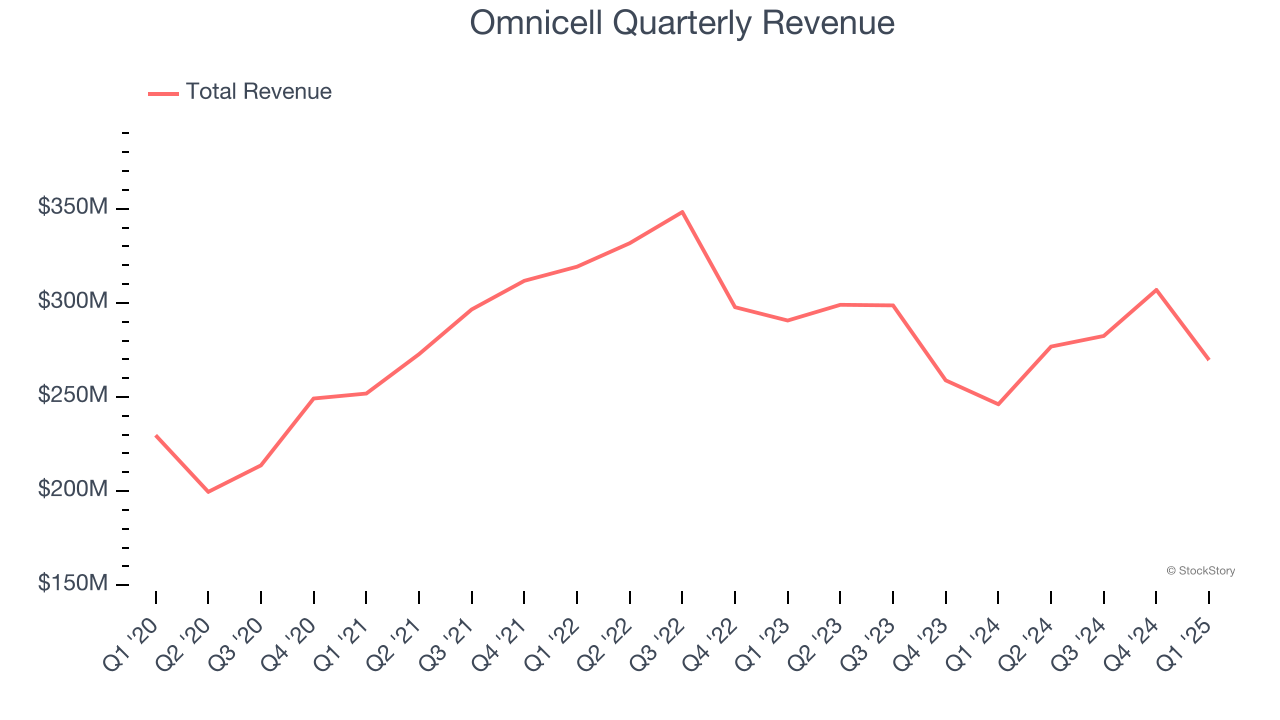

Sales Growth

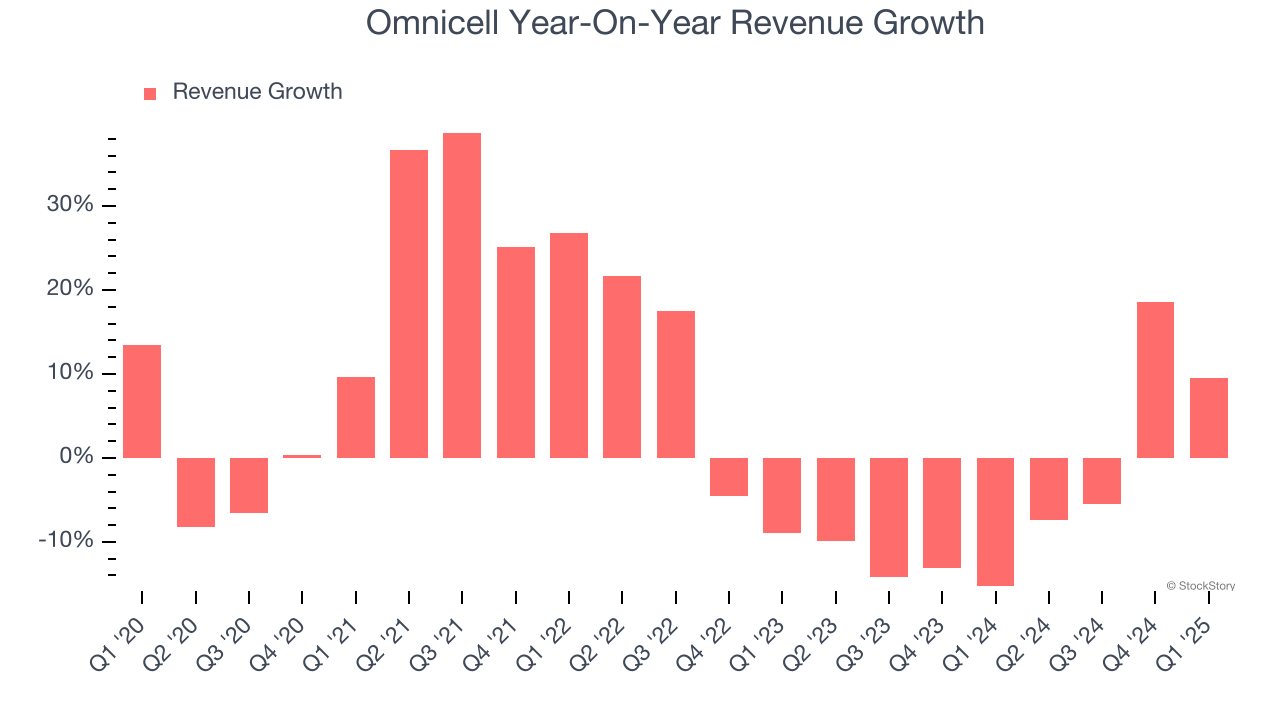

A company’s long-term performance is an indicator of its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last five years, Omnicell grew its sales at a mediocre 4.2% compounded annual growth rate. This was below our standard for the healthcare sector and is a tough starting point for our analysis.

We at StockStory place the most emphasis on long-term growth, but within healthcare, a half-decade historical view may miss recent innovations or disruptive industry trends. Omnicell’s performance shows it grew in the past but relinquished its gains over the last two years, as its revenue fell by 5.4% annually.

We can better understand the company’s revenue dynamics by analyzing its most important segment, Product. Over the last two years, Omnicell’s Product revenue averaged 12% year-on-year declines. This segment has lagged the company’s overall sales.

This quarter, Omnicell reported year-on-year revenue growth of 9.6%, and its $269.7 million of revenue exceeded Wall Street’s estimates by 3.7%. Company management is currently guiding for flat sales next quarter.

Looking further ahead, sell-side analysts expect revenue to remain flat over the next 12 months. Although this projection suggests its newer products and services will fuel better top-line performance, it is still below the sector average.

Here at StockStory, we certainly understand the potential of thematic investing. Diverse winners from Microsoft (MSFT) to Alphabet (GOOG), Coca-Cola (KO) to Monster Beverage (MNST) could all have been identified as promising growth stories with a megatrend driving the growth. So, in that spirit, we’ve identified a relatively under-the-radar profitable growth stock benefiting from the rise of AI, available to you FREE via this link.

Operating Margin

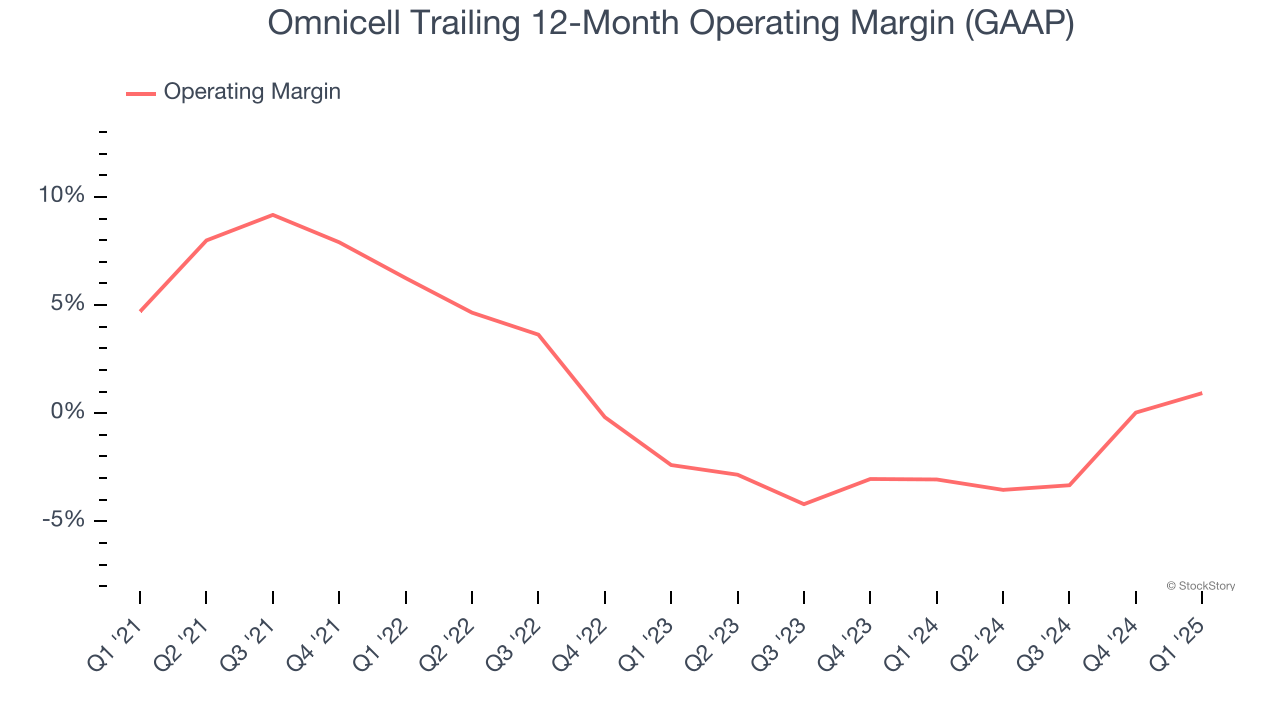

Omnicell was profitable over the last five years but held back by its large cost base. Its average operating margin of 1.1% was weak for a healthcare business.

Looking at the trend in its profitability, Omnicell’s operating margin decreased by 3.8 percentage points over the last five years, but it rose by 3.3 percentage points on a two-year basis. Still, shareholders will want to see Omnicell become more profitable in the future.

This quarter, Omnicell generated an operating profit margin of negative 4.3%, up 4.6 percentage points year on year. This increase was a welcome development and shows it was more efficient.

Earnings Per Share

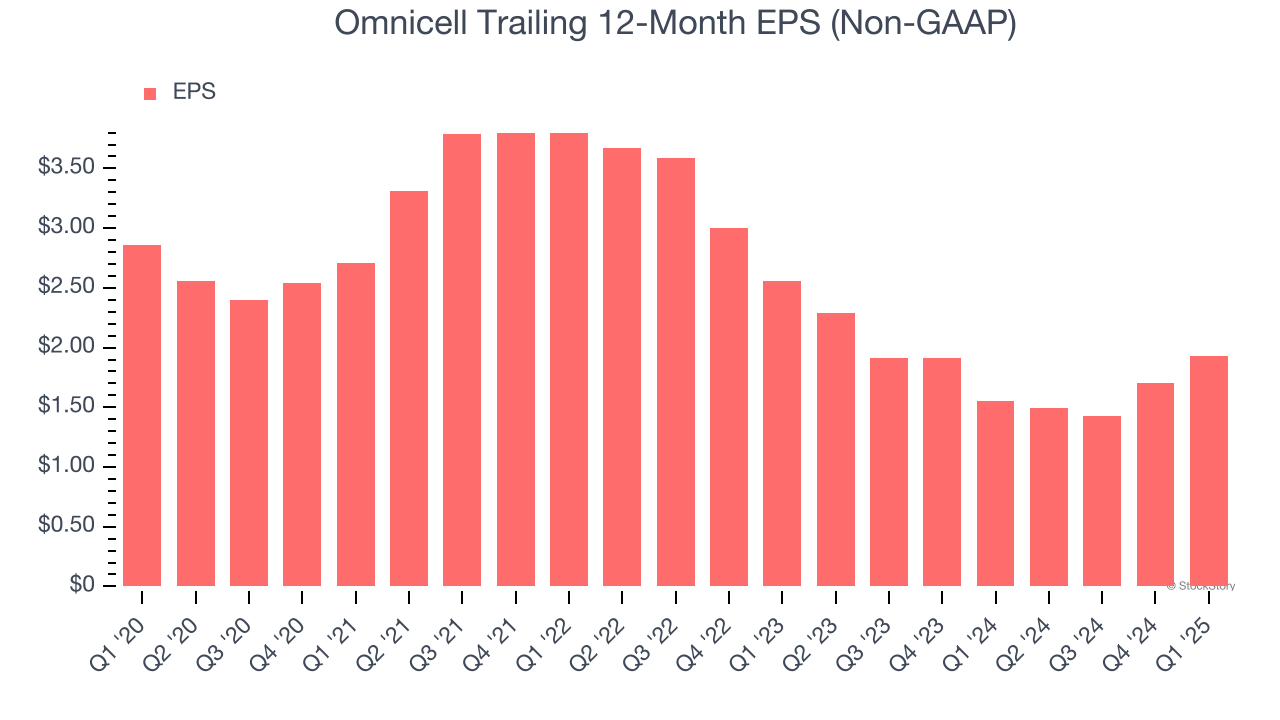

We track the long-term change in earnings per share (EPS) for the same reason as long-term revenue growth. Compared to revenue, however, EPS highlights whether a company’s growth is profitable.

Sadly for Omnicell, its EPS declined by 7.6% annually over the last five years while its revenue grew by 4.2%. This tells us the company became less profitable on a per-share basis as it expanded.

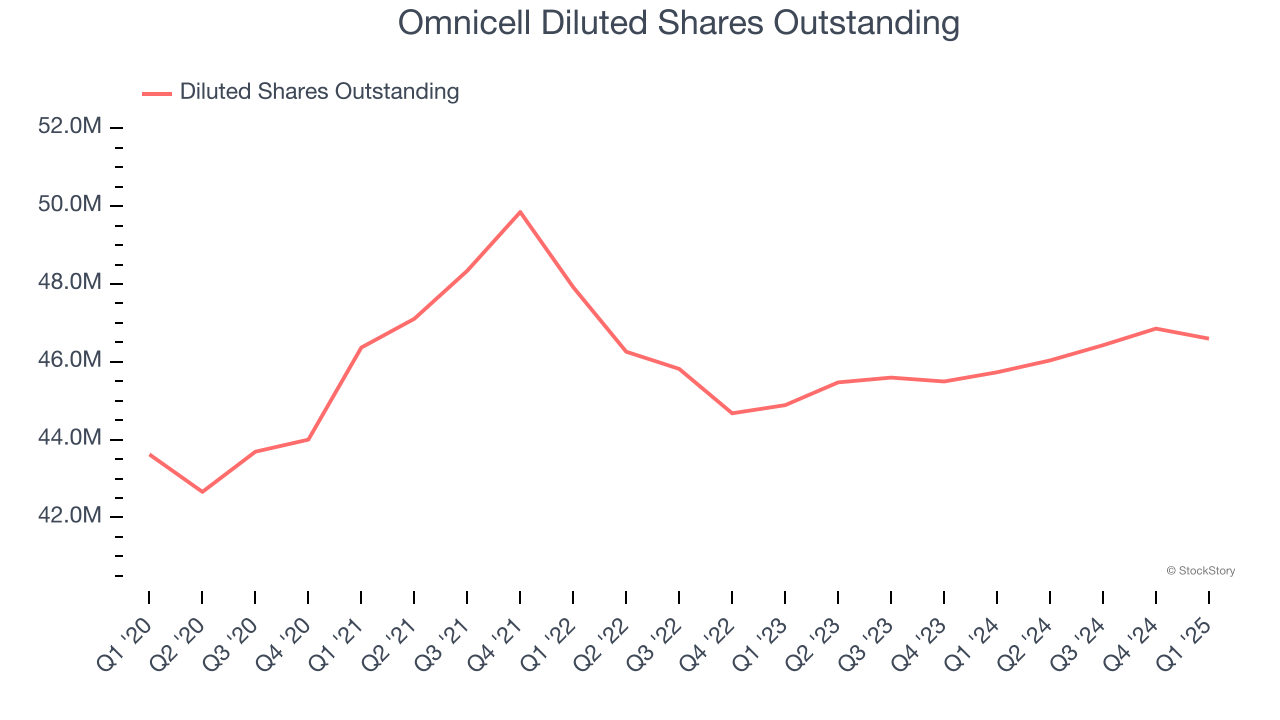

Diving into the nuances of Omnicell’s earnings can give us a better understanding of its performance. As we mentioned earlier, Omnicell’s operating margin improved this quarter but declined by 3.8 percentage points over the last five years. Its share count also grew by 6.8%, meaning the company not only became less efficient with its operating expenses but also diluted its shareholders.

In Q1, Omnicell reported EPS at $0.26, up from $0.03 in the same quarter last year. This print easily cleared analysts’ estimates, and shareholders should be content with the results. Over the next 12 months, Wall Street expects Omnicell’s full-year EPS of $1.93 to shrink by 4.5%.

Key Takeaways from Omnicell’s Q1 Results

We were impressed by how significantly Omnicell blew past analysts’ EPS expectations this quarter. We were also glad its revenue outperformed Wall Street’s estimates. On the other hand, its full-year EPS guidance missed significantly and its full-year EBITDA guidance fell short of Wall Street’s estimates. Overall, this was a softer quarter. The stock traded down 9.8% to $27.50 immediately after reporting.

Omnicell may have had a tough quarter, but does that actually create an opportunity to invest right now? What happened in the latest quarter matters, but not as much as longer-term business quality and valuation, when deciding whether to invest in this stock. We cover that in our actionable full research report which you can read here, it’s free.