Since November 2024, Wix has been in a holding pattern, floating around $166.20.

Is there a buying opportunity in Wix, or does it present a risk to your portfolio? See what our analysts have to say in our full research report, it’s free.

Why Is Wix Not Exciting?

We're sitting this one out for now. Here are two reasons why there are better opportunities than WIX and a stock we'd rather own.

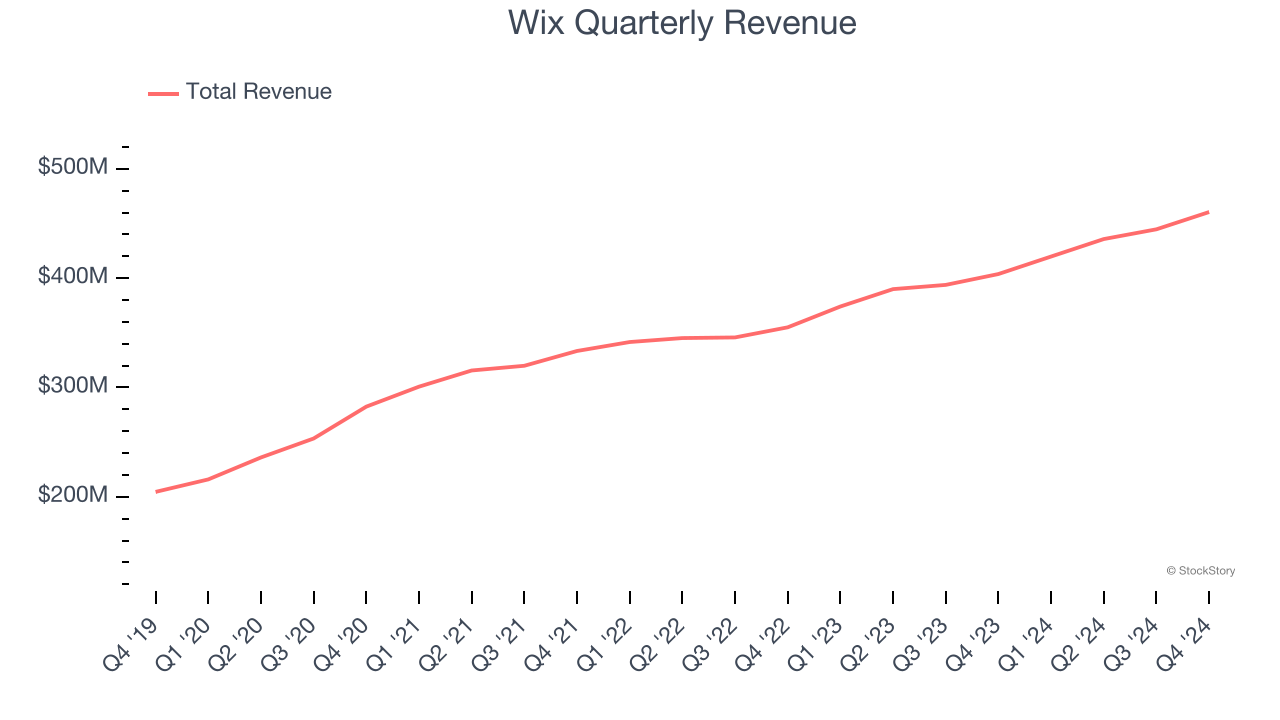

1. Long-Term Revenue Growth Disappoints

A company’s long-term sales performance can indicate its overall quality. Any business can have short-term success, but a top-tier one grows for years. Over the last three years, Wix grew its sales at a 11.5% annual rate. Although this growth is acceptable on an absolute basis, it fell short of our standards for the software sector, which enjoys a number of secular tailwinds.

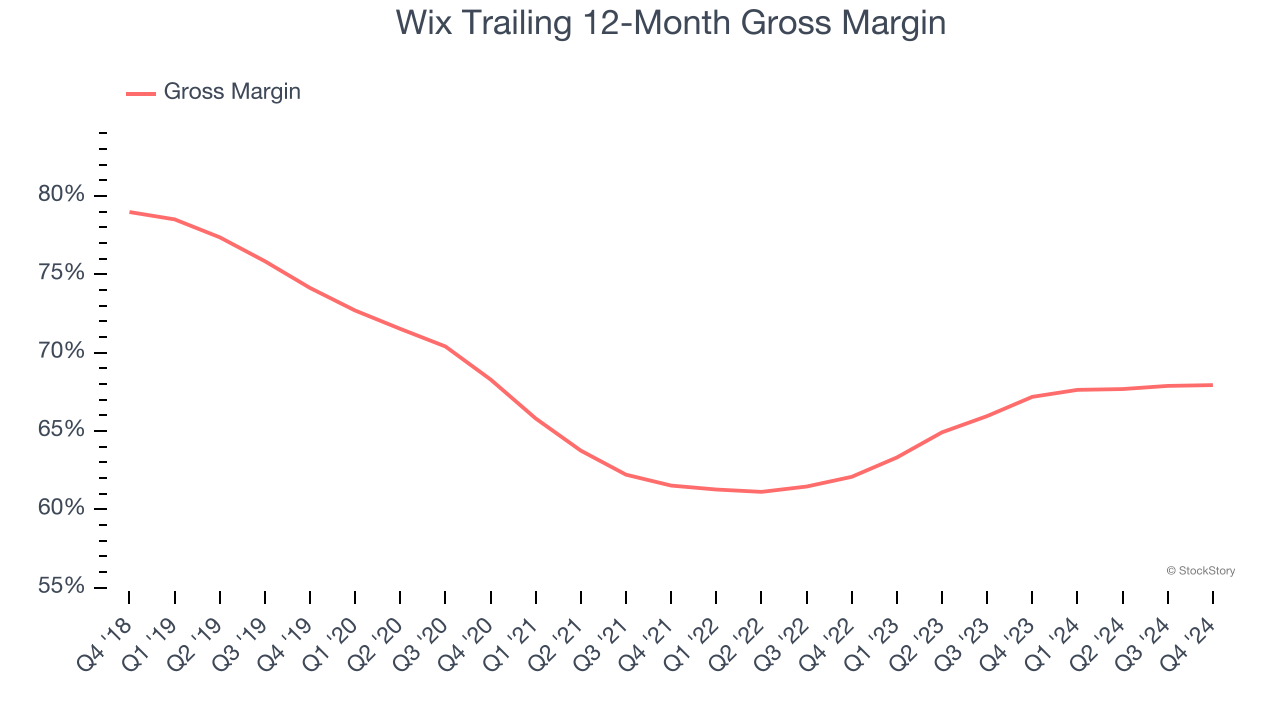

2. Low Gross Margin Reveals Weak Structural Profitability

For software companies like Wix, gross profit tells us how much money remains after paying for the base cost of products and services (typically servers, licenses, and certain personnel). These costs are usually low as a percentage of revenue, explaining why software is more lucrative than other sectors.

Wix’s gross margin is worse than the software industry average, giving it less room than its competitors to hire new talent that can expand its products and services. As you can see below, it averaged a 67.9% gross margin over the last year. Said differently, Wix had to pay a chunky $32.07 to its service providers for every $100 in revenue.

Final Judgment

Wix isn’t a terrible business, but it isn’t one of our picks. That said, the stock currently trades at 5.1× forward price-to-sales (or $166.20 per share). This valuation multiple is fair, but we don’t have much faith in the company. We're pretty confident there are more exciting stocks to buy at the moment. We’d recommend looking at one of our top software and edge computing picks.

Stocks We Like More Than Wix

Donald Trump’s victory in the 2024 U.S. Presidential Election sent major indices to all-time highs, but stocks have retraced as investors debate the health of the economy and the potential impact of tariffs.

While this leaves much uncertainty around 2025, a few companies are poised for long-term gains regardless of the political or macroeconomic climate, like our Top 6 Stocks for this week. This is a curated list of our High Quality stocks that have generated a market-beating return of 175% over the last five years.

Stocks that made our list in 2019 include now familiar names such as Nvidia (+2,183% between December 2019 and December 2024) as well as under-the-radar businesses like Sterling Infrastructure (+1,096% five-year return). Find your next big winner with StockStory today.