Packaged bakery food company Flower Foods (NYSE: FLO) missed Wall Street’s revenue expectations in Q1 CY2025, with sales falling 1.4% year on year to $1.55 billion. The company’s full-year revenue guidance of $5.35 billion at the midpoint came in 1.3% below analysts’ estimates. Its non-GAAP profit of $0.35 per share was 6.3% below analysts’ consensus estimates.

Is now the time to buy Flowers Foods? Find out by accessing our full research report, it’s free.

Flowers Foods (FLO) Q1 CY2025 Highlights:

- Revenue: $1.55 billion vs analyst estimates of $1.60 billion (1.4% year-on-year decline, 2.7% miss)

- Adjusted EPS: $0.35 vs analyst expectations of $0.37 (6.3% miss)

- Adjusted EBITDA: $162 million vs analyst estimates of $167.9 million (10.4% margin, 3.5% miss)

- The company dropped its revenue guidance for the full year to $5.35 billion at the midpoint from $5.45 billion, a 1.8% decrease

- Management lowered its full-year Adjusted EPS guidance to $1.10 at the midpoint, a 6.4% decrease

- EBITDA guidance for the full year is $548 million at the midpoint, below analyst estimates of $570.2 million

- Operating Margin: 5.5%, in line with the same quarter last year

- Free Cash Flow Margin: 7.1%, up from 4.6% in the same quarter last year

- Organic Revenue was down 3% year on year

- Sales Volumes fell 2.7% year on year (-0.8% in the same quarter last year)

- Market Capitalization: $3.60 billion

"Despite economic uncertainty and greater than expected category declines in the first quarter, Flowers' performance underscores the importance of our leading brands, each of which maintained or gained unit and dollar share," said Ryals McMullian, chairman and CEO of Flowers Foods.

Company Overview

With Wonder Bread as its premier brand, Flower Foods (NYSE: FLO) is a packaged foods company that focuses on bakery products such as breads, buns, and cakes.

Sales Growth

A company’s long-term sales performance is one signal of its overall quality. Any business can have short-term success, but a top-tier one grows for years.

With $5.08 billion in revenue over the past 12 months, Flowers Foods carries some recognizable products but is a mid-sized consumer staples company. Its size could bring disadvantages compared to larger competitors benefiting from better brand awareness and economies of scale.

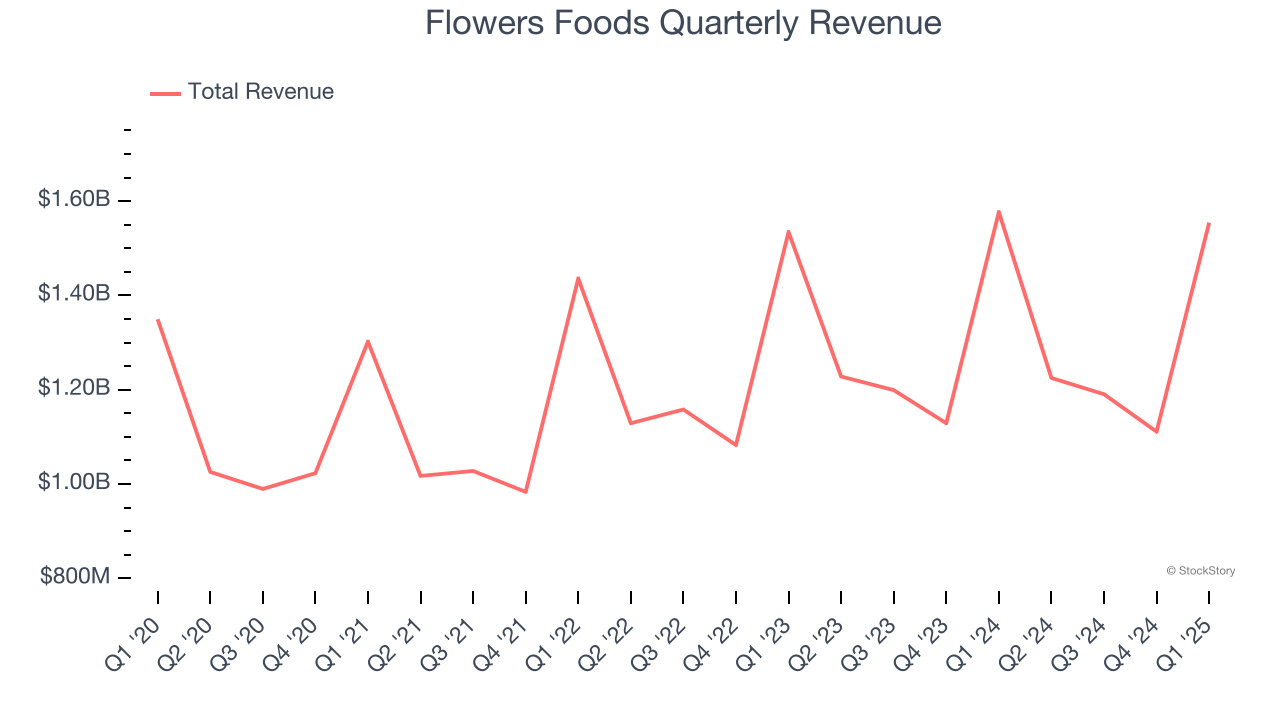

As you can see below, Flowers Foods grew its sales at a tepid 4.4% compounded annual growth rate over the last three years as consumers bought less of its products. We’ll explore what this means in the "Volume Growth" section.

This quarter, Flowers Foods missed Wall Street’s estimates and reported a rather uninspiring 1.4% year-on-year revenue decline, generating $1.55 billion of revenue.

Looking ahead, sell-side analysts expect revenue to grow 7.5% over the next 12 months, an acceleration versus the last three years. This projection is above average for the sector and suggests its newer products will spur better top-line performance.

Today’s young investors won’t have read the timeless lessons in Gorilla Game: Picking Winners In High Technology because it was written more than 20 years ago when Microsoft and Apple were first establishing their supremacy. But if we apply the same principles, then enterprise software stocks leveraging their own generative AI capabilities may well be the Gorillas of the future. So, in that spirit, we are excited to present our Special Free Report on a profitable, fast-growing enterprise software stock that is already riding the automation wave and looking to catch the generative AI next.

Volume Growth

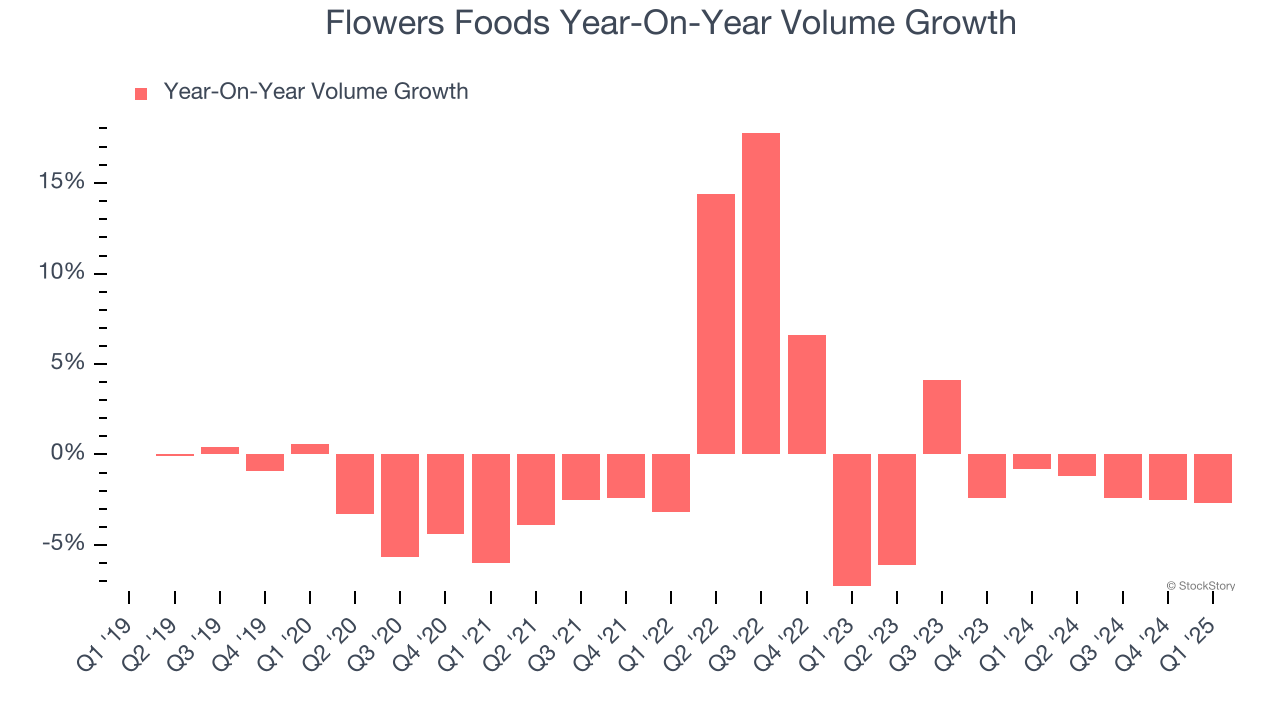

Revenue growth can be broken down into changes in price and volume (the number of units sold). While both are important, volume is the lifeblood of a successful staples business as there’s a ceiling to what consumers will pay for everyday goods; they can always trade down to non-branded products if the branded versions are too expensive.

Flowers Foods’s average quarterly sales volumes have shrunk by 1.7% over the last two years. This decrease isn’t ideal because the quantity demanded for consumer staples products is typically stable.

In Flowers Foods’s Q1 2025, sales volumes dropped 2.7% year on year. This result represents a further deceleration from its historical levels, showing the business is struggling to move its products.

Key Takeaways from Flowers Foods’s Q1 Results

It was encouraging to see Flowers Foods beat analysts’ gross margin expectations this quarter. On the other hand, its EBITDA missed and its revenue fell short of Wall Street’s estimates. Overall, this quarter could have been better. The stock traded down 5.4% to $16.13 immediately following the results.

Flowers Foods didn’t show it’s best hand this quarter, but does that create an opportunity to buy the stock right now? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation, when deciding if the stock is a buy. We cover that in our actionable full research report which you can read here, it’s free.